TL;DR

- The U.S. government is considering banning microchip exports to China, citing national security concerns

- It highlights a lesser known form of investing risk, in the form of regulatory risk

- The potential for a recession continues to bubble along in the background, and it could be helped along by the Fed, as Chairman Jerome Powell’s latest comment suggest they could be looking to implement more hikes

- Top weekly and monthly trades

Subscribe to the Forbes AI newsletter to stay in the loop and get our AI-backed investing insights, latest news and more delivered directly to your inbox every weekend. And download Q.ai today for access to AI-powered investment strategies.

Major events that could affect your portfolio

It’s amazing how much impact microchips now have on the world. These tiny pieces of metal and silicon are responsible for making all of the tech we use every day work like magic. And whenever you have an industry which can exert influence on the entire world, it brings along with it a hefty amount of political baggage.

This is particularly the case with microchips.

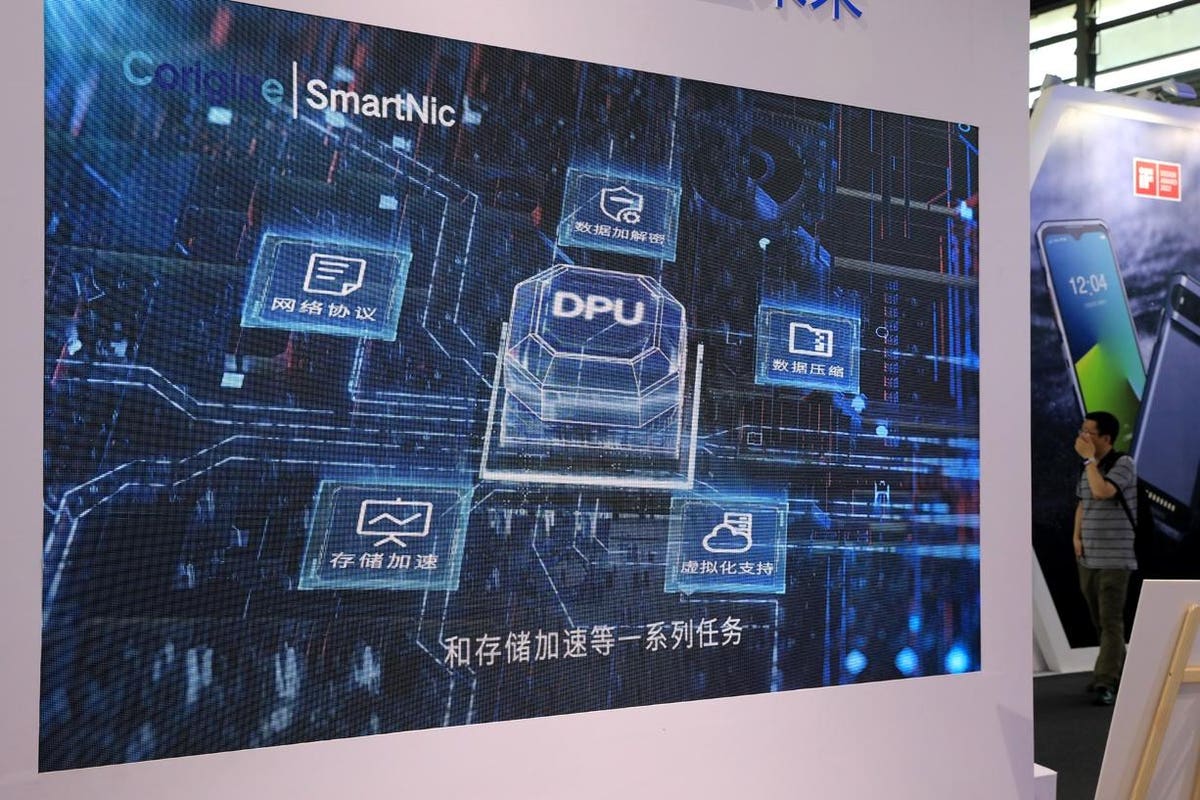

Chips are used to power the most advanced technology available, and now that includes areas like AI and cutting edge military equipment. So while there’s no outright conflict between China and US, or even a ‘new cold war,’ the two countries also aren’t super keen on helping the other build up their tech and military capabilities.

The latest development has been talk of the U.S. potentially banning the export of chips to China. Companies like Nvidia and AMD saw their stock prices pull back on this news, though Nvidia CFO Collete Kross doesn’t seem worried – stating that they wouldn’t expect an “immediate material impact” if the ban was enforced.

