(Note: This article was in the newsletter on June 24, 2023.)

Exxon Mobil Corporation (NYSE:XOM) management appears to be adding to what many would call an already full plate. If they manage to pull off not only the current initiatives but also some idea for the future, then this company will have a very different future from the past. That is going to be very good news for shareholders because the stock “sat there” for roughly a decade, and that will not be happening in the future.

Guyana Partnership

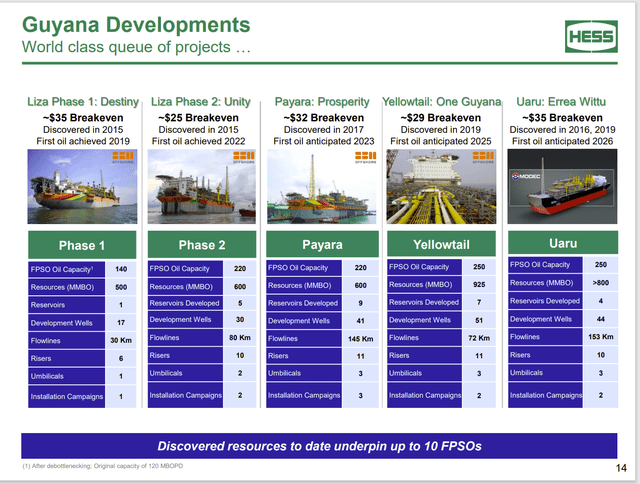

Probably the most visible project is located in Guyana.

Hess Presentation Of Approved FPSO Projects And Guidance (Hess Presentation At JP Morgan Energy, Power, and Renewables Conference June 2023)

Exxon Mobil has accelerated the date of first oil for the Payara project from the fourth quarter to either late in the third quarter or early in the fourth quarter (depending upon the source of the information). On this one, Hess appears to be a little less optimistic than the latest Reuters report.

But the big deal is that this appears to follow a trend of Exxon Mobil beating its own deadlines for these rather large FPSO projects that were approved. Now it is possible that it is worth accelerating the project because Exxon Mobil sees some better prices ahead. An operating FPSO could easily take advantage of higher prices to raise the return on the project a few percentage points while shortening the payback period. Money sooner is worth more than money later according to the “time value of money” theories.

On the other hand, it is also possible the project will be so profitable with that low breakeven above, that it is worth paying overtime to get the FPSO” producing faster no matter the future prices of oil. Investors can kind of take it as a “straw in the wind” that Exxon Mobil accelerated the start date and see what else appears in the future throughout the industry. I personally take it as a mild vote about the future of commodity prices.

The other thing to consider is that Exxon Mobil typically reports about 80K BOED growth in a fiscal year. In this case, all of that growth is showing up at one time the minute production starts from Payara. The Exxon Mobil interest (of 40%) in this production should be at least 80K once it reaches full production. Of course, it does take time for full production to ramp up. But the idea that a typical growth amount comes from one event could point to a higher future growth rate for years to come for this giant company.

This acceleration also likely means that the company is now taking tangible measures to accelerate the approval and placement of FPSO’s because the cash flow from the project is getting large enough to handle a larger capital budget while distributing income to the partners. This rather large discovery is beginning to take on significance even for a company the size of Exxon Mobil.

The other thing to note is that Exxon Mobil has been selling some high-cost older production that slowed the growth rate reported. As those sales slowdown and probably cease for the time being, the growth rate will accelerate just from the lack of sales of older production.

As a side issue, this project generates very low greenhouse gases. One of the reasons is that the company is reinjecting any gas produced to maintain reservoir pressure and enhance recovery. Management has mentioned that several times that they only sell the oil from the project.

Permian

But management is not only relying upon the Guyana (and Suriname) area for future growth. Management is aggressively growing Permian production. Not only that but management also expanded refining capacity to handle that production.

The Dallas Fed conducted a survey that showed that cost pressures were declining. Sometimes a lower cost structure starts an industry recovery rather than a pricing recovery. So, this bears watching. The Fed also received a comment that the supply-demand situation was pointing to some strong “draws” in the future (as in lower inventories headed our way). But the current market focus is on a possible recession rather than those draws.

