Hexcel Corp. (NYSE:HXL) is a critical supplier of structural materials to the biggest plane manufacturers, Boeing and Airbus. Fifty-two percent of Hexcel Corp’s net sales are from Airbus and Boeing, with the production of commercial aerospace accounting for 58% of total sales. Hexcel’s aerospace and defense division makes up the second part of the pie with 29% of its net sales. The final portion of Hexcel is its industrial segment at 13% total of net sales. Both the defense and industrial segments have seen a decline in total percentage in 2022 compared to previous years. This reduction seems to match previous levels in 2019 where commercial aerospace dominated overall net sales. Hexcel faced extreme challenges during the covid pandemic that seems to be turning a corner in its recent reports.

Ever since the pandemic, commercial airline manufacturers have had a reduced demand from airlines for new planes. Though airplanes require more advanced composite materials over time, the huge production halt in planes significantly hit Hexcel in the years 2020 and 2021. Total revenue has been cut roughly in half compared to its highs in 2019. As such, most of the fundamentals of Hexcel Corp. saw a sharp decline during covid with a resurgence back to pre-pandemic levels in most recent financial reports. The current share price does not really reflect the reduction in total revenue compared to 2019 due to the stock price currently reaching highs previously obtained in 2019. I am worried the stock currently reflects already perceived future value from total revenue returns as airlines return to normal plane orders.

During the most recent guidance from Hexcel Corp, the company beat EPS and showed a possible resurgence due to large increases in travel since covid subsided. Hexcel saw a net sales improvement in the first quarter of 17.2% compared to last year in 2022. The company also reaffirmed guidance for the remainder of 2023 which follows the recent travel surge. This is all positive news for Hexcel Corp to eventually return to its pre-pandemic levels of financial fundamentals. One potential concerning news from recent guidance is the reduction of its industrial components in its net sales. Hexcel Corp is all in on commercial and defense aerospace composite structures continuing its growth above and beyond pre-pandemic levels.

When considering these current stories about Hexcel Corp, we need to determine which news topics will have a long-term and ongoing effect on the company and its share price. While the current customer demand for travel trickled up to improve net sales at Hexcel Corp, the company still has not reached pre-pandemic levels in its fundamentals. Additionally, the net debt of Hexcel Corp sits at 611 million, showing the company does have a large debt obligation that needs to be dealt with in the future. Even with such high debt, the overall cash flow of Hexcel shows that it is currently able to pay its obligations with its first unsecured credit line due in 2024 almost being paid off. In the end, Hexcel seems to be recovering well with the new travel demand helping to boost sales of composite materials through new plane orders.

While current news stories, good or bad, can sway our opinion about investing in a company, it’s good to analyze the fundamentals of the company and to see where it’s been in the past and in which direction it’s heading.

This article will focus on the long-term fundamentals of the company, which tend to give us a better picture of the company as a viable investment. I also analyze the value of the company versus the price and help you to determine if Hexcel Corp is currently trading at a bargain price. I provide various situations which help estimate the company’s future returns. In closing, I will tell you my personal opinion about whether I’m interested in taking a position in this company and why.

Snapshot of the Company

A fast way for me to get an overall understanding of the condition of the business is to use the BTMA Stock Analyzer’s company rating score. Hexcel Corp shows a poor rating score of 52.86 out of 100.

Before jumping to conclusions, we’ll have to look closer into individual categories to see what’s going on.

