Main Thesis & Background

The purpose of this article is to evaluate Mid-America Apartment Communities, Inc. (NYSE:MAA) as an investment option. The company is a “real estate investment trust that focuses on the acquisition, selective development, redevelopment, and management of multifamily homes throughout the Southeast, Southwest, and Mid-Atlantic regions of the United States”.

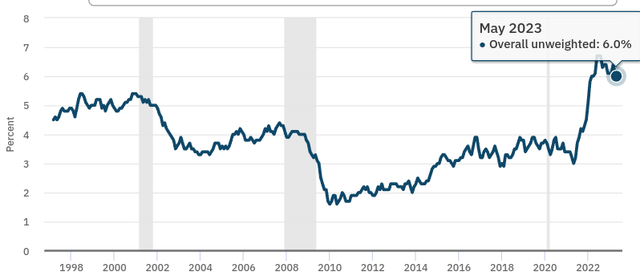

My followers know I have owned (and recommended) MAA many times over my ten year writing career here on SA. This included in Q1 2023, when I saw some value in the REIT after it dropped by over 16%. Looking back since March and that review, a buy call was reasonable at that time:

Stock Performance (Seeking Alpha)

So MAA has been a winner, but so has most of the market to be fair. As we enter the second half of the year, I view this slowing momentum as a reason to get a bit more cautious on my outlook. I think the broader consumer environment will pressure rental prices and that could pose a challenge for MAA to keep these gains going. An increase in interest rates will also act as a headwind. This leads me to think a downgrade to “hold” is most appropriate at this juncture and I will explain why in detail below.

Rents May See Some Pressure (Broadly Speaking)

One theme we have seen on a macro-level throughout the past couple of years should be of no shock to readers. This is rising home prices and rents, which has been fairly consistent across the country (and other parts of the globe). A shortage of supply coupled with population growth, a desire to live more spread out, and rising input costs have led to housing being a growing challenge for many Americans.

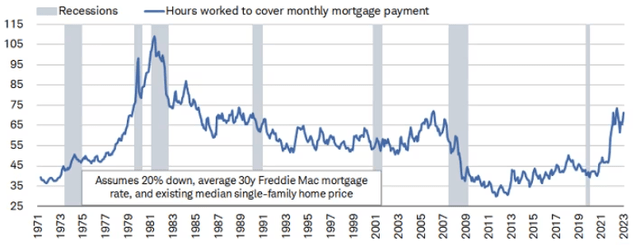

This is still the case today in all honesty. But we have seen home prices start to cool as more supply hits the market and interest rates stint affordability. This has actually benefited rental plays like MAA as some would-be home buyers are forced in to continuous renting:

Affordability Pinch (Hours to meet mortgage payment) (Bloomberg)

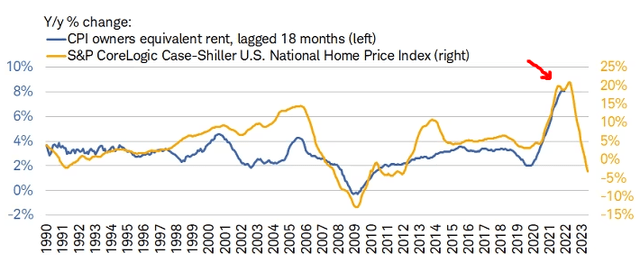

This was central to my bullishness on MAA for a while. But today I am looking at it with a new lens. As the housing market starts to turn a bit, the same can’t be said for the apartment rental market. Again – this is “good” for MAA for the time being. But my concern is that it will not last. As we have seen in prior economic cycles, rents will typically come down along with home prices, albeit with a bit of a lag:

Buy vs. Rent (Charles Schwab)

This is in no way meant to be alarmist. The backdrop for MAA is still reasonable and rents are not just going to plummet. But as with any stock or funds, MAA should be approached at the right time. TO initiate a position when rents may start to see some pressure AND the REIT has had a nice run-up over the past quarter, strikes me as a bit ill-timed. I will stay patient and see if a better entry point presents itself, which is why “hold” makes sense to me.

Higher Rates Have Taken Their Toll Before

I notice on SA that popular REITs – including MAA – get a lot of praise. This is pretty standard and the general consensus is usually “buy”. I don’t inherently disagree in the overall value and quality of this company and management. But we have to be realistic that no single idea is a buy all the time. We have to consider the current price action and what is going on in the market. This was central to my prior “hold” downgrade at the start of 2023. I saw rising interest rates as a fundamental headwind and believed readers would be well-advised to ignore the constant “buy” mantra and be selective. Suffice to say, those who ignored that advice and bought anyway would have found themselves still sitting at a loss today:

Stock Performance (Seeking Alpha)

Why is this relevant? It isn’t to pay myself on the back. Rather it is to show the historical relevance of being patient at the right time. Looking ahead, I think this is also one such time.

