Author’s note: This article was released to CEF/ETF Income Laboratory members on June 29th.

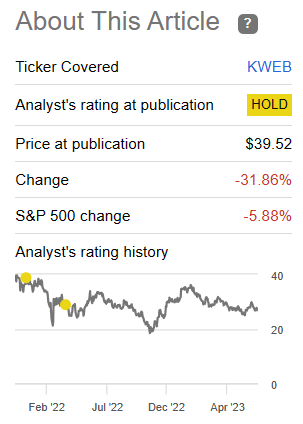

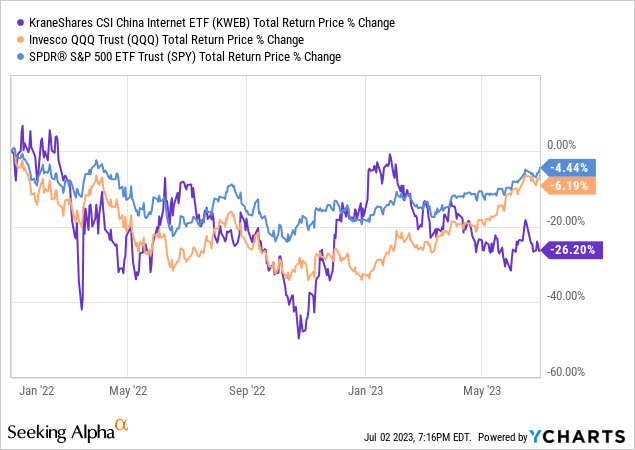

Last year, I wrote about some of the dangers faced by the KraneShares CSI China Internet ETF (NYSEARCA:KWEB) and its investors, including China’s tech crackdown, the prospect of delisting Chinese stocks from U.S. exchanges, and overall regulatory risk. The fund has significantly underperformed since, as investors re-priced the fund and its underlying holdings in light of these risks.

KWEB

Since then, the country has softened its stance on tech, while the threat of delisting has abated, significantly reducing overall regulatory risk. KWEB remains a relatively risky investment, as almost all Chinese investments are, but risks are much lower now than in the past, and the fund’s overall risk-return profile has materially improved. I maintain a hold rating on the fund, mostly because uncertainty is quite high, making it difficult for me to have a clear outlook on the fund, positive or negative.

KWEB – Quick Overview and Investment Thesis

A quick look at the fund and its investment thesis, before tackling its risks, and how these have evolved these past few months.

KWEB is an equity index ETF, tracking the CSI Overseas China Internet Index. Said index includes Chinese companies focusing on internet and internet-related activities, products, and services. The index includes stocks traded on both Hong Kong and U.S. exchanges. It is a market-cap weighted index.

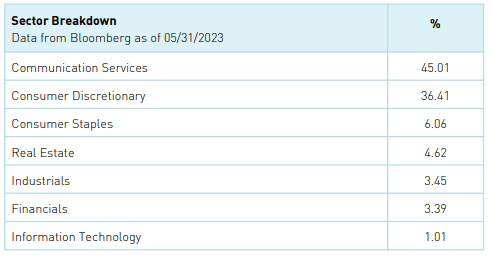

KWEB is a somewhat concentrated fund, with investments in just 33 different securities, and with significantly overweight positions in two industries: communications services and consumer discretionary.

KWEB

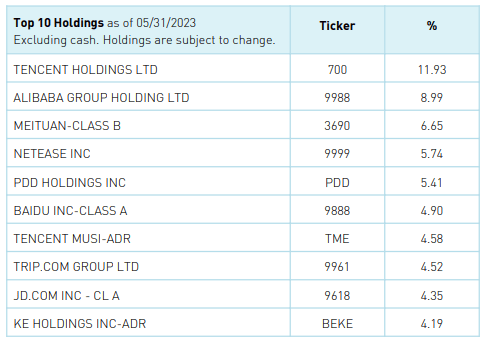

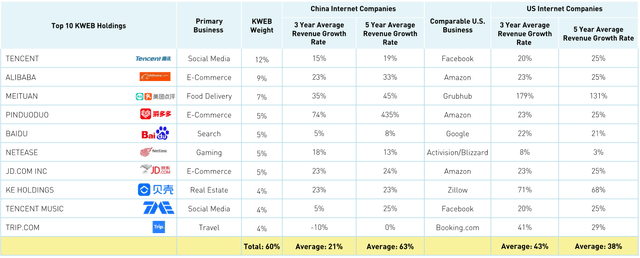

KWEB’s holdings include several well-known Chinese stocks, including Tencent (OTCPK:TCEHY) and Alibaba (BABA). The largest of these are as follows.

