Background

Sabre Insurance Group (OTCPK:SBIGY) is a niche UK auto insurer underwriting “non-standard” risk. This predominately includes higher risk motor coverage for first time drivers, drivers with motoring convictions/points, drivers with CCJs etc. These policies fetch a higher rate with Sabre’s average insurance premium of £700-750 (FY22) vs the UK motor policy premium average of £478 (ABI average).

There’s roughly 40m registered vehicles in the UK, Sabre only accounts for 303k or about 0.77% of the total market motor insurance market based on policies written in 2022. Management believes this puts Sabre in a position to increase market share when insurance conditions improve. While Sabre holds a small market share, it historically targets a combined ratio of at least 80% when underwriting policies making this segment highly profitable when compared to the mass market or in-fact any insurer.

While automotive underwriting is inelastic to economic activity with motor insurance being mandatory in the UK, Sabre acts as a small nimble player underwriting more risk when market conditions are favourable. After a horrid 2022 where claims costs resulted in record low profits, market conditions continue to improve as premium rates tick up (more on pricing later).

BC Partners IPOed the business in 2017, after a failed £500m+ bid from PE fund CentreBridge and reinsurance giant Swiss Re (OTCPK:SSREF). The business now trades at a £337m ($426m) valuation or 33% cheaper than a private equity bid from 6 years ago.

Why Sabre Insurance Sold Off in 2022

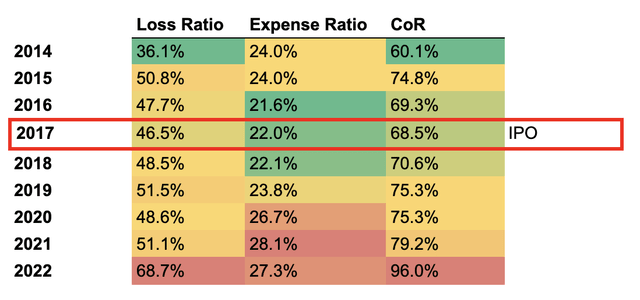

Sabre’s Loss Ratio increased to 68.7% the highest in 10yrs due to extreme claims inflation in 2022. Expense ratio includes wages, industries levies, operational costs etc. Loss Ratio refers to the percentage of net earned premium (revenue in the period) paid out for insurance claims.

Created by author

Insurers saw increased costs for car replacement, courtesy car hire, car parts, paint, garage utility/energy, mechanic wages, care services etc.

This resulted in the combined ratio increasing to 96%, way higher than the historical average of around 75% where Sabre was reporting net income between £40-50m (including income from FI securities but mostly underwriting profit).

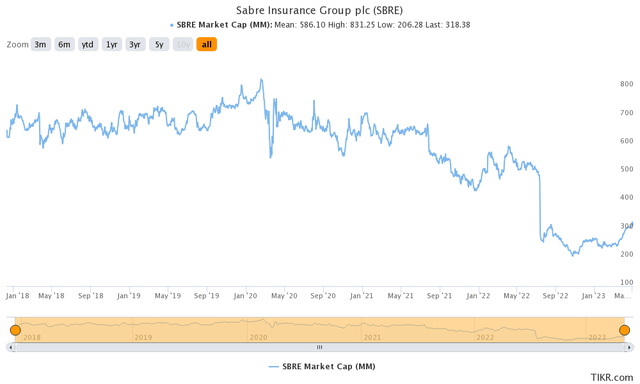

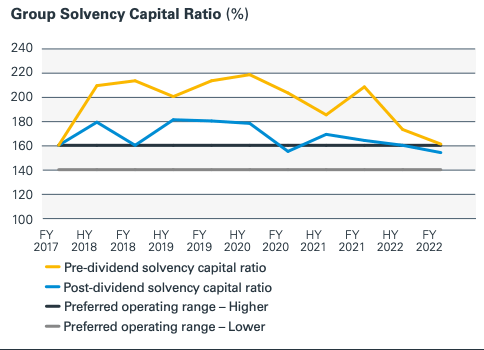

I believe the market overreacted to disappointing results in 2022, leaving the valuation to fall 40-50%. While nothing is certain it doesn’t take a genius to work out this fall the sharp fall in net income to £10m last year was probably temporary. The business has a strong capital base (154% solvency coverage ratio), is CapEx light and has zero debt.

