Investment Rundown

Riding the hype wave around renewables the share price for Altus Power Inc (NYSE:AMPS) has been a rollercoaster, peaking at over $14 per share back in September 2022. It has since come down a fair bit, but still boasts a rather high multiple at 61x FWD earnings. For investors seeking a value investment, this doesn’t on the surface look like one.

But estimates are suggesting the earnings bounce back hard and by 2025 EPS will be $0.63, representing a p/e of 8 which would make AMPS very appealing. The company has had strong expansion ventures in the last few years and now is present in 24 different states in the US. Guidance for 2023 remains unchanged and an EBITDA of $97 – $103 million is estimated, which would represent a 70% YoY increase. I think the strong future growth potential of AMPS does offset some of the rich valuations it currently has. I don’t think the current price is worth buying at, but I think instead inventors will do well holding onto shares, and possibly adding if there is a significant dip in the short-medium term. Rating AMPS a hold.

Company Segments

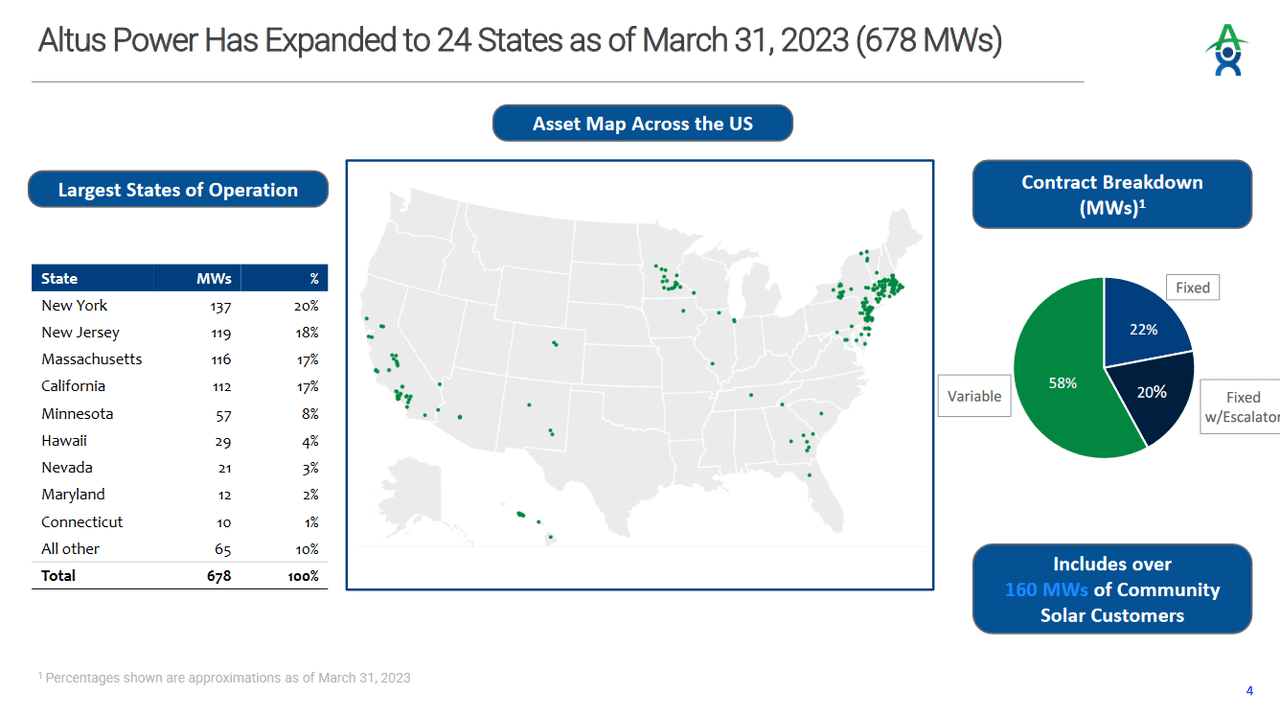

The focus for AMPS lies in developing, constructing, and operating solar power projects across the US. The company has expanded its set of projects and now boasts a portfolio consisting of 678MWs in total across 24 different states.

