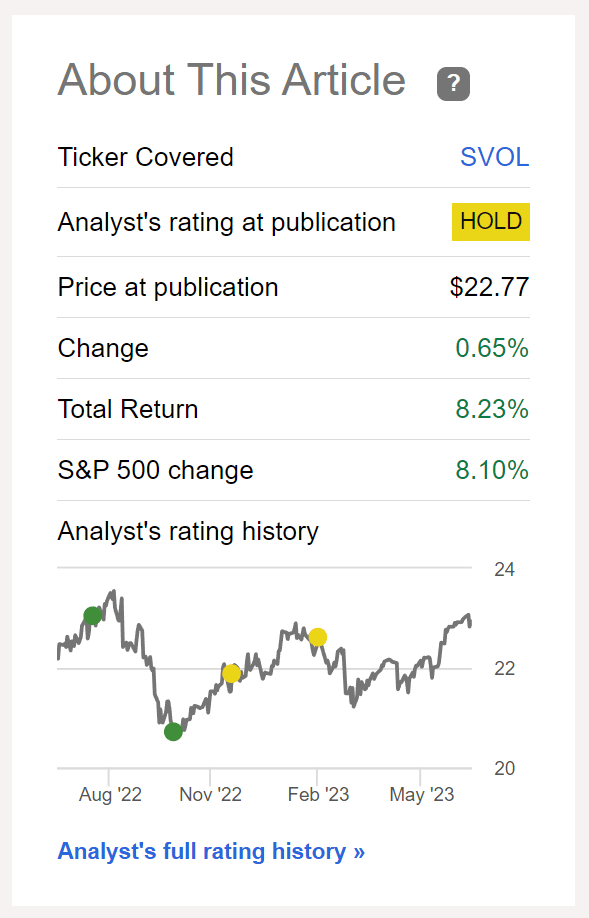

To be honest, the Simplify Volatility Premium ETF (NYSEARCA:SVOL) has done better than I expected, returning 8% since I last wrote about it in February, matching the returns of the S&P 500 (Figure 1).

Figure 1 – SVOL has kept pace with SPY (Seeking Alpha)

The main reason I liked the SVOL ETF was because of its ability to capture upside when the markets are rallying whereas traditional high-yield strategies like writing call options trade off upside for premiums.

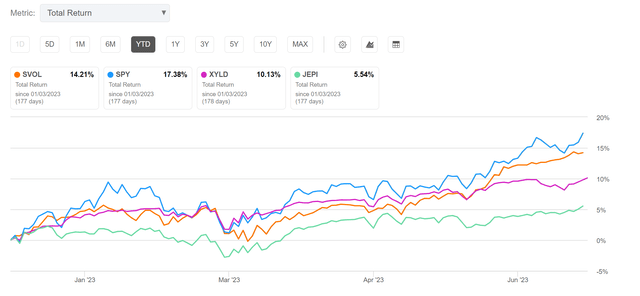

In my prior article, I compared the SVOL ETF against the SPDR S&P 500 Trust ETF (SPY), the Global X S&P 500 Covered Call ETF (XYLD) and the JPMorgan Equity Premium Income ETF (JEPI) and concluded SVOL may be a better vehicle for generating income than those call-write funds. On a YTD basis, SVOL has been the only high-yielding fund that has been roughly keeping pace with the scorching performance of the SPY ETF, returning 14.2% compared to SPY’s 17.4% (Figure 2).

Figure 2 – SVOL has almost kept pace with scorching SPY ETF (Seeking Alpha)

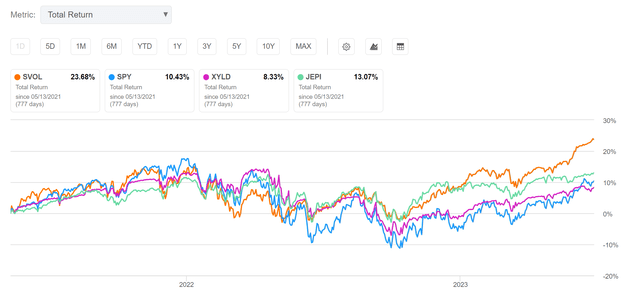

In fact, since inception, the SVOL ETF has solidly outperformed the SPY, XYLD, and JEPI ETFs with 23.7% total returns compared to 10.4%, 8.3% and 13.1% respectively.