For investors, it’s probably not worth worrying about this particular issue, but it throws up an important reminder on a less obvious form of risk.

Regulatory risk can impact many different industries in many different ways. A potential chip ban is one, AI regulation is another, but food, pharmaceuticals, technology more broadly and practically every other market sector can feel the brunt of government intervention.

As always, it’s diversification across industries which is the best shield against Uncle Sam’s heavy hand.

—

There hasn’t been any major news that suggests a recession is getting closer, but there also hasn’t been much to suggest it’s becoming less likely. Economic data continues to be mixed, inflation remains high and earnings outlooks are generally pretty soft.

Just this week, Fed chairman Jerome Powell spoke at the European Central Banks Forum on Central Banking, making comments that more rate hikes weren’t off the table. That followed Powell stating that the headline rate of inflation might not come back into the target range until 2024.

Now a soft economy is one thing, but all of this is against a backdrop of a stock performance that has now officially entered a bull market. Stock markets have made some serious gains since the end of last year, bouncing back from an ugly 2022 – particularly for the tech sector.

That begs the question – with uninspiring economic fundamentals and a market that appears frothy, is now the time to get in or are we on the precipice of a correction. The truth is there’s no way to know for sure. Often, markets can remain irrational for far longer than even the most optimistic analysts’ projections, and can turn on a dime at seemingly minor news.

That’s why trying to time the market is almost never worth your time. Those waiting on the sidelines now could miss out on months, even years, of gains waiting for a market crash. And if it does crash, it’s far too easy to wait too long to get back in.

This week’s top theme from Q.ai

There are a ton of different strategies for picking the right investments. Picking individual stocks is probably the first that comes to mind, but this comes with limited diversification and unless you have a massive amount to invest, is likely to mean high transaction costs and high levels of risk.

Picking based on market sectors or geographic regions is another, for example by buying a selection of ETFs focusing on the U.S. tech, consumer staples and mining and energy sectors. This is a better approach, and it’s generally the recommended way to go for beginners and experienced investors alike.

But there’s another, less common way to diversify that can lead to impressive results if done right. It’s what’s known as factor based investing. The idea behind this strategy is that there are certain times within the business cycle that different types of companies outperform.

During the low interest rate tech boom years, growth focused companies performed exceptionally well. When times get tough and a recession hits, it’s value stocks that often hold up the best. Sometimes mega cap stocks are the place to be, other times it’s small caps that offer the best opportunities.

Factor-based investing seeks to weigh a portfolio according to these factors, while staying unbiased around the industry or market sector they’re in. Our Smarter Beta Kit does just that, with the added bonus of using AI to predict which factors are expected to perform best in the coming week, and then automatically rebalancing the ETFs within the Kit accordingly.

Top trade ideas

Here are some of the best ideas our AI systems are recommending for the next week and month.

Modine Manufacturing (MOD) – The thermal management company remains our Top Buy for next week with our AI giving them an A rating in our Quality Value and Growth factors. Earnings per share is up 79% over the last 12 months.

Gaia Inc (GAIA) – The wellness content company is our Top Short for next week with our AI giving it an F rating in Low Momentum Volatility and Growth. Earnings per share was -$0.20 over the last 12 months.

Universal Insurance Holdings (UVE) – The insurance product and services company is a Top Buy for next month with an A rating in our AI’s Quality Value factor. Revenue is up 9.2% over the last 12 months.

Abercrombie & Fitch (ANF) – The clothing company is a Top Short for next month with our AI giving them an F rating in Low Momentum Volatility and Quality Value. Earnings per share is down 80.1% over the last 12 months.

Our AI’s Top ETF trades for the next month are to invest in the VIX, natural gas and oil, and to short European equities and global financials. Top Buys are the United States Natural Gas Fund, the iPath Series B S&P 500 VIX Short-Term Futures ETN and the ProShares Ultra Bloomberg Crude Oil ETF. Top shorts are the WisdomTree Europe Hedged Equity Fund and the iShares Global Financials ETF.

Recently published Qbits

Want to learn more about investing or sharpen your existing knowledge? Q.ai publishes Qbits on our Learn Center, where you can define investing terms, unpack financial concepts and up your skill level.

Qbits are digestible, snackable investing content intended to break down complex concepts in plain English.

Download Q.ai today for access to AI-powered investment strategies.

Read the full article here