Lyft (NASDAQ:LYFT) has a new CEO and a much smaller workforce, but it still faces challenges.

Company Profile

LYFT is a rideshare company that connects drivers with passengers. The company operates throughout cities in the U.S. and a select few in Canada.

Most of the company’s revenue comes from its rideshare marketplace. It collects service fees and commissions from drivers. It also has some other offerings including a car rental program for drivers, a rental car option for users that have long trips, a network of bikes and scooters, and an app that offers public transport options.

Q1 Earnings Preview

LYFT is set to report its Q1 earnings after the bell on Thursday, May 4th.

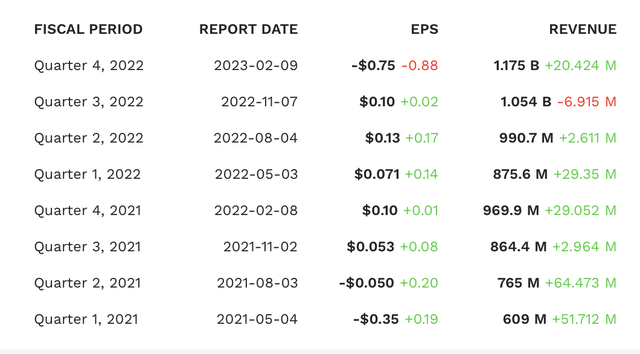

The current consensus is for LYFT to report $982 million in Q1 revenue, which would be an 11.5% increase versus a year ago. Analysts are projecting adjusted EPS of a loss of -8 cents. That compares to the company recording adjusted EPS of 7 cents a year ago in Q1 2022.

As for guidance, LYFT forecast Q1 revenue of approximately $975 million. The company guided for adjusted EPS of between $5-15 million. It reported adjusted EBITDA of $54.8 million a year ago.

The company said that prime time (surge pricing) is coming down dramatically quarter over quarter due to a big increase in driver supply. This will impact revenue, but margins and adjusted EBITDA even more so. In addition, it also slightly reduced its base pricing to remain competitive versus the industry.

On its Q4 earnings call, founder and now former CEO Logan Green said:

“This is obviously not the level of growth or profitability we are aiming for or capable of. And we are laser-focused on driving additional growth and managing costs. Relative to 3 months ago, the competitive dynamics changed and the better marketplace balance we see today creates significant opportunities for long-term growth. To take advantage of this opportunity and grow the market, we must prioritize competitive service levels. This will impact our 2024 adjusted EBITDA and free cash flow targets. We are assessing the impacts of these changes and are actively reviewing adjustments to the business, including cost-cutting measures. We will share additional long-term margin targets in the near future.”

The company followed up on Green’s cost-cutting comments, announcing a -26% reduction in its workforce last week. Green, however, exited earlier, stepping down in mid-April in favor of David Risher, who is the cofounder of a non-profit called Worldreader and who was previously SVP at Amazon (AMZN).

Commenting further on its Q1 guidance, CFO Elaine Paul said:

“Now let me talk about Q1. As Logan mentioned, there are 3 key factors affecting our outlook relative to Q4. First, seasonality. We tend to see a different mix of rideshare rides. For example, shorter rides and fewer airport trips. And cold weather means bike and scooter usage is always lowest in Q1. Second, rapidly improving supply conditions are resulting in less prime time. This is ultimately good for our service levels that will reduce our revenue and adjusted EBITDA in Q1. And third, base price. We slightly reduced base pricing to remain competitive with the industry…

“Our profitability in Q1 is a consequence of the dynamics we are facing, and we are taking immediate action to improve our future financial results. We are looking very closely at our fixed and variable costs to ensure we are operating a durable and profitable model. We are looking for opportunities to significantly cut costs and drive efficiencies. As one example, let me speak to stock-based compensation expense. Our current plans are to reduce this expense to approximately $400 million in fiscal year 2024 through measures such as our previously announced headcount reduction and shifting more of our employee-based international locations.”

LYFT is facing a difficult market environment, and layoffs appear to be adding to people picking up shifts as drivers, which is causing increased driver supply and less surge pricing power. In addition, the economy itself may be weakening. That’s a double whammy for rideshare supply-demand dynamics.