Figure 3 – SVOL has outperformed peers since inception (Seeking Alpha)

However, with the VIX Index trading at multi-year lows at ~13 recently, I, and many fellow investors, was starting to question whether SVOL’s amazing performance can be sustained.

Fund Overview

Readers who want to learn more about the details of the Simplify Volatility Premium ETF should take a look at my initiation article written a few months ago.

Briefly for those new to the fund, the SVOL ETF seeks to provide investment returns that correspond to 0.2x to 0.3x the inverse of the S&P 500 VIX short-term futures index while owning tail hedge for extreme events.

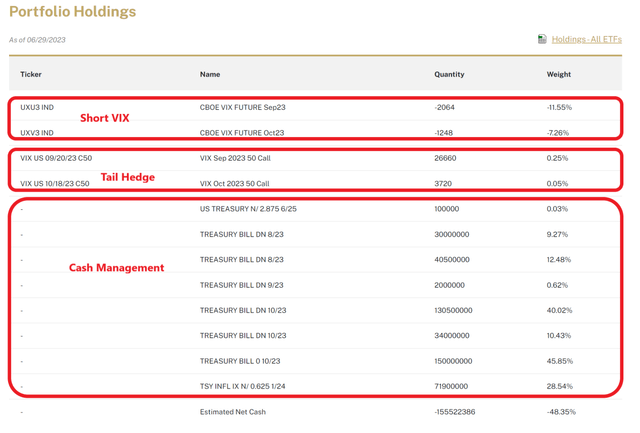

SVOL’s portfolio is fairly easy to understand. It is short ~20-30% of VIX short-term futures, while owning treasury bills to generate additional yield on idle cash, and it spends ~2-4% a year on tail hedges to protect against black swan events (Figure 4).

Figure 4 – SVOL portfolio holdings (simplify.us)

Investors should note that the SVOL ETF may occassional change up its portfolio by buying short-term corporate bonds or hedging with calls on other instruments like the ProShares Ultra VIX Short-Term Futures ETF (UVXY) instead of the VIX Index, however, the main structure remains the same.

How Does SVOL Work In Low Volatility Regimes?

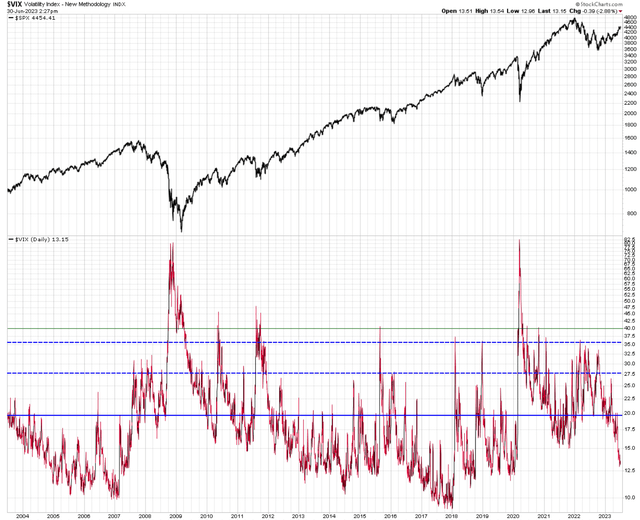

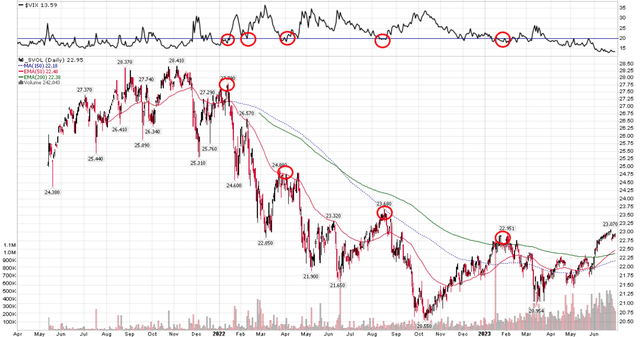

The most pressing question on my mind is how does shorting volatility work when volatility is low? The VIX Index is currently trading at ~13, the lowest in years and far below the long-term average of ~19 as the equity markets have seemingly brushed off every negative headline in recent months (Figure 5).

