VALE’s Iron Ore Investment Thesis Has Faded

We previously covered Vale S.A. (NYSE:VALE) in January 2023, cautioning investors not to add due to the stock trading at its peak cyclical cadence. This was attributed to the market analysts’ overly bullish sentiments about the potential rally of iron ore prices, thanks to China’s sudden reopening and demand recovery.

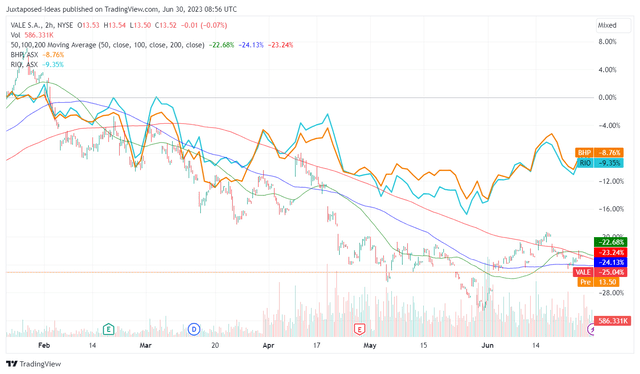

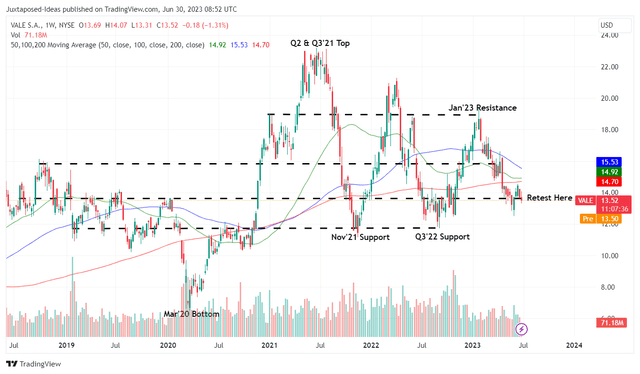

VALE 6M Stock Price

Trading View

True enough, VALE had dramatically retraced from those peaks and returned to the previous Q3’22 support levels, a cadence similarly experienced by other iron ore producers, such as BHP Group Limited (BHP) and Rio Tinto (RIO).

Iron Ore Spot Prices

Trading Economics

Much of the pessimism is naturally attributed to the moderation of iron ore spot prices from the peak hyper-pandemic levels of $223.49 per metric ton to $115.50 per metric ton at the time of writing.

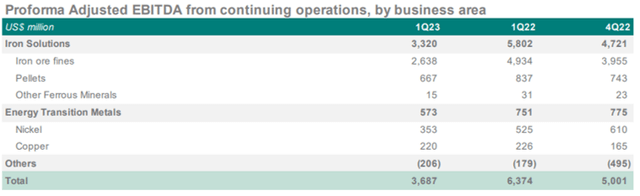

VALE’s EBITDA By Segment

VALE

With Iron Solutions comprising 90.2% (-4.2 points QoQ/ -0.8 YoY) or the equivalent of $13.28B (-29.6% QoQ/ -42.7% YoY) of VALE’s annualized adj EBITDA of $14.72B (-26.4% QoQ/ -42.2% YoY) in FQ1’23, it is unsurprising that its top and bottom lines have been impacted.

This is because the producer has recorded lower realized average prices of $108.6 per metric ton (+13.5% QoQ/ -23.1% YoY) for iron ore fines, with iron pellets similarly impacted at $162.5 (-1.8% QoQ/ -16.4% YoY) in the latest quarter.

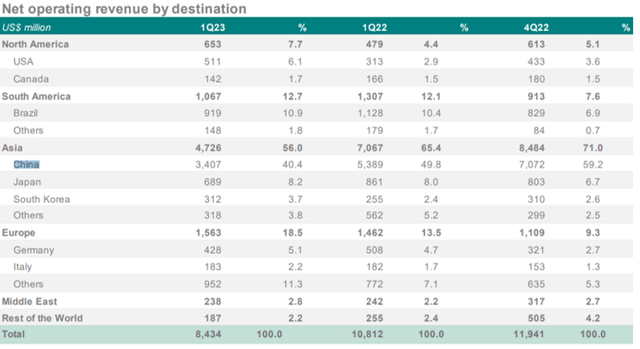

VALE’s Revenues By Destination

VALE

VALE’s situation is also impacted by China’s lower than expected contracted rates, since the country comprises 40.3% (-18.9 points QoQ/ -9.4 YoY) or the equivalent of $13.6B (-51.9% QoQ/ -36.8% YoY) of the producers annualized revenues of $33.72B (-29.3% QoQ/ -22% YoY) in the latest quarter.