Market Overview (Investor Presentation)

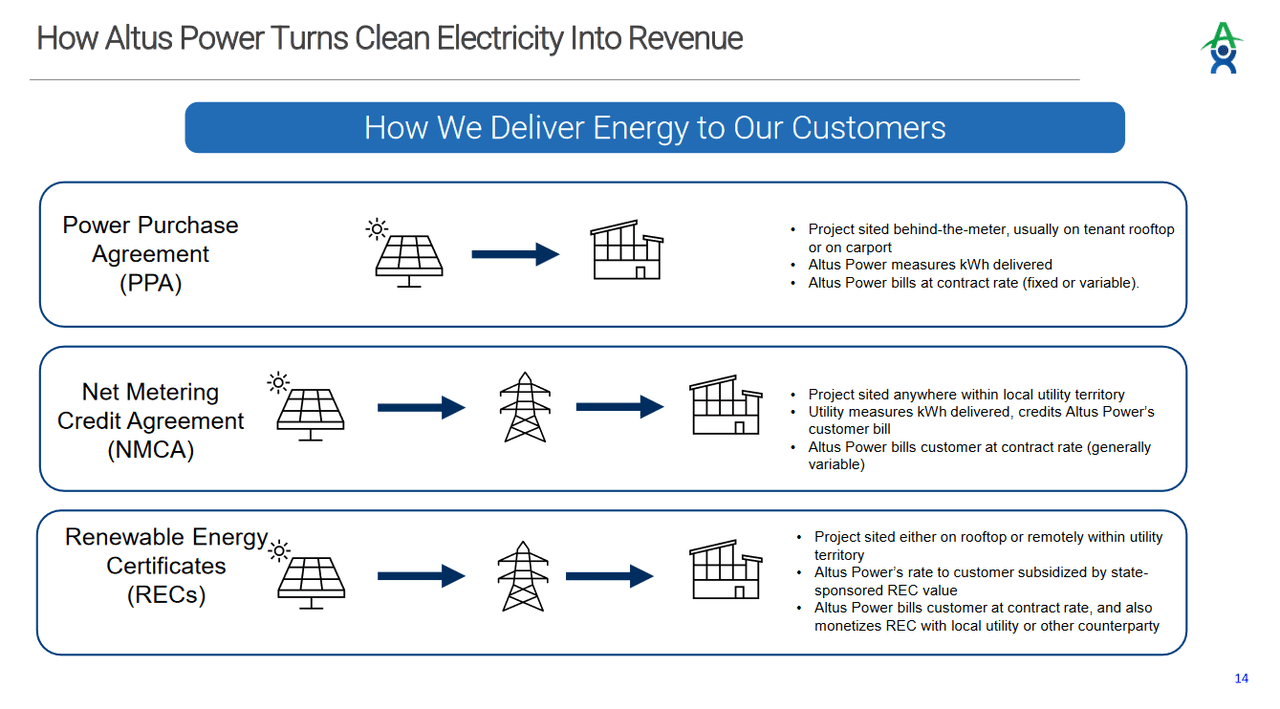

What I find very interesting is that AMPS has been able to already establish very solid fixed revenue streams. As far as renewable companies go, they very often have lackluster margins in the beginning, but as more and more projects come online for AMPS the margins look very decent. In 2024, if the estimates for both the top and bottom line come true the net margin would be around 15% if the dilution of shares ends up at 170 million, a 12.5% increase from today’s levels.

What could justify this would be the many projects that are expected to finish at the end of FY2023. In Q1 2023 there were 8MWs projects finished, and an additional 67MWs are projected to finish before the year’s end.

Markets They Are In

The renewable sector has been in the spotlight for a very long time, as demand for new energy sources is growing. The pressure put on government officials but the public is the cause of this shift. But in 2022, for example, the deployment of new solar projects seemed to have faced an obstacle and it dropped 13% YoY.

As AMPS is niched towards solar panels as they are responsible for essentially the whole manufacturing line of solar energy generation and storage systems. This in-house business model has benefited them greatly as seen in the EBITDA growth for example. Looking at the broader market for solar panels the trends remain upwards as more and more households are adopting the technology.

There is a seasonality with solar panels and about 65% of the total energy generated is between March 21st and September 21st. I think this is very much worth mentioning as the same sort of seasonality might very well be seen in reports from AMPS. Seeing as they operate solar projects, the fixed revenues from here will very likely differ from quarter to quarter.

