Investment Summary

Selective investment opportunities continue to present themselves at whim in FY’23 for the patient and intelligent–minded investor. In the same breath, many companies have reasonable growth prospects, but the investment criteria simply don’t add up.

After a 34% 6-month rally, the equity stock of Evotec SE (NASDAQ:EVO) has caught my attention. I had been watching EVO on the sides after the company extended its partnership with Bristol–Myers Squibb (BMY) in March. The pair will engage in drug discovery and clinical programs for another 8 years, building on prior work.

This is certainly a tremendous vote of confidence in EVO’s capacity– to fulfil the clinical development pathways for enormous players such as BMY. Considering this is much of EVO’s core offering, I would opine this is central to the investment debate. Further, robust evidence suggests the company is well-positioned to benefit from market crosscurrents in Omics sciences, thereby providing a clear differentiator for those investors positioning against clinical-stage or biological assets. A fantastic overview of the Omics opportunity EVO has is presented by Seeking Alpha analyst, Another Mountain’s Rock Investing, from December last year. The analysis covers all of the salient points you need to know, and then some. I would encourage all to read that report for the most informed investment reasoning [you can see it here].

Following extensive analysis of all the moving parts in the investment debate, I find there is insufficient evidence to corroborate that EVO is a buy at the present time. This report will cover all of the critical facts for EVO and respective investors, providing additional details in doing so. Net-net, based on analysis of fundamental, sentimental and valuation factors, I rate EVO a hold.

Figure 1. EVO rally off December ’22 lows

Data: Updata

Critical Facts in EVO Investment Case

EVO claims to possess a distinct advantage over its industry counterparts in identifying novel drug targets. It has been building momentum around this point for some time.

As mentioned earlier, in May 2022, EVO expanded its alliance with BMY, covering targeted protein degradation for an additional 8 years. The pair will develop a pipeline of molecular glue degraders within the new agreement. The partnership has a deal potential of $5Bn to EVO. The company received an upfront payment of $200mm and the promise of double-digit royalties into the future. It has already received $50mm upfront under this.

These are potentially attractive economics. I would strongly suggest, however, that whilst this is a potentially exciting extension of the old agreement ––more so with the prospect of royalties–– it is essential to acknowledge that the long-term outcomes of these endeavours remain quite uncertain, and that EVO’s investment prospects shouldn’t hinge solely on this agreement.

Further, the market’s response to the Omics and BMY updates has been muted, clear indication of the flat expectations on EVO moving forward. Recall– a firm’s market value is simply all of the known expectations discounted into the price. Hence, flat price action = flat forward expectations. The question we have to answer, is, whether there is reason to differ from the market’s view. To know this, additional fundamental, sentimental and valuation–based drivers must be discussed.

1. Financial and Fundamental Drivers

EVO posted its FY’22 annual numbers last month, with revenues up 22% YoY, or $133.4mm, to clip €751.5mm [note: EVO reports in Euros; hence, all figures will be presented as thus to keep standard convention]. The gain surpassed management’s revenue guidance by €15mm. J.POD printed a 24% YoY growth in turnover, with an average 15% growth across the remainder of the portfolio.

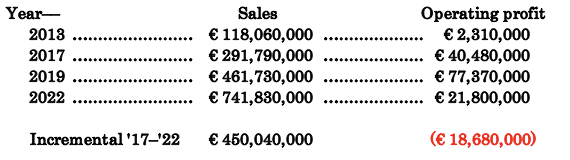

Table 1. EVO long-term operating performance [note: all figures are presented in €, with the exchange rate of 1 USD = €0.92 at the time of writing].

Data: Author, EVO 10-K’s

Growth was predominantly driven by strength in the core business, with customers up by 23 to 842 last year. Impressively, it sees repeat business form ~92% of its customer base, up 100bps YoY.

Despite the growth in unit economics, I’d also point out that FY’22 gross margin decreased by 130bps YoY. You can thank the rising input costs of Just-EVO Biologics’ manufacturing, compounded by reduced milestone contributions to the top line, as the primary reasons for the contraction. Inflation factors like energy prices, raw materials, and logistics expenses further tightened the gross for FY’22.

