By Behnood Noei and Rick Harper

As previously discussed in our earlier posts, the prevailing trend in the fixed income market this year has been the resurgence of income within fixed income.

Our discussions have encompassed various sectors, including U.S. investment-grade (IG) and high-yield (HY), as well as local currency emerging markets (EM) bonds. These asset classes have exhibited robust performance, delivering year-to-date returns of 3.28%, 4.96% and 8.13%, as of June 21, 2023.

Despite experiencing an impressive rally in their spreads, these asset classes continue to offer attractive yield levels to long-term investors. This is primarily attributable to elevated risk-free interest rates.

Depending on one’s perspective on the future trajectory of Federal Reserve policy tightening, which may involve a pause or a few additional rate hikes, it can be said that investors may still be in the early stages of benefiting from above-average returns within the fixed income space.

However, it is important to recognize that not all investors possess the flexibility to venture into riskier segments of the market, such as HY or EM. Some investors and advisors are required to maintain a closer proximity to traditional asset classes within fixed income (core sectors).

In this article, we will explore WisdomTree Yield Enhanced U.S. Aggregate Bond Fund (AGGY) and outline the reasons why it may serve as a favorable alternative to other conventional Agg products.

AGGY: An Attractive Alternative

AGGY tracks an index that uses a rules-based approach to reallocate across subcomponents of the Bloomberg U.S. Aggregate Index (Agg), seeking to enhance yield while maintaining a similar risk profile.

Yield can typically be increased by shifting exposure along any of a number of risk dimensions, including sector exposure (Treasury, agency, credit, securitized), interest rate risk (duration) and credit risk. The three main steps of the Fund’s index construction include:

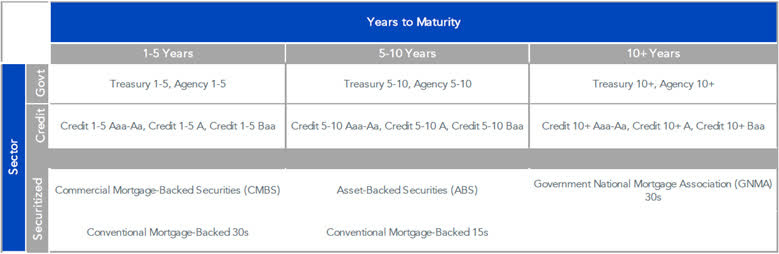

- Divide the Agg into 20 subcomponents: The index is decomposed into 20 buckets across sector, maturity and credit quality.

- Develop and apply constraints: Four major constraints will be applied after the first step in order to construct the new index – tracking error, duration, sector and subcomponent, and turnover constraints.

- Determine Index weights: On a monthly basis, weights of the Index are reallocated across the 20 subcomponents to maximize yield while adhering to the four constraints.

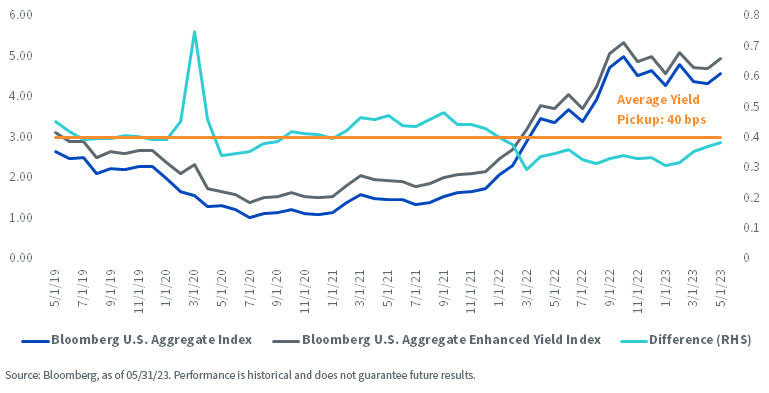

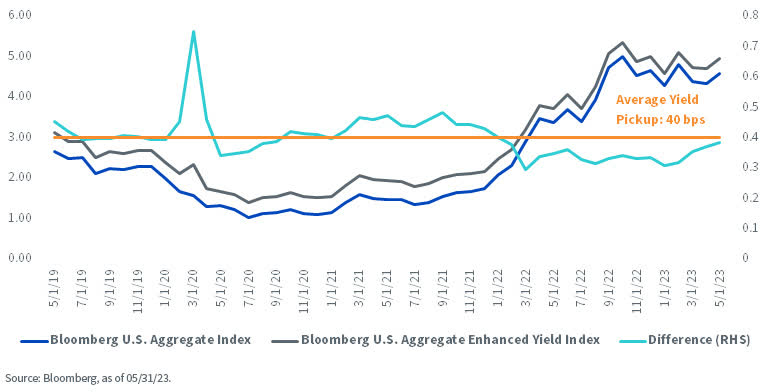

The resulting index will exhibit comparable risk characteristics to the Agg while on average providing around 40 basis points (bps) more yield (carry) since May 2019.

