The talk out of the Federal Reserve these days is that there will be two more increases in the Fed’s policy rate of interest this year.

The economy is still showing unexpected strength.

Real GDP in the first quarter of 2023 has been revised upwards to a 2.0 percent annualized rate of growth. This is up from previous estimates of 1.1 percent and 1.3 percent.

Now the Fed has even revised its forecast for the full year of 2023 to 1.1 percent, up from a previous forecast of 0.4 percent.

These are not substantial changes, but, for one, they push off a possible recession further into the future.

They also cause us to look at the economy differently to ask what has changed in how the economy functions. What is different now? Has the “tech” revolution changed the way the economy functions?

They also cause us to ask about how much of the “unexpected” economic strength is connected with the after-effects of the asset bubble created by the Fed in fighting the spread of the Covid-19 pandemic.

Finally, there is the question about the fiscal policy stimulus coming from the Biden administration and the U.S. Congress.

Whatever the cause, it turns out that the real economy is performing at a higher level, for a longer period of time, that Fed officials originally thought would happen.

Consequently, Federal Reserve officials are talking about the need to extend the time horizon for possible policy rate increases. In most cases, the time frame is still restricted to the second half of 2023.

There will be four more meetings of the Federal Open Market Committee in the next six months, the first one will be held on July 25 and 26.

The dilemma that Federal Reserve officials face is that a lot of different things are happening in the world and no one has a real clear picture of what they are going to be facing.

That is one reason that Fed Chairman Jerome Powell keeps hedging on all his statements. There is a lot of uncertainty about the future, and Powell just doesn’t want to commit too much in any particular direction because of the fear of being wrong.

Radical uncertainty dominates the environment.

Quantitative Tightening

To Mr. Powell and his associates, quantitative tightening still dominates Fed policy actions.

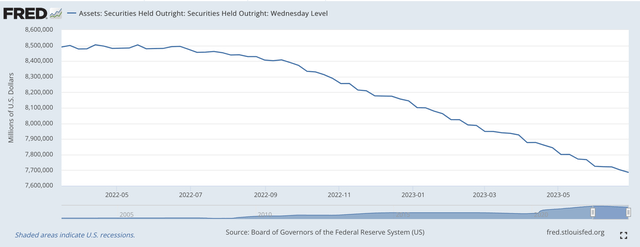

In the last banking week, the one ending on June 28, 2023, the Fed oversaw a $15.9 billion reduction in its portfolio of securities held outright.

This brings the total reduction in the securities for June up to $39.2 billion.

The total reduction in the securities portfolio since the quantitative tightening began in the middle of March 2022 is $804.9 billion.

The picture of this declining portfolio looks like this.

Securities Held Outright (Federal Reserve)

The Federal Reserve has done what it said it was going to do with the securities portfolio. The Fed has overseen a steady reduction, over time, a time period lasting fifteen months.

Note: The length of this time period is consistent with the four earlier efforts at quantitative easing that the Fed conducted previous to the battle against inflation.

Monetary Policy

This is what the Federal Reserve has done to its securities portfolio.

However, this has not been the only thing going on during this time period.

For instance, in early March 2023, the banking industry began to experience some commercial banks having solvency problems…like Silicon Valley Bank.

The Federal Reserve could not and did not “sit on its hands” during this time period. It supplied reserves to the banking system that eased the problems being faced by various individual banks.

For example, reverse repurchase agreements were opened up to allow commercial banks in need of liquidity an easy source of funds.

Furthermore, the Fed worked with the U.S. Treasury Department to move funds into and out of the Treasury’s General Account at the Fed to provide additional funds, when needed.

Thus, the Fed was able to manage its way through these short-run difficulties, without having to disrupt the efforts that were being made to reduce the size of the securities portfolio held outfight.

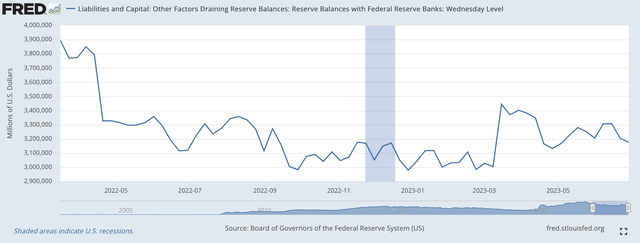

The results of these efforts show up in the Fed’s line item “Reserve Balances With Federal Reserve Banks,” which I often refer to as the “excess reserves” in the banking system.

Here is the chart reflecting on how “excess reserves” in the banking system moved during this period of time.

Reserve Balances With Federal Reserve Banks (Federal Reserve)

Notice that in March 2022, the Federal Reserve oversaw the reduction in these “excess reserves” as the Fed began raising its policy rate of interest. That is, this shows how the Fed “tightened” up on bank reserves to support the effort to raise rates.

The reserve balances continue to decline, only not as rapidly as at first, during the rest of 2022 and through February 2023.

Then the banking difficulties hit the system and the Federal Reserve responded by allowing banks to use the reverse repurchase agreement window and the U.S. Treasury Department reduced its balances at the Fed.

The “excess reserves” in the banking system rose so as to help banks through any “money” problems they might have had.

“Excess reserves” did not increase that much and their use moderated with time, but, the picture is shown that the Fed did not just sit by during this period and let the bank difficulties work themselves out.

In the month of June, U.S. Treasury deposits with the Fed in the General Account rose by $360.0 billion, and this took reserves out of the banking system.

During this time period, reverse repurchase agreements fell by $345.0 billion, adding reserves to the banking system.

The two almost exactly offset each other, indicating, I believe, how closely the Federal Reserve was managing the very difficult “liquidity” situation.

And, the banking system moved along smoothly into the start of July.

Going Forward

Going forward from here is not going to be easy.

There is some thought that quantitative tightening might not last much longer.

The problem here is that government spending might become so dominant in the near future that the Fed just will not be able to continue reducing the size of its securities portfolio. That is, so much debt will be coming to the financial market that the Fed cannot further remove itself from the market.

That would signal an end to the current effort to battle inflation.

So what then?

Many analysts believe that Mr. Powell is not up to pulling off a “Paul Volcker” when it comes to an extreme battle of raising interest rates to fight inflation.

One problem is that Janet Yellen, U.S. Treasury Secretary, may not be able to pull off a “Robert Rubin” when it comes to getting government spending under control.

As I have written elsewhere, the battle for the future may be about government spending, with Federal Reserve issues serving just as a residual interest.

I hope it doesn’t come to this, but…

Read the full article here