BTMA Stock Analyzer

Fundamentals

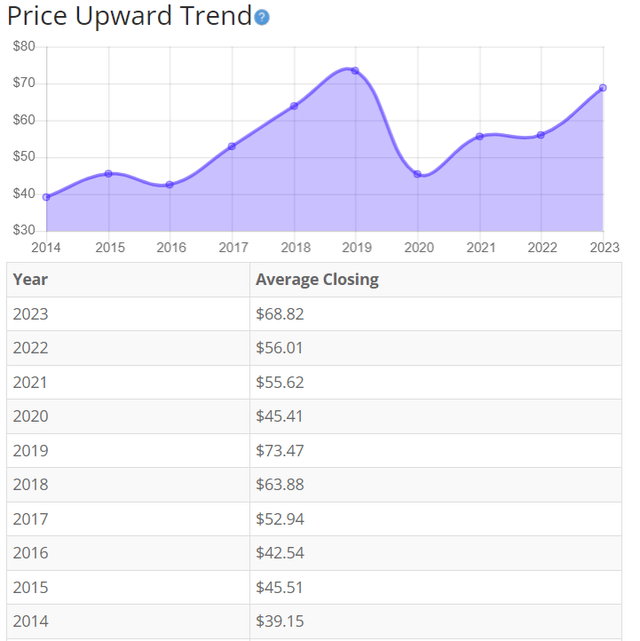

The current share price shows a resurgence back to previous highs in 2019. A low point for the stock was seen around 2020 during the height of the pandemic. As Covid has subsided the share price has steadily risen in conjunction with other improvements in ROE, ROIC, GMP, and ROE. The increasing demand for air travel seems to have uplifted this stock considerably. Total revenue and key fundamentals have still not reached 2019 levels, which could mean the current sharp rise is due to an expectation of returning to those levels. This makes me cautious as this stock could already be at a premium with little room to grow. Overall, the share price average has grown by about 75.8% over the past 10 years, or a Compound Annual Growth Rate of 6.5%. This is an okay return but generally less than the market.

BTMA Stock Analyzer

Earnings

Earnings saw a steady rise before the pandemic fallout in 2020. This seems to follow Hexcel’s claim that more commercial airliners require additional composite material.

The low EPS in 2020 and 2021 is most likely a direct result of major cuts in commercial airline orders during the travel shutdown. This forced Hexcel to reduce its sales to Boeing and Airbus, which make up a large majority of its net sales as a company. During this time, Hexcel also took out a loan of over one billion in senior notes to continue operations and create sufficient liquidity during the crisis. The earnings seem to have rebounded recently and even showed beating expectations during Q1 of 2023. Overall, I would expect to see a continued improvement in earnings as the airline industry gets back to normal with its plane orders.

BTMA Stock Analyzer

Since earnings and price per share don’t always give the whole picture, it’s good to look at other factors like the gross margins, return on equity, and return on invested capital.

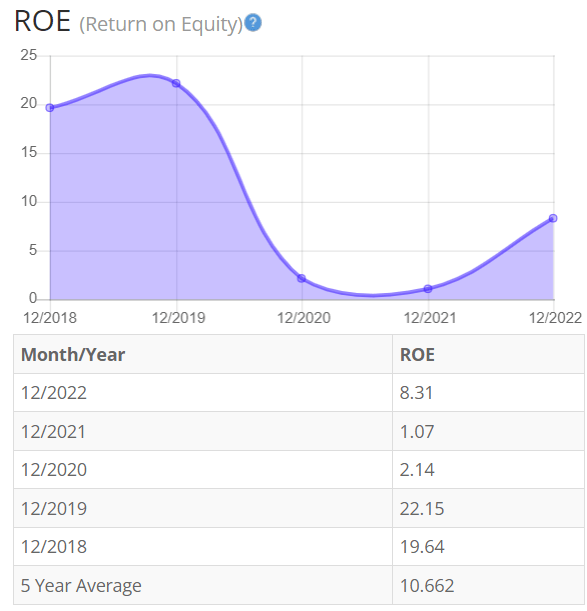

Return on Equity

The return on equity seems to show a similar trend to earnings from the previous chart. ROE has fallen sharply during the pandemic years of 2020 and 2021 with an upward trend into 2023. Hexcel did have a high ROE before 2020 when its share price reached a high. I would expect a similar rebound for ROE as earnings rise back to previous levels from increased composite material needs from new plane orders. For return on equity (ROE), I look for a 5-year average of 16% or more. So, Hexcel does not meet my requirements. Even though Hexcel does not meet my requirements I believe the covid years to be outliers.

BTMA Stock Analyzer

Let’s compare the ROE of this company to its industry. The average ROE of 77 Aerospace and Defense companies is 9.87%.

Therefore, Hexcel’s 5-year average of 10.66% is right above the standard in the industry. If we return to 2019 levels of ROE, Hexcel would be exceeding the industry averages by more than double. The current level is relatively close to the industry standard with an upward trend.

