While we’ve this a slow start to the year from the Gold Miners Index (GDX) which is up just 4%, Osisko Gold Royalties (NYSE:OR) continues to trounce its peer group from a performance standpoint, sporting a 28% total return year-to-date. Notably, this outperformance is lapping outperformance in 2021 and 2022 as well, with Osisko Gold Royalties (“Osisko”) down just 4% vs. a 20% decline over two those years for its benchmark. And while the outperformance of some names like McEwen Mining (MUX) this year makes less sense given its marginal assets and an underwhelming PEA from Los Azules, Osisko’s performance is entirely justified, with the company continuing to fire on all cylinders and benefiting from surprise positive developments within its portfolio.

One of the most recent positive developments was the long-awaited closing of the CSA Copper Mine transaction by Metals Acquisition Limited (MTAL) with Osisko landing not only a 100% silver stream but also a sliding scale copper stream on this high-grade producing asset that sits on a ~350 square kilometer land package just 11 kilometers northwest of Cobar in Australia. For those unfamiliar, copper mineralization was discovered in 1871 at CSA and underground production began in 1967. The mine would spend time under several different owners in the 1967-1999 period, before finding itself in the hands of Cobar Management Pty, a wholly owned subsidiary of Glencore (OTCPK:GLCNF) who has operated it for the past 22 years until its recent sale. Let’s take a closer look at the asset below and how this deal impacts Osisko’s production profile:

All figures are in United States Dollars unless otherwise noted.

CSA Mine (Osisko Presentation)

CSA Mine

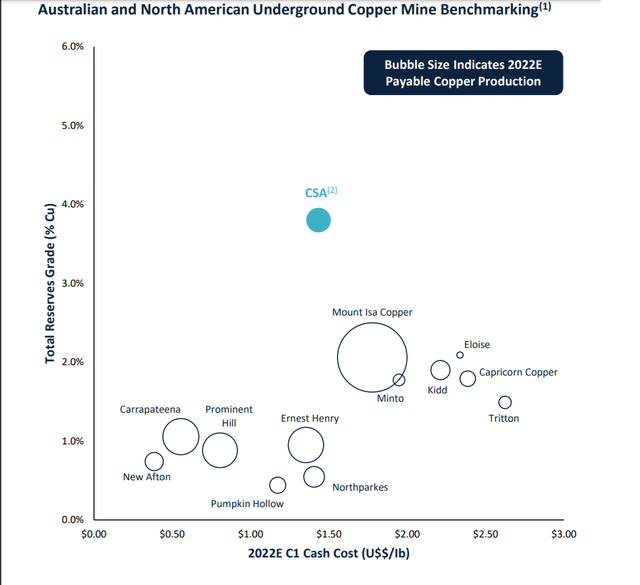

The CSA Mine is a world-class asset in NSW, Australia, with it being a top-5 copper mine from a grade standpoint with a current reserve grade of 4.0% copper. This places it just behind mines like Sudbury, Las Cruces, and Kinsenda, but it’s one of only two of these assets in Tier-1 jurisdictions within the top-5. This is because mining activities at Degrussa (Australia) completed in Q4 2022, and the other assets among the top-5 from a grade standpoint are located in the DRC (KOV, Kinsenda), and Spain (Las Cruces). Hence, Osisko’s ability to lock down two streams on this world-class asset for ~$190 million in consideration (metals streams and equity subscriptions) is certainly a very positive development, as is the fact that the company evaded paying the extra $15 million given that the silver price did not average above $25.50/oz for the ten business days prior to the transaction closing.

Australia & North American Copper Mine Benchmarking (Company Presentation)

Digging into the CSA Mine a little closer, the asset is impressive on several fronts, and currently hosts a reserve base of ~7.9 million tonnes at 4.0% copper and 16.1 grams per tonne silver, giving it a total reserve of ~314,100 tonnes of copper and ~4.1 million ounces of silver. The mine produces a high-grade copper concentrate with respectable estimated cash costs of ~$1.41/lb with by-product credits and all-in sustaining costs [AISC] that should come in near $2.10/lb if the company succeeds in optimization work to lower operating costs, which would translate to ~45% AISC margins at a $3.80/lb copper price. However, it’s not just the grades and margins that are impressive, it’s also the size, with the dual-shaft (~2.3 million tonnes per annum of combined hoisting capacity) mine expected to produce ~46,000 tonnes of copper on average from 2023-2025 even while operating at well below its potential total processing capacity (1.3 million tonnes per annum vs. 1.9 million tonnes per annum).

