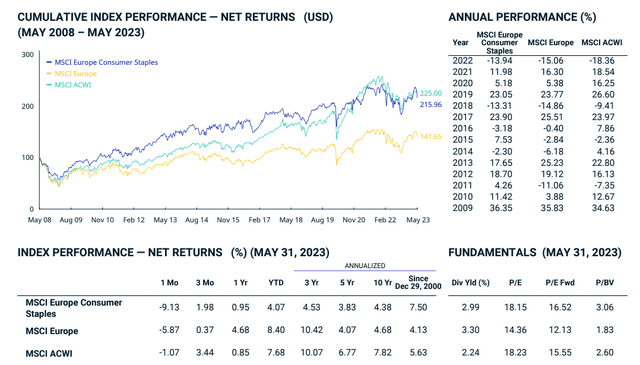

War in Ukraine, energy shock, and rising transport prices sent food costs to an all-time high. Since wages have remained unchanged, end-costumers’ purchasing power has been under pressure. Thanks to its diversified product portfolio, Unilever PLC (UL) (OTCPK:UNLYF) is still a good player in a resilient sector. The MSCI Europe Consumer Staples Index performance supported our Unilever buy investment thesis. Indeed, only a few European equity sectors managed to outperform the MSCI Index and make new all-time highs; however, Unilever still needs to catch up with the index. Given the latest quarterly performance, we believe that investors need to be adequately valuing the company on a MACRO basis and on a MICRO basis.

Mare Ev. Lab vs Wall Street mispricing

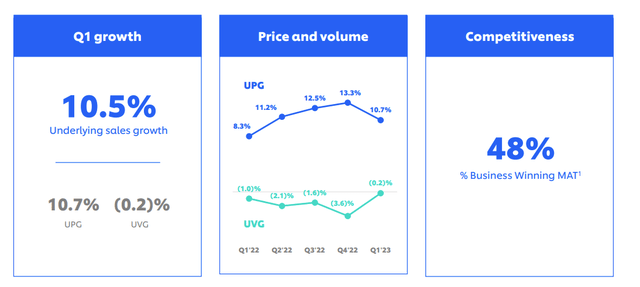

Last time, in our October 2022 publication titled “Changes In Client Demand Might Not Be At Risk,” we anticipated higher sales versus Wall Street consensus expectations. Our detailed revenue forecast predicted Underlying Sales Growth (‘USG’) of 9.5% compared to Vara’s forecast at +7.8%, with higher selling price evolution fully offsetting volume decline. In Q1, USG increased revenue at a double-digit rate, signing a plus 10.5% versus Visible Alpha consensus at +7.3% (Fig 1). Once again, Wall Street was not correctly forecasting Unilever’s pricing power and growth story trajectory. As a reminder, Unilever achieved a revenue CAGR growth of plus 5.8% over the last four years. Again, this beat was volume-driven, with output down by -0.2% in the quarter, well above consensus at -3.3%, while product price increased by +10.7%.

The MSCI Europe Consumer Staples Index evolution (MSCI Index)

Source: MSCI Index

Why are we still optimistic?

We should note that price increases do not affect all products equally. Consumers’ price sensitivity is more significant for some items, such as fruit, vegetables, and meat, than for others, such as soap, ice cream, and dairy products. While price elasticity is generally a reliable guide for estimating customer behavior, we still advise a cautious stance, especially since rising costs are present in almost all staples categories. For this reason, demand changes may be less intense, given the fact that substitute products have also increased in price.

What the analyst community needs to consider is volume improvement over the year. In addition, 30% of Unilever’s top-line sales come from products launched in the last two years, considerably up from 2021. Unilever’s MAT business winning share was 48% in Q123 compared to 47% achieved in Q4 (Fig 1).

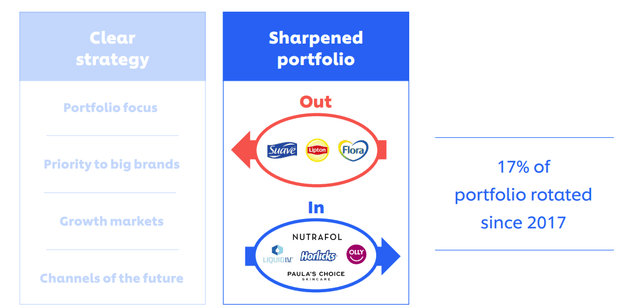

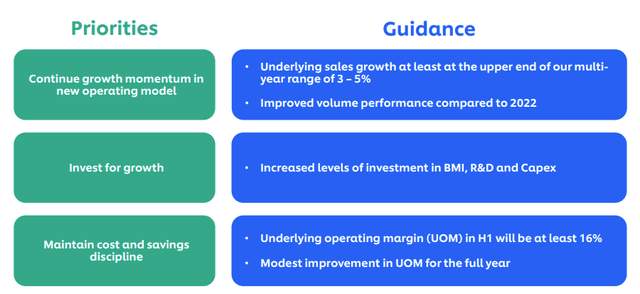

The company now expects higher guidance. In detail, Unilever foresees underlying sales growth at the upper end of the range of +3% to 5% and a core EBIT margin of at least 16% compared to a previous outlook of “around 16%” (Fig 3). Despite a few negative one-offs, such as Indonesia’s destocking, with SKU rationalization and portfolio rotation (Fig 2), Unilever’s management forecasts better margin development. In the quarter in-home care, 650 SKUs were removed in Africa and Europe.

