Author’s Note: This article is part of our periodic/monthly series that attempts to present three lists of stocks for the month that could be suitable for writing options to generate relatively safe income. Certain parts of the introduction, definitions, and section describing the selection process will have some commonality and repetitiveness with our other articles in the series. This is unavoidable as well as intentional to keep the entire series consistent and easy to follow for new readers. Regular readers who follow the series from month to month could skip such sections.

Why This Monthly Options Series?

Earning a decent income from your investments that is significantly higher than the rate of inflation is always challenging. This has been especially true in the past decade and a half. More recently, the interest rates have gone up, but in most cases, the fixed deposit rates are still lower than the rate of inflation. Investing in fundamentally strong dividend stocks is a good choice for long-term wealth building but not for the current income. We believe selling Options (cash-covered puts and covered calls) remains a relatively good choice to earn a high current income. Obviously, there are some risks involved with Options, and we do not recommend blindly jumping into the game. We will discuss how to mitigate the risks in a bit. Also, in the current volatile market situation, we will urge extra caution and due diligence.

“Selling Options” versus “Buying Options”

Please note that the options strategies discussed in this monthly series are limited to selling (or writing) the Covered Call options and cash-covered PUT options. We do not cover “buying” the Options as they’re not only risky, but at the same time, they’re not really suited for income strategies. The primary purpose of our options strategies is to generate income.

As such, there are two sides to options. There’s an option buyer for every seller of an option. When you sell an option, you earn an immediate premium, and you get to keep that premium irrespective of the outcome of the option. However, when you buy an option, you pay the premium upfront and basically buy the right to buy (or sell) the underlying security at a pre-set price (called the strike price). As an option buyer, you’re essentially looking for a high gain, but your entire investment (the amount of premium paid) is at risk if the option expires worthless, which, by the way, happens the majority of the time. We believe the strategy of selling options (opposite of buying options) to generate income is the safer strategy. It’s more akin to acting like an insurance provider, where you earn the premium upfront, and if you act conservatively, 80%-90% of options should expire worthless, thereby limiting your risk.

All tables in this article have been created by the author (unless explicitly specified). Most of the data in this article is sourced from Fidelity, Yahoo Finance, DripInvesting, and Barchart.com.

Options Income Strategy 101

Note: This section is for readers who do not have much prior exposure or experience with Options. Please see our blog post by clicking here.

How To Mitigate the Risks

We do not intend to convey an impression, especially to the folks who are new to options, that there’s no risk in selling options. In fact, there’s plenty, especially if we’re not careful. However, there are ways we can minimize the risk by following certain time-tested principles. We encourage you to read our blog post on SA that covers “How to mitigate risks with writing Options.”

In brief, we cover the following in the above blog post:

- Never use margin (or borrowed) money to sell/write options

- Write options on stocks that you do not mind holding mid to long term

- Use only dividend-paying underlying stocks so that if a call is assigned, you get the dividend while waiting for them to recover.

- Do not write Call options on stocks or positions that you do not want to lose under any circumstances.

- Do not chase very high premiums; 10-15% premiums (annualized) should be good enough.

Selection Strategy For Underlying Stocks

Note: This section describes the broader selection process and is repeated every month for the benefit of new readers. Regular readers could skip this and jump to the next section.

One of the most important aspects of writing or selling options is to select the right kind of stocks and to use the right kind of options strategy. What kind of stocks will be suitable will depend on the investor’s goals and risk profile. In this monthly series, we will present three lists of 10 stocks, each with different characteristics. Please note that some stocks may appear in multiple lists. We will scan the complete universe of stocks and apply some broad-based filtering criteria to make our list smaller.

- The market cap of the company is near or higher than $10 billion (this can be lowered somewhat in a down market).

- Daily volume for the underlying stock to be > 100,000.

- Dividend yield preferably > 1.5%; however, we like to make some exceptions for well-established dividend stocks (for example, stocks like Apple Inc. (AAPL), Microsoft Corporation (MSFT), and many others) at this initial stage.