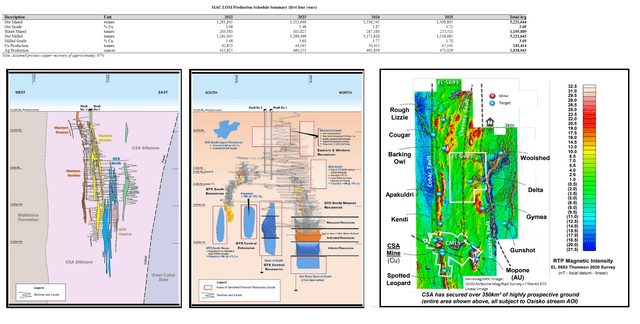

CSA Mine Life of Mine Production Schedule (Company Filings)

The CSA Mine is located near past producing or currently operating mines including Endeavor (lead-zinc), Peak and Hera (gold-copper), and the Tritton Mine (copper) in the Cobar region, and there are currently five known vein systems at CSA, including Eastern, Western, QTS North, QTS Central, and QTS South, with QST North containing the bulk of the current reserves. As shown in the images above, the mine has five to thirty meter wide lenses over relatively short strikes (sub 300 meters), but significant vertical continuity down plunge (1,000+ meters). And while the CSA Mine’s life of mine plan already extends into the 2030s, there is meaningful exploration upside near-mine (at depth as well as up-dip where historical mining was incomplete) and from a regional standpoint, with 11 targets identified all within close proximity to the CSA Mine, pointing to the opportunity for mine life extensions and potential increases to throughput if a satellite deposit was uncovered.

As for the exploration upside and opportunity to grow reserves, there are multiple opportunities here. For starters, there is near-surface potential at the Western Gossan target directly next to the two existing shafts with untested downhole electromagnetic anomalies. Second, there are untested downhole electromagnetic targets directly south of the Western Gossan at QTS South Upper with high-grade intercepts that include 3.6 meters at 19.2% copper and 5.7 meters at 8.3% copper. Third, QTS South Deeps offers upside at depth below the current QTS South resources with drill intercepts in excess of 10% copper reported south of the shafts and at depth. Finally, QTS North is also open to the east at higher elevations and at depth, with highlight intercepts at QTS North including 10.1 meters at 9.6% copper and 20.1 meters at 4.4% copper, and drill intercepts suggesting mineralization is present below the current inferred resource base.

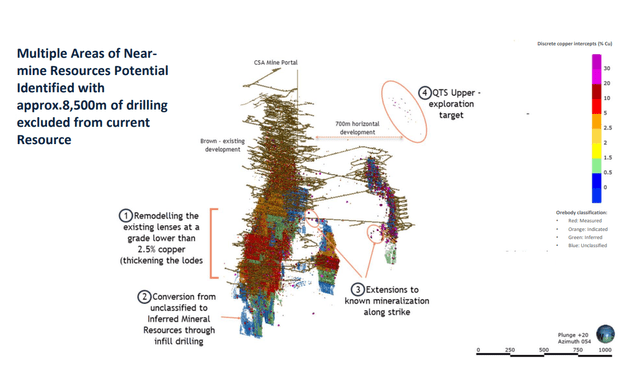

CSA Mine – Exploration Upside (Company Presentation)

However, the bigger opportunity here looks to be the relatively high cut-off grades used at the CSA Mine, with a current cut-off of 2.5% copper that is nearly double that of other underground copper mines in Australia (~1.3% copper excluding Degrussa). And if the company were to lower its cut-off grade to 1.5% – 2.0% which would still be above the underground copper mine average in Australia, this could open up the opportunity to mine wider zones or additional lenses, with the company noting that the current cut-off grade has restricted the width of defined lenses, resulting in potentially economic mineralization being left behind in some areas. While analysis is preliminary, Metals Acquisition Corp noted that we could see up to 200,000 tonnes of contained copper added by lowering the cut-off grade to 1.5%, which would effectively double the current resource base of ~193,000 tonnes of copper.