Tikr Terminal

I see this reaction as an opportunity while premium pricing in the sector bottomed in 2022. Small capitalised stocks pose liquidity risks and are highly volatile which significantly limits the number of funds and sell-side analysts following the company – hence the greater opportunity for valuation inefficiencies.

Sabre has already adjusted quotations and the market is following suit. As annual policies from 2022 are renewed at higher prices CoR should fall, management are guiding a CoR of 85%-90% and expect UK inflation to remain around 8% for 2023.

Lastly over the past few years the “non-standard” segment hasn’t really increased in size due to fewer younger drivers, fewer driven miles as a result of pandemic lockdowns or WFH which in turn reduces the aggregate number of drivers gaining points on their license. More driven miles can be seen as a positive as there is greater likely hood for points/conviction which would increase Sabre’s addressable market.

Premium Prices Increasing QoQ

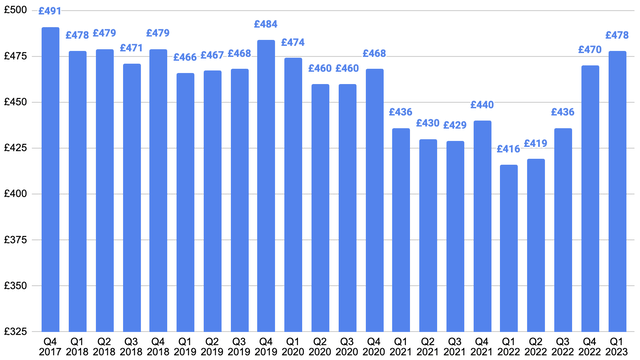

In a ‘soft market’, insurance providers across the sector have more appetite for underwriting risk, they compete more on price to win business, they might go into new insurance lines etc. The chart below illustrates average UK car premiums since 2017 when Sabre floated.

Premiums remained flat until 2020 when the pandemic hit, resulting in fewer driven miles and lower claims frequency resulting in ‘covid discount’ pricing.

ABI Average Motor Insurance Premium QoQ:

Created by Author

Premiums bottomed in Q1 2022 and have since steadily increased QoQ. Direct Line (OTCPK:DIISF), Admiral (OTCPK:AMIGF) and Sabre all communicated during recent earnings calls their pricing adjustments.

Sabre management earnings call (14th March) – when talking about price increases:

“30% in year, 50% since January 2020 is well ahead of the market, I suspect. I might also play a card on how well we are now positioned moving into this year and into 2024.”

Management believes the market is still underpricing.

Income uplift from FI securities

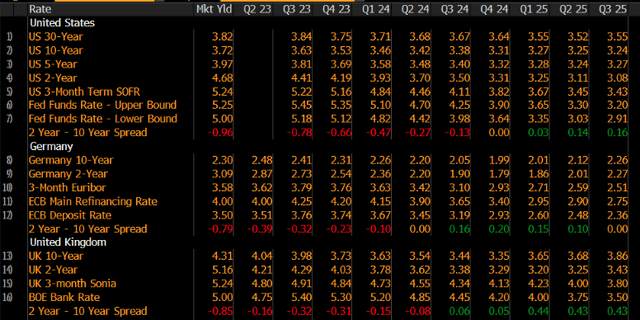

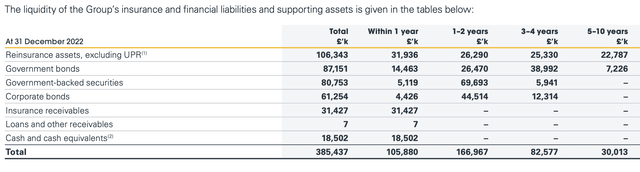

While I’m mostly focused on Sabre’s underwriting business I do expect an income uplift from FI securities due to lasting higher rates. The yield on both 2yr UK government bonds sits around 5.2%, far higher than the average over the last decade. 2yr bonds will be of interest to Sabre instead of long duration as 90%+ of held securities mature in within 4yrs.

UK 2yr (Bloomberg)

Forecasts indicate BoE policy rates both remaining above 350bps until Q3 2025 (was 300bps few weeks ago), meaning Sabre will be reinvesting at yields not seen since before their IPO, leading to greater FI income from 2024 onwards.

