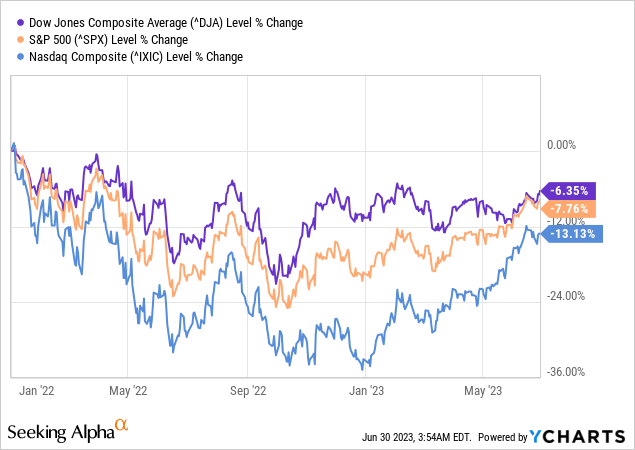

I think it’s worth reiterating what I wrote about in my article Undervalued Dividend Stocks Watchlist – What Goes Up Must Come Down where the recent rally we saw in the last few weeks really hasn’t been anything more than a return to the baseline of where the major indexes were going back to January of 2022.

Even with the YTD return of the Nasdaq Composite sitting at 30% it is still underperforming by roughly double the returns for the DJIA and S&P 500.

I have mentioned that AI seems to be a significant contributing factor but another issue that is getting much less coverage is that the earnings reports of many tech companies have been favorable because expenses are dropping after the massive layoffs that began showing 18 months ago. Reduced headcount means fewer expenses but also translates into less innovation which for some companies will mean a flat line in revenue growth and an overall stagnation of earnings per share. So while many of these companies are now beating EPS expectations we can likely assume reductions to EPS in the future.

For a more in-depth view of tech sector layoffs it is something I covered extensively with other issues in my article The Retirees Guide To An Upcoming Recession.

It makes sense why these companies would favor this now as interest rates rise what may have been a viable project before now doesn’t make sense because the spread between the cost of funds and the return provided is being compressed. This doesn’t just apply to tech companies as you’ll see in the review of Kinder Morgan (KMI) where there is the potential for projects to be canceled or pushed off based on the lack of return compared to the return that was available when funds were readily available and cost almost nothing to borrow.

Background

For those interested in John and Jane’s full background, you can find at least three articles a month published for the last five years detailing the performance of their portfolio. I have continued to evolve the report over time by adding and removing information/images to make the updates more useful to the average investor. Here are the key details that should be understood when reading these updates.

- This is a real portfolio with actual shares being traded. This is not a practice portfolio which is why I include screenshots from Charles Schwab to document every change that is made.

- I am not a financial advisor and merely provide guidance based on a relationship that goes back several years.

- John retired in January 2018 and has collected Social Security income as his regular source of income. John also currently withdraws $1,000/month from his Traditional IRA.

- Jane retired at the beginning of 2021 and decided to begin collecting Social Security early and has not made any withdrawals from her retirement accounts yet.

- John and Jane began drawing funds from the Taxable Account in 2022 at $1,000/month. After speaking with them this amount has been increased to $1,700/month. This withdrawal is still covered entirely by dividend and interest income.

- John and Jane have other investments outside of what I manage. These investments primarily consist of minimal-risk bonds and low-yield certificates.

- John and Jane have no debt or monthly payments other than basic recurring bills such as water, power, property taxes, etc.

The reason why I started helping John and Jane with their retirement accounts is that I was infuriated by the fees they were being charged by their previous financial advisor. I do not charge John and Jane for anything that I do.

The only request I have made of John and Jane is that they allow me to publish their portfolio anonymously because I want to help as many people as I can while holding myself accountable and improving my thought process.

I started this series to address issues I have had when reading other authors with similar types of updates (I am not saying they are wrong, but I found myself questioning their actual performance because they never provided enough information to cover loose ends).

Here is My Promise to Readers:

- I aim to give as much information as needed so readers can feel confident that what I do is real.

- Even if you agree the results are real this does not mean I expect you to agree with me and I will always answer constructive criticism whenever possible. I will respond with the same genuine intent that the question was asked with.

- I am very transparent about the portfolio and consistency is a significant goal of mine. All of my data points (unless noted otherwise) are derived from month-end statements from Charles Schwab. Even when things aren’t looking great (Spring 2020 for example) you will know because I provide enough information that it would be impossible for me to manipulate.

