Thesis

Due to The Honest Company, Inc. (NASDAQ:HNST) exclusive focus on the clean and natural sector, I believe the company is in a strong position to capitalize on the accelerated growth within this market. As consumers increasingly prioritize health, wellness, and sustainability, HNST stands to benefit across categories such as baby care, personal care, and home care, as these attributes play a significant role in their purchasing decisions. I am bullish on the stock, and my December 2023 price target of $2.6 is derived from a forward EV/sale of 1x applied to the 2024 revenue estimate.

Q1 Review & Outlook

HNST reported strong revenue growth of 21% in Q1, which outweighed the disappointing operational performance, including a negative adjusted EBITDA of $10 million. The company introduced the Transformation Initiative in the first quarter, aiming to improve its cost structure, drive growth, and increase profitability. The initiative is expected to generate savings of $15 million to $20 million annually, with management anticipating these benefits to be realized by late 2023 and mainly in 2024. The Transformation Initiative will incur costs of $10 million to $15 million in fiscal year 2023, with $6 million to $8 million being non-cash expenses.

HNST recognizes that relying solely on revenue growth is insufficient and is committed to improving its cost structure and margin performance to achieve long-term profitability and enhance shareholder value. With this objective in mind, HNST launched the Transformation Initiative in Q1, which aims to address the company’s cost structure, foster growth, and drive profitability. The initiative is expected to generate annual savings of $15 million to $20 million, with the benefits starting to materialize by late 2023 and becoming more significant in 2024 and beyond. While the Transformation Initiative will incur costs of $10 million to $15 million in FY23 (including $6 million to $8 million in non-cash expenses), it encompasses three key pillars. The first pillar focuses on brand maximization, aiming to realign premium pricing, stimulate growth through innovation, and prioritize margin-enhancing products. The second pillar, margin enhancement, entails optimizing the cost structure by shifting the company’s focus to North America, exiting the European and Asian markets to reduce complexity, inventory levels, associated costs, and SKU rationalization. Cost-saving measures, such as supply chain and sourcing projects, contract manufacturing strategies, and reduced shipping and logistics costs, will also be implemented. The third pillar, operating discipline, emphasizes executional excellence, a targeted approach to trade and promotion activities, and effective management of working capital through inventory reduction, resulting in lower warehousing, fulfillment, SG&A costs, and overall operational efficiency.

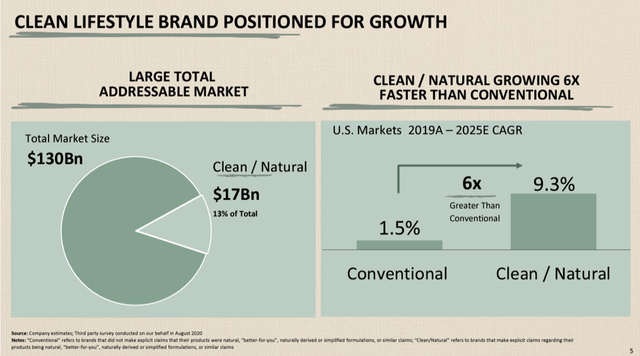

Pure Play in Fast Growing Clean and Natural Market

Given its exclusive focus on the clean and natural segment within household and personal care categories, HNST is exceptionally well-positioned to capitalize on the strong growth in this particular market. The company benefits from the increasing consumer emphasis on health, wellness, and sustainability when making purchasing decisions. This trend has been further accelerated by the COVID-19 pandemic and is expected to remain prominent even after the reopening phase. Although the exact size of this market is challenging to determine, it is already substantial and continues to expand. For context, according to the Global Wellness Institute, the wellness market will continue to grow at an impressive annual rate of 10% until 2025. By that time, the market is projected to reach $7 trillion.

HNST provides investors with a distinctive opportunity to capitalize on the strong growth within the clean and natural market in the consumer-packaged goods industry. HNST has successfully established substantial brand loyalty in the clean and natural market by promoting a “clean lifestyle” through its innovative marketing strategy, which emphasizes easily digestible content and community engagement. Given the increasing focus on health and wellness, particularly among younger consumers, I anticipate rising demand for clean and natural products in the coming years, presenting HNST with significant opportunities within this thriving industry trend.

Company Presentation

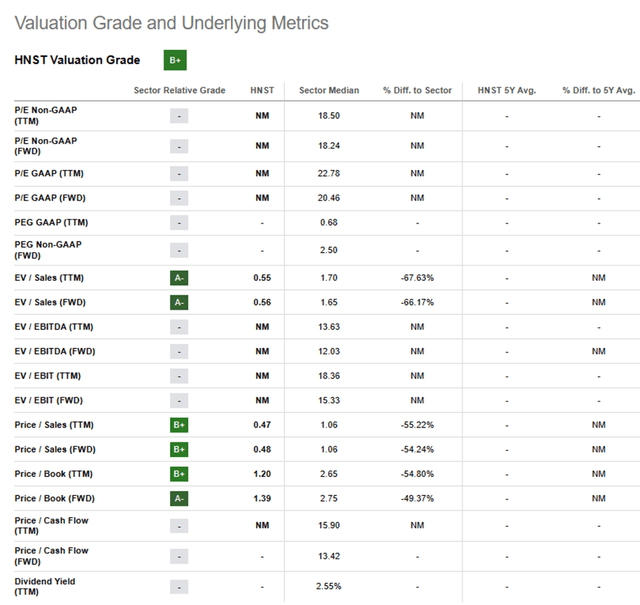

Valuation

Given HNST’s pure-play focus in the clean and natural end market as well as the company’s digital foundation, I do not think there is currently any one true, publicly traded comp for HNST. Although HNST’s current business mix is geared towards the baby care category, which naturally leads to a comparison to HPC names, I believe the company’s faster growth profile warrants a comparison to high-growth companies within the consumer space. My December 2023 price target of $2.6 is derived from a forward EV/sale of 1x applied to the 2024 revenue estimate.

Seeking Alpha

Risks

The rapid growth of “free-of” harmful ingredients in household and personal care products has led to an influx of new competitors, not only through direct-to-consumer websites but also from established brands such as Pampers Pure and Huggies Special Delivery. In the personal care and beauty segments, the competition is even more fragmented. This increased competition poses a potential challenge for HNST, as it may limit the company’s growth or require substantial investments in marketing, potentially delaying the aspiration to achieve a 20% EBITDA margin. Moreover, while HNST generates a significant portion of its sales through direct channels, with 33% of sales coming from Honest.com, the remaining 67% of sales are highly concentrated. However, HNST aims to mitigate this risk over time by expanding its distribution to other retailers. For example, the company is currently present on Walmart.com and Ulta.com, with potential plans for brick-and-mortar store expansion in the future.

Conclusion

I consider HNST’s growth opportunity to be highly attractive and unique due to its exclusive focus on the clean and natural market, strong digital foundation, expanding distribution network, and potential for international expansion. This positioning provides clear visibility of double-digit revenue growth, which is expected to result in improved profitability as the company benefits from operational efficiencies and economies of scale. I view the stock as a buy and have an end-of-year price target of $2.6 on the stock.

Read the full article here