The discovery of a discrepancy between the valuation of large caps and small caps has led to my focus on researching smaller companies. The latest article covered the mismatch between large and small caps. Now, it is time to look at two new stocks that showed up in the screener, Atkore (NYSE:ATKR) and Encore Wire (NASDAQ:WIRE). Both have a market cap between $500 million and $6 billion. They generate strong free cash flow compared to the valuation of the business. In addition, either is a great capital allocator and has a healthy balance sheet.

Criteria Screener:

Atkore

- Market cap: $5.5 billion

- Price To Free Cash Flow: 5.41

- ROIC (Return On Invested Capital): 34.8% / AVG 5y 23.0%

- ROA (Return On Assets): 30.7% / AVG 5y 18.51%

- Current Ratio: 2.99

Encore Wire Corporation

- Market cap: $3.09 billion

- Price To Free Cash Flow: 4.43

- ROIC (Return On Invested Capital): 32.76% / AVG 5y 18.86%

- ROA (Return On Assets): 33.85% / AVG 5y 18.23%

- Current Ratio: 10.48

Business Overview

Atkore is a manufacturer of electrical products and serves the markets non-residential, electric power, data centers and telecom, water, transportation and solar. The company’s products include: conduits, cables, installation accessories, metal framing, mechanical pipes and many more. In 2022, the sales in the United States accounted for 91% of total sales, with customers like Wesco, Rexel and The Home Depot. Next to the manufacturing facilities in the United States, Atkore has manufacturing in Australia, Belgium, Canada, New Zealand and the United Kingdom.

The company grew revenues organically through pricing improvements, of which 40% is sustainable according to management. Further, strategic acquisitions were also a key driver of sales. In the latest quarter, sales grew quarter over quarter but were down year over year. The business seems to be more resilient than expected, with guidance increases in adjusted EBITDA and EPS.

Atkore Investor Relations 23Q2

The company sees opportunities in the HDPE (High-Density Polyethylene) market. HDPE is used in pipe systems, since it is UV-resistant and can withstand low and high temperatures. One of the growth drivers in HDPE products would be the expansion of 5G networks and “fiber to the home”. Additionally, Atkore is making use of the tailwind in the solar sector to increase sales for the large tube business. Capacity expansion in Hobart, Indiana should support the growth in solar and other large tube applications.

Encore Wire is a manufacturer of electrical wire and cables in the industry of data centers, renewables, healthcare, commercial, industrial and residential. The company primarily focuses on manufacturing and distributing copper electrical wire and cable products, therefore it is dependent on copper prices and the possibility of increasing the pricing of their products. Copper accounted for 44% of the total cost of goods sold in 2022.

Encore Wire has an single site campus from where all products are made. Vertical integration helps the company to be cost efficient, flexible and have an competitive advantage compared to the other players in the sector. Though, this does also come with disadvantages as transportation costs could run up for long-distance travel of goods.

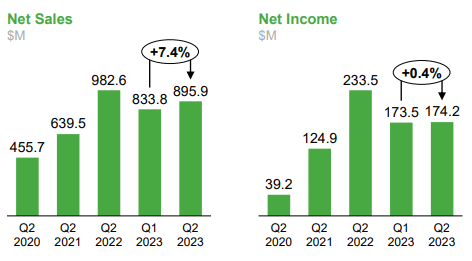

Similar to Atkore, revenue declined year over year, mainly due to a business cycle downturn after the highs of 2021. Higher interest rates make loans more expensive and slows down the expansion and renovation of real estate. Therefore, home building products see a slowdown in demand.

Encore Wire Investor Relations 23Q1

Encore Wire sees opportunities in the demand for copper. Renewable energy generation, through wind power and solar power, commands more copper (x3-5) than the non-renewable energy sources. Furthermore, electric vehicles also need a lot more copper (x3-10) than normal gasoline vehicles. These growth factors could give a boost to higher margins in the long-term.

