Price pressures remain elevated, but economic momentum slowed as Q2 wound down. Many market participants think this poses a dilemma for policymakers and are skeptical that the hikes signaled will be delivered because of economic weakness or financial strains. These developments are thought to limit the tightening cycle before the inflation genie can be stuffed back into the bottle.

Yet, this may underestimate the resolve of most of the major central banks in tackling inflation. Many seem willing to risk a shallow downturn if necessary to bring price pressures. Only if there are signs of a significant downturn or heightened financial stress, beyond what was seen earlier this year, would central banks not extend the tightening cycle into Q3, and possibly Q4. The Federal Reserve and the European Central Bank are likely to hike rates in July. The Bank of Canada may also move again after ending the conditional pause it announced in January and the surprise hike in June. The odds of hikes by the central banks of Australia and New Zealand seem slimmer. The Scandinavian central banks and the Bank of England do not meet in July, but they have not reached their terminal rates either.

The undervaluation of the euro and yen remains stark and near historically extreme levels. According to the OECD’s model of purchasing power parity, the euro and yen are roughly 50% and 48% undervalued, respectively. Compared to the Plaza Agreement in September 1985, that saw the G5 coordinate efforts to drive the dollar down, a highwater mark of concerted action, the undervaluation now is greater. In January 1985, the undervaluation of the yen peaked near 24.5% and the German mark around 36%. For dollar-based investors, the price of EMU and Japanese assets, revenue streams, wages, and products are cheap. It is not about market timing, but the recognition that the extreme misalignment offers opportunities for some businesses and investors and that over time, it will correct. This adjustment could offer a significant contribution to total returns over the medium and longer term.

Intervention is best conceived of as an escalation ladder. Among the highest rungs is the coordinated intervention, like arranged by the Plaza Agreement. The low rungs on the escalation ladder are different types of verbal intervention. At least three Japanese officials from distinct parts of the government discussed the exchange rate last month. However, it is difficult to say that the yen’s weakness is not fundamentally driven given the divergence in monetary policy. With updated forecasts to be presented, the July Bank of Japan meeting could offer an opportunity to adjust the settings of monetary policy. There may be scope for a modest step, like changing the policy bias to neutral from easing. The 10-year yield is near 0.40%, indicating that the yield curve control cap is not under pressure. On a trade-weighted basis, the yen fell below last year’s low in June to levels not seen since before 2000, which warns of the risk of another wave of imported inflation. Arguably, the yen’s weakness is more significant for developing Asia than the yuan’s weakness.

Intervention by the Bank of Japan, authorized by the Ministry of Finance, typically occurs after warnings about excessive volatility. Implied three-month vol reached nearly 8.8% in the first half of June, the lowest in more than a year. It finished the month near 10.5%. When the BOJ intervened last September and October, three-month implied volatility was 12-15%. It reached almost 14.5% this past January and above 14.1% in March without official comments about excessive volatility. It is probably wrong to think that the BOJ is defending a particular level. Japanese officials recognize the typically strong correlation between the dollar-yen exchange rate and the 10-year Treasury yield. Its last bout of intervention was on October 21 last year, the same day the US 10-year yield peaked.

While the risk of a snap election in Japan has receded, a cabinet reshuffle remains a distinct possibility. There is another risk for Japan in the month ahead. Following NATO’s decision to open an office in Japan, Prime Minister Kishida has been invited to the NATO gathering (July 11-12). Beijing has expressed concern as these play on its fears of an Asian NATO. It could find ways to express its disapproval.

Policy divergence has also weighed on the Chinese yuan. Some observers seem to suggest that the mere fact that it has a large trade surplus means that the yuan should be appreciating. Yet, it seems too simple, and after all, the US, with the chronic trade and current account deficit, has experienced a strong dollar. Instead, we suggest financial variables are more important than trade in explaining the yuan’s weakness. Simply put, Beijing is easing monetary policy when most of the G10 are tightening policy. Interest rate differentials have moved against it. The US 10-year premium rose 120 bp at the end of June, last month, the most in seven months. The US two-year premium over China tested the year’s high slightly above 275 bp. It has not been above 2.65% since 2007. Chinese equities have also underperformed. The Hang Seng in Hong Kong and the China’s CSI 300 are among the few large bourses that have not risen in H1 23.

There are three changes that will be implemented in the US in July that will impact businesses and investors. First, the Federal Reserve will launch a new instant payment infrastructure for financial institutions. It will operate all the time, including weekends and holidays. It will facilitate private sector innovations that allow for payments and transfers in real time. The program will be rolled out in phases starting in July. Over time, the FedNow service will allow banks and credit unions to address the growing demand for safe and near-instantaneous account-to-account transfers and bill payment, among other use cases. This is not the same thing, of course, as a digital currency, but it is a step toward providing some of the functionality associated with it.