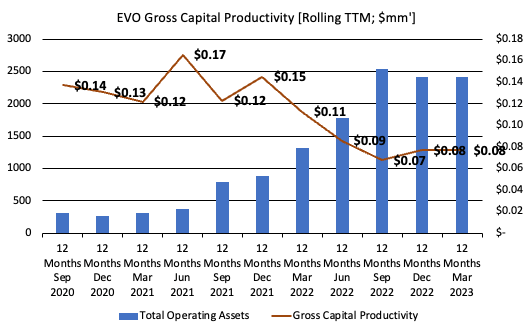

This would be an acceptable point in the interim, if it weren’t for the fact that EVO’s gross capital productivity has been on the slide over the last 2–3 years to date. As seen in Figure 2, the firm’s gross profitability, defined as the trailing gross profit scaled by total operating assets each quarter, has clipped from $0.14 to just $0.08 as of Q1 FY’23 (TTM figures). This tells me that for every $1 the company has committed to operating capital, it recycles back just $0.08– simply not acceptable in my investment cortex. You’re getting just 8% gross return on capital, not even close to the market’s return on capital, thus, an undeniable erosion of shareholder value.

Figure 2.

Data: Author, EVO 10-K’s

Moving down the P&L, I would highlight the following takeouts to investors:

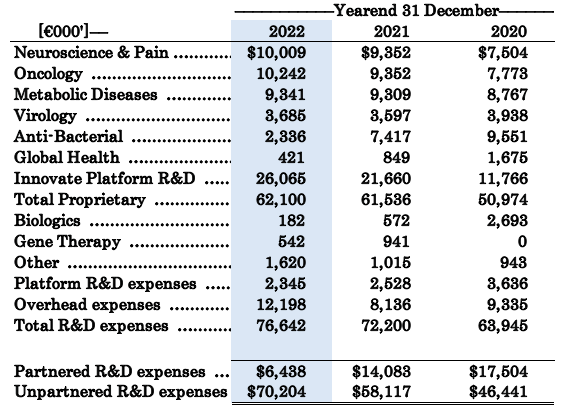

- Unpartnered R&D costs increased by 21% YoY to €70.2mm. That would mark an increase of $46.4mm from FY’20.

- The spike in investment drove the number of partnered pipeline assets on EVO’s books to >130, coupled with the pool of unpartnered programs of >60 assets. Equity participation increased to 33 assets. The firm’s complete R&D investment profile is observed in Table 2.

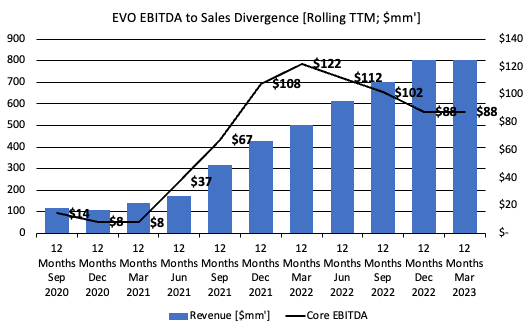

- The firm clipped adj. EBITDA of €104.1mm, on a net loss of €175.65mm for the quarter, down from the €215mm profit in FY’21.

- This is a potential risk as the spread in sales to core EBITDA has been diverging since FY’20, as seen in Figure 3.

Table 2.

Note: All R&D investment is categorized as ‘expenditure’ under GAAP accounting. The language is reflected here. (Data: Author, EVO 10-K’s)

Figure 3.

Data: Author, EVO 10-K’s

- I would also highlight, as a potential tailwind, the opportunities in the market for iPSC-derived therapies. As a reminder, ISPCs are somatic cells that have been modified to provide cell therapy or to be used in a research function. In my view, EVO’s exploration of affordable and widely accessible iPSC-derived therapies presents an interesting venture for the firm.

