Tuttle Capital Short Innovation ETF (NASDAQ: NASDAQ:SARK) is a large inverse ETF. It’s the inverse of the famous ARK Innovation ETF (NYSEARCA: ARKK) from Cathie Woods, which is up 50% from its 52-week lows. That strong performance from ARKK means a great opportunity with SARK, which as we’ll see throughout this article, will be able to drive substantial shareholder returns.

SARK Overview

SARK is a unique exchange-traded fund, or ETF, because of how it operates as a short ETF.

SARK

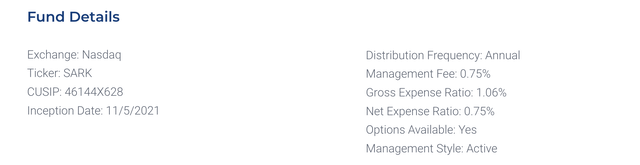

The ETF doesn’t attempt to short ARKK’s specific holdings to match, but rather it attempts to short ARKK itself. It has a relatively high both management fee and gross expense ratio (0.75% and 1.06% respectively), although that’s not surprising for a short ETF. The ETF operates on a daily basis with derivatives, so its inverse share price attempt is on a daily basis.

The ETF does have a unique benefit that until August 2024 total fees aren’t to exceed 0.75%, supported by the organizer, so fees will be capped at that slightly lower level for another 1 year few months.

Investors should note the risk of a daily inverse ETF due to the use of derivates. While we feel it’s unlikely, major derivative ETFs have collapsed before. At the same time, cumulative movement and error on the one-day targets can affect the ETF to the downside substantially. As always, be thoughtful with your risk exposure.

ARKK Holdings

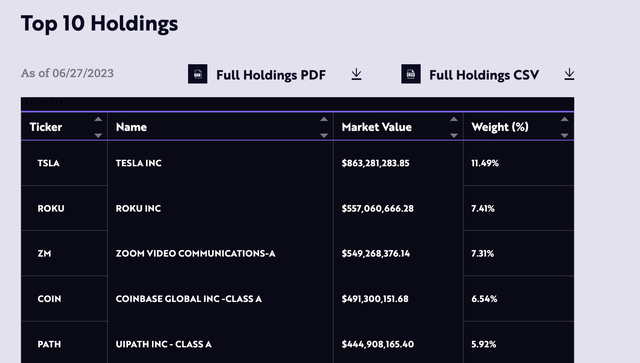

ARKK’s holdings are concentrated in a number of volatile technology stocks.

ARKK

The company’s 5 largest investments combined are 39% of its portfolio. The largest of the company’s investments are Tesla (TSLA) and Roku (ROKU) that make up almost 20% of its portfolio. The company remains concentrated into a number of major investments leftover from what was popular during COVID-19, such as Coinbase and Zoom.

However, times are changing. Remote work is declining despite its popularity during the pandemic, as cultures revert back to their prior positioning. That puts Zoom Video Communications, Inc. (ZM) in a tough position. The crypto boom is falling into irrelevancy, which is our opinion on Coinbase (COIN). Our negative opinion on Tesla is more than evident in our last article on the company.

The fund’s largest investments are struggling. We expect that its investments will continue to underperform, and that’s what makes SARK interesting.