Valuation

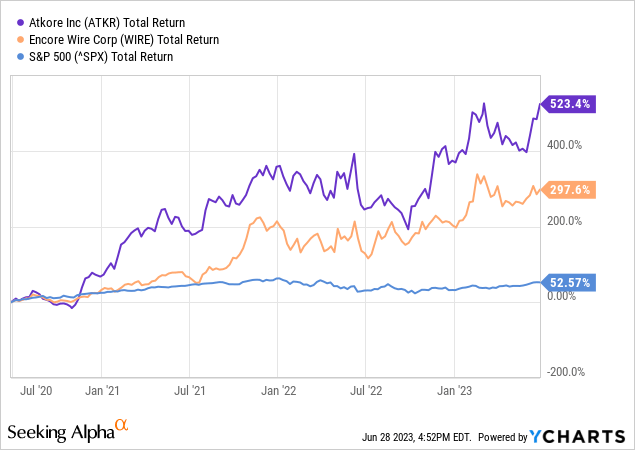

Both Atkore and Encore Wire have outperformed the S&P 500 by a wide margin over the last three years. Yet, after such a homerun the valuation seems to be modest for either.

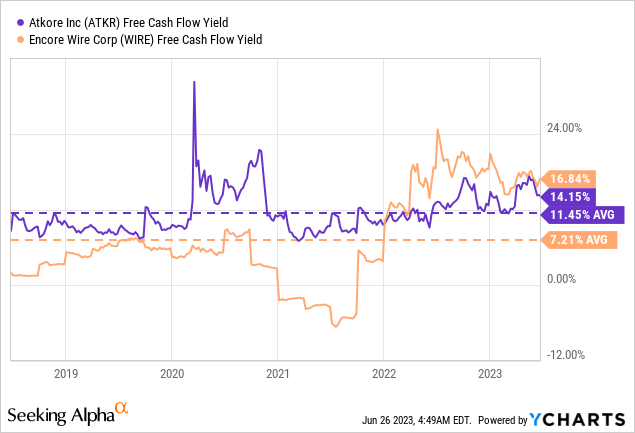

Surprisingly, the free cash flow yield of Atkore and Encore Wire are above the average of the past years. Considering the stock appreciation, both companies have improved their free cash flow generation massively.

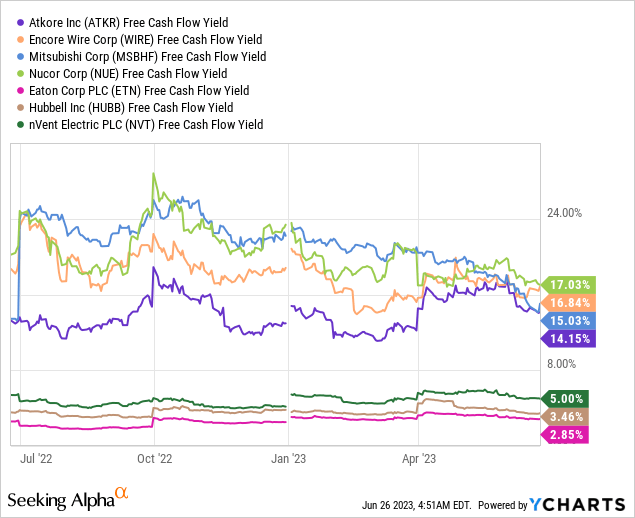

Comparing the two companies with some peers, it is visible that Atkore and Encore Wire trade at the higher end of the graph, which makes them rather cheap. Only Nucor (NUE) is trading at a higher free cash flow yield at 17%.

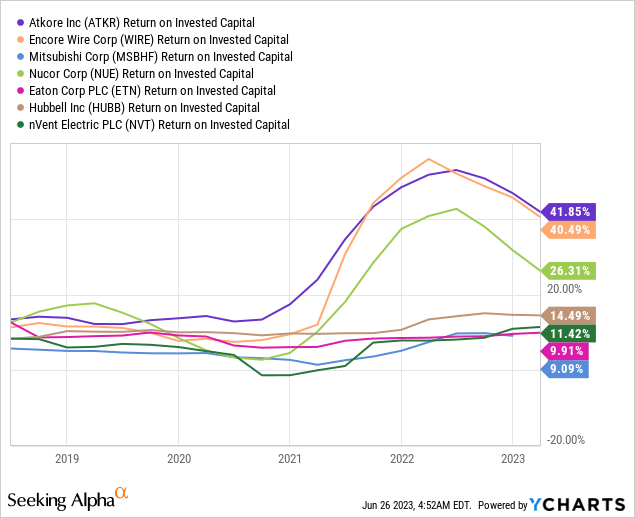

On top of that, the two businesses stand out with their return on invested capital, beating the other peers by a wide margin.

