Just over three months ago, I wrote on OceanaGold (OTCPK:OCANF), noting that while the company had a unique combination of growth with margin expansion looking toward 2025, the stock was no longer in a low-risk buy zone and that rallies above US$2.36 would provide profit-taking opportunities. Since the March 15 update, the stock has significantly underperformed the Gold Miners Index (GDX) with a 12% decline. In addition, OceanaGold has suffered a 20% drawdown from its zone where its profit-taking zone is above US$2.36. The good news is that the company has released impressive drilling results since then from Wharekirauponga (WKP), and is benefiting from a gold price that continues to hang out above the $1,900/oz level. In this update, we’ll dig into the company’s 2022 Reserve/Resource update and whether the stock has now dropped into a low-risk buy zone after recent underperformance.

All figures are in United States Dollars unless otherwise noted.

2022 Mineral Reserves

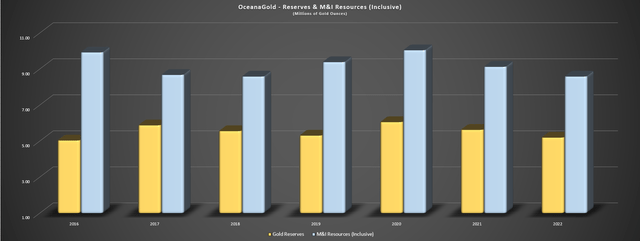

OceanaGold released its FY2022 Reserve/Resource update earlier this year, reporting gold reserves of ~5.2 million ounces, a 7% decline from the year-ago period. The decline in reserves was attributed to unsuccessful reserve replacement at all operations, with the most significant reserve declines coming from Macraes and Waihi, the company’s operations in New Zealand. Meanwhile, measured & indicated (M&I) also fell over 5% year-over-year to ~8.6 million ounces of gold, down from ~9.13 million ounces in FY2021 and over 10.0 million ounces in FY2020. This was despite resource growth at Haile Underground (190,000 increase in indicated ounces), with the gains from this deposit offset by ~550,000 ounces of depletion, and ~210,000 combined ounces lost from economic factors and adjustments.

OceanaGold – Gold Reserves & M&I Resources (Company Filings, Author’s Chart)

Digging into the operations a little closer, the company’s reserve base at its flagship Haile Mine in South Carolina ended the year at ~2.45 million ounces of gold, a slight decrease from ~2.56 million ounces with the company unable to completely replace mining depletion (~160,000 ounces), and this ~100,000 ounce decline in reserves lapped a ~120,000 ounce decline in reserves at year-end 2021 associated with a higher cut-off grade due to upwardly revised cost estimates for mining, processing, and G&A. Within the year-end 2022 reserve update, we saw another increase in cut-off grades to 1.56 to 1.72 grams per tonne of gold vs. 1.37 to 1.53 grams per tonne of gold previously. This is not that unusual and we’ve seen much of this sector-wide, with rising operating costs contributing to 10% plus increases in cut-off grades at several operations.

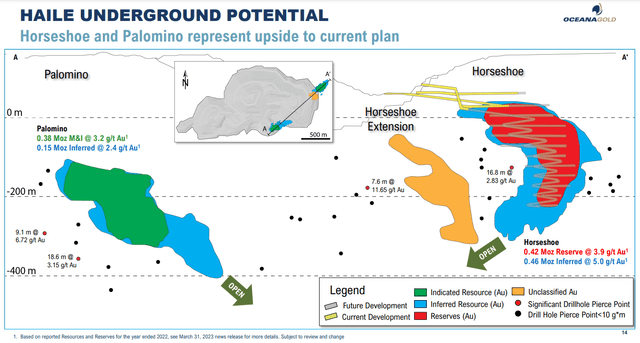

Haile Underground Resource/Reserve Growth Opportunities (Company Website)

That said, this reserve base does not include Palomino (800 meters southwest of Horseshoe reserves) where an economic study is planned this year, which should contribute to the reserve base in 2024 (currently 380,000 M&I ounces at 3.2 grams per tonne of gold in the indicated resource category). And it also doesn’t include any future reserve growth at Horseshoe Main, Horseshoe Extension, and or regional targets like Capricorn, Ledbetter Deep, Ramona Deep, Aquarius, Palomino Extension, and Horsetail. To summarize, while the Haile reserve base is declining and the rising cut-off grade isn’t ideal, I don’t see the steadily declining reserves as a deal-breaker. Plus, this is a mine life that extends out to 2034, even assuming no exploration upside and no inclusion of Palomino into the mine plan.