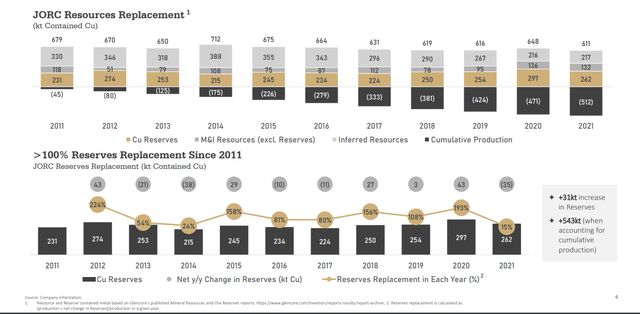

JORC Resource Replacement – CSA Mine (Osisko Presentation)

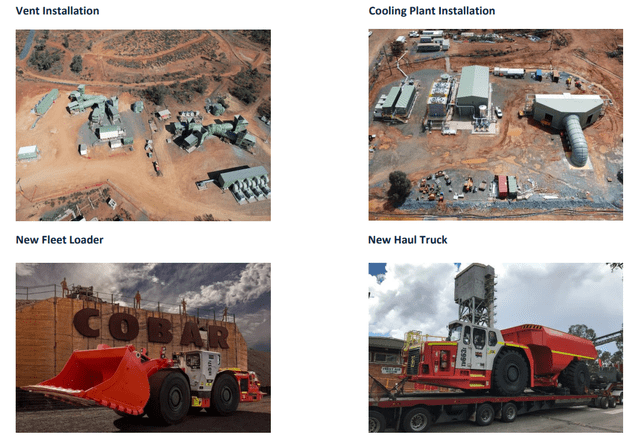

Lastly, from a cost standpoint, there are levers to pull to help maintain this asset’s incredible track record of positive reserve replacement and justify lowering cut-off grades. As highlighted by Metals Acquisition Corp, the company is confident it can bring down costs at this asset, with a new offtake agreement signed, a new mining fleet that should translate to lower maintenance costs and improved efficiency, and new ventilation systems/cooling systems that should increase productivity. This is a big deal because jumbo utilization, truck utilization, loader utilization, and lateral advance rates are all well below the Australian industry average at CSA and these optimization opportunities could have a dramatic effect on unit costs if productivity improves, supporting the possibility of lowering cut-off grades to pull new reserves into the mine plan even without tapping any regional opportunities or exploration upside at depth.

CSA Mine Upgrades (Company Presentation)

In summary, this is a phenomenal asset and assuming a ~1.3 million tonne per annum processing rate at 3.7% copper (97% recovery) and ~14.3 grams per tonne of silver (~76% recovery), we would see annual production of 45,000+ tonnes of copper and ~460,000 ounces of silver per annum at exceptional margins if copper prices can continue to find a floor at $3.50/lb. So, with this being a Tier-1 jurisdiction asset with a strong history of reserve replacement and a significant explored land package, I see this deal as a home-run for Osisko, especially given the price paid at less than 1.0x NAV vs. other deals sector-wide on Tier-1 assets that have come at much higher multiples for peers. Hence, landing these streams should be quite encouraging for investors, with the CSA deal reinforcing that Osisko will maintain a Tier-1 jurisdiction focus but also maintain strong discipline on price paid, willing to swing at the fat pitches but let the over-priced deals float by vs. trying to find growth at any price.

Benefits to Osisko

So, what are the benefits to Osisko?

Based on the 100% silver stream at a cost of 4% of spot prices, Osisko will benefit from deliveries of ~460,000 ounces of silver per annum at a cost of less than $1.00/oz, assuming a ~1.32 million tonne per annum processing rate, a 76% recovery, and an average silver grade of 14.3 grams per tonne. This would translate to ~6,100 gold-equivalent ounces [GEOs] at a 75/1 gold/silver ratio or over $10.0 million in revenue per annum. Meanwhile, the copper stream is not expected to deliver in the first year but will kick in during late June 2024, starting at a 3.0% stream at 4.0% of spot prices from the 1st to 5th anniversary of the deal closing. At this lower stream rate and assuming production of ~43,000 tonnes of copper per annum, this would translate to ~1,300 tonnes of copper or $10.0+ million in revenue per annum at an $8,000/tonne copper price, translating to over 5,600 GEOs assuming a gold price of $1,850/oz.