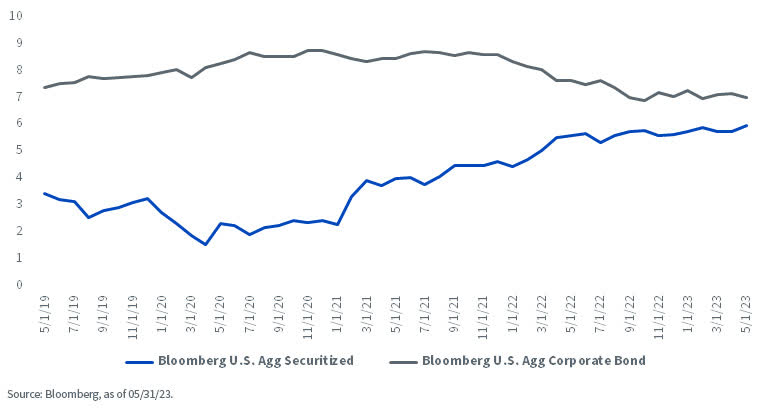

Yield to Worst (%)

In the past, achieving this yield pickup typically involved maintaining a higher duration and greater sensitivity to changes in interest rates. However, as a result of the Federal Reserve’s quantitative tightening and the subsequent shift in the risk attributes of the aforementioned 20 subcomponents, the current landscape enables the index to attain this increased yield without extending the duration relative to the Agg.

Duration (Years)

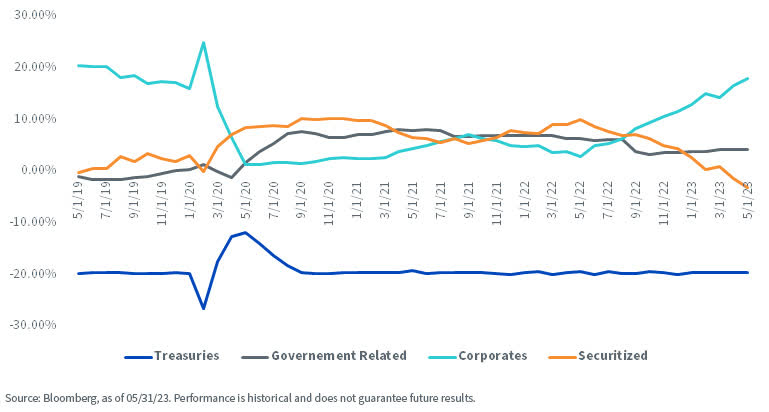

This fundamental shift can be attributed to the notable increase in the allocation of corporates within the portfolio relative to the Agg, which has risen from an over-weight allocation of approximately 3% one year ago to above 18% as of the end of May.

In contrast, the relative market value of the securitized asset class has gone from a 10% over-weight allocation to a 3% under-weight allocation during the same period.

Relative Market Value % (Bloomberg U.S. Aggregate Enhanced Yield Index – Bloomberg U.S. Aggregate Index)

Upon deeper analysis, one can see why our Index construction process has made this happen. With the rise in risk-free rates, and consequently mortgage rates, borrowers have had less incentive to pursue refinancing or new home acquisitions, leading to extension in duration for the majority of mortgages.

Corporate duration has fallen. As a result, AGGY has effectively managed to sustain an average yield advantage over Agg while maintaining a lower relative duration.

Duration (Years)

Conclusion

With the biggest policy tightening in recent Fed history almost in the books, the Fed has created different pockets of opportunities for investors. While riskier segments of fixed income (“plus” sectors) can offer an attractive risk-reward profile for long-term investors, core investors need not feel left out.

Through a quantitative approach, AGGY presents these investors an opportunity to achieve higher carry compared to a typical Agg portfolio, while currently taking less interest rate risk and offering lower exposure to segments of the market that lack appealing risk-adjusted rewards.

Important Risks Related to this Article

There are risks associated with investing, including the possible loss of principal. Fixed income investments are subject to interest rate risk; their value will normally decline as interest rates rise. Fixed income investments are also subject to credit risk, the risk that the issuer of a bond will fail to pay interest and principal in a timely manner, or that negative perceptions of the issuer’s ability to make such payments will cause the price of that bond to decline. Investing in mortgage- and asset-backed securities involves interest rate, credit, valuation, extension and liquidity risks and the risk that payments on the underlying assets are delayed, prepaid, subordinated or defaulted on. Due to the investment strategy of the Fund, it may make higher capital gain distributions than other ETFs. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

Behnood Noei, Associate Director, Fixed Income

Behnood Noei serves as Associate Director of Fixed Income at WisdomTree Asset Management, where he develops the firm’s suite of fixed income and currency exchange-traded funds and enhances existing investment processes. Behnood has 11 years investment experience in portfolio management and quantitative research. Prior to joining WisdomTree in 2022, Behnood was a portfolio manager and developer of some of the fixed income ETFs at J.P.Morgan Asset Management, where he was directly responsible for managing more than 7 Fixed Income ETFs and multiple SMAs with more than $13Billion in assets. He graduated from The Ohio State University with Master of Science degree in Finance and is a CFA charter holder.

Rick Harper, CIO, Fixed Income

Rick Harper serves as the Chief Investment Officer (CIO), Fixed Income at WisdomTree Asset Management, where he oversees the firm’s suite of fixed income and currency exchange-traded funds. He is also a member of the WisdomTree Model Portfolio Investment Committee and takes a leading role in the management and oversight of the fixed income model allocations. Rick has 28 years investment experience in strategy and portfolio management positions at prominent investment firms. Prior to joining WisdomTree in 2007, Rick held senior level strategist roles with RBC Dain Rauscher, Bank One Capital Markets, ETF Advisors, and Nuveen Investments. At ETF Advisors, he was the portfolio manager and developer of some of the first fixed income exchange-traded funds. His research has been featured in leading periodicals including the Journal of Portfolio Management and the Journal of Indexes. He graduated from Emory University and earned his MBA at Indiana University.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here