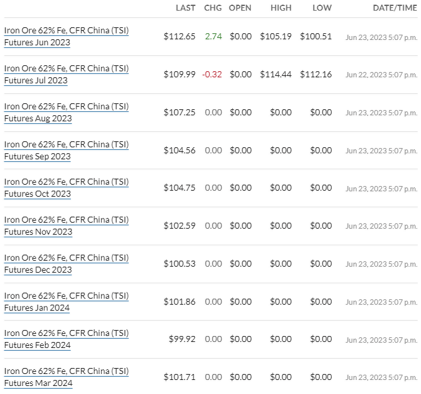

Recent Contract Rates For Iron Ores

Market Watch

The commodity’s contracted rates of between $112.65 for June 2023 contracts to $99.92 for February 2024 contracts suggest further normalizations in the spot prices to pre-pandemic levels of $90s in 2019, likely to trigger a similar cadence in VALE’s top and bottom lines moving forward.

VALE 5Y Stock Price

Trading View

Given these market developments, it is unsurprising that VALE has been normalized to its previous pre-pandemic levels in 2019 as well, implying that the correction may already be priced in, with the stock still well-supported at $12s.

While the producer may offer variable dividends, we are encouraged by the improved forward dividend yield of 5.13%, compared to the 3.38% recorded in 2019 and the sector median of 2.25%.

Therefore, we are upgrading our rating on the VALE stock to a Buy, due to the improved risk/reward ratio and its strategic electrification cadence, to be further discussed below.

VALE Stock Is Still A Buy, Given Its Strategic Electrification Cadence

Prospective investors must have been aware that VALE is looking to separate its base metal business moving forward. Depending on how it is structured, we may see an IPO or a 10% sale in stake for $2.5B.

We generally prefer the latter since it suggests a valuation of 3.14x in EV/ Revenues and 10.91x in EV/ EBITDA for the Energy Transition Metal segment, based on its annualized revenues of $7.96B (-21.6% QoQ/ +3.1% YoY) and adj EBITDA of $2.29B (-26% QoQ/ -23.7% YoY) in FQ1’23. This is impressive indeed, compared to the whole company’s NTM valuations of 1.78x and 3.79x, respectively.

Then again, we must also highlight that these numbers suggest a drastic decline from the VALE management’s previous estimates of $40B in valuation for the Energy Transition Metal segment, implying a -37.5% discount thanks to the peak recessionary fears.

In addition, the Energy Transition Metal segment only records 28.7% in EBITDA margin, compared to the 51.7% for the Iron Solutions in the latest quarter, suggesting the comparatively higher costs involved in electrification.

Copper And Nickel 5Y Spot Prices

Trading Economics

Then again, market analysts already expect copper and nickel spot prices to rally from $3.71 per lbs and $20.45K per metric ton at the time of writing, to $6.50 per lbs and $32K per metric ton by 2030, expanding at a CAGR of +8.34% and +6.61%, respectively.

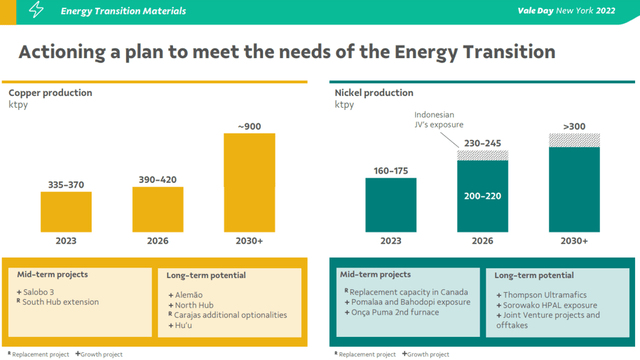

VALE’s 2030 Production Target

VALE

As a result of the potential rise in the commodities’ spot prices, it appears that VALE’s investment in electrification may pay off in the long-term, especially aided the producer’s production target of ~900ktpy for copper and >300 ktpy by 2030, respectively, expanding at a CAGR of +15.16% and +9.40%. This is on top of being the second-largest nickel producer in 2021.

Assuming so, we may see its Energy Transition Metal segment overtake the Iron Solutions as the top and bottom-line driver, significantly aided by the US and EU governments’ aggressive EV targets by 2030 and 2035, respectively.

As a result of the tailwinds, we believe VALE remains at the cusp of the great electrification cadence over the next decade, made significantly attractive due to the stock’s sell-off thus far.

Naturally, anyone adding the stock must also be comfortable with the cyclical nature of the commodity market, with volatility being a constant.

Read the full article here