The industry has historically encountered obstacles concerning the cost-effectiveness of these therapies. Nonetheless, with EVO’s progress in this space, in creating the potential for creating off-the-shelf treatments, the landscape may witness a revival, leading to an increase in market adoption. This is definitely something to consider moving forward.

2. Sentimental Factors

Measures of sentiment are critical to identifying potential directional changes in a company’s market value. The evolution of analyst targets measures one form of investor sentiment, representing the viewpoint of an entire substratum of investors who use these targets in their reasoning. For EVO, there have been 7 upward revisions to sales targets in the last 3 months. However, there’s also been 4 downward revisions, in addition to 2 bearish revisions to earnings targets. Both of these were within the last 3 months. Consensus expects 12.6% YoY growth in FY’23 and 15% in FY’24. The balance of analyst views (revisions up/down) is supportive of a neutral view. There are also no options on the company’s ADRs to go by either to show the money at risk in the stock.

On the flip side, momentum studies are positive. Looking over key price averages (10-day, 50-day, 100-day and 200-day moving averages) the stock trades above each of these points. Given these are averages of different time frames, you can say EVO is trading “above average” in this regard. Hence, positive sentiment may also be “above average” using the same reasoning. This is something to consider heavily and does plug directly into the core of the investment debate, showing market sentiment versus longer-term range.

Collectively, it is my view the sentiment is neutral based on the data here. There’s certainly no concrete bullishness or bearishness on show, with balancing factors on each side of the account.

3. Valuation Factors

Any hope of advocating a speculative buy on EVO are quashed by the multiples you’re asked to pay at the minute. Investors are selling EVO stock at 85.76x forward earnings, and more importantly to this investment thesis, at 113x forward EBIT, a whole 569% premium to the sector. Granted, these are based on USD figures–– but so is the company’s market capitalization, so this doesn’t appear to be a factor.

“Would I pay $113 for every $1 in pre-tax income from EVO?” That’s the question you must ask yourself here. And– what you’re getting for that price. So far, we’ve uncovered:

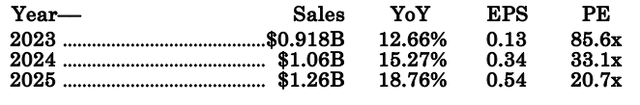

- Reasonable forward sales projections of 12–18% in the next 3 years [Figure 4].

- Tightening gross capital productivity, just 8 cents return in gross on the dollar, even when capitalizing R&D investments from the income statement as an intangible asset.

- Growth in unpartnered R&D investment programs, including key extension with BMY.

- Reported operating earnings contracted in recent times.

By all means, the findings here suggest that these 4 points may continue as headwinds going forward. To put it bluntly, based on the evidence, I firmly believe that EVO does not deserve to trade at such a premium to its sector. Instead, the sector multiple is far more reasonable at 16.9x–– and even then, I believe is bordering on pricey.

At 16.9x forward I get to $7.04 per ADR on my FY’23 EBIT estimates of $73.4mm, otherwise c.8% pre-tax margin. This also supports a neutral view.

Table 3.

Data: Author Estimates

Discussion

Based on the culmination of factors presented here (fundamental, sentimental, valuation) there doesn’t appear to be corroborative evidence suggesting EVO is an immediate buy in my view. Market expectations are balanced, in line with the Street’s, and this investor’s own expectations. Looking ahead, my numbers have the firm to do $918mm at the top line this year and pull this to $73.44mm in pre-tax income, in line with pre-pandemic range. The question I’ve still got no answer to from the rigorous analysis– is the best still yet to come ahead of EVO? This is critical to know, seeing the market’s discounting function of future expectations into the firm’s market price. At the $3.93Bn current market cap, it would appear the company is overvalued, as I get to a fair value of $1.3Bn, implying EVO is still running hot. In that vein, considering the multitude of selective opportunities elsewhere ––each offering tremendous returns on capital above the market returns on capital–– I rate EVO a hold, in search for more lucrative positions elsewhere.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here