Frost Bank Tower – downtown Austin Texas

Research Brief

When I worked in the tech sector in Austin Texas, a common sight downtown was the Frost Bank Tower, the tallest building in the city, and home to not only the Austin offices of San Antonio-based Frost Bank but also local offices of other financial firms. As it turns out, Austin has a growing financial sector!

While this Texas bank may not be covered highly outside that region, today I will rate its parent company, Cullen/Frost Bankers (CFR), and see if their stock presents a value buying opportunity to my investor readers interested in the regional banks.

From their website, notable items of mention about this company that offers personal & business banking as well as insurance are that it dates back to 1868 in the days of the Texas frontier, survived the 1980s Texas oil crisis and real estate market crash, and has been listed on the NYSE since 1997.

Our Rating Approach

Our goal is to find value buying opportunities for stocks in the financial & technology sectors that otherwise have strong financial fundamentals, and to present them here for investors using a simplified approach.

We use a 5 step holistic methodology breaking down our rating into 5 categories: share price, valuation, dividend yield, financial condition, & macro factors affecting the company. If the stock is recommended on 4 of the 5categories, it gets a buy rating. 3 out of 5 would give it a hold rating. Less than 3 is a sell rating.

Then we compare our rating to that of both the Wall Street and Seeking Alpha consensus.

Share Price Below 200 day SMA but Waiting on A Further Dip

Next, let’s take a look at the price chart as of market close on Friday June 30th, which was also the close of Q2. This stock closed the quarter at $107.53.

Frost – price chart on Jun 30 (StreetSmart Edge trading platform by Charles Schwab)

Based on this chart, I would not recommend this stock just yet but would wait for it to dip below the 50 day SMA, putting it in a buy range of $100 to $104 which is my targeted buy range.

However, since the death cross formation in February the price has been in a bearish trend since then, particularly the buying opportunity during the March regional bank failures. Whether another dip below the 50 day will occur is yet to be seen.

Overvalued based on P/E & P/B Ratios

Using Seeking Alpha valuation info, I will be comparing the GAAP-based forward price to earnings (P/E) ratio and forward price to book (P/B) ratios, two key metrics I use for valuation. The benchmarks I compare to are the sector medians.

Frost currently has a P/E of 10.98, which is just over 21% higher than its sector average. Its P/B of 1.89 is almost 100% above the sector average.

Based on this data, I would not recommend this stock on the basis of valuation, as it appears overvalued right now.

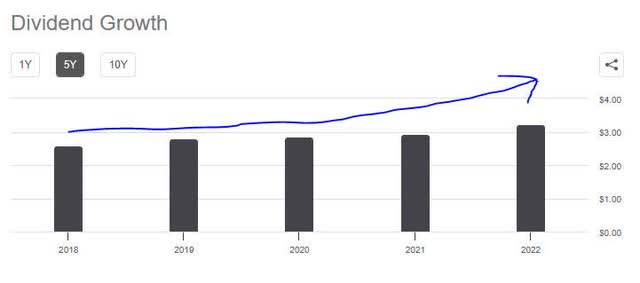

Solid Dividend Growth but Yield Trailing Behind Peers

Taken from Seeking Alpha dividend info, this stock currently offers a dividend yield of 3.24%, with a dividend of $0.87 per share, and no immediate ex dates coming up.

I like their 5 year dividend growth chart, as follows:

Cullen/Frost Bankers – 5 year dividend growth (Seeking Alpha)

For example, their annual dividend in 2018 was $2.58 and grew to $3.24 in 2022, a 26% increase over 5 years.

To compare its yield with peers, I will use two of them: New York Community Bancorp (NYCB) and East West Bancorp (EWBC). Both are regional banks.

The dividend yield at East West is 3.64%, while the yield at NYCB is 6.05%.

Frost falls slightly under that of East West, while trailing NYCB by 3 points. So, if you want the best yield, your best bet is NYCB. However, since Frost has a significant 5 year dividend growth, steady quarterly payouts, and a yield above 3%, I would still recommend this stock in the category of dividends.

Financial Condition of Company is Healthy

Although this bank was not listed as having participated in the recent 2023 Fed stress test of banks, nevertheless the financial condition of this company is an important metric to me as an analyst as well as to potential investors.

My first question is how is their CET1 ratio looking. The answer I got from their most recent Q1 earnings release, which showed that ratio to be well above minimum regulatory standards:

The Common Equity Tier 1, Tier 1 and Total Risk-Based Capital Ratios at the end of the first quarter of 2023 were 13.24 percent, 13.74 percent and 15.22 percent, respectively, and continue to be in excess of well-capitalized levels and exceed Basel III minimum requirements.