However, from the 5th anniversary to 33,000 tonnes of copper being delivered, Osisko’s stream rate will increase to 4.875%, a massive increase from the 3.0% previously. Even if we assume a slightly lower production rate of 40,000 tonnes of copper per annum, this would translate to ~1,950 tonnes of copper or $15.0+ million in revenue, translating to ~8,400 GEOs. This means that starting in H2 2029 and assuming no upside in the copper price which I would argue is unlikely given the favorable supply/demand outlook, Osisko will generate $25.0+ million in revenue from this asset alone per year, with this asset contributing to ~10% growth initially vs. its current production profile and ~15% once it moves up to the higher rate of 4.875% at extremely high margins.

It’s important to note that these growth assumptions assume that Metals Acquisition Corp continues to operate the CSA Mine at well below its potential throughput capacity of 1.9 million tonnes per annum, with material upside to these figures if we do see throughput increases. Hence, I would argue that the $20.0 – $25.0 million in revenue per annum from CSA has upside, given that it is based on conservative spot metals prices for copper and silver and does not include any upside from a throughput standpoint. Let’s see how this improves the company’s growth pipeline:

Medium-Term & Long-Term Outlook

As Osisko has signaled in past updates, the company was aiming to grow into a 130,000 to 140,000 ounce per annum royalty/streaming company by 2027, up from ~100,000 ounces currently. And following the addition of ~5,000+ GEOs per annum from the CSA Mine Copper stream, this has de-risked the growth profile and checked another box to delivering on this target. However, as I’ve highlighted in past updates, there are multiple opportunities to grow production at assets that are not yet in production, and Osisko has been methodically adding new royalty assets over the past two years months at attractive prices to embolden its pipeline even further. These include royalties on Marimaca (1.0% NSR), Cascabel (0.6% NSR), AntaKori (1.5% NSR), West Kenya (2.0% NSR), Central Hounde (1.0% NSR), Kandiole (1.0% NSR), giving it several irons in the fire to add new producing assets that could deliver by 2031 even if they might not sneak into the 2027 growth outlook.

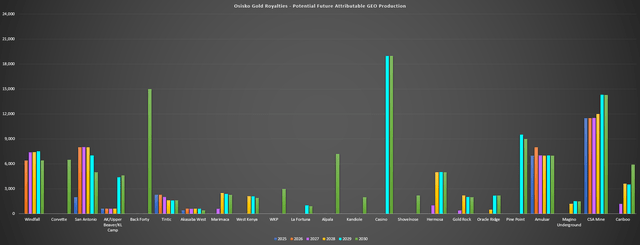

Osisko Gold Royalties – Potential Future GEO Production (Company Filings, Author’s Chart)

If we dig into what this looks like on the above chart when including its other assets that were acquired since its inception, we can see that the CSA Mine (right side of chart) will provide major growth, and is the first of these assets in this potential future attributable GEO production profile to cross the finish line. However, there are nearly two dozen other assets that should begin production by 2030 and earlier in many cases, including Windfall, Hermosa, Gold Rock, Amalgamated Kirkland, Upper Beaver, West Kenya, Marimaca, Akasaba West, La Fortuna, Magino Underground, and potentially the high-grade WKP asset. And in addition, there are several assets capable of delivering very lumpy growth that are harder to pin down a timeline for currently, including Casino (~18,000 GEOs per annum), Pine Point (8,000+ GEOs per annum), Cariboo (7,000+ GEOs by Year 5), Back Forty (~15,000 GEOs), and Corvette (~6,000 GEOs depending on scale).

On top of this, an asset that wasn’t even contemplated, Amulsar, looks like it could head into production by 2024 (~7,000 GEOs per annum or $13.0+ million in annual attributable revenue to Osisko), and this doesn’t factor in Agnico’s (AEM) ambitions to turn Malartic into a 900,000+ ounce per annum asset. So, with Osisko continuing to further diversify its portfolio with advanced development-stage assets across the globe while focusing the majority of its capital on solid cash-flowing deals like the CSA streams that could produce into the 2040s if the asset can be optimized, I remain quite confident in the company meeting the low end of 130,000-ounce target by 2027, and taking a longer-term outlook, this is a portfolio that could produce upwards of 200,000 GEOs if a couple of the larger assets are brought into production, such as Casino, Horne 5, Pine Point and or Back Forty.