KWEB

KWEB is a niche industry fund, with targeted, concentrated investments in a specific industry niche, and in a couple dozen holdings. Risks are high, and performance could materially differ from that of broader equity indexes, including the S&P 500, and the MSCI World Index. As such, and in my opinion, allocations to KWEB should be kept relatively small. I would not go above 10%.

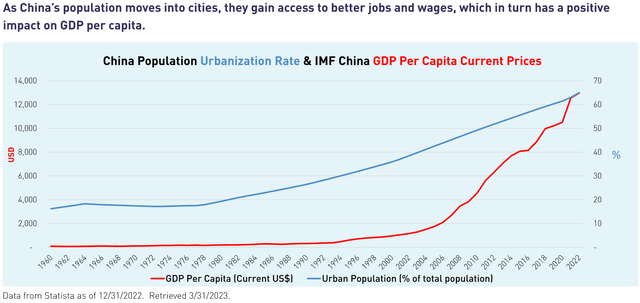

KWEB’s investment thesis rests on the fund’s strong growth prospects, driven by rapid Chinese economic growth:

KWEB

This is evidenced by the strong revenue growth of KWEB’s underlying holdings:

KWEB

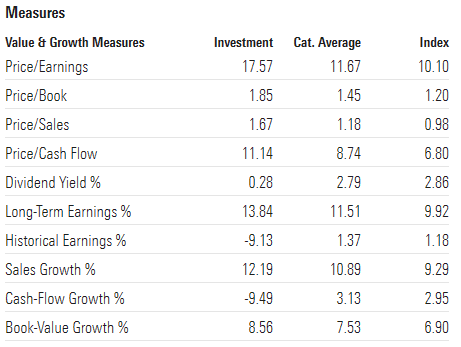

Investors also benefit from KWEB’s comparatively cheap valuation:

Morningstar

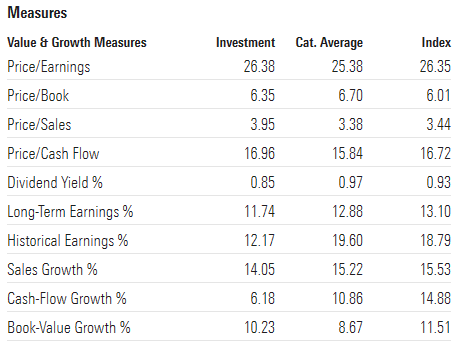

The cheap valuation is especially true when compared to U.S. tech indexes, including the benchmark Invesco QQQ Trust ETF (QQQ):

Morningstar

KWEB’s outstanding growth prospects and comparatively cheap valuation could lead to strong, market-beating returns moving forward. At the same time, the fund is quite a bit riskier than average, although risks have somewhat decreased these past few months. Let’s have a closer look at these issues.

KWEB – Risks, and Reductions Thereof

Regulatory Risk and the Chinese Tech Crackdown

KWEB invests in Chinese equities. Although the country has many benefits, including billions in potential consumers, strong economic growth, and a burgeoning middle class. It is also an incredibly risky choice for investors, due to heightened regulatory and political risk. Investor protections are weak, and the country’s government sometimes makes aggressive decisions, some of which are harmful to investors.

Specifically, the Chinese government embarked on an aggressive economic restructuring plan in 2022, meant to re-orient its tech sector to be more aligned with Chinese government goals. Said plan had many planks, de-emphasing consumer tech products and apps, while pivoting towards more tangible high-tech industries and sectors, including semiconductors and renewable energy. Regardless of the overall merits of said pivot, it was detrimental to more consumer-oriented Chinese tech companies. These include Tencent and Alibaba, both of which suffered sizable losses during the year.

Computer gaming companies were hit particularly hard, with the government freezing the development of new titles, and capping the hours children are allowed to play. Private tutoring companies were effectively banned as well.