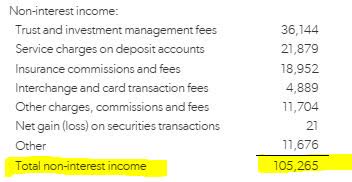

Second, I want to see if their revenue is diversified beyond just interest income. And it is. Consider the following from their Q1 earnings release:

Frost – non interest income – Q1 (Frost – q1 earnings release)

As you can see, they have over $105MM in non-interest income in the first quarter, a major part of it being fees from trust and investment management.

Additionally, they have a solid balance sheet, with assets well in excess of liabilities, and positive equity showing in the last several years actually.

I also look at whether they manage the expenses well in addition to revenue, and based on their income statement they have achieved YoY gains in both net income as well as earnings per share.

Therefore, I would recommend this stock in the category of the company’s financial condition.

Macro Effect of Higher Interest Rates Helped this Bank

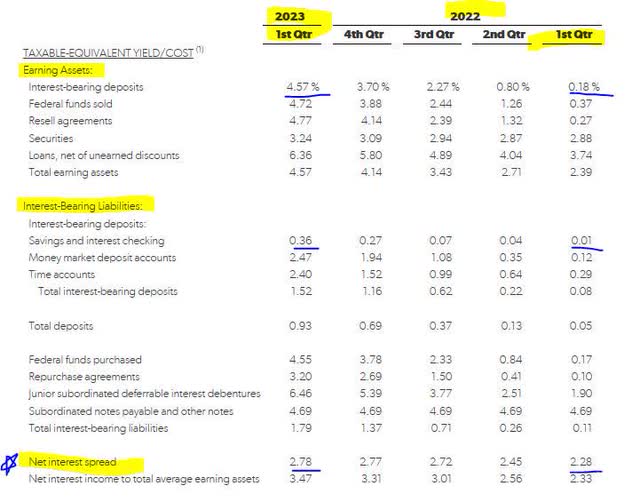

The next category I am rating is the macro environment’s effect on this business, whether positive or negative. Specifically, I will show that the last year of interest rate hikes by the Fed has benefited this business, which depends heavily on interest income and rate spreads, as most banks do.

Consider this from its Q1 earnings release:

For the first quarter of 2023, net interest income on a taxable-equivalent basis was $425.8MM, up 56.4 percent, compared to the same quarter in 2022.

Further, to dive deeper on this topic, here is a look at their rate spread comparing Q1 with the same quarter a year ago:

Frost – rate spreads (Frost – q1 earnings release)

So, while the yields went up on interest-bearing deposits, as the table above shows, they also went up on interest-bearing liabilities like customer deposit accounts. However, the bank managed to grow its net interest spread quite nicely, by 0.50 points YoY.

Hence, I would recommend this stock based on the macro environment that has benefited this type of business model.

Rating Score

Today I recommended this stock in 3 out of my 5 categories, so it gets a hold rating. Based on the consensus from SA and Wall Street, shown below, my rating is in line with the Wall Street consensus and SA quant system but more bearish than the consensus from SA analysts:

rating consensus (Seeking Alpha)

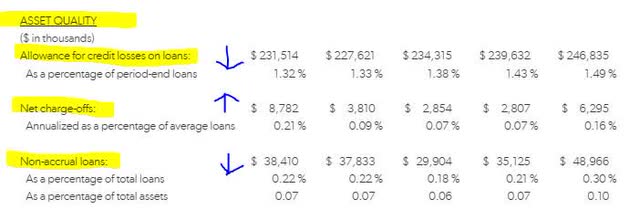

Risks to our Rating Outlook

A risk to my neutral outlook on this stock that I can foresee is that in the next few quarterly results the credit risk they are exposed to could increase in the form of increased net charge-offs.

However, when looking at the most recent quarterly results showing asset quality, while there was an increase YoY in net charge-offs there were actually YoY decreases in non-accrual loans and allowances for credit losses:

Frost – asset quality (Frost – q1 earnings release)

What is needed is to wait until the Q2 results, I think, to get a better gauge on this bank’s asset portfolio, however until now it has mostly improved vs the prior year, so it appears they are managing the risk well, which should give investors some added confidence at this time.

Analysis Wrap-up

To recap, today I am giving this stock a hold rating. Its positives are strong financial condition, interest margins benefiting from the macro factors discussed, and reliable dividend growth. Its headwinds are overvaluation and current price that I believe could use another dip before buying.

As mentioned in recent articles covering regional banks, this subsector of financial stocks is worth keeping an eye on after the March dip and bearish market sentiment, as there are several regionals with strong fundamentals, as I have shown with this one.

Regional banking is still very much a necessity to the economy and financial sector, particularly in such a big nation as the US with several key regions of economic & cultural significance, and hence regional banks who already have well established market penetration there.

Read the full article here