Introduction

Ever since Silicon Valley Bank went bust, I have written a number of articles on what I believe to be attractive and undervalued banking stocks. Most of them were regional banks.

While it’s fun to buy undervalued regional banks, they have one major disadvantage: they tend to sell off violently whenever the economy takes a beating.

Hence, they are great buys during severe stock price declines but not great for consistent wealth compounding.

That’s where Morgan Stanley (NYSE:MS) comes in. This investment banking powerhouse comes with a juicy 3.6% dividend yield, a business model that’s not as dependent on lending as regional banks, and a track record of consistent outperformance with ambitious growth plans.

In this article, we’ll discuss all of this and more!

Consistent Outperformance Thanks To A Great Business Model

I have never covered Morgan Stanley on Seeking Alpha – or anywhere else.

However, I have used its research, and I do like the output of its economists and market experts. I’m not paid to say this (I wish – just kidding), but I believe that MS has some of the best institutional research on Wall Street.

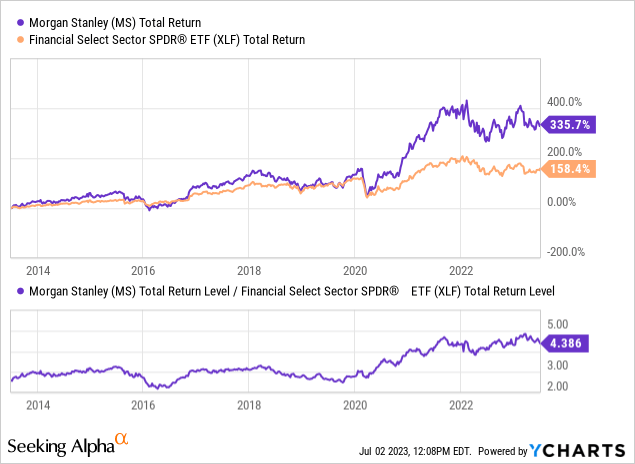

Before discussing any numbers, we see that MS shares have outperformed the Financial Select Sector SPDR ETF (XLF) by a wide margin over the past ten years – including reinvested dividends. MS has a 2.4% weighting in this ETF.

One reason for the outperformance is less dependence on loans.

Morgan Stanley is an investment bank with a history that goes back to 1924.

Operating as a financial holding company, the company provides a wide range of services, including advising, originating, trading, managing, and distributing capital for governments, institutions, and individuals.

In addition to its headquarters in New York City, the company has regional offices in the US and principal offices in London, Tokyo, Hong Kong, and other major financial centers.

The company has three key business segments:

- Institutional Securities

- Wealth Management

- Investment Management.

As discussed during the recent Bernstein Annual Strategic Decisions Conference, the company has gone through four distinct phases to boost its footprint in wealth management.

- Phase one was building scale through acquisitions.

- The second phase involved leveraging technology to support advisors and become a technology and innovation leader.

- In the third phase, new client segments were targeted, including the acquisitions of Solium and E*Trade, which expanded their reach in the workplace channel and provided a direct digital platform.

- Now in Phase 4, the focus is on deepening relationships and converting them into advisory clients over time. The goal is to target virtually every segment within the $50 trillion wealth management asset pool.

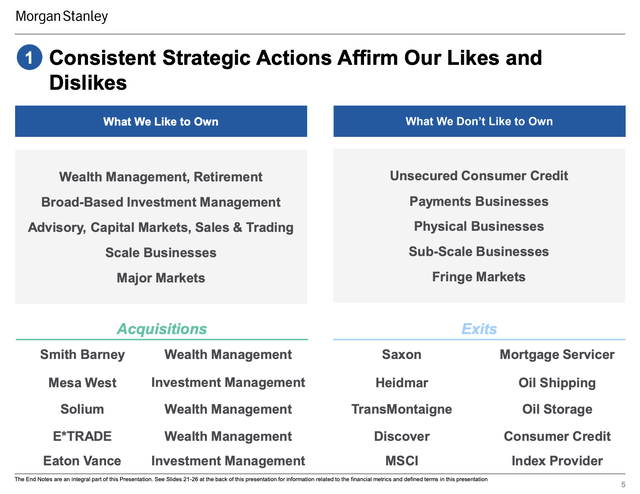

As the overview below shows, the company’s acquisitions have all been focused on wealth management. Divestitures were focused on getting rid of everything that didn’t go well with its core business.

Morgan Stanley

One of its divestitures is MSCI (MSCI), a business I like a lot. I covered it in this article.

Morgan Stanley believes that it reinvented the wealth management business model, integrating multiple channels and capabilities to meet clients’ needs and engage with them across various channels.