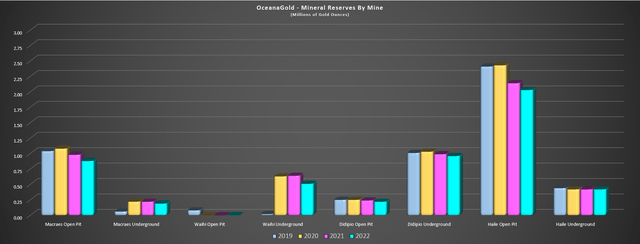

OceanaGold – Mineral Reserves by Mine (Company Filings, Author’s Chart)

Moving over to the company’s other assets, there’s been a steady decline in reserves at Macraes, Waihi, and Didipio as well, with Macraes open-pit reserves declining for the second year in a row to ~0.88 million ounces of gold, down from 1.08 million ounces at year-end 2020. The year-over-year decline was related to mining depletion and adjustments which offset a 50,000 ounce gain from reserve model updates, and like Haile, we also saw an increase in underground cut-off grades at Macraes, with cut-off grades at Golden Point Underground increasing from 1.44 grams per tonne of gold to 1.47 grams per tonne of gold. Given the further reserve decline to just ~1.07 million ounces, Macraes is now staring down a barely 6-year mine life based on reserves, assuming an average throughput rate of ~5.4 million tonnes per annum and ~35.7 million tonnes of ore in reserves.

OceanaGold also noted in its reserve update that technical risks associated with the Round Hill and Southern Pit open pits were investigated given the location near the Mixed Tailings Impoundment (“MTI”) embankment wall and the requirement to relocate another in-pit tailings facility if it were mined. The recent analysis has determined that the risk profile of mining Round Hill and the Southern Pit open pits is higher than previously understood, and one option includes not mining these areas, which would result in a material decrease (~420,000 ounces) in reserves. So, while open-pit reserves are sitting at ~880,000 ounces, we saw a downgrade in proven reserves from the year-end 2021 report (5.3 million tonnes of proven material vs. 15.6 million tonnes), and there is the risk that the mine life is much shorter than envisioned in the June 2020 Technical Report.

As for OceanaGold’s low-cost gold-copper asset in the Philippines (Didipio), gold reserves declined ~4% year-over-year to ~1.18 million ounces of gold, with mining depletion more than offsetting positive adjustments and reserve model updates. The good news is that this asset’s mine life extends well into the 2030s (albeit with a sharp drop off in annual production and cash flow post-2027), and has discovered two new intrusions within 200 meters of the current mine development, suggesting the potential to increase the mine life if exploration success continues with relatively low capex. In addition, OceanaGold noted it would increase its exploration by 35% year-over-year in 2023, suggesting the potential for a reversal in the trend of declining reserves assuming we don’t see meaningful deletions at Macraes which would offset growth from Palomino and Didipio.

Finally, looking at the company’s smallest asset, Waihi, we saw another year-over-year decline in gold reserves, with Waihi’s reserve base sitting at just ~510,000 ounces at 4.16 grams per tonne of gold. This was down from ~640,000 ounces at 4.20 grams per tonne of gold at year-end 2021, with losses from depletion, reserve model updates, and adjustments. Plus, we saw a meaningful increase in the underground cut-off grade at Waihi from 2.2 to 2.9 grams per tonne of gold to 2.6 to 3.1 grams per tonne of gold. Fortunately, the reserve base is higher grade, but this has created a larger hurdle to converting reserves at Waihi given the significant increase in cut-off grades despite already using a gold price assumption above the peer average to calculate reserves ($1,500/oz).

