Thesis

Enphase Energy (NASDAQ:ENPH) sold off steeply after reporting Q1 earnings. The selloff was likely due to disappointing forward guidance. Enphase currently faces significant short-term headwinds including higher interest rates and the recent change to California’s net metering policy. That being said, Enphase has a lot of long-term potential and investors who are bullish on solar adoption can consider this pullback as a buying opportunity.

Dramatic Selloff

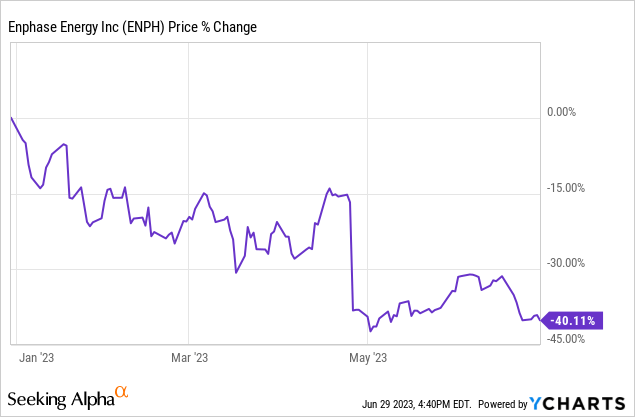

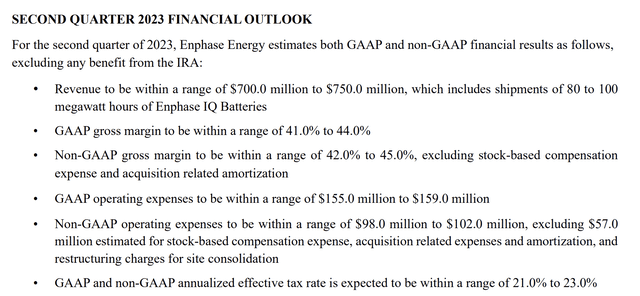

Enphase is down -40.11% YTD, with much of this selloff occurring after the company released their Q1 earnings. The market was likely disappointed with the less than stellar forward guidance. Management forecasted a Q2 revenue midpoint that is essentially 0% QoQ growth, likely spooking growth-oriented investors.

Enphase

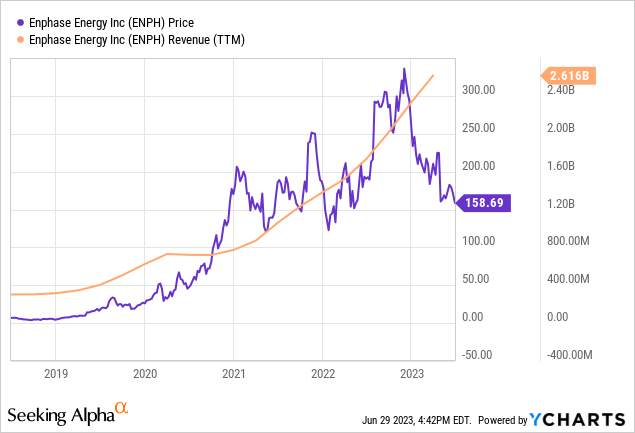

When we zoom out we can see that Enphase has done a good job of growing their revenues over the past few years, and the trajectory of the stock has generally followed that revenue growth. From the beginning of the year until now the stock has been on a nosedive and has diverged from roughly tracking their growth in revenue. This divergence somewhat makes sense considering their disappointing Q2 revenue guidance, although it is likely overdone at this point.

Significant Headwinds

The growth slowdown Enphase management is forecasting can be attributed mainly to two factors.

The first is the high interest rate environment. Solar panels and management systems are often financed with debt. Interest rate increases make installing solar solutions less economically viable.

The second is the net metering changes put in place in California. While this is isolated to that state, California serves as a large market for Enphase. The net metering change has likely resulted in some amount of pull-forward and could result in lower demand in the short to intermediate term.

Both higher interest rates and net metering changes have served to elongate the payback period for residential solar, making Enphase’s products less economically attractive to potential buyers in the residential solar market (for the time being). That being said, the bull case for Enphase revolves around growth in solar adoption over the next decade and beyond.