Earnings Highlights

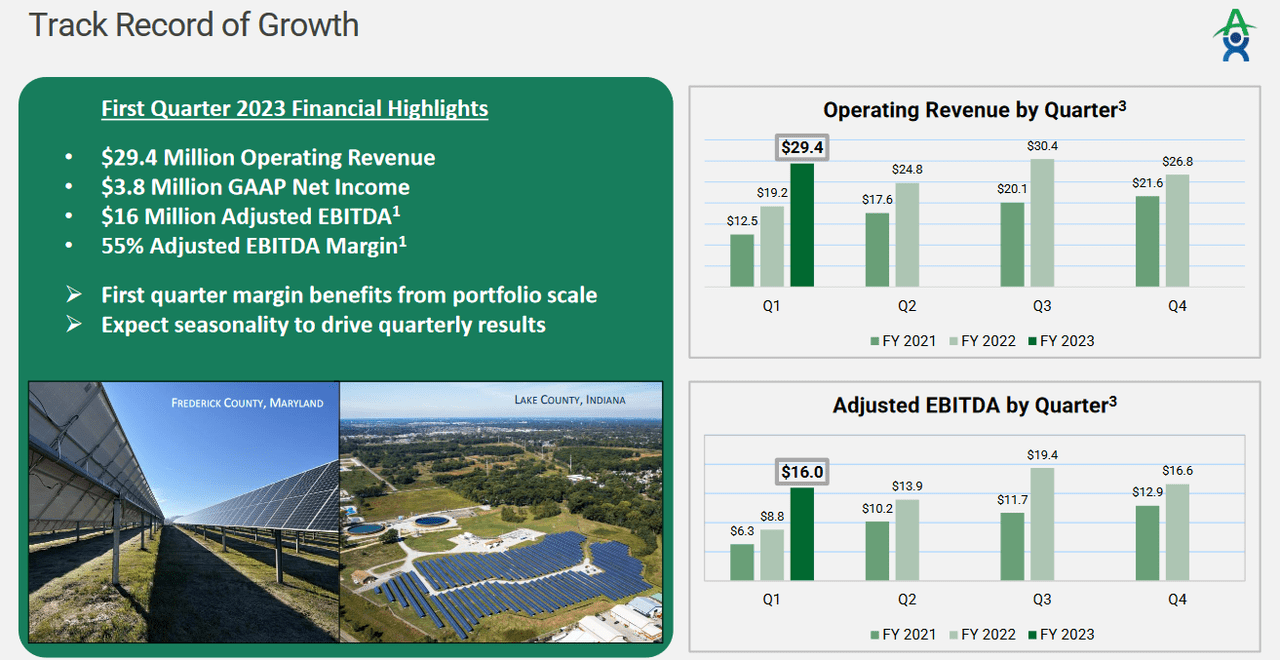

As for the first quarter to 2023, I think AMPS did very well when looking at the numbers. An Adjusted EBITDA margin of 55% is far higher than the sector’s 33%. With results like this, it’s no wonder the company is still trading at the valuation it does.

Q1 Highlights (Q1 Report)

One thing worth taking for the coming quarters is that the management is stating the expansion of its portfolio is fueling margin expansions. This was experienced in Q1 2023. As stated previously, AMPS is aiming to build out its portfolio by an additional 13% this year. I think this will have a positive impact on the margins in 2024. With stronger margins, the EPS estimates also look a lot more realistic.

AMPS Growth (Investor Presentation)

In terms of guidance for 2023, the Adjusted EBITDA is to be between $97 – $103 million, representing a 70% increase YoY. This sort of growth seems to be calculated in the share price already. But I think what could translate to a catalyst is AMPS’s lacking the need to dilute shares to fuel growth. Shares have grown by 77% between 2020 and 2022. With strong bottom-line margins, the need to dilute further seems unnecessary. If shares present around 160 million, then the projected EPS might need to be revised upwards to calculate for the lacking dilution. That could mean paying 60x FWD earnings right now might be a great buy.

Risks

The most prominent risk with AMPS right now I think is the significant amount of debt they have built up. It’s nearing the same as the entire market cap, sitting at $794 million. Comparing the long-term debts to the cash position will highlight the much-needed work the company has to do once margins are improved and cash flows begin rolling in. The long-term debt/EBITDA right now is over 14, which indicates that AMPS will face significant challenges in paying down debt in the short-medium term without the help of diluting shares or raising capital in other ways.

Final Words

Having exposure to the renewable energy market I think is a key thing for most of today’s investors. It’s a rapidly growing market and picking out the winners in it from the losers is very difficult. Where I think you need to be looking is the ones able to secure fixed revenues and maintain strong margins as they operate various projects or supply materials.

AMPS seems to be such an option. They have strong growth outlooks and by 2025 it would trade at a p/e of 8 if the same share price today persists. Today p/e is at 60x which I find too high and there are some issues on the balance sheet that puts me off from rating it a buy right now. I find the outlook for AMPS very believable and will be rating them a hold. If the share price goes down to the year lows of around $4.4 I can see a buy case taking shape instead.

Read the full article here