By applying the above criteria, we get roughly 600 stocks.

Since our goal is to look for companies that we do NOT mind owning for at least in the short to medium term, we will filter out the companies that have less than five years of dividend growth history. This filter leaves us roughly 300+ companies that have a consistent record of paying and growing dividends for at least five years, preferably longer.

Now, we will import financial data for each company in our list. We want to see the dividend safety of each company, at least on a relative basis. So, we import the following data elements:

- Number of years of dividend growth history

- Dividend growth during the last year, three years, and five years

- Dividend Payout Ratio (preferably based on cash-flow basis rather than EPS)

- Debt/Capital

- Return on Capital – ROC

- Sales Growth during the last five years

- Credit Rating (from S&P)

- EPS growth rating.

We will combine these factors and calculate a dividend safety score for each company. Sure, a high safety score would not guarantee absolute safety because business conditions can change over time, new competition can emerge, or the management can get distracted or make some bad decisions destroying shareholder value. Nonetheless, a high dividend safety score will at least provide a reasonable level of assurance that the company has the financial capability to continue making its dividend payments for the foreseeable future.

We also will import the data on price movements related to 1-week, 4-weeks, and 12-week price performance for the selected stocks to help in filtering the probable candidates for writing PUT options. We also obtain the relative strength data to shortlist stocks that have a recent price momentum.

We’re going to use our proprietary formulas (as detailed below) to calculate the optimal strike prices for CALL and PUT options. However, there are many other ways to determine the appropriate strike prices. The readers are encouraged to try several methods before determining what works best for them. There are many other ways to determine the appropriate strike prices. Your brokerage provider may provide more information on variables like delta, gamma, theta, etc., and how they can be relevant to options.

We also will calculate the following ratios and factors:

Distance-Ratio = (52-WK-HIGH – 52-WK-LOW)/((52-WK-HIGH + 52-WK-LOW)/2)

Distance-Ratio % = Distance-Ratio x 100

- Strike-Price Safe Distance

Strike-Price-Safe-Distance % = [(Distance-Ratio %) x STPR-factor (STRIKE-PRICE-factor)] / 10

Whereas STPRC-factor = 1.2 (can vary from 1.0 to 1.5)

Note: The STPRC-Factor can be adjusted based on how volatile the underlying stock is. If the stock is highly volatile, the factor should be adjusted to a higher value like 1.5, whereas it can be set to a lower band like 1.2 (or less) for low-volatility stocks.

- CALL Option Strike-price = Close-price + (Close-price x Strike-Price-Safe-Distance)

This price may need to be rounded to the lowest dollar or half-dollar amount depending upon what strike prices are prevailing for the underlying stock for the specific strike date.

- PUT Option Strike-price = Close-price – (Close-price x Strike-Price-Safe-Distance)

This price may need to be rounded up to the nearest dollar or half-dollar amount, depending upon what strike prices are prevailing for the underlying stock for the specific strike date.

There are many ways to determine the appropriate strike prices. You could use the Greek metrics, like delta, gamma, theta, etc., from your brokers’ site to help select optimal strike prices. However, we have chosen to use our proprietary formulas to calculate the optimal strike prices for the sake of ease and simplicity.

Option Candidates For The Next Month

Below, we present two lists of 10 stocks each, one for writing PUT options and the other one for writing CALL options. The second list is presented with two different options – the first one with stocks that you may want to own (or already own), whereas the second one is using the same stocks for the purpose of earning a high rate of income but possibly avoiding owning them. Please note that some stocks may appear in multiple lists as they may satisfy the criteria for more than one category.

10 Option Stocks Suitable For PUT Options

For PUT options, our primary objective is to generate income. We do not wish to hold these stocks as much as possible, so we would want to see them expire worthless. To identify such stocks, we should preferably select stocks that have had a rising trend recently. These stocks generally would have high relative strength and positive momentum. We will analyze the 1-week, 4-week, and 12-week price performance as well as Relative-Strength data and try to see if the underlying stock is having a rising trend or a downward trend.