- This article is not intended to be advice or a call to action and is for informational purposes only (I am not a financial advisor and I don’t claim to be one). My goal is to challenge conventional thinking and empower you to take control of your investments (if that’s something you want to do).

While many authors require paid subscriptions to see their portfolio I do not want to go that route and will continue to publish this series for free as long as there is enough interest to make it worth my time (and I spend a lot of time on these articles).

Generating a stable and growing dividend income with an emphasis on capital preservation has become the primary focus of this portfolio. I am least concerned about capital appreciation which is why the decisions made will seem pretty conservative most of the time. I may measure the performance of the portfolio relative to indexes and ETFs but the key metric I am focused on is delivering a more stable source of cash flow to John and Jane over time that allows them to live a comfortable retirement that includes minimal stress related to finances.

Dividend Decreases

No companies in John’s Traditional and Roth IRA accounts eliminated or reduced their dividend during the month of May.

Dividend Increases

Only one company paid increased dividends/distributions or a special dividend during the month of May.

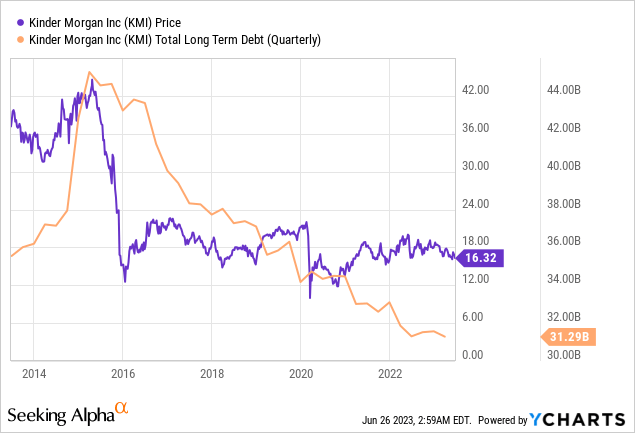

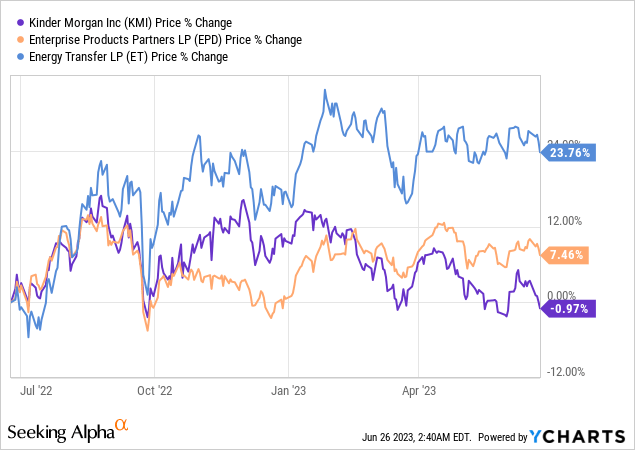

Kinder Morgan – Oil and gas transportation space when it comes to pipelines has been an interesting environment over the last few months and KMI is no exception. Compared to the large MLP holdings in John and Jane’s Taxable account, KMI is currently underperforming both Energy Transfer (ET) and Enterprise Products Partners (EPD). The underperformance relative to ET makes sense given the strong turnaround of ET after the dividend was slashed and is now back at the same levels prior to the cut.

From what I have read it appears that KMI lacks any major catalysts that would justify a higher stock price. Here are the positives that KMI currently has going in its favor:

- The backlog of projects stands at $3.7 billion, up from $3.3 billion the prior quarter.

- Positive trends for natural gas demand remain strong and are KMI’s largest business segment. This is especially true as more natural gas power plants are coming online to replace coal-fired power plants.

- Management has been much more prudent with its use of debt since the stock cratered back in 2015. KMI maintains no balance on its $4 billion revolving credit with $400 million of cash on hand.

The primary risk/issue that I see for KMI is that its backlog of projects makes sense at the current interest rates but if interest rates rise that is going to compress and become questionable as to whether or not a project is going to generate a return that justifies the expense. The most recent earnings call addressed that management locked in half of the floating rate exposure for 2023 they haven’t locked in anything yet for 2024.

At the current price, there is a reason to consider adding more shares considering we are at the 52-week-low but the position has been on the short-list to be eliminated altogether because of the lackluster performance. We currently have a limit sell order for all 300 shares at $18.50.