Second, the exemption given to US brokers from Europe’s regulations that require financial institutions to separate research costs from trading fees will expire on July 3 for European clients. Europe adopted the regulations as part of what is called “MiFID II” five years ago. An industry survey found that 71% of US brokers do not plan on offering research as advisers. Some academic studies have found that while MiFID II reduced the overall amount of research generated, the research that is provided has more accurate forecasts. Regardless of the merits of the regulation, the timing could not be worse, the European Parliament is considering a major revision of the “unbundling” rules. The new proposal would allow investment firms to only inform their clients whether they are paying for trading and research together and record the allocation. In a letter to the Securities and Exchange Commission last month, the European Commission, the UK Treasury, and several industry associations, called for the extension of the MiFID II exemptions until the changes are implemented, but to no avail.

Third, as has been well telegraphed, USD LIBOR will be officially replaced by SOFR (Secured Overnight Funding Rate). It is a broad measure of the cost of borrowing overnight, collateralized by Treasury securities. In contrast, LIBOR was uncollateralized and therefore embedded credit risk. LIBOR would often rise during times of financial stress, amplifying the volatility. SOFR is more stable and typically is near the effective (weighted average) of Fed funds. There are futures contracts and other derivatives that allow SOFR to be used as a benchmark for contracts, a hedging vehicle, and helpful for price discovery. Meanwhile, new bank capital requirements and changes to US bank supervision rules are awaited.

The JP Morgan Emerging Market Currency Index fell for the third consecutive month to its lowest level since last October. However, the index is debt issuance weighted and overstates the weakness of the emerging market currency complex. Most of the losses could be traced to a handful of Asia Pacific currencies (China, Malaysia, and Thailand account for about 25% of the JP Morgan index). We note that despite (or because) of a new and more orthodox economic team in Turkey, the lira depreciated by more than 20% last month.

Meanwhile, most of the other emerging market currencies rose. Latin American currencies (Colombian peso, Brazilian real, and Mexican peso) led the charge, and accounted for three of the top four performing emerging market currencies last month, joined by the South African rand. Five central European currencies were in the top 10 EM performers last month. The MSCI Emerging Market equity index snapped a two-month decline, and its roughly 3.0% gain recouped most of the loss recorded in April and May.

