The accelerated global market growth for AI accelerators, expected to multiply fivefold in the next five years, provides a substantial growth avenue for Advanced Micro Devices, Inc. (NASDAQ:AMD) stock. Amid Nvidia Corporation’s (NVDA) supply shortage, AMD has swiftly seized the opportunity by introducing the MI300 Instinct accelerators, thereby establishing a strong foothold in the AI accelerators market and potentially influencing its growth trajectory and stock price. Additionally, AMD’s MI300X generative AI GPU is poised to challenge Nvidia’s market dominance with faster and more efficient AI model training capabilities. Despite a substantial rally in its stock price, AMD still has the potential for further growth, aided by its diversification into AI, gaming, and cloud services.

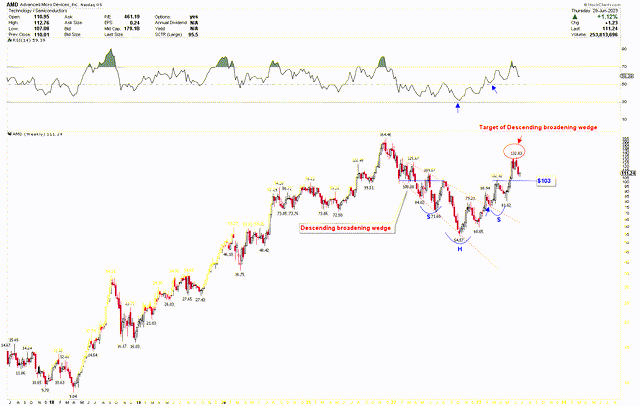

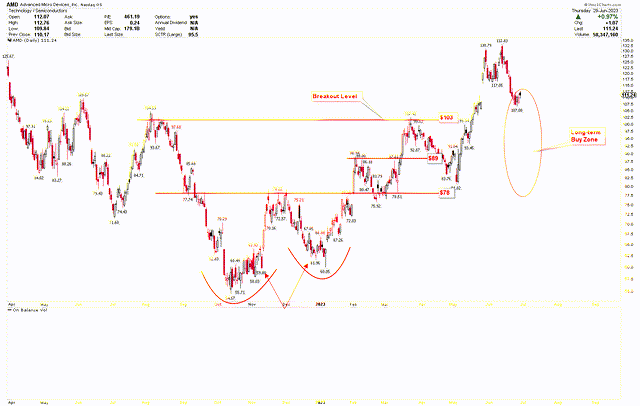

This piece provides a technical analysis of the AMD stock price, to forecast its future trend and identify key levels for long-term investors. The AMD stock price is rallying, demonstrating a strong recovery from the base formation that was marked by the inverted head and shoulders pattern. After reaching the target of the descending broadening wedge at $130, the stock is currently undergoing a correction, which is considered an attractive entry point for those looking to invest in AMD for the long term.

AMD’s Strategic Trajectory in Shaping the Future of AI

The rapid expansion of the global market for AI accelerators, projected by AMD’s CEO Lisa Su to grow fivefold over the next five years, is creating lucrative opportunities for the growth of AMD. Amidst a supply shortage experienced by the market leader, Nvidia, AMD has swiftly emerged as a strong contender, filling the gap with its innovative MI300 Instinct accelerators. The special customer interest these products have attracted suggests the robust potential for sales growth upon commencement of shipments, thereby enabling AMD to solidify its position in the lucrative AI accelerators market and influencing the company’s growth trajectory and stock price.

Leveraging its strength in innovation, AMD has embarked on a bold endeavor to challenge Nvidia’s dominance by creating powerful GPUs specifically designed for AI training and inference. The company’s flagship MI300X generative AI GPU, with memory capacity surpassing that of Nvidia’s products, is positioned to enable faster and more efficient AI model training. Should these GPUs deliver on the company’s promises, AMD is likely to capture a significant market share, triggering a transformative shift in its fortunes and promoting considerable growth in its stock price.

While AMD’s stock has observed a significant rally this year, rising more than 70% in value, it is still well below its all-time high. This suggests there is ample room for further growth. AMD’s diverse business ventures, spanning AI, gaming, and cloud services, provide a multitude of revenue-generation avenues. As AMD capitalizes on these opportunities, investors could witness substantial returns, enhancing AMD’s attractiveness as an investment proposition. Partnerships have been instrumental in reinforcing AMD’s position in the AI market. The backing of tech giant Microsoft Corporation (MSFT), through both financial and engineering resources, is expected to expedite AMD’s AI development efforts. Similarly, a potential partnership with Amazon Web Services, which is reportedly testing AMD’s MI300X, could help AMD further solidify its foothold in the AI market. These partnerships, along with the opportunities they create, have the potential to ignite a significant surge in AMD’s stock price.