Like the Exxon Mobil action to accelerate the beginning of FPSO production, this comment points to higher liquids pricing in the future. Insiders often have a much better view of the future than the market.

Even more interesting is that management appears to be planning to find a way to double recovery from unconventional wells. Unconventional is a relatively young part of the upstream industry. As such recovery levels are relatively low (in the single digit percentage range of recovery). Conventional recoveries (considering the use of secondary and other recovery techniques) can reach as high as 40%. So, the reader can see that unconventional as a “ways” to go.

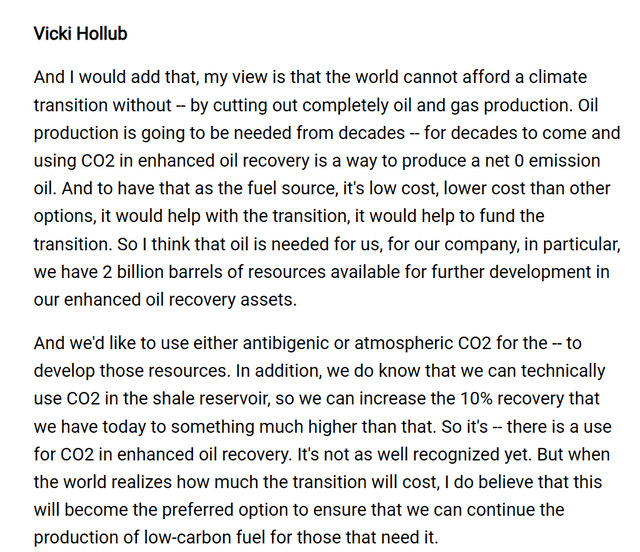

This project has an interesting backup in the form of a short speech from the Occidental Petroleum (OXY) CEO, Vicki Holub:

Vicki Holub, CEO, Occidental Petroleum Explaining The Ability Of Secondary Recovery To Increase Unconventional Well Production (Occidental Petroleum Third Quarter 2022, Earnings Call Transcript, Seeking Alpha Website)

Doubling or more production from wells at an economic cost carries enormous effects to the oil reserves of the United States and probably Canada as well (for starters). This third quarter 2022, conference call answer to a question gives some idea as to how much untapped future there is yet to the unconventional business. Far from the business peaking, there is actually a whole lot of possibilities for the business to grow to meet projected growing demand for the foreseeable future.

It appears both companies are now racing to meet that growing demand.

Interestingly, the use of C02 to inject in reservoirs to produce more oil (and probably natural gas as well) means that we can solve a pollution problem while getting the energy sources we need for the future.

Key Ideas

There is a lot more to Exxon Mobil than just this. But the above gives an investor some idea as to what management is doing about the future. The actions taken seem to be shifting Exxon Mobil from a strictly dividend play to a growth and income type idea in the future.

This would appeal to a wide range of investors because the combined dividend and growth could easily be in the teens. Yet the investor can invest in one of the financially strongest companies around with diversification in most aspects and some chemicals business to protect earnings somewhat from the volatile upstream cycle the business is known for.

Exxon Mobil has begun to explore in more places and actually has several partnerships in Guyana. An offshore evaluation of commerciality of a discovery would mean more growth projects ahead. That prospect is highly likely over the long-term. Timing is of course uncertain.

But it would appear that the past action of “standing pat” is now gone. This company is notoriously counter cyclical. So, the acceleration of the Guyana project during a time when prices have pulled back is very typical.

Similarly, the relaxation of cost inflation reported by the Dallas Fed probably means that the aggressive growth of the Permian production will continue.

Add to these possibilities previously discussed projects and an occasional opportunistic acquisition or two and the future growth of high single digits looks very plausible. Clearly, Exxon Mobil Corporation management sees a great time to invest in growth. The time to consider exiting the industry is when management decides to “stand pat” as they did for approximately a decade or so. I tend to follow managements that know what they are doing. Therefore, I am well invested in the industry and will do so as long as managements like this one pursue a growth agenda.

Read the full article here