Long-Term Potential

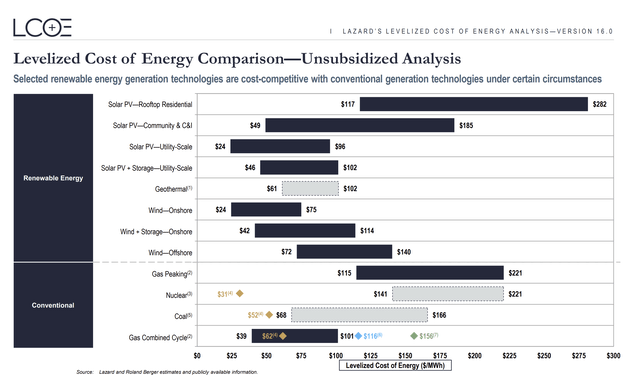

The transition to solar is being made political, but over the long-term economic forces will be the primary driver of solar adoption. On a utility-scale basis the economics of solar already look attractive when compared to conventional energy sources. Residential solar looks somewhat less attractive from an economic perspective, however this is to be expected due to the relative lack of scale. As costs continue to decline, the economics of both utility scale and residential solar + energy storage will continue to improve. This will further tilt the economic scale in the favor of renewables.

Lazard

Critics of solar and renewables often bring up the difficulties of energy storage. We believe that as renewable adoption increases and the financial incentive to solve storage becomes greater, the market will continue to advance battery technology forward while also developing new forms of cost-effective energy storage.

We believe that non-renewables will continue to play an important role in the grid, but as generation and storage solutions improve in both quality and cost the economics will lead to a more balanced energy mix going forward. Renewable and non-renewable sources of energy both have an important role to play in the energy mix of the future.

Enphase is well positioned to take advantage of the shift to renewables. The company has a differentiated product and well established installer relationships. With the introduction of EV chargers Enphase is showing their desire to provide a comprehensive solution for residential renewable energy generation and management.

Enphase is continuing to diversify their revenue away from North America by expanding into other geographic regions. The company appears to be focused on expanding their IQ8 roll out in Europe, which will likely see continued momentum as Europe continues to diversify their energy grid away from oil and gas.

Valuation

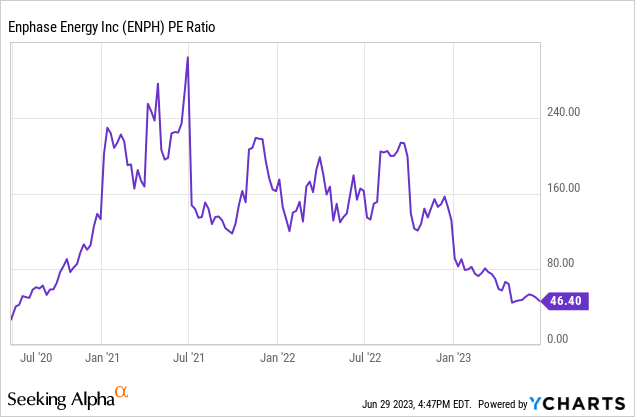

Enphase appears to be trading at the lower end of their recent valuation history (on a GAAP PE basis). This is despite the monumental progress the company has made over the past three years in growing their revenue and earnings. We believe the company has done well to justify its valuation and that current prices represent a good time for investors to consider building a position.

Risks

Enphase operates in an industry that is somewhat cyclical and currently derives meaningful demand resulting from government policies. This creates some risks that differ from the typical company, and as with any cyclical company, investors should be cautious regarding the associated risks. Some of the risks to Enphase are as follows:

There could be a pullback in government incentives towards renewable energy generation and storage.

Competition could eat into Enphase’s revenue and pressure their margins. Long-term there is the potential for a commoditization of inverter and power management solutions.

There could be slower than expected solar adoption on a regional or global scale.

Rising input costs for Enphase’s solutions could hamper their margins.

Rising prices of materials such as lithium could result in lower demand for green energy solutions.

Geopolitical risks could disrupt Enphase’s supply chain, particularly in China.

The risk/reward seems attractive at these levels. We view the greatest risks being the potential commoditization of inverters in the same way that panels have become commoditized, as well as geopolitical supply chain risks. That being said, Enphase is expanding their solutions and their continued innovation serves as a meaningful source of differentiation.

Key Takeaway

Enphase is a high quality company that is trading at an attractive valuation and is well positioned to take advantage of long-term trends in the energy market. The company has executed well over the past few years and bullish investors can use the ongoing selloff as a buying opportunity.

Read the full article here