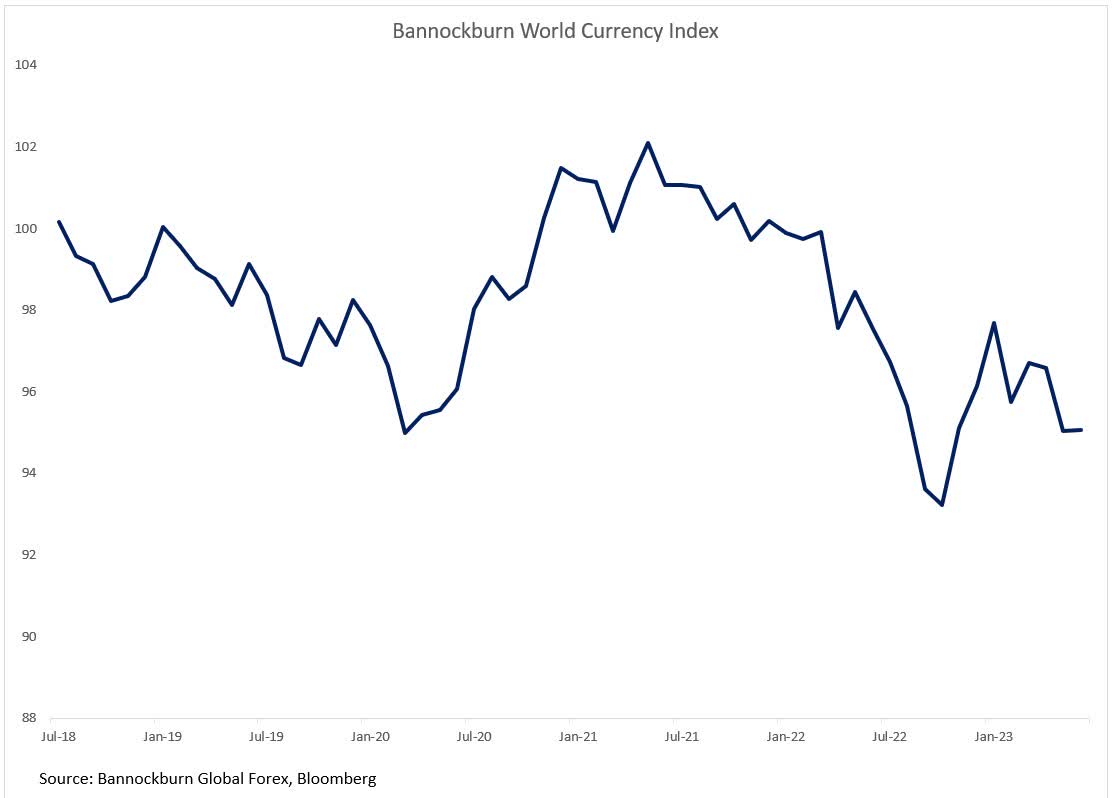

Bannockburn’s World Currency Index, a GDP-weighted basket composed of the currencies of the 12 largest economies, was virtually flat in June after falling in April and May. Only three currencies in the index fell: the Japanese yen (-3.5%), Chinese yuan (-2.1%), and the Russian rouble (-8.5%). However, those three currencies account for nearly half of the non-US dollar part of the BWCI. The Brazilian real (+4.6%) and the Mexican peso (3.7%) were the strongest, but together they account for less than 4% of the overall basket. Among the major currencies, the Canadian dollar was the best performer, with a 2.2% gain (2.4% weighting), followed by the Australian dollar’s 2.1% gain (1.9% weighting).

Barring a significant shock, we expect that the market convergence toward the Federal Reserve’s forward guidance will help lift the dollar. The Bannockburn World Currency Index unwound the gain in the first half of June and returned toward the six-month low set in May (~95.00). We envision another 1.00%-1.25% decline and do not expect it to take out last year’s multi-year low set near 93.20. In the bigger picture. The monetary tightening cycle we expected to have been largely completed by H1 23, now looks to extend, possibly for some countries, like Great Britain, into the end of the year. Meanwhile, Brazil (and Chile) seem well positioned to begin cutting rates in Q3, and Mexico in Q4.

There are many moving pieces and countless developments that put this view at risk. Anything that risks the markets converging with the Fed would weigh on the dollar. Either a broadening of the war in Ukraine or a ceasefire could have dramatic economic and financial consequences. There is talk of a regime change in the coming months in Russia after the recent turmoil, but this seems more like wishful thinking. Even then, it seems politically naive to think that things cannot get worse. US bank stress appears to have eased, and while share prices snapped a four-month decline, they lost momentum in the last few weeks. Commercial real estate exposure is a major concern. Flows from the Fed’s reverse repo facility and foreign demand appear to be helping cushion the tightening that rebuilding the Treasury’s General Account could inflict if it came exclusively from bank reserves. However, rising rates may cause new financial stress, and many households may begin pulling back consumption to prepare to begin re-servicing student loans. Even though senior US officials have been or will go to Beijing, it is hard to say that the relationship has improved, and the risk of an accident always looms.

Dollar: The market has resisted the Fed’s forward guidance. Earlier this year, the Fed funds futures were implying 3-4 rate cuts this year. Fed Chair Powell was adamant that it was not going to happen. Reluctantly, and encouraged by the resilience of the US economy, firm underlying measures of inflation, the market converged with the Fed. This helped the dollar recover from the bank-stressed induced sell-off. We thought the interest rate adjustment was largely complete in late May, leaving the dollar vulnerable in June. The Dollar Index fell from the three-month high at the end of May (~104.70) and briefly dipped below 102.00 in late May. However, a new gap has opened between the markets and the Fed. The Summary of Economic Projections, released at June’s FOMC meeting upgraded growth and inflation forecasts, while the median forecast for unemployment was shaved. The median “dot” now looks for two more quarter point hikes in the Fed funds rate. Only two officials thought the Fed ought to be done. The market has about an 80% chance of hike when the next FOMC meeting concludes on July 26, which would bring the top of the target band to 5.50%. At the end of last year, the terminal rate was seen near 5.0%. Still, the market is suspicious about a second rate hike, and the year-end effective rate is seen near 5.38%. Fair value, assuming a two quarter-point hike, is about 5.57%. With little progress on core inflation, and a strong labor market, we expect the market to further converge toward the Fed, which may give the dollar traction in July. Meanwhile, with the replenishing of the Treasury’s General Account and the ongoing Quantitative Tightening, there is some pressure on bank reserves. At the same time, the tightening of credit conditions following the bank stress that erupted in March, appears less than expected.