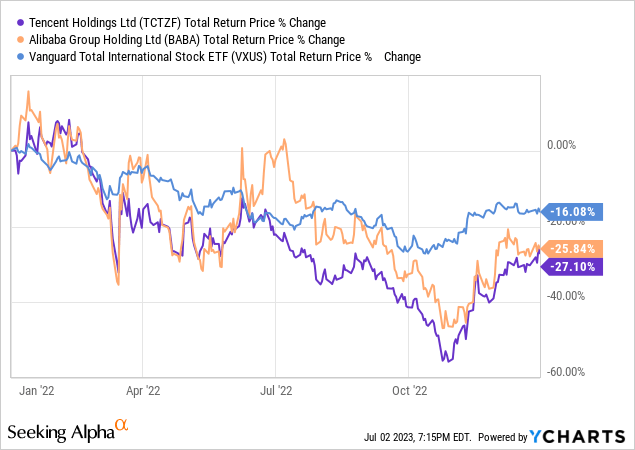

These and similar policies were directly detrimental to several of KWEB’s underlying holdings. At the same time, these policies were indicative of an incredibly unfavorable, risky regulatory and political environment. Losses could mount if the crackdown intensified. KWEB suffered significant losses as investors re-priced Chinese stocks in light of the worsening environment, with these suffering significant losses (with tons of volatility).

Importantly, the country has softened its stance on tech in the last few months, with the Economist declaring the crackdown over, in a bid to boost a stagnating economy. Although the crackdown may always start anew, the situation seems much improved from last year. Under these conditions, KWEB’s risks are much lower, albeit still high.

Delisting Risk

To trade in U.S. exchanges, foreign stocks must comply with U.S. regulatory standards, including (reviews of) audits by U.S. regulators. Several Chinese stocks have failed to comply with said standards, and the SEC had implied, in the past, that these could be delisted from U.S. exchanges. U.S. regulators got access to audit data in late 2022, and said the date was sufficient to put regulator worries at ease. As such, delisting is no longer an important, short-term risk. Regulations could always change, as could Chinese policy, so some risks remain, but much less than in the past.

Taiwan War Risk

There have been rumors of a possible Chinese invasion of Taiwan for decades, as the Chinese government sees Taiwan as a breakaway province, to be unified with the mainland one day. Unification might require, or come, through the use of force, hence rumors and fears of a possible war. Any such war would almost certainly result in a significant deterioration of economic ties between China and the U.S., including the imposition of sanctions. These would almost certainly negatively impact investors, leading to significant losses for the same.

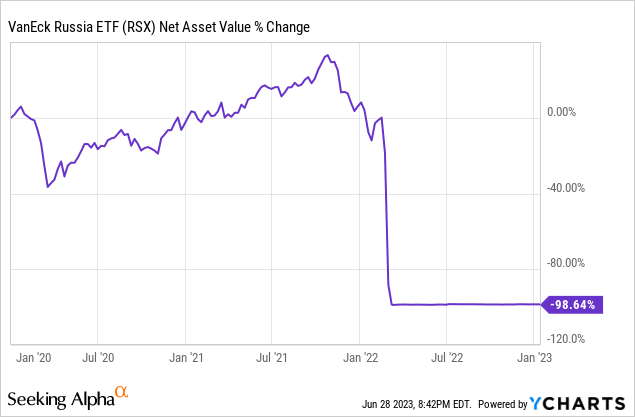

For reference, U.S. investors in Russian stocks lost almost 99% of their investment following the Ukraine War. Investors in Chinese stocks could, conceivably, see similar losses during a possible Taiwan War.

Data by YCharts

I’m not a military analyst, so I can’t really comment on these issues/changes thereof in any real depth. I will say that I never believed Ukraine and Russia would find themselves on a full-fledged war, until they did. Perhaps the same will happen with Taiwan.

In my opinion, and considering the above, investors would be wise to limit their exposure to Chinese stocks. Small investments are fine, but double-digit allocations seem unwise.

Conclusion

In my opinion, KWEB remains a relatively risky investment, as almost all Chinese investments are, but risks are much lower now than in the past, and the fund’s overall risk-return profile has materially improved.

Read the full article here