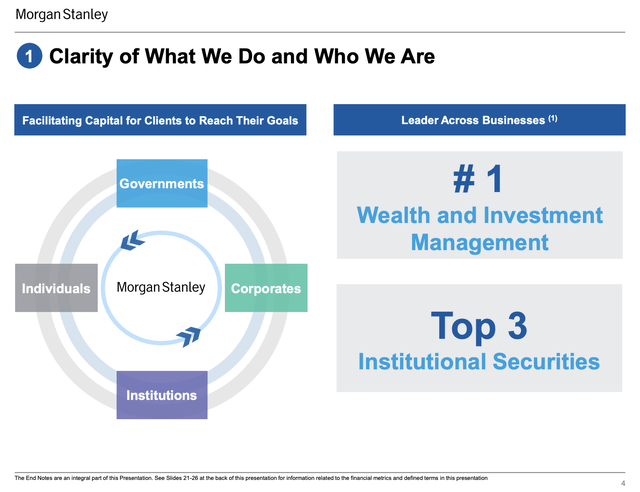

While some of these factors are hard to define, the company isn’t lying. It’s the largest wealth management company and a top-3 institutional securities firm.

Morgan Stanley

A big driver of growth is its ecosystem, which integrates channels and capabilities. According to the company, the integration allows for efficient and effective coordination of processes, data, and analytics.

For example, referring a workplace stock plan participant to an advisor involves a complex process that requires data gathering, analytics, education, customization, and seamless handover to the advisor.

With that said, the ecosystem also combines advanced machine learning tools with coordination across multiple data systems and vendors.

In this case, machine learning is artificial intelligence, which could be a big driver of profitability – although it needs to be seen how effective AI can become in the future.

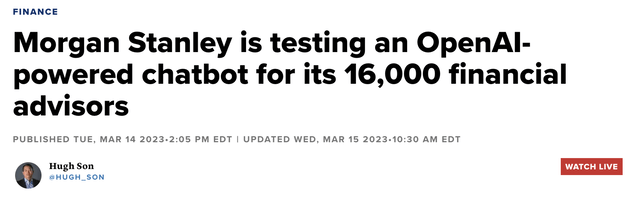

CNBC

As reported by CNBC in March, the company is introducing an advanced chatbot powered by OpenAI’s latest technology to assist its financial advisors.

The bank has been testing the artificial intelligence tool with 300 advisors and plans to implement it widely in the coming months.

The tool, which is based on GPT 4, aims to help the bank’s 16,000 advisors leverage the firm’s aforementioned research and data repository. It generates responses based on the 100,000 research pieces vetted by Morgan Stanley, reducing the risk of errors.

Not only is this an easy way to make processes more efficient, but I also believe this perfectly shows how companies with loads of proprietary data can implement artificial intelligence.

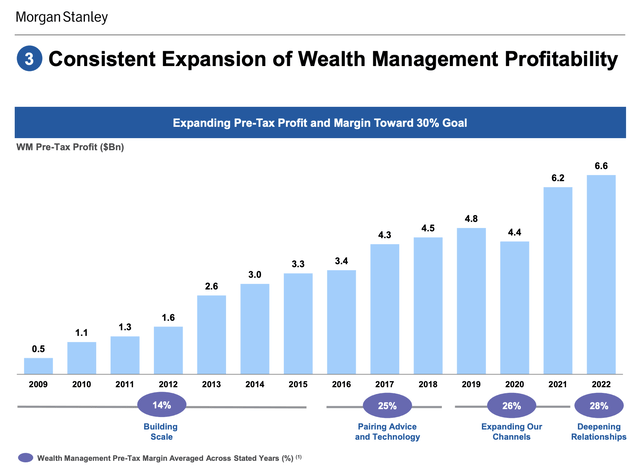

Speaking of profitability, the company has consistently grown its pre-tax profits. In the years after the Great Financial Crisis, the company generated less than $2 billion in pre-tax profit. After the pandemic, that number soared to more than $6 billion. Also, note that the chart below goes well with the aforementioned 4-phase growth plan.

Morgan Stanley

Having said that, during the Bernstein conference, Morgan Stanley made clear that it believes that its strongest period of growth is still ahead.

By increasing the number of client relationships, deepening those relationships, and expanding assets and pre-tax profits, the company aims to reach $10 trillion in total client assets, with wealth management contributing around $8 trillion.

Essentially, that’s how the company accelerated growth after 2018.

According to the company, this growth could lead to a more than doubling of pre-tax profits. Organic growth, shifting client assets from cash to fee-based investments, and additional lending opportunities are the key drivers of this growth.