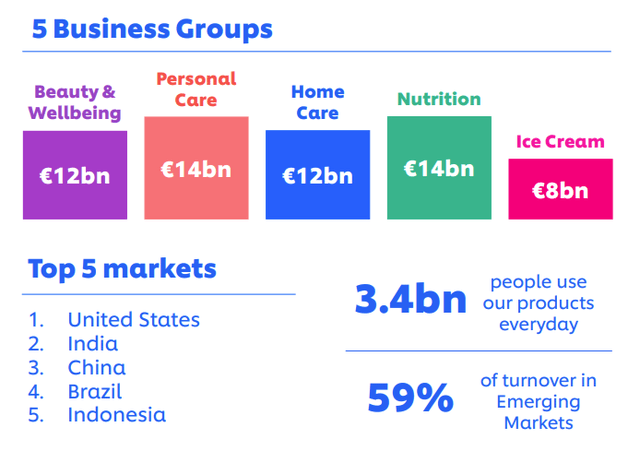

Last year, Unilever announced 1,500 jobs cut, with particular emphasis on reducing senior management roles. This is part of a new organizational model that has simplified the corporate structure. Currently, Unilever is organized into five new divisions (Fig 4), and this allowed the company to become more responsive to client demand and channel trends.

Despite destocking activities in Indonesia, Unilever is recording solid growth in India and the APAC region. If we combined this with a clear strategy not to reduce price and a flat promotional activity, we should also anticipate better profitability estimates.

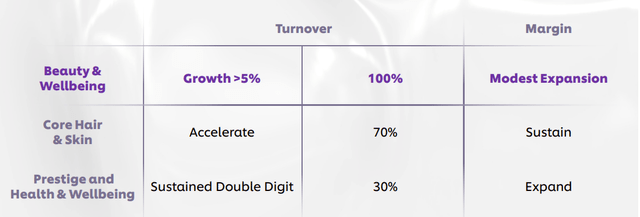

The company is still innovating. The latest examples include 1) Dove body wash with a formula that is 98% bio-degradable, 2) Omo capsule to wash at low temperatures, 3) Clear, a premium product to tackle hair loss, and 4) Magnum ice cream premiumization. Once again, we believe the market is not correctly pricing Unilever’s rapid innovation improvements. Health and Prestige divisions have delivered nine quarters of double-digit revenue growth (Fig 5).

Unilever Q1 Results Presentation – Fig 1

Unilever Q1 sales growth

Deutsche Bank Global Consumer Conference 2023 – Fig 2

Unilever portfolio optimisation

Fig 3

Unilever higher guidance

Fig 4

Unilever new structure

Fig 5

Unilever Prestige and Health division evolution

Conclusion and Valuation

For the above points, we are estimating an operating profit margin of 16.4% for H2, and we arrive at a twelve-month forward EPS estimate of 3.05 from 2.99. Our EPS revision is mainly supported by higher price assumptions for the current year and almost flat volumes. In our numbers, we continued to increase marketing investment (up by €500 million) and R&D expenses. On a negative note, based on the current spot rates, the company expects a negative currency impact of -5% on its yearly sales and a minus 6/7% on the EPS. Considering these negative developments and continuing to value Unilever with a 2023 P/E at 17x, we derive a valuation of €52 per share ($56.7 in ADR), implying an upside of 10% on the current stock price. If we look at the MSCI Europe Consumer Staples Index, the sector is currently trading at 18.15x; however, if we exclude the tobacco companies, we arrive at a P/E of 21x. Unilever is now trading at 15x with a beta of 0.17, and we believe that the discount is not justified given its revenue growth trajectory and business safeness.

With activist involvement, better growth end-market estimates (supported by Unilever country MIX – Emerging Market sales represent 59% of the company’s total sales – Fig 4), elasticities evolution better than expected, and the recent focus on innovation make Unilever a clear buy. We should see Unilever as a growth story supported by downside protection from a recurrent dividend per share. The company is now yielding 3.6%. Downside risks include 1) value-destructive M&A activity (GSK’s last year bid was a clear example), 2) lower margin evolution, 3) a higher competitive landscape, 4) failure of new products launches, and 5) shrinking available shelf space with private label replacement products.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here