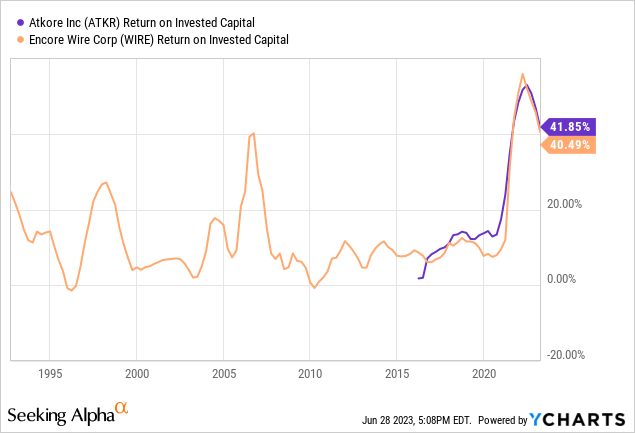

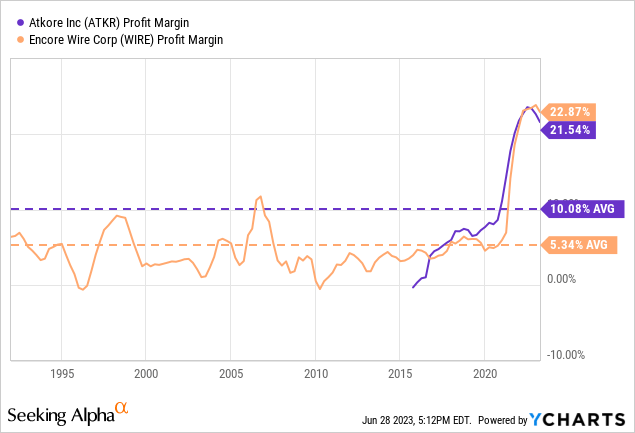

Although, the last two years have been great, it is important to keep an eye on the long term picture. There will always be business cycles with ups and downs. We definitely see that 2021 and 2022 have been an outlier while looking at Encore Wire’s history of ROIC.

A normalization of profit margins would mean that the current “cheap” valuation might be a value trap and a period of lower profitability could be near.

Balance Sheet & Buybacks

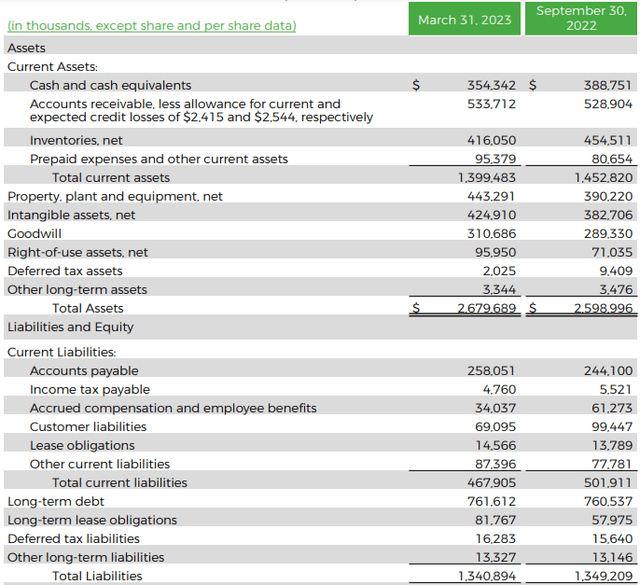

Atkore has a solid balance sheet with $354 million in cash and cash equivalents and $1.4 billion in current assets. On the other hand, the company has $467 million in current liabilities and $761 million in total debt. As a result the current ratio is 2.99, which is not bad at all. In my eyes the balance sheet is not superb, since the company has only 5.8% (of the current market cap) cash on hand , this will limit further stock buybacks when we might see a collapse in stock price or lower free cash flow generation.