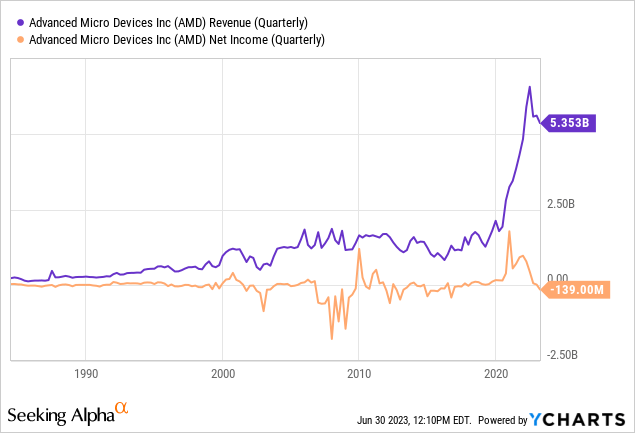

AMD’s financial performance was affected by various factors, resulting in a 9% year-over-year revenue decline as per the latest earnings announcement of Q1 2023. The decline was predominantly due to a stark drop in client revenue, triggered by plummeting PC sales, resulting in a 64% year-over-year decrease from $2.1 billion in Q1 2022 to $739 million in Q1 2023. Meanwhile, data center revenues showed marginal growth, from $1.293 billion in Q1 2022 to $1.295 billion in Q1 2023. This segment was somewhat undermined by a dip in enterprise sales, which Lisa Su attributed to softening end customer demand owing to near-term macroeconomic uncertainty. However, the overall impact was somewhat mitigated by high cloud sales, supported by ongoing production from server providers. The chart below presents the decline in revenue and net income for the first quarter of 2023.

Despite a recent dip in revenue and net income, AMD’s strategic focus on AI, diversified portfolio, and expanding partnerships, provide a robust foundation for future profitability. The rising demand in the AI market, alongside AMD’s innovations and proactive investments, such as the MI300 accelerators and the MI300X GPU, position the company for potential growth, indicating a promising future in increasing profitability and enhancing shareholder value.

Navigating the Long-Term Trajectory of AMD

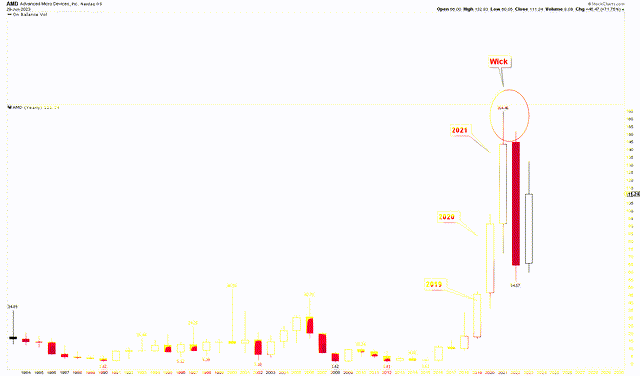

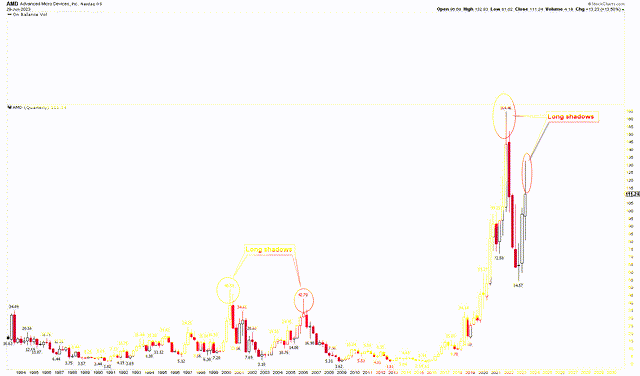

A comprehensive examination of AMD’s historical performance suggests a long-term bullish outlook, supported by key fundamental developments. The yearly chart for AMD displays considerable volatility for the years 2019, 2020, and 2021, during which the stock price underwent significant increases, peaking at $164.46. The primary drivers for AMD’s sharp rise during these years were multifaceted.