Euro: A hike at the European Central Bank’s July 27 meeting is nearly a foregone conclusion. A quarter-point hike would bring the deposit rate to 3.75%. The battle at the ECB is over next move. Data-dependency is weak forward guidance when the regional economy is showing poor growth momentum and inflation remains elevated. There may be scope for a compromise to pause in September, with a low bar for an October hike. The implication of this is that ECB President Lagarde may sound somewhat less hawkish at the post-meeting press conference. Within the EU, the debate is over the Stability and Growth Pact fiscal rules, which were suspended during Covid and again after Russia’s invasion of Ukraine. The forbearance is to end with the 2024 budgets. The EC has proposed reforms that would allow a more flexible and tailored for individual countries. Germany, and ten other EU countries (including Denmark, Austria, the Czech Republic, and the Baltic states) pushed back in favor of stricter fiscal discipline and less EC discretion. While the Bundesbank sees the German economy expanding in Q2 after two quarters of contraction, the risk to the regional economy seems to be on the downside. The ECB shaved its growth forecast by 0.1% for this year (to 0.9%) and next year (1.5%) and lifted its inflation forecast by the same amount to 5.4% this year and 3.0% in 2024.(As of June 30, indicative closing prices, previous are in parentheses)Spot: $1.0910 ($1.0725)Median Bloomberg One-month Forecast $1.0945 ($1.0890)One-month forward $1.0925 ($1.0740) One-month implied vol 6.6% (6.8%) Japanese Yen: The divergence of policy pressed the yen lower in June. While it fell to new lows for the year against the US dollar, it fell to a record low against the Swiss franc, 15-year lows against the euro, and more than a seven-year low against sterling. In the trade-sensitive Asia Pacific region, it is the weakest currency and has slumped to its lowest level against the South Korean won since 2015. While the yen’s weakness is fundamentally driven, the speculators in the CME futures have amassed their largest gross short yen positions in five years. Previously, most observers expected the Bank of Japan to adjust policy in June, but Governor Ueda is still talking patience. At the July 28 meeting, the BOJ will update its macroeconomic forecasts, and that could provide the cover to adjust monetary policy. Still, expectations seem to have mostly been pushed into the second half of the fiscal year, which begins on October 1. The prospects of a snap election have diminished, and instead the political focus is on the cabinet shuffle. The correlation between changes in the dollar-yen exchange rate and US Treasuries remains high but could be disrupted in the run-up to the BOJ meeting.

Spot: JPY144.30 (JPY140.60)Median Bloomberg One-month Forecast JPY140.85 (JPY133.45)One-month forward JPY143.60 (JPY139.95) One-month implied vol 10.7% (10.8%)British Pound: Sterling gained about 2.0% against the dollar in June, to bring the gain in the first half of the year to around 5.0%. Stubborn price pressure spurred the Bank of England to reaccelerate its tightening by delivering a 50 bp hike last month that brought the base rate to 5.0%. The swaps market has the terminal rate in Q1 between 6.0% and 6.25%. At the end of May, the terminal rate was seen near 5.25%. Rate hike expectations helped lift the UK’s two-year yield to around 5.32%, up from 3.0% in late Q1. The 10-year yield reached 4.50%, a little shy of the panic peak last September-October near 4.65%. Moreover, the UK budget deficit in the first two months of the fiscal year is running at more than twice what was recorded last year. Supported by the Chancellor of the Exchequer, the Bank of England is willing to risk a recession to bring inflation under control. The 10-year breakeven (the difference between the yield of the inflation-linked and the conventional Gilt) rose to new highs for the year last month near 3.90%. In comparison, Germany’s 10-year breakeven is near 2.30%, and Italy’s is around 2.15%. Sterling reached our $1.2750 objective in June and stretched momentum indicators before consolidating in the second half of June. Support in July may be seen ahead of $1.2500, the next important chart area on the upside is closer to $1.3000.

Spot: $1.2705 ($1.2345) Median Bloomberg One-month Forecast $1.2630 ($1.2400)One-month forward $1.2710 ($1.2355) One-month implied vol 7.8% (8.0%)Canadian Dollar: Encouraged by the end of the Bank of Canada’s “conditional pause” announced in January and the prospects of additional rate hikes, the Canadian dollar rose by more than 2.5% to its best level since last September. It was the second best performing G10 currency in June, behind the Norwegian krone (3.2%). The swaps market leans in favor of a hike at the July 12 Bank of Canada meeting (~52%), and it is fully discounted by the end of Q3. Excluding mortgage interest costs, Canada’s CPI rose by 2.5% year-over-year in May from 3.7% in April. The headline measure put it at 3.4% (and 4.4% in April). The three-month average of the underlying measures, which the Bank of Canada singled out, slowed slightly (3.72% vs. 3.83%). In what is bound to be a close call, the June employment data on July 7 may be a decisive consideration. Meanwhile, the Canadian dollar is trading less as a risk currency (the 60-day rolling correlation of changes in the exchange rate and the S&P 500 has fallen to 15-month lows) and more in line with broader moves of the US dollar (proxy Dollar Index). The June rally left the Canadian dollar overbought on a technical basis. A correction could lift the US dollar back toward CAD1.3300-30 before the downtrend resumes, which we expect to bring it CAD1.3000 later in the year.