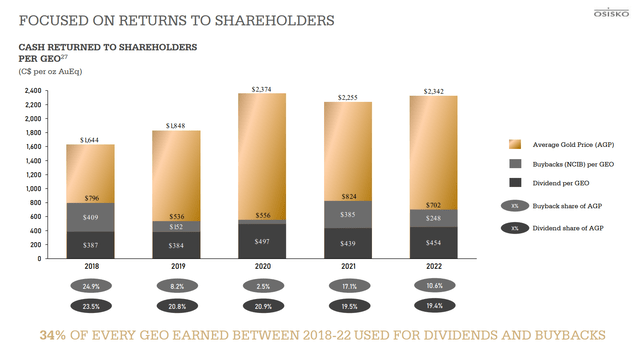

Osisko – Returns To Shareholders (Company Presentation)

And what’s so enviable about this portfolio is that there are so many royalty/streaming assets in the advanced development stage, meaning that or two assets that don’t come through won’t break the back of these growth plans, which is one reason I highlighted Osisko Gold Royalties as the far superior bet to Sandstorm Gold (SAND) last year in May 2022, with OR outperforming SAND by over 55%, given that Sandstorm was reliant on one asset to deliver most of its growth, and as we’ve seen, its schedule was pushed out yet again, even if it is now in the hands of an operator that is experienced and more well capitalized and much more likely to push it to the finish line. And as Osisko sees new assets come online like Amulsar, Tocantinzinho, and growth from Island/Mantos Blancos, we should be able to expect continued growth when it comes to cash returned to shareholders, an area which Osisko has exceled, and should be commended for its timely share buybacks over the past 18 months while it traded at a deep discount to NAV.

Valuation & Technical Picture

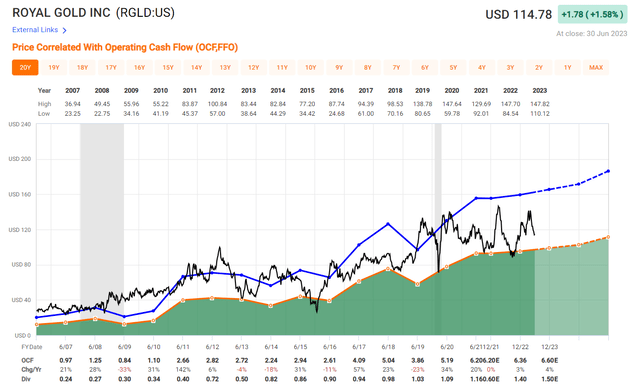

Based on ~185 million shares outstanding and a share price of US$15.10, Osisko Gold Royalties trades at a market cap of US$2.79 billion and an enterprise value of ~$2.81 billion. At first glance, this might appear to be a steep valuation for a company that generated just ~$45 million in cash flow in the most recent quarter and less than $140 million in operating cash flow last year. However, the company’s FY2022 results don’t do this business justice, as highlighted in the medium-term & long-term outlook section, with this being a company with the potential to grow its attributable production to 180,000+ GEOs by 2030, even without bought and paid for opportunities like Cariboo, Casino, Back Forty, and Horne 5 which could combine for well over 50,000 GEOs per annum. At this scale, Osisko would generate ~$310 million in cash flow per annum at a $2,000/oz gold price, and a company of this scale with a focus on Tier-1 jurisdictions could easily command a cash flow multiple of 20.0 to 28.0, in line with where Royal Gold (RGLD) has historically traded.

Royal Gold – Historical Cash Flow Multiple (FASTGraphs.com)

Even if we use the mid-point of this range for future cash flow multiples (24.0x), this would translate to a fair value for Osisko Gold Royalties of ~$7.44 billion or a fair value of US$39.15 assuming a share count of 190 million shares. Importantly, this assumes relatively modest deal flow regarding adding new cash-flowing or near-term cash-flowing assets to its portfolio, which I would argue is conservative given that Osisko has the liquidity (~$400 million) to support mid and large-scale transactions. To summarize, while the stock has outperformed its peers, it’s still very reasonably valued relative to its long-term potential, and it continues to trade at a very reasonable P/NAV multiple of ~1.15x P/NAV compared to an estimated net asset value of ~$2.47 billion. This is a steep discount to the top-3 royalty/streaming names which may deserve premiums because of their scale, but Osisko certainly has the more attractive jurisdictional profile and has seen a material improvement in its concentration to a single asset as new mines come online (CSA Mine) and others benefit from organic growth (Mantos Blancos, Island, Tintic).