Figure 5 – Spot VIX trading at 13 recently (Author created with price charts from stockcharts.com)

Are investors still being compensated for selling volatility at these levels?

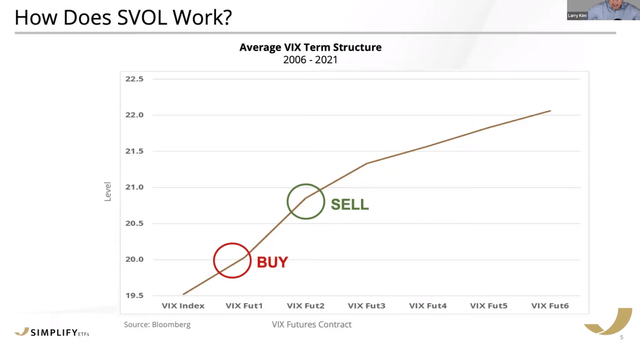

The short-answer is yes, according to a recent video from the Simplify portfolio management team explaining the mechanics of the SVOL ETF. The important thing to understand with the SVOL ETF is that operationally, it shorts the 2nd or 3rd month VIX future and cover after a month or two when the future becomes the 1st month (Figure 6).

Figure 6 – Operational mechanics of SVOL ETF (simplify.us)

So the SVOL ETF does not depend on the absolute level of VIX, rather, it is capturing the contango spread between the near month future and the farther dated future. As long as the VIX futures curve remain in contango, the SVOL ETF’s strategy should work.

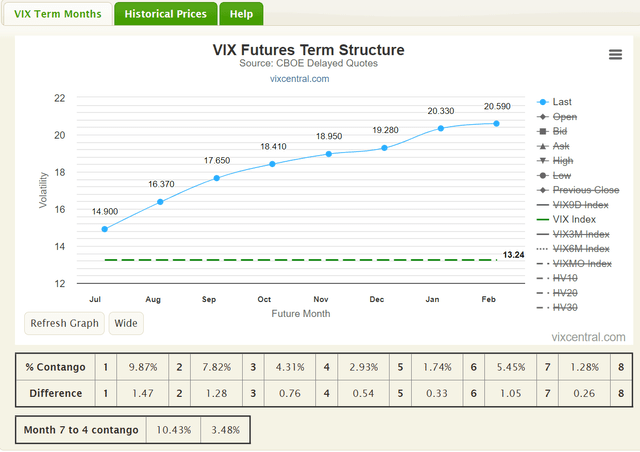

Currently, although spot VIX is very low at ~13, the VIX futures curve remains in steep contango with 1.5 VIX pt difference between the July and August futures and 1.3 pt difference between September and August (Figure 7).

Figure 7 – Current VIX futures curve (vixcentral.com)

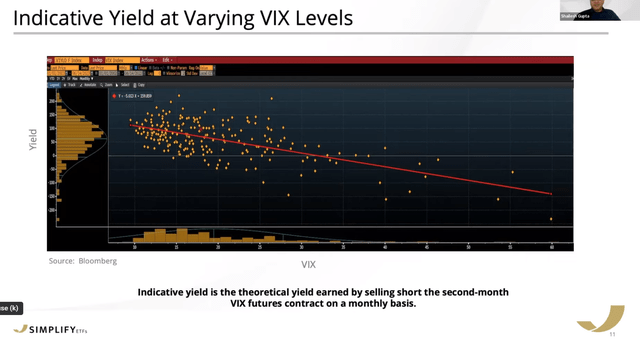

In fact, according to the portfolio manager Shailesh Gupta, the indicative annualized yield from the short VIX futures strategy actually increases with lower VIX levels, as low VIX prompts investors to buy long-dated VIX futures as hedges which keeps the VIX futures curve in steep contango (Figure 8).