The reason being that the interest rate headwind is not going away. After a widely accepted belief that the Fed could halt interest rate increases (with some even wrongly predicting cuts in 2023), Fed Chairman Powell has thrown cold water on those ideas. Just this past week he was quoted:

We expect the moderate pace of interest rate decisions to continue.”

Source: Reuters

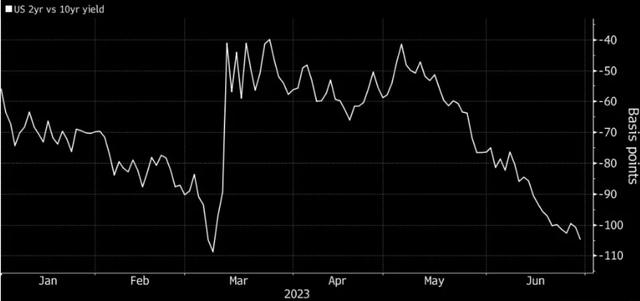

And markets have taken notice. The yield curve inversion has been pushed towards its one year peak. This indicates that investors believe short-term rates will keep on rising faster than long-term rates. With the Fed all but signaling more hikes to come – and investors worried about longer term economic growth and that impact on rates – it is not a surprise the yield curve remains inverted. But the sharpness of the inversion is a concern:

Yield Curve (2 Year vs 10 Year) (Yahoo Finance)

This ties back to MAA because higher interest rates pressure REITS – all other things being equal. This doesn’t mean MAA will see its share price decline, or even that it will perform poorly. But it does mean the company will probably see higher interest rates have an impact through a decrease the value of properties they own. Further, MAA will see higher borrowing costs along with the rest of corporate America. It can also make relatively high dividend yield, which sits under 4% right now (3.7%), less attractive than it otherwise would be.

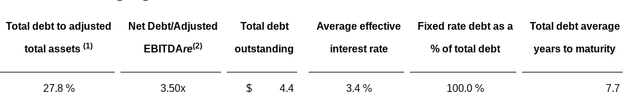

Of course there are upsides to inflation and higher rates for REITs. They often have the ability to pass on inflationary costs to their customers. This would benefit MAA in the form of higher rents, something not all companies can count on when their costs rise. This company in particular also uses a large amount of fixed-rate debt. So unless they plan on going on a borrowing spree in the near term, or if rates stay higher for long, MAA may actually be better leveraged to ride out the coming storm better than most:

MAA’s Debt Structure (Q1 Earnings Report (MAA Investor Center))

The takeaway for me is that I believe REITs such as MAA may get caught-up in the sector selling as rates push higher. But when sector rotations like that occur they can often be undiscerning. Tactical investors should use that as the buying opportunity since MAA is structured with long-term debt and should therefore ride out short-term interest rate volatility well on a practical level. That doesn’t mean the share price won’t take a hit – and I believe it will. But it does mean the fundamental soundness of the company won’t be too impacted. This push-pull dynamic is central to why I see “hold” (and not a more bearish outlook) as the right call.

Sun-Belt Still The Place To Be

To help balance out this review I will now shift to some positive aspects for MAA. I am up on this REIT and – as mentioned – I am not a strong bear by any means. I will keep holding because there are some central attributes that make my investment thesis for first buying in to this company as relevant as ever.

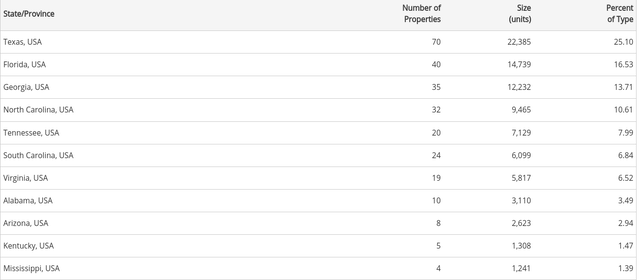

The primary is the markets where MAA serves. This is a “Sun Belt” play, as the Southeast and Southwest are the company’s core markets. And, not surprisingly to those that are following intra-country migration patterns, these are also the states Americans are moving to. According to a National Association of Realtors report, (based on U.S. Census data), Florida, Texas, North Carolina, South Carolina, Tennessee, Georgia, Arizona, Idaho, Alabama and Oklahoma made up the top 10 states for domestic net migration last year. This directly benefits MAA as the company serves residents via apartments in eight of those states (the exceptions being Idaho and Oklahoma).