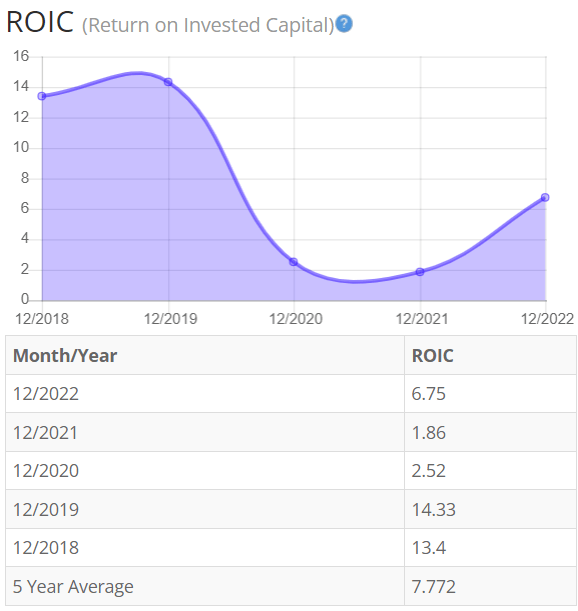

Return on Invested Capital

The return on invested capital again looks to match the previous charts on its trends. As earnings cratered during the pandemic so did the ROIC. Hexcel did continue to invest capital to expand current production facilities and open new ones during the pandemic which bodes well as demand continues to return in 2023 and beyond. I expect the ROIC to continue to improve as airline demand orders rise back to normal levels. Additionally, as more planes require increased composite materials, this could further improve above previous 2019 levels. For return on invested capital (ROIC), I also look for a 5-year average of 16% or more. So, Hexcel does not pass this test and never has in the previous 5 years. This is most likely due to a high capital expenditure cost to continue to produce these highly advanced materials.

BTMA Stock Analyzer

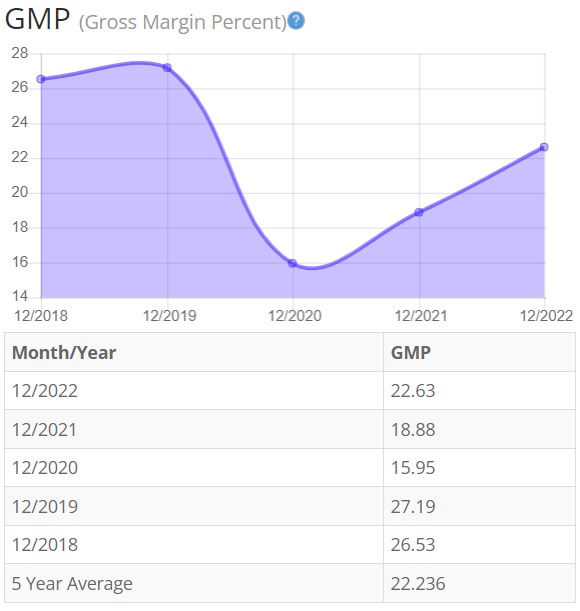

Gross Margin Percent

The gross margin percent (GMP) saw a steady rise before falling during covid. Due to the complicated manufacturing process of these types of materials, gross margin follows closely with volume. The higher volume means the production facility is running at full throughput, which improves the cost of goods sold. As volume returns to normal, I expect the gross margin to continue improving for the company. I typically look for companies with gross margin percent consistently above 30%. So, Hexcel did not make the cut and in the previous 5 years has never gotten to 30%.

BTMA Stock Analyzer

Financial Stability

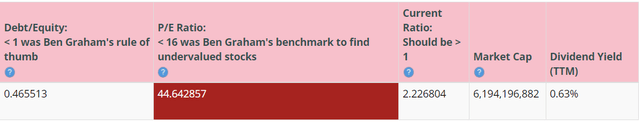

Looking at other fundamentals involving the balance sheet, we can see that the debt-to-equity is less than 1. This is a positive indicator, telling us that the company owns more than it owes.

Hexcel’s Current Ratio of 2.2 is satisfactory, indicating it has an adequate ability to use its assets to pay its short-term debt.

Ideally, we’d want to see a Current Ratio of more than 1, so Hexcel exceeds this amount.

Hexcel does appear to be in good financial health even with the major debt obligations. Hexcel also appears to have enough short-term liquidity to cover its most pressing obligations. Recent positive cash flow from the previous quarters has been used to pay off its shorter-term debt due in 2024. Hexcel’s interest obligations during 2022 only accounted for 20 percent of its operating income, making it safe to say Hexcel can operate currently with these debt levels.