Spot: CAD1.3240 (CAD 1.3615) Median Bloomberg One-month Forecast CAD1.3265 (CAD1.3405)One-month forward CAD1.3235 (CAD1.3605) One-month implied vol 5.9% (6.0%) Australian Dollar: After pausing in April, the Reserve Bank of Australia resumed the tightening cycle by lifting the overnight cash target rate by 25 bp in both May and June. The futures market sees it pausing in July but hiking once in Q3 and probably once in Q4. The Australian dollar rose by about 2.4% in June to snap a four-month losing streak. The rally had carried it to about $0.6900 in the middle of June before corrective forces cut the gains in half, and a new base was forged near $0.6600. The central bank will be watching developments in the labor market and the evolution of prices. We suspect that stimulus from China (or indeed the lack thereof) could impact the Australian economy and Australian dollar through commodity and especially metal prices. RBA Governor Lowe’s seven-year term expires on September 17. A decision was expected by the end of June, and Treasurer Chalmers has delayed an announcement into July. Although Lowe’s immediate predecessors were given three-year extensions and Lowe expressed the desire to remain. However, the substance of the policy and the communication have been broadly criticized. Moreover, the central bank is expected to adopt several recommendations following an independent review that may include a separate committee for the conduct of monetary policy proper, fewer policy meetings, and followed by a press conference. To lead those changes, a new leader is desired. Yet, the delay in the announcement suggests a suitable candidate has not been found, which would seem then to favor an insider, a former or current official at the central bank or Treasury.

Spot: $0.6665 ($0.6515) Median Bloomberg One-month Forecast $0.6695 ($0.6785) One-month forward $0.6670($0.6525) One-month implied vol 9.7% (10.3%)

Mexican Peso: The dollar extended its downtrend against the Mexican peso in the first half of June, and nearly met our MXN17.00 objective cited here last month. It is the lowest level since the end of 2015. It spent the second half of June consolidating. A significant low does not appear to be in place. The drivers of the peso’s strength, like the carry with relatively low vol, the strength and independence of the central bank and Supreme Court, and favorable external position, remain intact. This suggests additional peso gains are likely. Despite the peso’s nearly 20% appreciation over the last 18 months, exports are booming. In May, exports were up 5.8% from a year ago (to almost $53 bln) and were the second largest ever. This is in part the result of near-shoring/friends-shoring. Mexico’s non-oil shipments to the US were up nearly 11.5% in annual terms, while exports to the rest of the world fell 3.5%. Banxico is done raising rates as inflation is clearly falling. However, it is unlikely to cut rates before Q4, while Chile and Brazil appear likely to cut rates in Q3.

Spot: MXN17.1250 (MXN17.6250)

Median Bloomberg One-Month Forecast MXN17.3650 (MXN18.1675)

One-month forward MXN17.23 (MXN17.74) One-month implied vol 9.1% (11.4%)

Chinese Yuan: Policy divergence was the main weight on the Chinese yuan, which fell by about 2% against the dollar in June. It brings the year-to-date loss to almost 5.0%. Last year, the yuan depreciated by nearly 9% against the greenback. The US 2-year premium over China grew by about more than 25 bp in June to the most since 2007 (~265 bp). In H1 23 China’s CSI 300 is one of the few large equity markets that have not risen this year. With low inflation (0.2% year-over-year CPI in May and PPI -4.6%), the weakness of the yuan does not seem to be a particularly urgent problem for Beijing. The PBOC did signal cautionary signals for a few days in late June via its daily dollar fix. After a 10 bp cut in key lending rates in June, many look for a cut in reserve requirements. The Politburo meeting in late July has become the new focus for new economic measures. The dollar reached a multi-year high near CNY7.3275 in November 2022. There seems to be little to stand in the way of a retest if the market convergences with the Federal Reserve’s forward guidance, as we suspect.

Spot: CNY7.2535 (CNY7.0645)Median Bloomberg One-month Forecast CNY7.1750 (CNY6.8625) One-month forward CNY7.2255 (CNY7.0500) One-month implied vol 5.9% (5.4%)

Disclaimer

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here