Electric Truck Maker Rivian Debuts On The Nasdaq Exchange

Introduction

Rivian Automotive Inc (NASDAQ:RIVN) has established itself as a pioneer in the clean energy industry by incorporating the concept of sustainable energy into America’s most popular vehicle (pick-up truck) to create a new disturbance in this increasingly crowded industry. Rivian was founded back in 2009 by business tycoon Robert “RJ” Scaringe after he questioned the existing solutions to “Sustainable Change.” His vision has since gathered mainstream attention by partnering with E-Commerce Conglomerate, Amazon (AMZN) as well as the Saudi-Arabian Investment Fund, Abdul Latif Jameel. Rivian’s sluggish production line questions its ability to maintain or potentially increase its market share in an industry which has only experienced stiffer competition. Ever since Rivian’s IPO in November of 2021, Rivian’s stock has plummeted by 87.18% from $129.95 to a near all-time low of $16.66. However, with a reduced stock price, comes an opportunity, one at a potential bargain.

Domestic and Foreign Market Potential

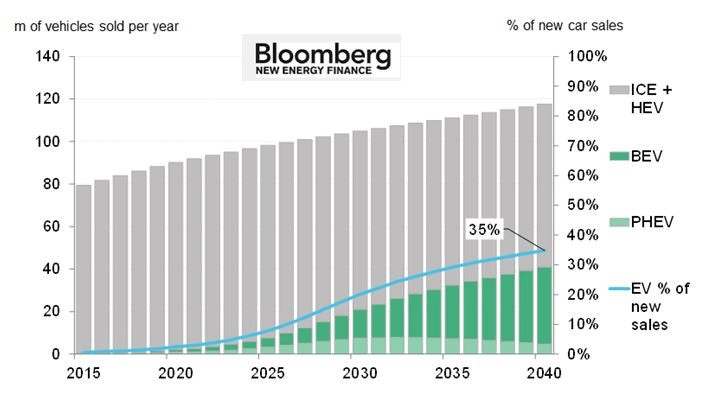

The automotive industry has experienced an unprecedented shift away from traditional gas powered cars with the growing presence of electric vehicles (EVs). Propelled by the increasingly worrisome environmental concerns as well as government initiatives, the EV market is now growing exponentially, so-much-so that it is expected to surpass the traditional gas powered market by the year 2027. According to Evadoption, the EV industry is estimated to reach an evaluation of $2.7 trillion by 2027, this is only possible with a compound annual growth rate (CAGR) of 34%. All this growth will acquaint to roughly 10 times the number of estimated EV sales in 2030 (Estimated 33 million sales) compared to 2020 (3.1 million sales).

Bloomberg

These statistics look very promising for a new company like Rivian, especially given how pick-up trucks account for 20.57% of all vehicles sold in America, this is closely followed by the SUV at 11.42% according to AfterMarketNews. However, the real opportunity is not found in America, but abroad in continents like Europe and Asia, which have both heavily incentivized the adoption of EVs. In order to capitalize on the European market which is expected to sell 40 million EVs by 2030 (larger than the US), Rivian has officially confirmed plans for overseas expansion with the build-up of staff and service centers, most notably in Berlin. However, a series of constant delays mostly attributed from supply-chain inefficiencies has called into-question Rivian’s abilities to appeal and deliver towards a market where pick-up trucks are not as prevalent. Much of the same can be said regarding the biggest EV market in the world (China) where Rivian maintains ambitious plans to expand towards China without the logistical infrastructure to show for it.

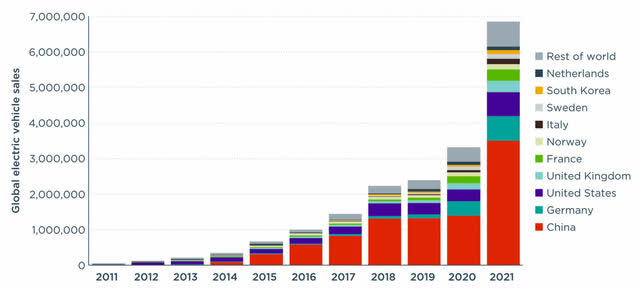

International Council On Clean Transportation

At the end of the day, Rivian’s success is largely measured by its abilities to thrive in foreign markets, but with unrealistic expectations, minimal production capacity, and missed target after missed target, it’s not hard to justify why Rivian finds itself in the position it is in today. However, despite its turbulent beginnings, Rivian has slowly begun to establish a more tangible presence, particularly in Germany where Rivian is expected to start selling the R1T and R1S in late 2023. Time can only tell if this just so happens to be another missed target or a potential break-through opportunity.