Momentum Score = (1Week-Perf)*3 + (4Week-Perf)*1 + (12Week-Perf)/2

The above formula gives higher weightage to more recent momentum.

We sort the list on the momentum score and cross-check with the Relative Strength and Composite Rating (sourced from IBD – Investor Business Daily, subscription required). Also, we try to avoid stocks with very high market prices (above $300 per share) as the cost per option contract becomes prohibitive, especially for folks with limited capital. However, some exceptions are made at times. We finally selected ten stocks for PUT options.

If the outcome of the option is not favorable at expiry, and the option does get assigned (we will be put the shares), the rising trend will help write a fresh CALL option immediately with a good premium.

In our list of 10 candidates, we should be careful not to put too many names from the same industry segment. We generally limit to two names from the same sector to avoid too much concentration in one sector.

A word of caution on PUT options: Do not start a PUT option on a stock that you do not see yourself holding for an extended period of time. Also, please note that this list only highlights probable good candidates, but further due diligence may be required.

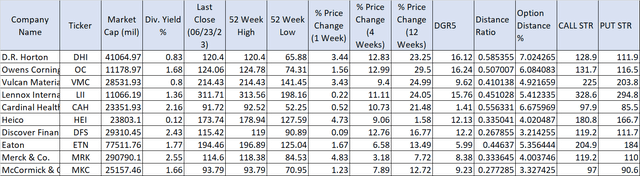

Here are the top 10 large-cap stocks for PUT options:

(DHI), (OC), (VMC), (LII), (CAH), (HEI), (DFS), (ETN), (MRK), (MKC).

Table 1:

Author

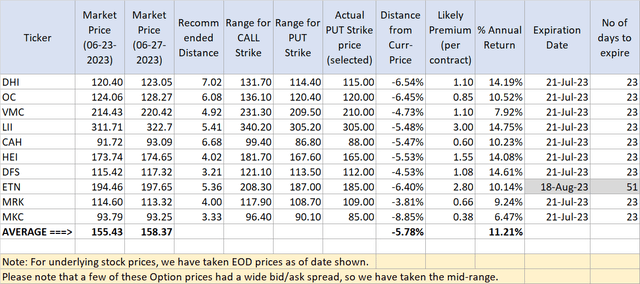

Below, we present the current PUT Options trades and likely current premiums that we can expect for the above ten stocks.

Table 1A:

Author

10 Option Stocks With Relatively Safe Dividends (PART-A)

In this category (part-A), we assume you already own these stocks (or you will be happy to own them at the right price). So, we’re aiming for an average of 2% dividend and roughly 10-12% income by writing call options. After accounting for some losses and gains during the year, we can expect a total yearly income (or return) in excess of 12%.

In this category, we will list ten large-cap stocks that are perceived to have very safe dividends. There’s nothing that we can claim to be absolutely safe in the investing world – the same can be said about dividends. But based on various financial metrics, we can shortlist companies that have low payout ratios, low debt, high credit ratings, positive top-line growth, and have been consistently growing their dividends. Based on the above factors and EPS rating, we calculate a dividend safety score. We present ten such companies with high dividend safety scores.

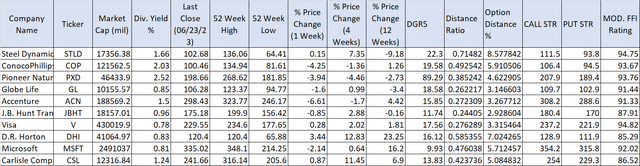

Our Top 10 Stocks with relatively safe dividends for (BUY-WRITE) CALL options:

(STLD), (COP), (PXD), (GL), (ACN), (JBHT), (V), (DHI), (MSFT), (CSL).