Firstly, AMD’s competitive position against industry rivals like Intel Corporation (INTC) and Nvidia was strengthened by the launch of cutting-edge products. The company’s release of Zen 2 and Zen 3 architectures, powering the Ryzen 3000 and 5000 series CPUs, showcased superior performance and value. These innovative offerings bolstered AMD’s market share and bolstered investor confidence. Furthermore, AMD leveraged Intel’s missteps and delays, making substantial gains in the desktop, laptop, and server markets, hence broadening its influence across both the CPU and GPU markets. AMD’s robust financial results during this period, characterized by strong revenue and profit growth, mirrored the successful execution of its strategic endeavors, thus augmenting the stock price.

The broader tech industry also experienced growth due to the emergence of trends such as remote work, cloud computing, gaming, and artificial intelligence. These trends amplified demand for CPUs and GPUs, and AMD, as a significant industry player, reaped the benefits. Late in 2020, AMD announced its acquisition of Xilinx, a frontrunner in adaptive computing solutions. This move was broadly seen as a positive development, set to enhance AMD’s product range and potential market reach. However, the market faced an overbought scenario in 2021, leading to a price correction to stabilize the market. The yearly candle for 2021 shows a wick that typically signifies market weakness and the likelihood of a correction. This correction instigated a precipitous drop in 2022, hitting a low of $54.57.

AMD Yearly Chart (stockcharts.com)

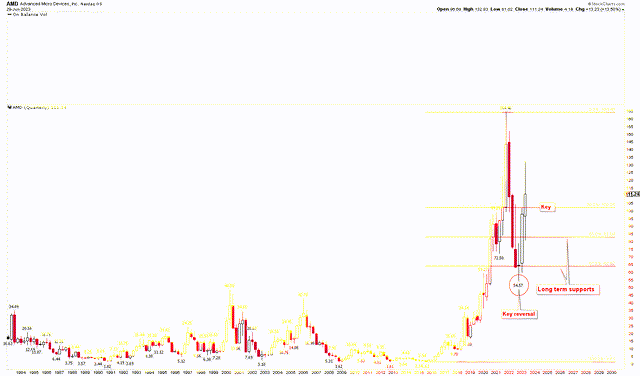

Nevertheless, the stock price saw a bullish rebound from this low, indicative of the likely formation of a price base for potential growth. An examination of the quarterly chart highlights the key market levels expected to provide support and resistance. The Fibonacci retracement drawn from $1.61 to the all-time highs indicates that the market corrected at the 61.8% retracement level, typically deemed a robust support area for long-term investors.

This support area resulted in a rapid reversal quarterly candle at $54.57, with the candle closing successfully above the 61.8% retracement, set at $63.82. This successful closure above the retracement level signifies a turnaround in the market, leading to a rally toward higher levels. The key level to consider, as highlighted in the chart below, is the 38.2% retracement, placed at $102.25. The closure of the quarterly candle for the second quarter above this critical level signals the potential for further price appreciation. This level is also deemed a strong consideration for long-term investors to add AMD positions.

AMD Quarterly (stockcharts.com)

Crucial Price Levels in AMD’s Stock History

The shorter-term timeframe for AMD, as evidenced in the following chart, shows the formation of a bullish pattern and the significance of the current levels. A descending broadening wedge emerges in the AMD weekly chart as the price falls from all-time highs. This pattern, typically considered bullish, has a target of $130, which the price has already reached, leading to a subsequent correction. Additionally, an inverted head and shoulder pattern, marked in blue, is also seen on the same chart. The neckline of this pattern was broken at $103, and the price escalated towards the $130 region, hitting the target of the descending broadening wedge. With the target achieved, the price is correcting lower, and strong support now lies at the neckline of the broken pattern, the $103 region. The intriguing alignment of the $103 support level as indicated in the weekly chart and the 38.2% Fibonacci retracement on the quarterly chart stands out. Hence, this convergence underscores the significance of this level as a pivotal point in the market.

AMD Weekly Chart (stockcharts.com)

For enhanced clarity, let’s consider the daily chart which prominently outlines the stock price support levels. The current low, standing at $107.08, has emerged as a significant support point. The existence of solid support levels at $103, $89, and $78, adjustable by a margin of $5 to account for inherent market volatility, is noteworthy. Interestingly, a double bottom formation characterized the previously formed low at $54.57, as indicated by the red arrows in the chart below. This pattern underscores the prevailing strength in the market.