Tech Bubble

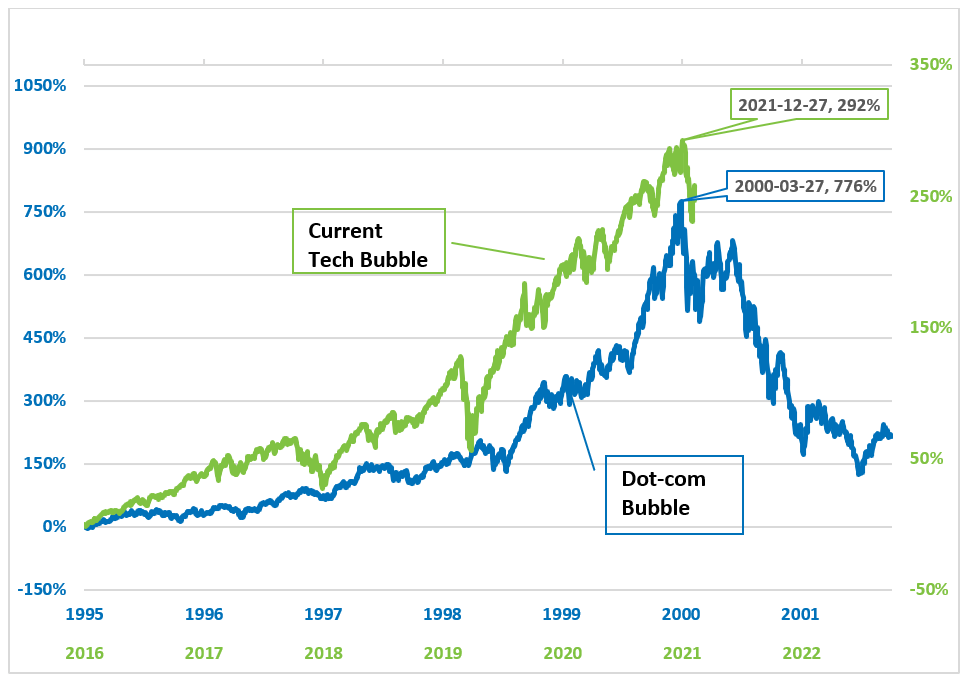

Tech stocks are in a massive bubble. There’s one hot thing after another. Remote work followed by NFTs followed by AI. Some of these are profitable. AI is already earning massive corporations profits, from ad targeting to more. However, there’s no guarantee that they’ll pan out anywhere near the expected valuations.

Dot Com Bubble

Here’s the difference between current tech valuations and where they peaked during the Dot Com bubble. Prices are well above that even with some recent weakness. They almost dropped back to reliability at the start of COVID-19, but after that they zoomed past that level. Why is this time now expected to be different?

Numerous companies, especially the portfolio companies we discussed above, are dramatically overvalued.

SARK Methodology

The methodology for SARK is clearly evident:

Next-gen Internet, electric vehicles, genomics, fintech. Does the bull thesis for such transformational industries seem stretched? Do you think disruptive innovation is overbought? Do you believe ultra-high growth stock valuations have reached uncomfortably lofty levels?

– SARK

As we saw from our discussion of SARK above, the answer is yes. The stock enables the ability to profit from the downfall of ARKK, something that we expect to be more likely, as the market eventually becomes rational. However, SARK offers something else. Traditional shorting has the potential for uncapped losses, with SARK your downside is limited.

That’s a massive tangible benefit.

SARK vs. ARKK

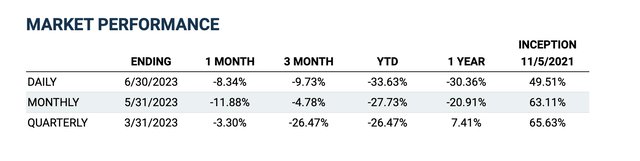

Historically ARKK has done well at its goal of emulating SARK.

SARK Performance ARKK Performance

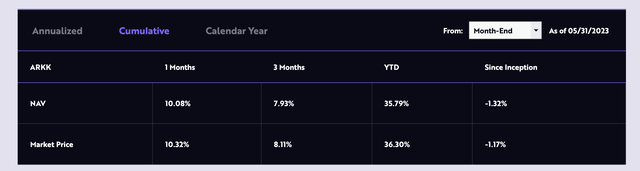

Comparing the monthly performances of SARK above versus ARKK below on the 1 month, 3 month, YTD timeframes SARK is down 11.88%, 4.78% and 27.73%, respectively. In contrast, ARKK is up 10.08%, 7.93%, and 35.79%, respectively. YTD, SARK has actually taken a much smaller impact than expected given how well ARKK has performed.

Since inception, which counts weakness for ARKK, SARK is up 63.11%, and ARKK is down 63.91% over the same time period since November 11, highlighting a miss of just 0.8%. That’s incredibly strong for a daily ETF and provides credence to SARK as a longer-term vehicle to bet against overvaluation in the tech market.

Thesis Risk

The largest risk to our thesis is the classic saying “the market can remain irrational longer than you can remain solvent.” SARK isn’t investing in anything, it’s shorting. That costs money, and if tech stocks remain irrationally higher for longer, SARK could underperform for the long-run, hurting shareholder returns.

Our View

ARKK has plenty of investments left over from a changing environment in COVID-19. For example, the fund’s 3rd largest investment is Zoom, despite remote work slowing down as even the largest tech companies start to make people return to the office. The fund struggles to admit when it’s wrong and hasn’t pivoted from the high-flying COVID-19 tech stocks.

For example, Cathie Woods has predicted $2000 / share as a 2027 base case for Tesla, which would make it by far the largest company in the world. We see that as being incredibly unlikely. We’ve discussed elsewhere, but our base case for 2027 is a lower stock price than today. That’s because competition will increase dramatically.

Overall we expect ARKK to underperform dramatically. The recent high-flying tech market represents a unique chance to invest in its fall with SARK. At the same time, SARK reduces to risks of shorting highlighting the opportunity. Let us know your thoughts in the comments below.

Read the full article here