Hexcel does pay a regular dividend; however, it was suspended previously during covid.

BTMA Stock Analyzer

This analysis wouldn’t be complete without considering the value of the company vs. share price.

Value Vs. Price

The company’s Price-Earnings Ratio of 44.6 indicates that Hexcel might be overpriced when comparing Hexcel PE Ratio to a long-term market average PE Ratio of 15.

The 10-year and 5-year average PE Ratio of Hexcel has typically been 26.5 and 27.9, respectively. This indicates that HXL could be currently trading at a high price when comparing to its average historical PE Ratio range.

BTMA Stock Analyzer

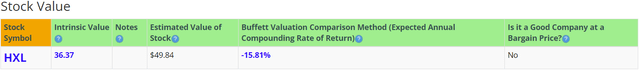

The Estimated Value of the Stock is $49.84, versus the current stock price of $73.76. This indicates that Hexcel Corp is currently selling at a premium.

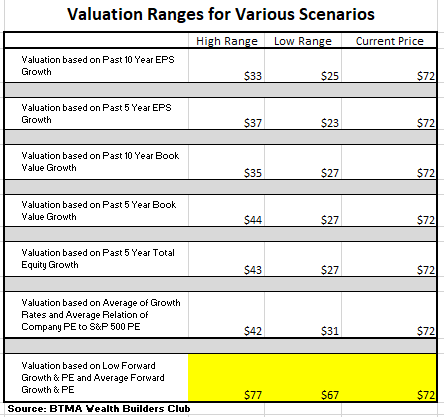

For more detailed valuation purposes, I will be using a conservative diluted EPS of 1.48. I’ve used various past averages of growth rates and PE Ratios to calculate different scenarios of valuation ranges from low to average values. The valuations compare growth rates of EPS, Book Value, and Total Equity.

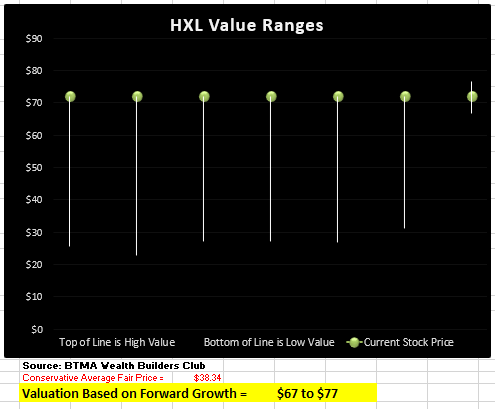

In the table below, you can see the different scenarios, and in the chart, you will see vertical valuation lines that correspond to the table valuation ranges. The dots on the lines represent the current stock price. If the dot is towards the bottom of the valuation range, this would indicate that the stock is undervalued. If the dot is near the top of the valuation line, this would show an overvalued stock.

BTMA Wealth Builders Club BTMA Wealth Builders Club

According to the valuation analysis based on forward growth, HXL is fairly priced. But valuation according to past performance shows that HXL is overpriced.

In my opinion, analysts are basing its valuation more on the forward growth of HXL because the revival of the airline industry after covid is expected to accelerate growth. As a result, analysts are forecasting earnings growth of 16% to 33% by the end of the year.

In summary, this forward growth analysis shows an average valuation range of around $67 to $77 per share versus its current price of about $72-$74, this would indicate that HXL is fairly-priced.

Summarizing the Fundamentals

After analyzing the fundamentals for Hexcel, the overall feeling is underwhelming. The company does seem to generate decent cash flow from operations that can pay off its debt holders in the short term and long term if no headwinds ruin its net sales. The return in large customer demand for travel has made airlines begin to increase their plane orders directly allowing Hexcel to begin to see a sharp rise in sales and other fundamentals. Diversification did see a reduction with the industrials wind segment being sold off, accounting for a reduction in overall net sales from the segment. Over 50% of its current sales come from Airbus and Boeing. If these companies experience any headwinds, this will be felt directly by Hexcel.

Other fundamentals such as ROE and ROIC show a recent resurgence. ROE had a continued upward trend before covid and with the current spike in 2022, I expect a return to previous levels as demand increases. Due to being a highly capital-intensive industry, ROIC will struggle to meet our threshold. Over time I do believe ROIC will return to pre-pandemic levels of around 14%.