Table 2:

Author

Note: The “Dividend Rating” (or “MOD. FFI Rating,” the last column above) is based on recent past parameters like dividend growth (1-year, 3-year, and 5-year), number of years of dividend growth, Payout Ratio based on cash flow (or EPS), ROC (Return on Capital), Sales growth, Debt/capital, Credit Rating, and EPS growth.

2) The dividend yield shown above only includes regular dividends. It does not include variable (or special) dividend payouts.

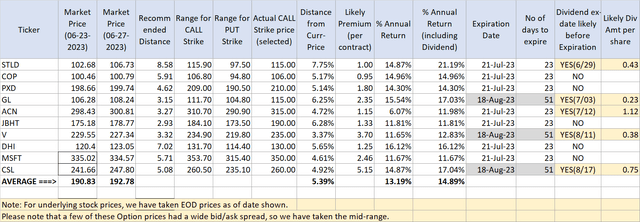

Below, we present the current CALL Option trades and current premiums that we can expect for the above ten stocks.

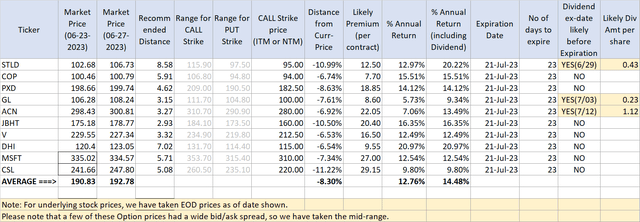

Table 2A:

Author

10 Option Stocks With Relatively Safe Dividends (PART-B)

If you are investing in Options purely for income and have no interest in holding the underlying stocks for the long term, then the below methodology is most appealing. So, in this part, the assumption is that you do not own these stocks to start with, and your goal is simply to earn a high income (>= 15% annualized rate). Even then, there’s always a chance that we could end up owning some of these companies, so we want to ensure their dividends are safe. Also, this option is better if you think the market will fall from the current levels.

To achieve this, we will use the buy-write CALL option. A buy-write CALL option means that you buy 100 shares of the underlying stock and sell one call-option contract simultaneously. You could do the same for writing multiple contracts. Since the goal is simply to earn a high income, we will sell the call option with a strike price that is deep ITM (in-the-money), meaning the strike price is much below the current price (as much as 10% below the current prices). In normal circumstances, the odds will be very high that the shares will get called away, and we will earn a high premium. However, it’s always possible in some instances that the underlying stock price falls as much as 10% (or more). In such a scenario, the shares will not be called away, and we will be forced to own these shares. However, our cost basis will be much lower (roughly 8% to 10% lower than the current price due to the premium already earned), and we can write another set of call-option.

Caution: However, there’s one caveat here, and it’s an important one. In case you write such call options on a large number of stocks (10 different stocks in our example below), and if the market was to take a deep dive (> 10% down) during the option period (which is always a possibility but does not occur so frequently), the majority of our shares would NOT get called away, and we will end up owning most of these stocks, albeit at much-reduced cost basis (on average -8% to -10%). So, it’s important to know how much capital you’re willing to commit and if you can really afford to allocate it. Secondly, you always want to use this strategy with stocks that you do not mind owning and holding for an extended period of time.

This list of stocks is the same as in Part-A:

(STLD), (COP), (PXD), (GL), (ACN), (JBHT), (V), (DHI), (MSFT), (CSL).

Table 3:

Author

Note: Some of the Option prices have a wide bid/ask spread. We have taken the mid-range prices based on bid/ask, but there is no guarantee that those prices would fill at all times. Also, during open market hours, Option prices can fluctuate rapidly based on the price movement of the underlying stock.

Conclusion

Please review the goals of each of the three distinct strategies carefully. We think these lists could be great selections for writing/selling PUT or CALL options. We have tried to put relatively safe stocks in all three groups; however, the stocks listed in the second list (parts A and B) for call options (or buy-write call options) have been specifically filtered based on the safety of their dividends. However, nothing is absolutely safe in the investing world. Also, if generating income was your only objective, we believe the second list (with the second option) is the safer bet.

Read the full article here