For clarity, MAA is heavily exposed to Texas, Florida, and Georgia. But if we look at the broader breakdown of their apartments communities we see the other states mentioned in the census data as key components of the company’s portfolio:

Units By State (MAA Investor Center)

This bodes well for the company for the foreseeable future and is key to why I will keep on owning MAA and look to build on this position when the opportunity strikes.

Rate Fears Could Be Overblown

I touched on why I am less worried about higher interest rates impacting MAA fundamentally due to its debt structure. But I also pointed that oftentimes the market is not discerning – when a sector/theme/idea sells-off, often the good get hit with the bad.

On this point though – will things really be “bad” in the second half of the year? They could be if inflation remains stubborn and the Fed keeps up its pace of rate hikes faster than the market really wants. But there are some signs of relief on this front that may mean the Fed could be done after all.

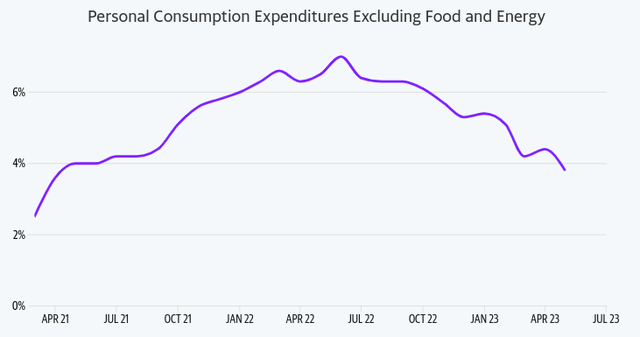

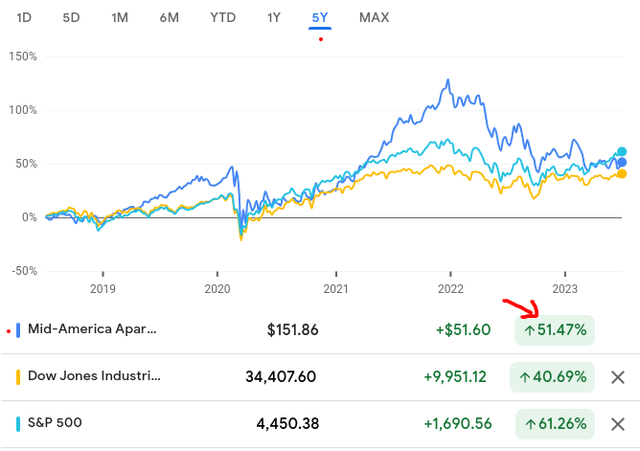

Specifically, we are seeing inflation gauges drift lower as higher borrowing costs and less stimulus from the government takes its toll. The Fed’s preferred inflation measure, which is uses to dictate how it will move with respect to rate hikes, has recently hit a two-year low:

PCE (US) (Excluding Food & Energy) (Bureau of Economic Analysis)

This could be a positive for MAA (and equities overall) if the market normalizes and that allows the Fed to pause. That is what investors are ultimately hoping for, and metrics like this suggest we are getting closer to that reality. Whether it will happen in 2023 remains to be seen, but we are clearly on the path to a normalized inflationary environment.

Wage Growth Still, But Slowing

My final point is another mixed one. This is related to U.S. worker wage growth. This impacts discretionary sectors – such as Consumer Discretionary – more than areas like housing to be sure. Mortgage and rental costs are more sticky than average everyday items. But we do have to consider that wage growth is fundamental to affordability of higher rents. People can only pay so much to live somewhere and that has to be considered.

In this regard there is not an immediate concern. Wage growth popped as the Covid-reopening got underway in America. It soared well beyond historical norms and still sits at a high level relative to past economic cycles:

Wage Growth Tracker (US) (Federal Reserve Bank of Atlanta)

How one reads this can be subjective. On the one hand wages are growing at a historically high rate and that is supportive of higher rental prices for living accommodations – benefiting MAA. On the other hand, these gains are starting to slow along with inflation. That will make rental increases harder to swing for most apartment REITs, balancing out some of the positive. The conclusion I draw here is this is neither a buy or sell indicator, so it helps justifies a hold.

Bottom-line

I have been investing in MAA for a long time and have generally been pleased with the results. The return over time has been strong, dividend growth has been reliable, and it provides some diversification for a portfolio that is heavily dependent on the major indices:

5-Year Chart (Google Finance)

I see a future ahead where this company continues to perform well and benefits from migration patterns, a rising white-collar workforce in the Southeast, and the ability to pass on higher rents to its residents.

But there are risks at these levels too. Inflation remains stubborn and wage growth is slowing. The Fed has reiterated more rate hikes could be on the way. MAA has also seen a nice short-term bounce in share price and those who follow this company know there can be plenty of swings along the way. This leads me to a more cautious outlook at this juncture. I suggest readers carefully consider new entry points as a result.

Read the full article here