BYFC Function (Bloomberg)

As you can see below 10% of the FI portfolio matures within 1yr, 61% within 2yrs and roughly 96% within 4 yrs. As these securities mature and proceeds are reinvested at higher rates, I can see easily see an additional 7m-10m in FI income from 2024/25 onwards. Total portfolio value of £229m with an average reinvestment yield of 4.5% (some yield uplift from Corp bond mix AA+ – BBB-) is attractive.

Group Liquidity (Sabre Insurance 2022 Annual Report)

Risks

1. Acceleration in UK motor theft rates (higher loss ratio) or fraudulent claims due to weakening economic activity & deteriorating living standards. This would lead to a higher CoR than what is guided by management.

2. Harder than expected recession and rise in unemployment leading to fewer first time drivers under the age of 25 (not disclosed by management but I’m guessing this is a key demographic under the “Go Girl” brand). Recessions have a more severe impact on younger drivers who recently entered the labour market.

3. Competitors pricing at uneconomical levels in order to win business causing flat QoQ premium pricing meaning getting back to £40-50m net income will be more difficult.

4. While Sabre benefits from higher interest rates, high-single digit policy rates would limit share price appreciation as the cost of capital would increase leading to valuation compression below historical averages i.e. sub 10x.

Valuation

I see profitability getting back to £40-50m in a few years. Sabre’s dividend policy is to distribute 70% of their earnings plus additional distribution when their solvency capital ratio is above 160%. I think 2023 will be an improvement but still not close to historical performance. Below are basic dividend estimates for 2024 or 2025 excluding any excess distribution. This is based on a market cap of £337m ($426m).

| Scenario FY24/25 | Net Income | Payout | Distribution | Forward dividend |

| Conservative | £40m | 70% | £28m | 8.3% |

| Fair | £50m | 70% | £35m | 10.38% |

| V Hard Market | £60m | 70% | £42m | 12.4% |

The point of this exercise is not to be exact. These estimates are above analyst consensus who I see as being too conservative. Analysts suggest total revenue in 2023, 2024 and 2025 of £190m, £207m and £218m respectively. So revenue is expected to break a record in the next 3 years yet analysts see net income peaking at £35m during this period – quite low to historical standards. Meaning analysts don’t see an 80% CoR in 3 years’ time, something I see as being probable due to harder market conditions and Sabre’s reputation of writing at or below 80% CoR consistently between 2017-2021.

Ignoring the potential for a strong dividend, annual earnings of £40-50m means Sabre could be worth £400-£500m at a simple P/E of 10x. This is fair multiple considering interest rates will be lower in 2-3 yrs. An intrinsic value of £400-500m is 20-50% above the current valuation plus the additional return generated from dividends. Based on this I don’t think it’s unreasonable to expect a 50% total return (including dividends) if management’s expectations materialise over the next 2-3yrs.

Conclusion

While I believe Sabre is undervalued by the market, I don’t expect we will see a full recovery in FY23 as management think they’ll be increasing premiums by around 1% monthly in 2023. Therefore I’m more interested in FY24 & FY25. Several insiders have been purchasing shares on the open market over the last 12 months which is a good sign. Furthermore I see additional income being generated by the £229m FI portfolio as existing maturities are reinvested at far more attractive yields.

CCJs issued to consumers increased 14% from Q1 2022 to Q1 2023, considering the economic climate this will probably continue increase. However we don’t know what percentage of Sabre’s policy holders have CCJs and if it’s a meaningful amount but this could be seen as a positive for Sabre. A negative would be the number of first time drivers purchasing their first car as this group is more sensitive to economic conditions.

The group’s SCR still sits at a healthy level meaning Sabre does not have to rebuild their capital base thus allowing distributions to continue as normal, unlike some insurers who hit 100%+ CoR in 2022.

Sabre Insurance 2022 Annual Report (Sabre Insurance IR)

The strength of this business lies in its experienced actuaries and deep library of claims data. This data library allows Sabre to price risk accurately and understand the likely trend of claims development liability.

Overall Sabre hasn’t really performed at their full potential since IPO, due to a number of temporary factors. Because of the low valuation around £337m ($426m) compared to historical annual earnings of £40-50m during soft market conditions, I view the downside scenario as limited. In simple terms I believe the market overreacted to temporary disappointing results in 2022 and overall I see a 50% total return over the next 2-3yrs as extremely likely.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here