Figure 8 – Indicative annualized yield of short-volatiltiy strategy (simplify.us)

15% Target Yield Achieved

Another question I had on the SVOL ETF was what kind of yields can safely be delivered by the SVOL ETF? From figure 6 above, we can see shorting vol can capture on average 1 VIX pt between the 2nd and 1st VIX future, or about 5% in monthly returns. Given the SVOL ETF is short about 20-25% of VIX futures, that means it can generate about ~1.25% / month, or ~15% annualized.

Alternatively, another way to think about shorting volatility is to compare it to owning stocks. Mr. Gupta believes owning large cap stocks is basically the same trade as being short volatility, since when volatility increases, stock prices decline. Historically, “VIX futures is a 100 vol asset”, meaning it has 5x the volatility of the equity markets.

Mr. Gupta believes that for an equivalent amount of exposure compared to equities (i.e. 1/5th the notional exposure), where equities can generate ~10% in equity risk premium (author’s note, this is technically incorrect, as equity risk premium is the difference between equity returns and risk free returns), shorting vol can generate a ~15% yield (28 minute mark in the video highlighted above) for a better risk/reward.

Currently, the SVOL ETF is paying a $0.32 / month distribution or a 16.8% annualized distribution yield. So the SVOL ETF is basically paying out the target distribution yield achievable with this strategy, give or take some wiggle room with higher treasury bill yields or a smaller hedging budget.

What Happens If There Is A Volmageddon 2.0?

Another concern I have with the SVOL ETF is what if there is another ‘volmageddon’ event where some external event causes volatility to spike in a very short period of time, wiping out months if not years of gains on short-vol strategies? For example, in 2018’s ‘Volmageddon’ event, the VIX Index doubled overnight and wiped out many investors including the VelocityShares Daily Inverse VIX Short-Term ETN (“XIV”).

SVOL ETF claims to hedge this risk via the long calls on the VIX Index. Since there has not been a ‘Volmageddon’-type event in recent years, this claim is unproven.

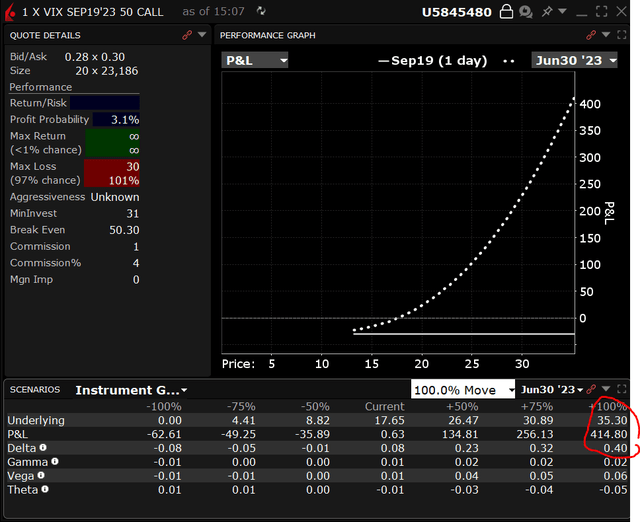

Hypothetically, if the VIX were to double overnight at every point on the VIX curve, the September 50 calls that the SVOL ETF holds should deliver $415 in P&L against $30 in option value, or 14x returns (Figure 9).

Figure 9 – Theoretical gains on doubling of underlying on September 50 calls on VIX (Interactive Brokers)

The October calls should deliver similar levels of returns. With a 0.30% combined weight in these calls, the SVOL ETF may gain ~4.2% on a doubling of VIX. However, the short futures position would also presumably double overnight, losing the fund ~19%. Of course, the call option payoffs are convex, so if VIX spikes more, or if implied volatilties spike as well, then the options may gain more value, but at the same time, the short futures should lose more value. So it is unclear how a small 0.3% weight in call options can offset large potential losses from a 19% short exposure in practice.

Put another way, the short futures position is currently 63x the size of the call options in value. I have reservations that a doubling of spot VIX from 13 to 26, or September VIX from 17.65 to 35.3, can cause enough convexity in September 50 calls to offset the potential 19% loss from the short futures position.

Will NAV Ever Increase?