In terms of valuation, my analysis shows that the stock is fairly priced.

Hexcel Vs. The S&P 500

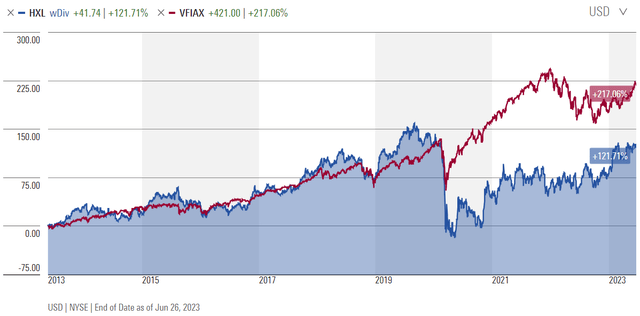

Now, let’s see how Hexcel compares versus the US stock market benchmark S&P 500 over the past 10 years. From the chart below, we can see that Hexcel normally beat the S&P consistently until Covid. After Covid, the returns lag way behind the market overall. The gap does appear to be closing as more airplanes are needed to support the new travel demand. Hexcel could return to seeing high growth if its commercial aerospace boom continues.

This chart makes me realize that Hexcel can be a somewhat high growth investment that can slightly outpace the market. However, in the long run it seems like investing in the S&P 500 could be a safer choice because of the added risk of Hexcel’s lack of diversification.

On the flip side, Hexcel seems like it could still experience a good deal of growth in the short-term to catch up to the market’s performance. So, as a short-term play and if Hexcel is selling at a bargain price, it could bring above average gains. But in the long-run, if Hexcel is fairly priced, then the more diversified and similarly performing S&P 500 is probably a wiser choice.

Morningstar

Forward-Looking Conclusion

Over the next five years, the analysts that follow this company are expecting it to grow earnings at an average annual rate of 33.6%.

In addition, the average one-year price target for this stock is $71.46, which is about a 3.1% decrease in a year.

The Expected Annual Compounding Rate of Return is -15.8%.

Does Hexcel Pass My Checklist?

- Company Rating 70+ out of 100? No (52.9)

- Share Price Compound Annual Growth Rate > 12%? No (6.5%)

- Earnings history mostly increasing? YES

- ROE (5-year average 16% or greater)? No (10%)

- ROIC (5-year average 16% or greater)? No (7.7%)

- Gross Margin % (5-year average > 30%)? No (22%)

- Debt-to-Equity (less than 1)? YES

- Current Ratio (greater than 1)? YES

- Outperformed S&P 500 during most of the past 10 years? No

- Do I think this company will continue to successfully sell their same main product/service for the next 10 years? YES

Hexcel scored 4/10 or 40%. Therefore, Hexcel fails to pass our fundamentals test for a solid investment at this time.

Is Hexcel currently selling at a bargain price?

- Price Earnings less than 16? No (44)

- Estimated Value greater than the Current Stock Price? No (Value $49.84 < $73 Stock Price)

- The forward growth analysis shows an average valuation range of $67 to $77 per share versus its current price of about $72-$74, this would indicate that HXL is fairly-priced. No

Overall metrics show that Hexcel may not be the best investment at this time. The company is well-positioned to continue to supply more composite materials in new places. It seems that this upside is already baked into the stock price and leaves less potential returns for the taking.

My biggest concern is the current stock price has reached 2019 levels when the total net income is a third of what it was in 2019. Hexcel would have to beat its previous total sales and net income considerably to justify this investment compared to the S&P500. With its historical and increasing reliance on only commercial aerospace for growth, I find it difficult to see the new markets that could support a large new revenue stream. The industrials and defense segment does not seem to be a major priority for them at this time based on its historical numbers.

The current first quarter has shown positive signs with an earnings’ beat and confirmed guidance. Most of the improvement in commercial net sales seems to have come from increased plane orders and not higher needs for Hexcel composite materials. A trend of higher material supplied would be critical to determine the additional growth potential of Hexcel.

As for Hexcel’s current stock price, I believe that there is less potential gain to be achieved since the stock already has future growth baked in. Additionally, Hexcel seems to be, at worst, overpriced, and at best, fairly-priced. Therefore, I’m looking for other investments with better fundamentals, selling at a bargain price. To sum it up, there are better stocks out there with the potential for bigger returns.

Read the full article here