In terms of a medium-term price target, I see a fair value for Osisko Gold Royalties of US$19.80 (18-month price target) based on what I believe to be a fair P/NAV multiple of 1.50x given the quality of this portfolio.

Osisko Gold Royalties – September 2022 Update (Seeking Alpha Premium/PRO)

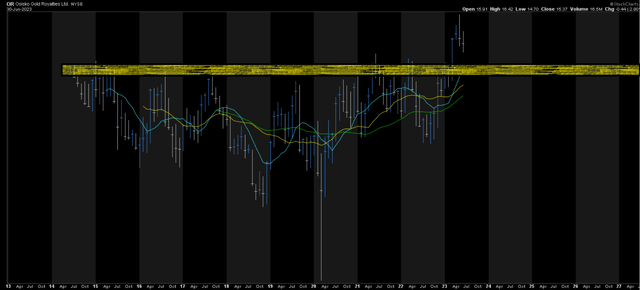

As shown in the monthly chart below, the market has finally clued into this long-term potential, with the incredible buying opportunity below US$10.00 per share in the rear-view mirror, and the stock breaking out to new all-time highs earlier this year. This is a major technical development, with major resistance areas often morphing into new support levels when broken, and the prior resistance zone certainly being significant with the stock butting its head up against the US$13.00 level for over five years. Hence, if we were to see a deeper pullback in the stock, I would be surprised if the US$13.00 level didn’t mark the floor, given that those that missed OR at its lows might look at this as a final opportunity to get on board, and those that accumulated at the stock’s lows might use any sharp pullbacks to top up their positions. In summary, with a phenomenal fundamental growth story combined with a multi-year breakout, OR continues to be one of the sector’s best buy-the-dip candidates if we see further weakness.

Osisko Gold Royalties – Monthly Chart (StockCharts.com)

Summary

Osisko Gold Royalties came out of the gate strong in Q1 with ~23,100 GEOs earned (+27% year-over-year) and rewarded its shareholders with a dividend increase to US$0.17 annualized (+9% year-over-year). However, as discussed previously, we’ve seen a massive upgrade to the investment thesis just six months into the year, with the CSA Mine transaction closing with two streams (100% of silver production, 2.25% – 4.87% of copper production), a major teaming up at Windfall (2.0% – 3.0% NSR) which de-risks this asset and increases the probability of a throughput expansion longer-term, and a longer mine life (2042 vs. 2039) with continued exploration success at Odyssey, where Osisko will have the opportunity to double-dip on Upper Beaver with a 2.0% NSR on the Kirkland Lake Camp (Upper Beaver, Upper Canada) and a per tonne royalty (PTR = $0.40/tonne) at Malartic.

So, for anyone that bought Osisko Gold Royalties on the belief that the stock wasn’t getting the value it deserved for holding one of the best royalty assets in the sector (3.0% – 5.0% NSR on Canadian Malartic/Odyssey) and its strong pipeline which made it a must-own name, that thesis has gone from an 8/10 to a 10/10 since Q2 2022. This is because another exceptional asset has been added to the portfolio in a Tier-1 jurisdiction to provide further diversification (CSA Mine) and it addresses one of Osisko’s previous weak points (high concentration to one asset). And elsewhere, Agnico Eagle now has full control of Canadian Malartic with multiple available spokes to increase mill throughput long-term (benefiting Osisko’s PTR), Windfall has a new well capitalized/experienced 50% owner in Gold Fields (GFI), and we’ve seen surprise exploration success at Corvette (2.0% NSR on lithium) which could be a meaningful contributor by the end of the decade that wasn’t even part of the thesis last year (resource due by year-end).

Odyssey Underground (3-5% NSR held by Osisko) (Agnico Eagle Presentation)

Given all these positive developments, I see Osisko Gold Royalties as one of only three names where averaging up is entirely justified, and I would strongly consider adding to my position on any pullback below US$14.00. Obviously, there’s no guarantee that the stock pulls back this sharply, but I would consider it a gift if we see a ~25% pullback to re-test the stock’s breakout level.

Read the full article here