Finally, in my prior article, I pointed out that although the SVOL fund paid out a very attractive distribution yield, it may come at the expense of an ‘amortizing’ NAV, as every time the VIX spikes, SVOL’s NAV takes a permanent step lower (Figure 10).

Figure 9 – SVOL NAV vs. VIX (Author created with price chart from stockcharts.com)

This could be become a long-term concern, as lower NAV indicates there is less assets to support future distributions.

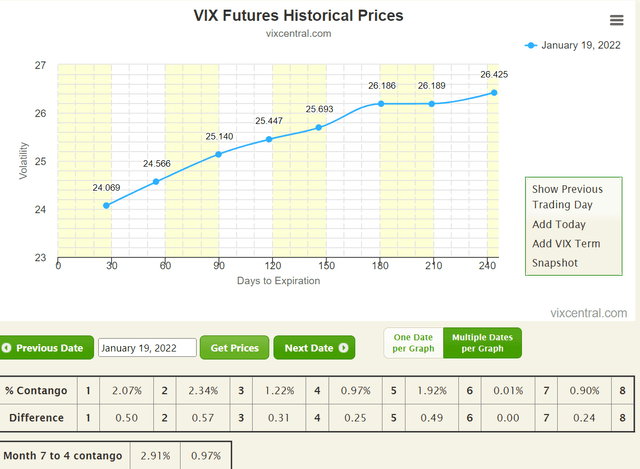

With some time to think about this issue in more detail, I believe the declining NAV has to do with SVOL’s fixed distribution of $0.32 / month and the steepness of the contango curve. Specifically, in the periods highlighted in figure 10 above, for example in January 2022, the VIX curve contango was not very steep, with VIX1-2 (difference between 1st and 2nd month futures) contango of only 0.5 VIX points, and VIX2-3 of only 0.6 VIX points (Figure 10).

Figure 10 – VIX curve was flatter for most of 2022 (vixcentral.com)

In fact, most of 2022 was characterized by a flatter contango in the VIX curve, as near-term risk was elevated due to the ongoing equity bear market. Incidentally, it is interesting that the average VIX curve in figure 6 was calculated from 2006 to 2021. If 2022 was included, it may show a flatter average, which may not support the fund’s designed 15% yield.

Average spot VIX was 25.6 in 2022, above the long-term average of ~19, and from figure 8 above (if the figure is blurry, readers may wish to look up the original chart in Simplify’s video at the 25 minute mark), we can see that the annualized yield with VIX at 25 is ~50%.

Since SVOL is short 20-25% notional exposure, that means it may be only earning 10-13% ‘yield’ in 2022, insufficient to fully fund the $0.32 / month distribution, hence SVOL’s NAV declined.

Fortunately, the VIX curve steepened towards the end of 2022 as spot VIX fell below 20, and so far in 2022, SVOL appears to be able to fund its generous monthly distribution, as NAV is flat to up YTD. However, as I mentioned above when discussing SVOL’s 15% target yield compared to its 16.8% forward yield, this is about as good as it gets.

The risk is that if NAV is flat to barely up in a 13 VIX environment, then SVOL may be too aggressive in its distribution policy. For me personally, I would prefer if SVOL reset its distribution policy to 7-10% instead of the current 16.8%, and allow NAV to accumulate, as that would create a buffer where the fund can still fund a generous distribution without depleting NAV when we inevitably hit rough patches in the macroeconomy and the VIX curve flattens.

Conclusion

In conclusion, the recent YouTube interview with the portfolio manager put to rest some concerns I had regarding the strategy’s performance in the low volatilty regime that we are currently in. As long as the VIX curve remains in contango, the SVOL ETF should work.

However, I am not so certain whether the small call position is sufficient to protect the portfolio in a ‘Volmageddon’ event, especially if volatility simply doubles to the ~30s (like in 2018) without pushing the tail hedge calls ‘in the money’.

Furthermore, considering the fund’s NAV is barely up so far in 2022 even with VIX declining to 13 and historically steep contango, I worry the fund may be too aggresive in its distribution policy.

Overall, I believe the SVOL ETF is an excellent yield generating investment and is superior to call-write strategies in generating monthly income. I continue to hold the SVOL ETF in my portfolio, although I would not add at this time.

Read the full article here