Competition & Quarterly Logistics

In a market with so much upside potential, comes fierce competition. Rivian faces an uphill battle against industry titans Tesla (TSLA) and Ford (F). Tesla, the clear front–runner, has established itself as the face of the EV industry thanks to its first-mover advantage, loyal following, and persistent focus on technological innovation. The company’s vertical integration strategy has produced cutting-edge functionality and a smooth user experience. Ford, on the other hand, aims to widen its consumer base by selling the country’s most popular pick-up truck (Ford F-150), just in electric form.

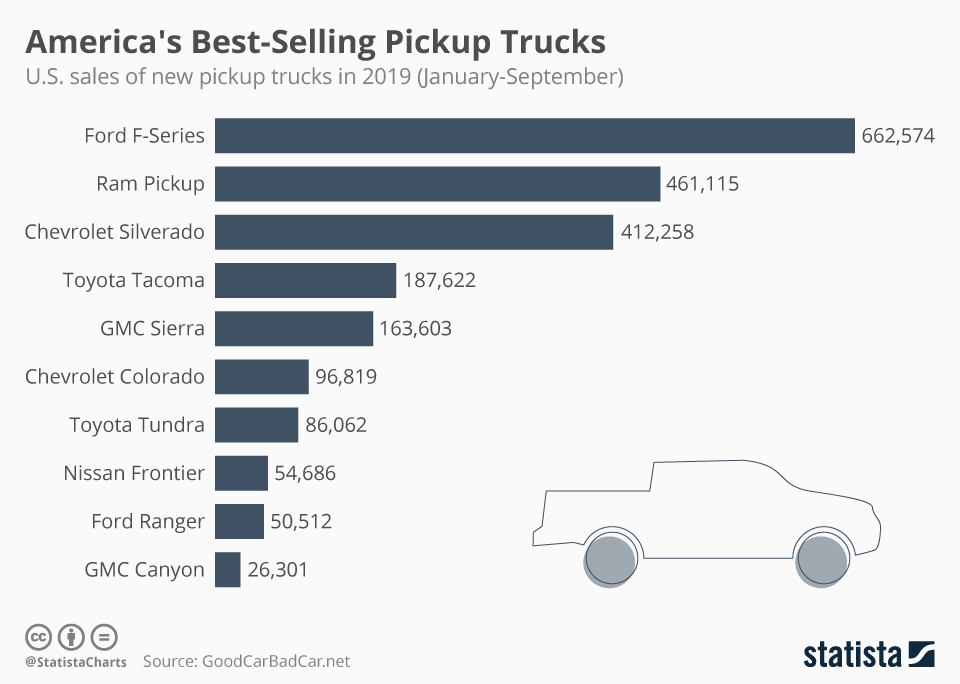

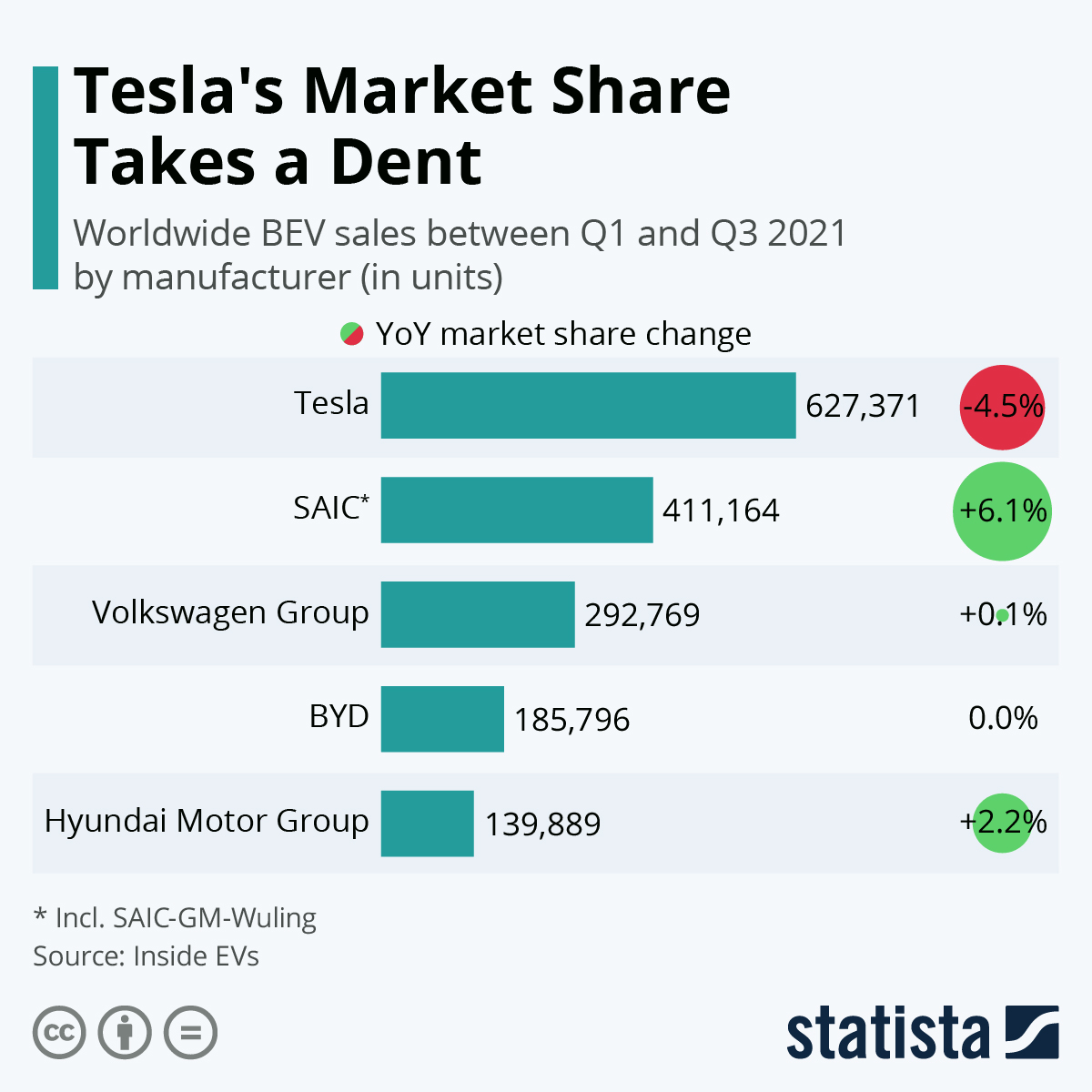

Statista

Its brand presence, production capabilities, and established dealer network gives Ford a unique advantage even over companies like Tesla. By capitalizing on its reputation for dependability, practicality, and performance, Ford has the unique ability to market towards a diverse group of consumers whether it be the loyal Ford owners or the gas-car owners who are looking to switch over to EVs in the “non-luxury” market.