The dividend was increased from $.2775/share per quarter to $.2825/share per quarter. This represents an increase of 1.8% and a new full-year payout of $1.13/share compared with the previous $1.11/share. This results in a current yield of 6.92% based on the current share price of $16.32.

Retirement Account Positions

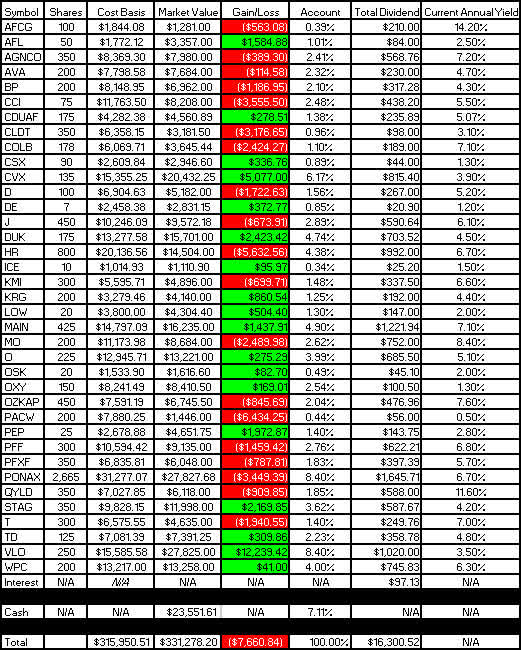

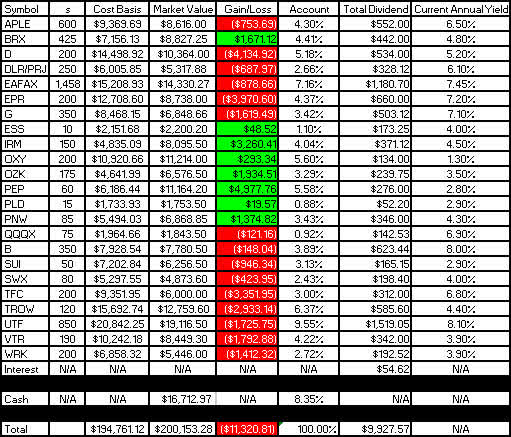

There are currently 37 different positions in John’s Traditional IRA and 23 different positions in John’s Roth IRA. While this may seem like a lot, it is important to remember that many of these stocks cross over in both accounts and are also held in the Taxable Portfolio.

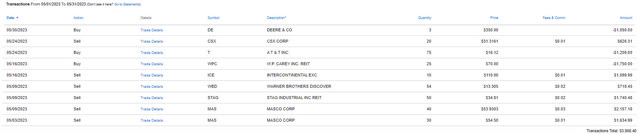

Below is a list of the trades that took place in the Traditional IRA during the month of May.

Traditional IRA – May 2023 Trades (Charles Schwab)

Below is a list of the trades that took place in the Roth IRA during the month of May.

Roth IRA – May 2023 Trades (Charles Schwab)

May Income Tracker – 2022 Vs. 2023

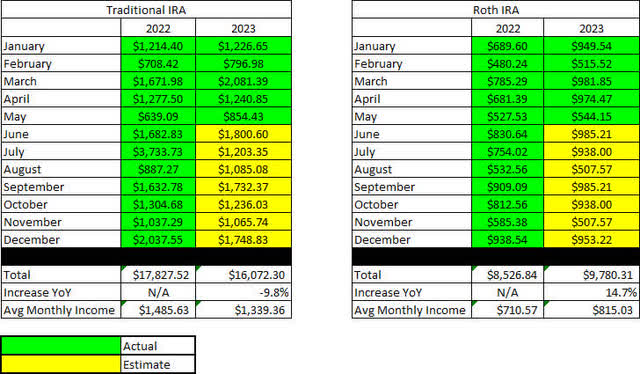

2023 dividend income performance was mixed with John’s accounts set for a large decrease in the dividend income generated by the Traditional IRA and a large increase in the dividend income generated by the Roth IRA. The reason for the large decrease in the Traditional IRA was due to the special dividend paid by Healthcare Trust of America (HTA) when it was acquired by Healthcare Realty (HR) – This can also be seen in the huge growth in 2022 dividends which came in at a whopping 35.3%. If this dividend is removed then the growth year-over-year is trending as flat overall. While it’s possible we could see more special dividends in 2023 I think it’s more likely that management will focus on deleveraging or stock buybacks in most cases.