AMD Daily Chart (stockcharts.com)

Risk of Downside

Given the pace of technological advancement, AMD must remain at the forefront of innovation to maintain its competitive edge. Any failure to develop and launch cutting-edge products promptly could negatively impact its market share and stock price. Moreover, technological defects or performance issues with new products such as the MI300 Instinct accelerators or the MI300X generative AI GPU could tarnish the company’s reputation and hinder sales growth. Furthermore, the tech sector is characterized by fierce rivalry, as businesses continually aim to surpass each other with their product portfolio. While AMD has managed to carve out a niche for itself amidst giants like Nvidia and Intel, maintaining this position will be an ongoing challenge. Any new, superior products launched by competitors could threaten AMD’s market position.

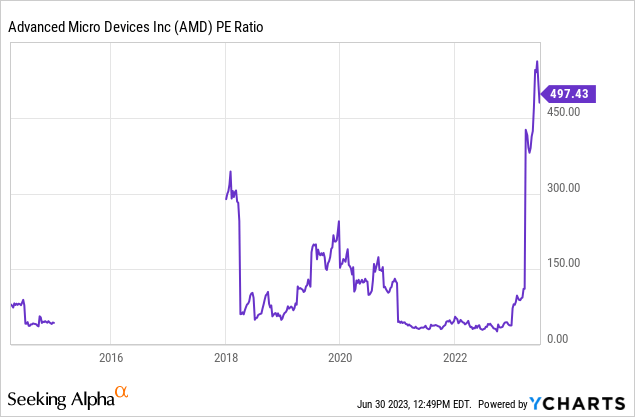

Despite the optimism in the semiconductor industry and the surge in AMD’s stock, the company’s financial performance doesn’t seem to justify the increase. With a current price-to-earnings ratio of 495.74, the stock appears overvalued. If the company’s earnings do not grow significantly, the stock may be subject to a market correction, which could lead to a decline in the stock price.

Additionally, AMD’s first-quarter performance showed a decline in both revenue and adjusted earnings. If the revenue and earnings continue to decline in the coming quarters, it could negatively impact investor sentiment, leading to a potential decline in the stock price. AMD suffered from a significant reduction in revenue from its client processor business due to a crash in PC sales. If PC demand continues to decrease and high channel inventories persist, this could further affect AMD’s revenues and bottom line.

From a technical standpoint, the quarterly chart of AMD’s stock price reveals a pronounced shadow for the second quarter of 2023, as visualized in the chart below. These elongated shadows suggest a weakness in price, which typically leads to a downturn. Similar long shadows were observed back in 2000 and 2006, after which the AMD stock price significantly declined in the subsequent years. However, the recent quarterly closing above the 38.2% retracement level of $102.25 signals resilience in the stock. AMD stock price must remain above the defined Fibonacci levels of $102.25, $83.04and $63.83 to remain strong in the coming months.

AMD Quarterly Chart (stockcharts.com)

Bottom Line

The burgeoning AI industry signifies a prominent growth avenue for Advanced Micro Devices, Inc. The company’s entrance into the creation of potent GPUs tailored for AI training and inference, such as the MI300X, contests Nvidia’s leadership. Its calculated alliances, expansion into fields like AI, gaming, and cloud services, and innovative approach set the stage for AMD’s future gains and value creation. Despite a notable rally in the stock, more room for growth remains. The escalating demand in the AI sector, coupled with AMD’s pre-emptive investments, indicates a promising future in terms of profitability and enhancing shareholder value.

Historically, AMD has exhibited a formidable market presence and financial expansion, mirrored in its stock price. However, periods of adjustment and volatility have also been seen in the stock, highlighting the importance of market timing for investors. In the near term, the focus will be on the company’s capacity to exploit the AI accelerators market and their performance in the gaming and cloud services industries.

The stock price seems to be nearing the end of its adjustment from its all-time highs, as the quarterly candle ends above the 38.2% retracement at $102.25, paving the way for further upside potential. Yet, the long shadows visible on the quarterly charts hint at market risks. For an upward momentum to be sustained, AMD’s stock price must maintain a close above $102.25. A monthly close beneath this level could potentially trigger a further drop toward $63.82, acting as a crucial long-term support pivot. On the other hand, the appearance of an inverted head and shoulders pattern suggests a powerful bullish basis and a probability for continued upward movement. Interestingly, the neckline of the inverted head and shoulders pattern coincides with the $103 mark, reinforcing its significance as a key level.

Given that the quarterly candlestick has closed above this pivotal point, and as the market currently retests this crucial level following its ascent to the strong resistance threshold at $130, Advanced Micro Devices, Inc. investors could view this corrective phase as a potentially lucrative long-term buying opportunity.

Read the full article here