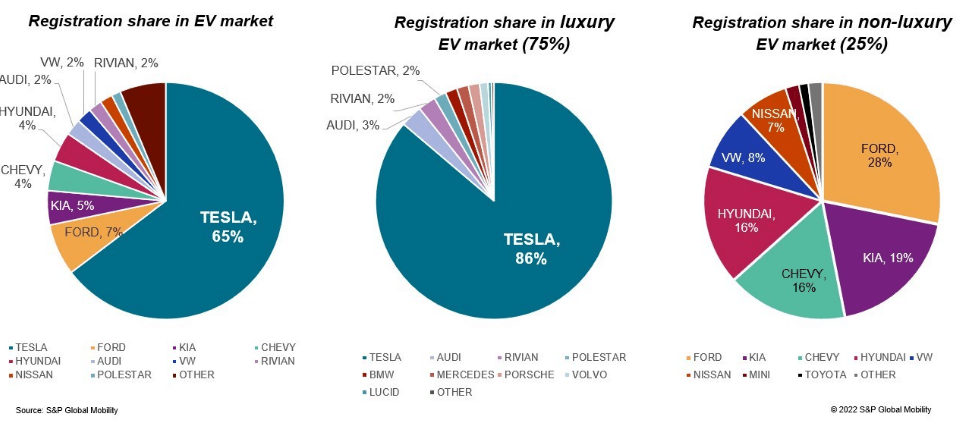

Electrek

With two conglomerates crashing down on Rivian, it’s hard to identify what makes Rivian different from everyone else. The answer can be found in the way Rivian markets itself. The manufacturer sets itself apart by focusing on adventure and the outdoors. Rivian caters to a specific market niche that is often times overlooked by other EV manufacturers. The R1T pickup truck and the R1S SUV are made to handle off-road conditions and difficult terrains while having long-lasting range. This is only possible with Rivian’s proprietary “Skateboard Platform,” a flexible battery platform that incorporates the battery pack, electric motors, suspension, and other essential components. With this, Rivian can build adaptable cars with low centers of gravity, which also maximizes internal space and offers better handling and performance. Rivian’s branding has had profound effects in its customer demographics, as over 73% of Rivian’s customers are male. This goes on to beg the question, is it enough? The answer is not simple. As of now, Tesla owns a whopping 66% of the entire EV market. This market share is only expected to dwindle down to roughly 22% in under a decade, thus opening a huge opportunity for Rivian to take advantage. This is already happening, as Tesla has lost 4.5% of its market share in just the first three quarters of 2021.

Statista

However, it is important to note that most of Tesla’s lost market share will take place in China, a country which Rivian does not expect to deliver towards in the near future. Domestically, on the other hand, Rivian’s potential market share looks promising. Its partnership with Amazon worth roughly $3.5 Billion has secured the sale of 100,000 custom electric delivery vehicles, which will be distributed across 500 cities. Although this does not compare with Tesla’s 2022 deliveries of 1.31 million, it’s a optimistic start for a company which has often been regarded as speculative.

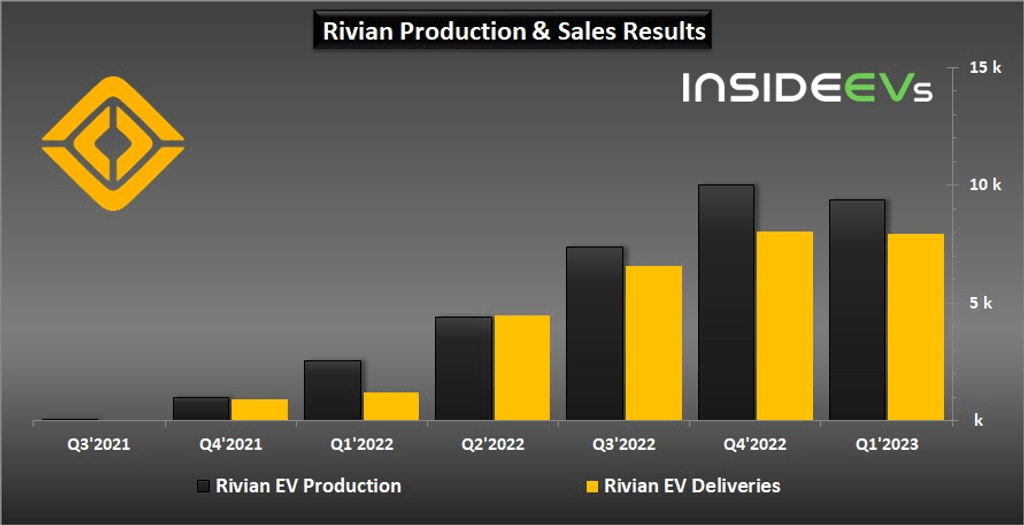

InsideEVs

This goes without mentioning Rivian’s consistent growth in both deliveries and production quarter after quarter. In 2022, Rivian produced 24,337 vehicles (increase of 1,015 from 2021) and delivered 20,332 vehicles (increase of 920 in 2021) with almost all of the production being for the US market. Rivian in the Q4 sales meeting went on to mention that its pre-order for the R1S was back-logged into 2024, clearly highlighting how Rivian has no-problem with demand. Therefore, it comes to no surprise that Rivian has already chipped 2.8% away from Tesla’s market share in America and is only expecting to take more. In the face of stiff competition, Rivian’s numbers speak for themselves, thus giving Rivian some breathing room to potentially capture more market share.