The Traditional IRA is expected to generate an average of $1,339.36/month of dividend income in 2023 compared to the average monthly income of $1,485.63 generated in FY-2022. The Roth IRA is expected to generate an average of $815.03/month of dividend income in 2023 compared to the average monthly income of $710.57 generated in FY-2022.

Once dividend increases are factored in and the additional interest income from CDs and SWVXX I expect we will see a very light increase in dividend income of 3-4%. (In this assumption I am also factoring out the large special dividend from the HTA acquisition but if I leave that in then I estimate we will see an overall negative combined dividend yield growth of 1-2%.)

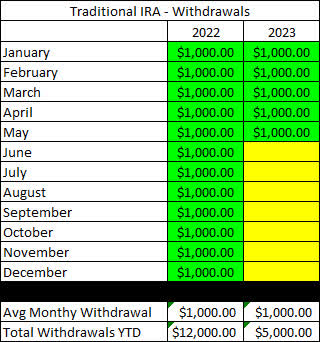

John plans to continue collecting $1,000/month from his Traditional IRA which matches the amount he withdrew monthly in 2022.

SNLH = Stocks No Longer Held – Dividends in this row represent the dividends collected on stocks that are no longer held in that portfolio. We still count the dividend income from stocks no longer held in the portfolio, even though it is non-recurring. All images below come from Consistent Dividend Investor, LLC. (also referred to as CDI as the source below).

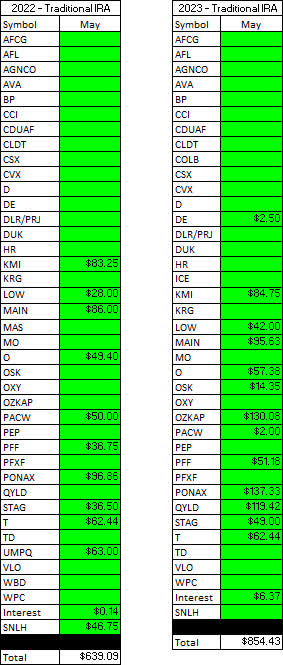

The tables below represent which companies paid dividends in May 2023 and how that income source has changed since May of the previous year.

Traditional IRA – May – 2022 V 2023 Dividend Breakdown (CDI)

Roth IRA – May – 2022 V 2023 Dividend Breakdown (CDI)

The table below represents all income generated in 2022 and collected/expected dividends in 2023.

Retirement Projections – May 2023 (CDI)

Below gives an extended look back at the dividend income generated when I first began writing these articles. I find this table to be most useful when comparing how dividend income has improved for a specific month over the course of six years.

Retirement Projections – May 2023 – Full Dividend History (CDI)

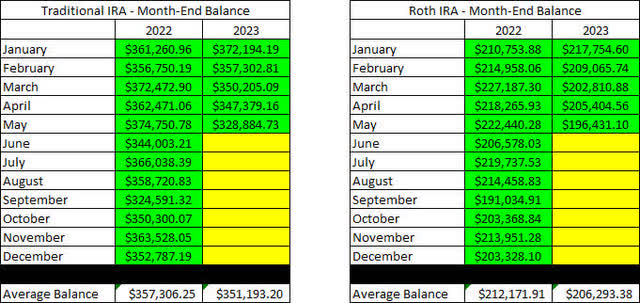

The balances below are from May 31, 2023, and all previous month’s balances are taken from the end-of-month statement provided by Charles Schwab.

Retirement Account – Month End Balances – May 2023 (CDI)

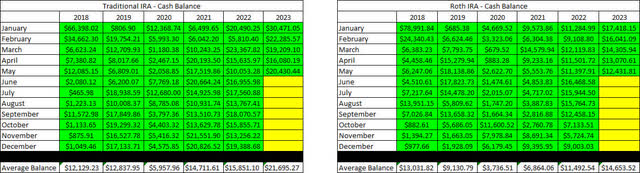

The next image is also pulled from the end-of-month statement provided by Charles Schwab which shows the cash balance of the account.

**Please note that cash balances may fluctuate based on CD renewal dates and the use of Schwab Value Advantage Money Fund (SWVXX) because I only count the cash that is 100% liquid. There were larger fluctuations in 2019 and 2020 that we the result of deposits and withdrawals being made. There will be no contributions made into either account in 2023 because John is no longer working.