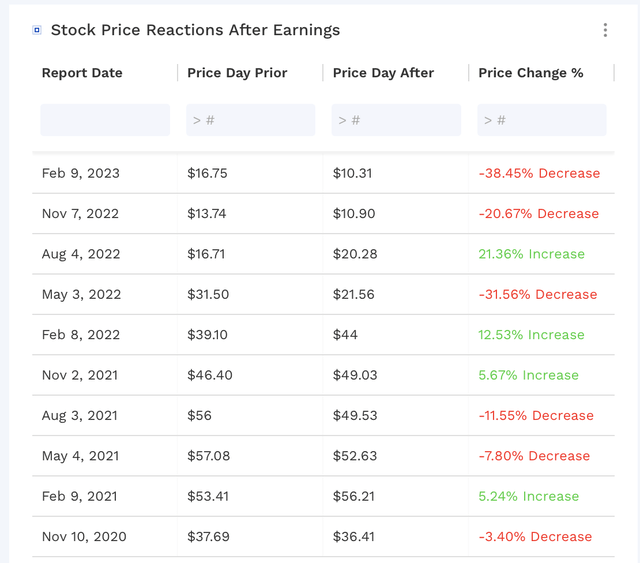

LYFT rarely misses analyst estimates, however, that hasn’t helped the stock from seeing some pretty dramatic drops post-earnings. The stock has fallen over -20% the day after earnings in three of the past four quarters, including a massive -38.5% decline after the last quarter.

LYFT Earnings VS Estimates (FinBox) LYFT Earnings Reactions (FinBox)

Long-Term Opportunities and Risks

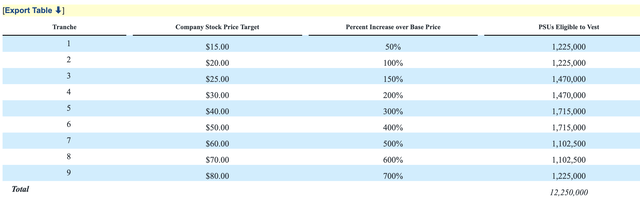

It’s worth noting that Risher has a big incentive to get LYFT’s share price much higher. He has PSUs priced between $15-80, which is significantly above the just over $10 price the stock currently trades at.

Risher Stock Comp (8-K)

Of course, the question is how does he turn the company around. He didn’t lay out much of a plan in a letter when he was announced as the next CEO at the end of March, just saying that its riders and drivers will have a great experience every time they interact with LYFT. He then turned around and cut over a quarter of the company’s staff, saying that they will “use these savings to invest in competitive pricing, faster pick-up times, and better driver earning.” He then made changes to the company’s flexible work schedule and ordered the remaining employees back into the office.

None of those three things is likely to help turn the company around in my view. The company will try to regain share from Uber (UBER), but a price war doesn’t likely benefit either.

Ridesharing is a difficult business to be the #2 player in, given the scale needed in the business. LYFT also hasn’t gotten into adjacent markets like food delivery or freight like UBER. Driverless vehicles and the eliminating drivers and the money that goes to them is likely the biggest long-term opportunity for a firm like LYFT, but that is a ways off and likely also brings with it increased competition.

The company could look to sell itself, but whether it can find a buyer is another question. It likely would have to be a tech giant that wants the LYFT brand name and to get into the rideshare business, or a food delivery company wanting to expand into rideshare. Both could be tough sells. For his part, Risher said the company is not for sale.

Additional risks include the ongoing battle of whether gig workers should be classified as independent contractors. In March, a California court overturned a lower court’s decision that wanted to classify gig workers as employees; however, that decision is expected to be appealed. Other states have also looked into the practice of classifying drivers as contractors. Classifying workers as employees would add costs to companies like LYFT.

Valuation

LYFT trades at 13x adjusted EBITDA based on 2023 analyst estimates of $247.1 million. Based on the 2024 consensus of $432 million, the stock trades at a 7.5x multiple.

On a PE basis, it trades at 73x the 2023 consensus of 14 cents.

It is projected to grow revenue by 9.4% this year and 12.9% next.

The company trades at a significant discount to UBER, as well as DoorDash. However, it is notable that LYFT has over $750 million in stock-based compensation expenses in 2022, or over 18% of its 2022 revenue. That’s an egregious amount, and high even compared to the much-criticized DASH, whose SBC was 13.5% of revenue in 2022. I discussed DASH’s SBC comp in an article in March.

Conclusion

Companies will often initially kitchen sink guidance when a new CEO comes in to help make them look better when they subsequently jump over low bars. With the company announcing some major layoffs, though, things don’t look like they are going so well, so the Q2 guide could be ugly.

Risher will have to sell his vision of getting LYFT on the right track, and early on he hasn’t done a great job of it. Q1 earnings will be his big shot to shift the LYFT narrative, but it won’t be easy. I’d expect a big post-earnings move, but I’m not willing to place a bet on the direction. Longer term, I think LYFT has a difficult journey ahead of it and would stay away from the name.

Read the full article here