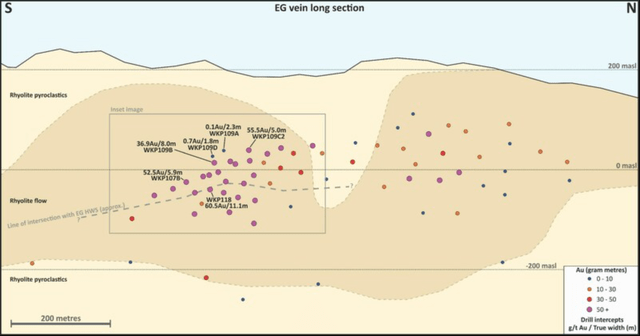

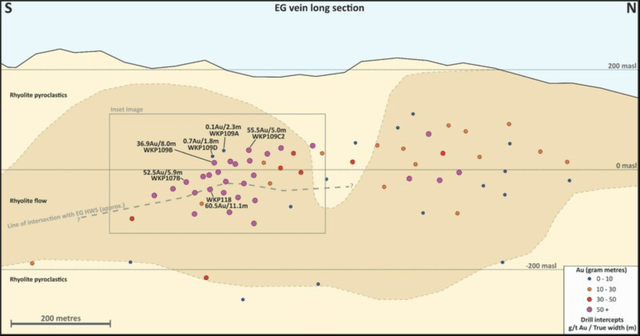

Fortunately, while Waihi’s reserve base is dwindling, OceanaGold continues to have exploration success 10 kilometers to the north at WKP, where a Pre-Feasibility Study is planned in 2024 that could lead to a boost in reserves. Among the recent drilling results, three intercepts stood out, which included 11.1 meters at 60.5 grams per tonne of gold, 8.0 meters at 36.9 grams per tonne of gold, and 5.0 meters at 51.3 grams per tonne of gold, with additional silver credits in all holes. These are phenomenal intercepts that are well above the average grade at Waihi, and Waihi is already sitting on a reserve base of ~660,000 ounces at 12.3 grams per tonne of gold in the indicated category. So, like Haile, while we continue to see reserve declines, there’s reason to be optimistic about reserve growth here once the company has completed economic studies at WKP.

WKP Drilling Highlights (Company Website)

Reserves Per Share

As I’ve noted in past updates, reserve growth is important, but far more important is reserve growth per share. This is because reserve growth that comes at the expense of significant share dilution means that investors are getting exposure to fewer ounces of gold per share held and the result is one is actually seeing their exposure to gold diluted by owning a given producer. The result is that an investor is not getting their desired leverage to the gold price if reserves and or production per share are declining. Obviously, this isn’t ideal, since it makes no sense to own a more volatile and riskier gold producer (vs. the metal itself) if it is not offering the leverage that one should get for taking on this added risk. Some examples of companies that have consistently failed to deliver reserve growth per share are Coeur Mining (CDE), Americas Gold and Silver (USAS), and McEwen Mining (MUX), which is why I continue to see these names as best to avoid.

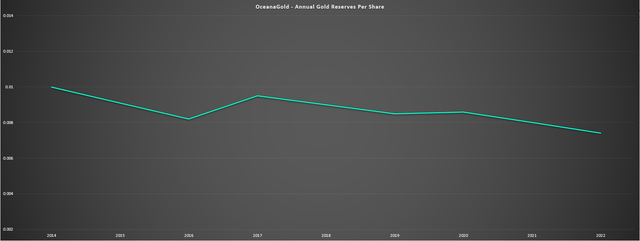

OceanaGold – Annual Gold Reserves Per Share (Company Filings, Author’s Chart)

In OceanaGold’s case, the company has seen reserve growth over the past decade given its acquisition of the large Haile Project (and now mine), but it has not successfully grown reserves per share. In fact, gold reserves per share held has declined over 20% vs. 2014 levels given that the reserve base has increased just ~73% while the year-end share count has more than doubled from ~302 million shares to ~704 million shares. And if we were to see deletions at RHOP at Macraes, this would put further pressure on this reserve growth per share figure. In summary, OceanaGold is going to need to add reserve ounces at assets like Didipio, Haile, and Waihi if it wants to improve its reserve growth per share metric, which pales compared to the reserve growth per share achieved by peers like SSR Mining (SSRM).

WKP Drilling (Company Website)

Summary

OceanaGold struggled to replace reserves again in 2023 and this was despite its reserve price assumption being slightly above the industry average at $1,500/oz. Fortunately, the company is increasing its exploration budget and continues to see exploration success at Haile Underground, Didipio Underground, and WKP, suggesting it might have a shot at growing its reserves net of depletion in future years. Given that OceanaGold has ambitious growth plans with higher production from Haile on deck as feed grades improve with contribution from Horseshoe Underground, there’s certainly reason to be optimistic about this story as the company works to become a ~600,000-ounce producer and below-average costs in FY2025.

OceanaGold Operations (Company Website)

The US$2.70 fair value is based on a 65/35 weighting to P/NAV (1.0x multiple) and FY2024 cash flow estimates (6.5x multiple).

That said, I prefer to wait for a significant margin of safety (35% – 40% discount to fair value) when buying mid-tier producers in the precious metals space, and while OceanaGold’s valuation has improved after a 20% plus correction, I still don’t see enough margin of safety just yet, with an estimated fair value of US$2.70 and a required 35% discount to fair value even at the low end. And after applying this required discount, the ideal buy zone comes in at US$1.76 or lower, suggesting that there’s no low-risk buying opportunity in place just yet. To summarize, I would only consider OCANF on a pullback to US$1.76 or lower, and for now, I continue to see better value in names like Pan American Silver (PAAS), which trades at less than 0.80x P/NAV and a ~10% free cash flow yield with greater diversification and a much stronger pipeline.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here