Retirement Accounts – May 2023 – Cash Balances (CDI)

The next image provides a history of the unrealized gain/loss at the end of each month going back to the beginning of January 2018.

Retirement Accounts – May 2023 – Unrealized Gain-Loss (CDI)

I think the table above is one of the most important for readers to understand because it paints a story of volatile markets and why we employ the strategy of generating consistent cash flows to overcome the uncertainty of the market. If we were dependent on selling shares to generate income for John and Jane’s retirement they would have to be much more considerate of when they withdraw and how much they choose to withdraw.

For example, a withdrawal in 2020 where shares must be sold would destroy more value by locking in losses or poor performance by stocks being sold compared to selling the same shares and withdrawing funds in 2021.

In an effort to be transparent about John’s Account, I would like to include an unrealized Gain/Loss summary. The numbers used are based on the closing prices from June 26, 2023.

Traditional IRA – May 2023 – Gain-Loss (CDI)

Roth IRA – May 2023 – Gain-Loss (CDI)

It is worth noting in the table above that the yield column is most accurate at the start of the year, but if I reduce the size of positions it may inflate the yield because it is based on how much dividend income is collected. At the same time, it may report excessively low dividends for positions added or significantly increased at the end of the year.

The last image represents the withdrawals being made from John’s Traditional IRA, as this is the only account he is currently withdrawing funds from. As mentioned before, he continues to withdraw $1,000/month.

Traditional IRA Withdrawals – May 2023 (CDI)

Conclusion

Compared to the previous month we have seen the gain-loss stabilize as the markets recovered in mid-June from the lows at the end of May. John’s Traditional IRA has bounced off of its three-month low balance of $330K (remember, this account is also seeing $1,000 of withdrawals every month as well) and is now resting at around $340K balance. John’s Roth IRA bounced off a low of $195K and is now resting at a three-month high of about $207.5K.

In all of John and Jane’s accounts, they are holding more cash or invested in short-term funds like certificates of deposit or money market funds like SWVXX. A lot of this cash has recently come from pulling chips off the table when it comes to stocks performing well (many of them were near their 52-week-high).

May Articles

I have provided the links to May Taxable and Jane’s Retirement articles below.

The Retirees’ Dividend Portfolio: John And Jane’s May 2023 Taxable Account Update

The Retiree’s Dividend Portfolio, Jane’s May Update: Account Balances Make A Large Recovery

In John’s Traditional and Roth IRAs, he is currently long the following mentioned in this article: AFC Gamma (AFCG), Aflac (AFL), Apple Hospitality REIT (APLE), Avista (AVA), BP plc (BP), Brixmor Property Group (BRX), Crown Castle (CCI), Canadian Utilities (OTCPK:CDUAF), Chatham Lodging Trust (CLDT), Columbia Banking System (COLB), Chevron (CVX), CSX (CSX), Dominion Energy (D), Deere (DE), Digital Realty Preferred Series J (DLR.PJ), Duke Energy (DUK), Eaton Vance Floating-Rate Advantage Fund (EAFAX), EPR Properties (EPR), EPR Properties Preferred Series G (EPR.PG), Healthcare Realty (HR), Intercontinental Exchange (ICE), Iron Mountain (IRM), Kinder Morgan (KMI), Kite Realty Group (KRG), Lowe’s (LOW), Main Street Capital (MAIN), Altria (MO), New Residential Investment Corp. Preferred Series B (NRZ.PB), Realty Income (O), Oshkosh (OSK), Occidental Petroleum Corp. (OXY), Bank OZK (OZK), Bank OZK Preferred Series A (OZKAP), PacWest Bancorp (PACW), PepsiCo (PEP), iShares Preferred and Income Securities ETF (PFF), VanEck Vectors Preferred Securities ex Financials ETF (PFXF), Pinnacle West (PNW), PIMCO Income Fund Class A (PONAX), Nuveen Nasdaq 100 Dynamic Overwrite Fund (QQQX), Global X Funds Nasdaq 100 Covered Call ETF (QYLD), STAG Industrial (STAG), Sun Communities (SUI), Southwest Gas (SWX), AT&T (T), Toronto-Dominion Bank (TD), Truist Financial (TFC), T. Rowe Price (TROW), Cohen&Steers Infrastructure Fund (UTF), Valero (VLO), Ventas (VTR), WestRock (WRK), and W. P. Carey (WPC).

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here