Financials

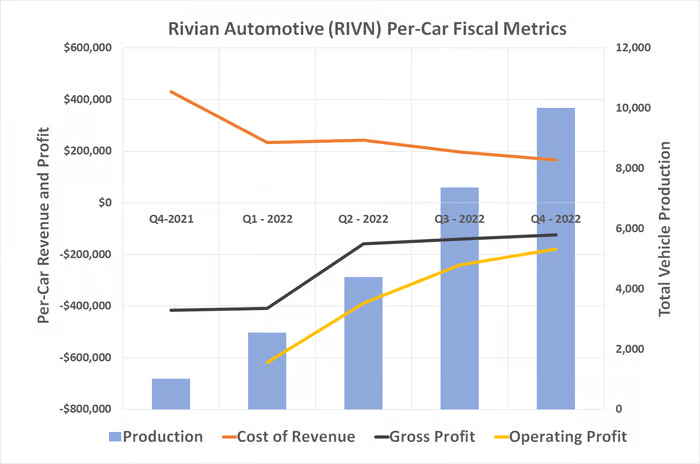

Like many other EV manufacturers, Rivian is yet to post a profit. This is attributed to a number of factors including development costs, scale of production, as well as the intense labor involved. All factors combined, and the result is a $6.5 Billion net loss from a roughly $3 Billion gross profit in 2022. Rivian blames this loss mostly on temporary logistics issues like high inflation and its sluggish production line.

The Motley Fool

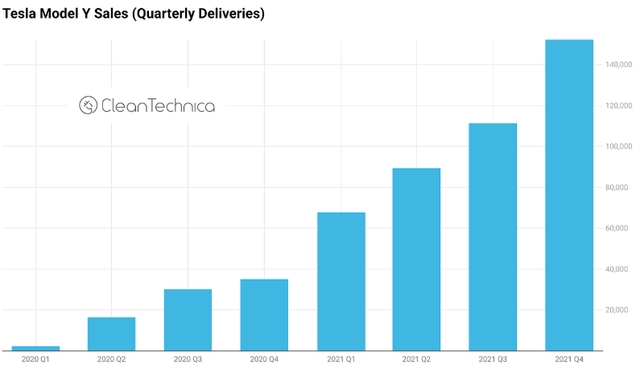

As inflation cools down and production resumes as expected, Rivian will be able to more effectively produce and deliver cars on a scale never seen before. This comes as new technologies were incorporated into Rivian’s production line in early 2023 in order to produce more vehicles at a fraction of the price while increasing range, according to Rivian’s Chief Financial Officer (CFO), Claire Rauh McDonough. With Rivian’s increased production capacity, it will not only reduce the price per vehicle, but also foster Rivian’s foreign presence in markets where there is virtually unlimited opportunity. So-much-so that Rivian aims to reduce the price of the R1S to rival Tesla’s Model Y as the global volume seller to $40,000 for the base-trim.

CleanTechnica

Rivian currently finds itself in a tough position to become profitable, however, its new developments including its partnership with Amazon along with its more efficient production line has allowed Rivian to potentially make a profit. According to McDonough, Rivian is on track to become profitable by the second half of 2024. She went on to mention that the EV manufacturer plans to produce 85,000 R1S vehicles in 2024 alone. This may sound far-fetched, as Rivian produced less than a ⅓ of McDonough’s 2024 target production across all vehicles in 2022. By managing its excessive costs as well as increasing production efficiency, Rivian’s potential to produce more for less is unmatched. All these factors combined can potentially validate McDonough’s profitability claims.

Conclusion

Rivian finds itself in the same position that Tesla was in roughly a decade ago. With missed targets, a sluggish production line, but a growing market, and the potential for profitability, Rivian can be seen as “neutral.” Ultimately, other factors both fundamental and technical can influence an investor’s opinion to either buy, hold, or even sell. At the end of the Rivian, is a new, “flashy,” company with so much potential, but at what cost?

Read the full article here