Atkore Investor Relations 23Q2

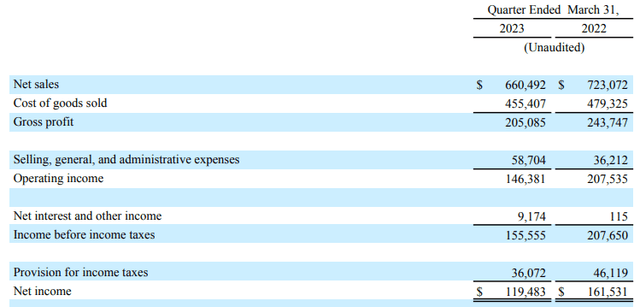

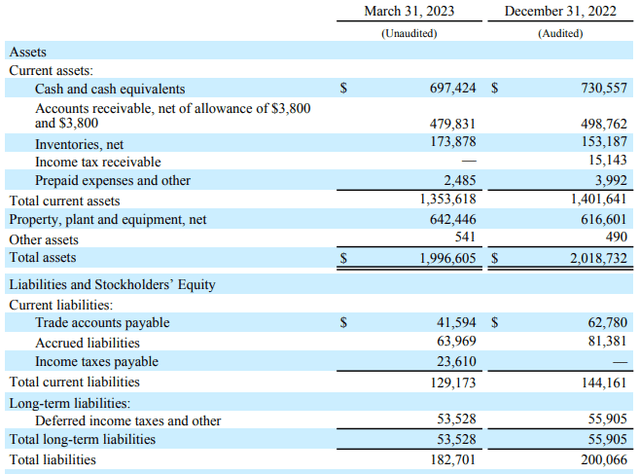

Encore Wire has built up a much stronger balance sheet in this windfall period. Cash and cash equivalents stand at $697 million and current assets rival that of Atkore at $1.35 billion. The company’s liabilities are almost non-existent with current liabilities at $129 million and $0 long term debt. Encore Wire’s balance is quite a fortress with a current ratio of 10.48 and 20% (of the current market cap) cash on hand.

Encore Wire Investor Relations 23Q1

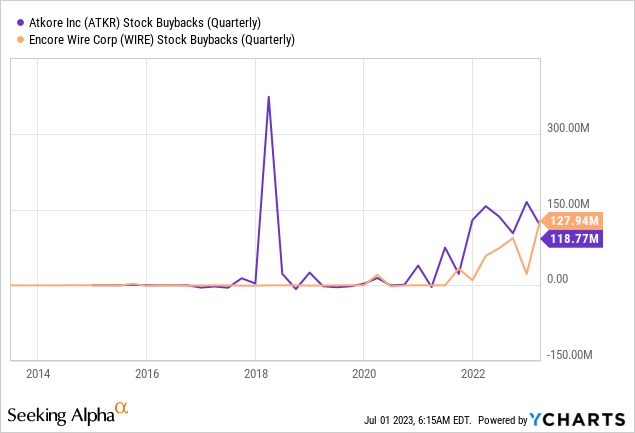

Both companies are buying back a lot of shares. The question is if this is the best place to invest their money right now. The stock prices of both companies are close to all-time highs, similar to their profit margins. Considering both businesses have a cyclical nature, it might not be the best time to buyback a lot of shares on the top of the cycle. One benefit for shareholders is that stock prices have less downward pressure, till profits might shrink more. But as a shareholder in those companies I would like more focus on profit efficiency, building a stronger business and maybe a dividend or dividend increase.

Takeaway

Both Atkore and Encore Wire have excellent years behind them with high profitability. Still, it is no better time for investors to re-evaluate the risk and reward balance. Both companies are cheaply valued based on the current profits they make. They have been able to pay back debt and stash up some cash.

I worry that profitability could shrink further before we see the growth initiatives play out. The enormous buybacks might not be the best at the top of the cycle, but will protect the shareholders temporarily from a drawback in share price. In my opinion, the risk on both stocks is rather high and the reward rather low. Therefore, I rate both stocks a “HOLD”. I do want to mention that Atkore’s business is more diversified and could hold up stronger with their profit margins. Although Encore Wire is on the other hand a “one trick pony” and could lose profit margins faster, the company has a fortress of a balance sheet and could definitely survive in the next decade when things go south.

While researching both companies, I learned the a screener is not perfect for looking for deals in the market. Keep doing your own due diligence and find out in which phase the business cycle is at.

Thank you for reading, I am always welcoming feedback!

Read the full article here