The focus remains on deepening client relationships and leveraging the scalability of the existing infrastructure to achieve sustainable growth.

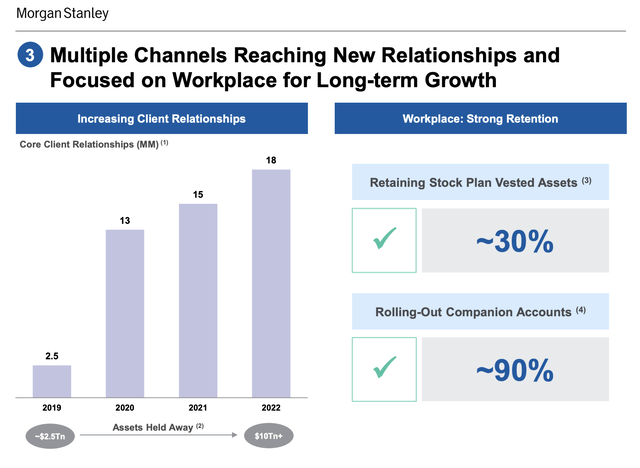

Between 2019 and 2022, the company added roughly 15 million core client relationships. The assets held by these clients rose from $2.5 trillion to more than $10 trillion.

Morgan Stanley

The good news continues, as investors have always been treated well by the company, which brings me to the next part of this article.

Dividends & Buybacks

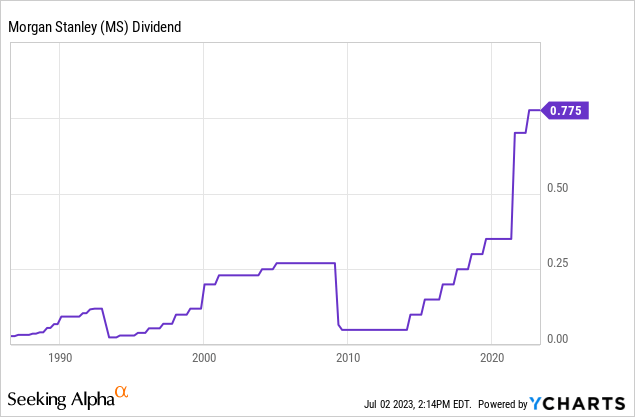

- Morgan Stanley has a 3.6% dividend yield. This is backed by a 51% payout ratio.

- Over the past five years, the average annual dividend growth rate was 25.4%.

- Over the past ten years, that number was 31.5%.

Since the end of the Great Financial Crisis, the dividend has been well-covered. However, during the GFC, the company was forced to cut its dividend, which was the case for almost all major financial firms back then.

This is what the company said during the first-quarter earnings call:

We’ve had a very healthy dividend yield. I think it’s over 3.5% churn, something like that now. We believe in the dividend. I’ve said for years, and I think of the wealth management business is a dividend stock, and we’re clearly making more money in that business than we’re paying out a dividend.

Speaking of that earnings call, let’s dive a bit into current developments, especially in light of (fading) banking woes.

Recent Events & Valuation

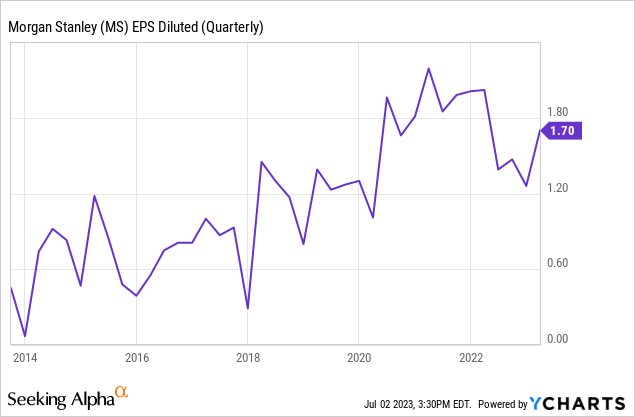

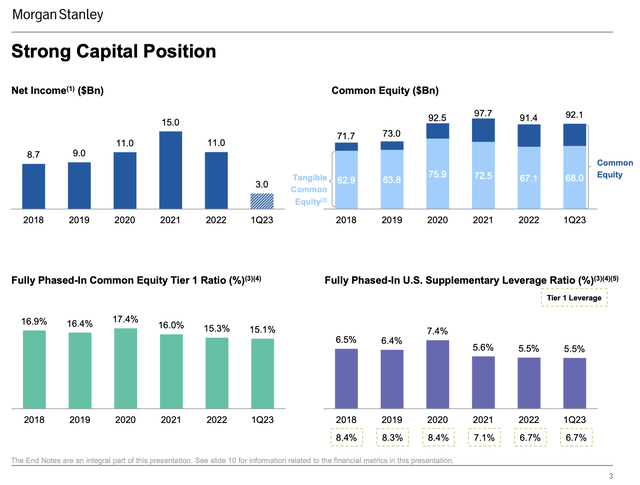

The first quarter was quite successful, as the company reported revenues of $14.5 billion, EPS of $1.70, and an ROTCE (return on tangible common equity) of 16.9%.

What’s interesting is that Morgan Stanley does not believe that we are dealing with a banking crisis. Strong regulatory intervention in both the United States and Europe played a crucial role in containing the damage, according to MS.

The company also emphasized that the current situation is incomparable to the 2008 financial crisis. In this case, Morgan Stanley contributed to solving market stress by providing an uninsured deposit line of $30 billion to First Republic Bank.

Morgan Stanley believes that the company has gone from being a part of the problem (in 2008) to being a part of the solution (2023).

Furthermore, Morgan Stanley’s Wealth Management division saw positive asset flows of $110 billion, indicating continued growth in the model and the flight to quality. These results contribute to the firm’s goal of achieving $1 trillion in asset flows every three years. The results also underline the aforementioned growth plans.

The balance sheet remained largely unchanged (and healthy), with spot assets at $1.2 trillion, a standardized CET1 ratio of 15.1%, and a supplementary leverage ratio of 5.5%.

Morgan Stanley

Going forward, the company believes that markets are difficult to predict. I agree with that. Hence, the bank is mainly focusing on the aforementioned growth plans.

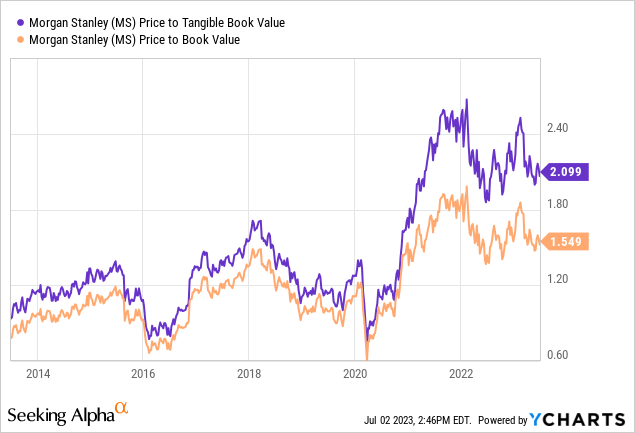

With that said, MS is trading at 1.55x its book value and 2.1x its tangible book value. The valuation has consistently risen as investors believe that the company’s growth measures deserve a higher multiple. I agree with that.

However, even using next year’s expected book value (per share) of $58.50, we’re dealing with a 1.5x multiple, which isn’t cheap.

The current consensus price target is $96, which is 13% above the current price.

I agree with that fair value, although I cannot make the case that MS is a must-buy at current prices.

As much as I like the company’s progress and ability to deliver long-term shareholder value, I would like to buy this one for close to $75 (or lower).

While this comes with the risks of missing more upside, I’m willing to take that risk, as I’m not extremely eager to buy more financials and because I believe that we’re not out of the woods yet. The market is now at the upper bound of my expected trading range, which has caused me to become a bit more careful.

Hence, my rating, for now, is neutral.

Additionally, I’m now mainly focused on buying compounders with even more growth potential, like MSCI.

Needless to say, people are free to disagree with my strategy. The main takeaway here is that I believe that MS is one of the best dividend growth stocks in the financial sector.

Takeaway

Morgan Stanley is a fantastic dividend growth stock in the financial sector, boasting a robust business model and impressive growth potential. Unlike regional banks, MS is less prone to economic downturns due to its diversified revenue streams. With a history dating back to 1924, the investment banking powerhouse has consistently outperformed the Financials Select Sector SPDR ETF, which underlines its ability to thrive in various market conditions.

A big part of MS’s success is its innovative ecosystem that integrates multiple channels and capabilities, enabling efficient coordination of processes and leveraging advanced machine learning tools. Moreover, the company’s focus on deepening client relationships and expanding assets and pre-tax profits is driving significant growth.

While the stock’s valuation has risen, indicating investor confidence in MS’s growth prospects, it may be prudent to wait for a better entry point.

Nevertheless, MS remains a top contender for those seeking consistent wealth compounding and a solid dividend yield.

Read the full article here