The Paris Airshow was hosted earlier this month. In a separate report, I previewed the airshow with a list of possible orders and tracked the order activity for members of The Aerospace Forum. In this report, I will be looking at the order activity for Airbus SE (OTCPK:EADSF). I also wrote a similar report covering Boeing (BA), which can be found here.

More importantly, I will provide a dollar value of the orders which is relevant to investors even more so in a time where Boeing and Airbus have stopped sharing list prices even though in a model agreement those list prices do matter for down payments. Furthermore, I will discuss which orders are actually accretive to the order book and I will discuss the backlog addition for each program and how that feathers into the long-term production plans.

Airbus: Buying Power From India On Display

The Aerospace Forum

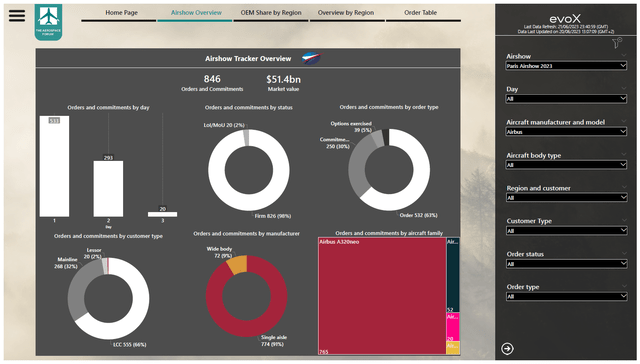

In total, there were 846 orders and announcements valued at $51.4 billion. The orders and announcements included 765 Airbus A320neo family airplanes, 52 Airbus A350-900s, 20 Airbus A330-900s and 9 Airbus A220s airplanes. What should be kept in mind that not all of these announcements add to the backlog.

Volaris (VLRS) was revealed as the customer for 25 A320neos valued $1.5 billion. These orders are already in the order book and therefore do not add value. So, from the $51.4 billion we should take out $1.5 billion and end up with $49.9 billion. Furthermore, there was a tentative agreement with Avolon for 20 Airbus A330-900 airplanes valued nearly $2.25 billion. Chances are high these will be firmed in due time, but until they are, we are not adding those to the backlog but view these tentative agreements as a peek into the sales pipeline.

If we only count the announcements that do add to the backlog, we are left with 801 orders valued $47.7 billion:

- Air India ordered 140 A320neo airplanes, 70 A321neos, 34 Airbus A350-1000s and six Airbus A350-900s.

- IndiGo ordered 500 A320neo airplanes.

- Air Mauritius ordered three Airbus A350-900s.

- Philippine Airlines ordered nine Airbus A350-1000s.

- Qantas (OTCPK:QUBSF) exercised options for nine Airbus A220-300s.

- Flynas firmed an order for 30 Airbus A320neo airplanes.

There weren’t many announcements from Airbus, but the ones they did have were big. The Air India and the IndiGo order were already anticipated, but the big difference with the order inflow that Boeing presented is that Airbus had a big new order while Boeing had smaller incremental orders. Furthermore, the incremental orders that Airbus had were also larger than what Boeing had to present. I don’t want to make this a Boeing versus Airbus discussion, but it is clear that Airbus had the better airshow.

Airbus Backlog To Surge

|

Aircraft type |

Backlog |

Increase |

Relative increase |

|

Airbus A220 |

528 |

9 |

2% |

|

Airbus A320 |

5,605 |

740 |

13% |

|

Airbus A330 |

189 |

0 |

0% |

|

Airbus A350 |

424 |

52 |

12% |

|

Total |

6,746 |

801 |

12% |

The evoX Aircraft Sales Monitor, available to members of The Aerospace Forum, shows that Airbus has a backlog of 6,746 airplanes valued nearly $425 billion. The Paris Airshow announcements added around 12% to that. Airbus’s commercial airplanes segment had a 11.6% adjusted EBIT margin in 2019. Using that margin, the order announcements during the airshow should provide $5.5 billion in profits to the European jet maker.

|

Aircraft type |

Backlog |

Implied monthly production rate |

|

Airbus A220 |

537 |

9 |

|

Airbus A320 |

6,345 |

106 |

|

Airbus A330 |

189 |

3 |

|

Airbus A350 |

476 |

8 |

|

Total |

7,547 |

126 |

Airbus currently produces 6 A220s per month and has plans to increase production to 14 airplanes per month by mid-decade. Taking a 5 year backlog as a standard, the backlog would require an average rate of 9 airplanes per month. Airbus plans to increase the rate to 14 airplanes by mid-decade, so that would indicate that the targeted rate is not fully supported by the backlog at this point, but I have observed that there are sales campaigns in Asia, and customers such as Delta hold additional options that can be firmed. Furthermore, the Airbus A220 is envisioned as the base for the Airbus A320neo replacement, which is highly likely to be an in-demand airplane and Airbus most likely is already thinking about increasing production to support production of a stretched version of the A220.

On the Airbus A320neo program, the targeted production rate is 75 airplanes by mid-decade, but the backlog would firmly support rates higher than that. This is likely going to be a watch item for the European jet maker. Currently it is facing challenges increasing the rate. However, the current planned expansions would allow Airbus to increase to production rates of 88 to 92 airplanes per month and modernizations of all lines could eventually increase production towards 105 airplanes per month fully supported by the backlog.

For the A330neo, a production rate of three airplanes per month is supported by the backlog but Airbus intends to increase the production to four airplanes per month which does make sense. If the Avolon order is firmed, roughly 6 months of production will be added to the books and the A330ceo replacement cycle has yet to fully kick in which should increase orders. On the A350 program, Airbus intends to increase production to 9 airplanes per month on a 11-month basis indicating that the envisioned production rate is supported by the backlog. As air travel capacity has yet to recapture the long-term trendline, there seems to be a lot of safety for the backlog and upward pressure on production rates for all programs.

Conclusion: Airbus Is The Big Winner Of The Paris Airshow

Airbus was the big winner of the Paris Airshow, taking home the majority of the orders during an airshow that was primarily focused on Indian orders. More importantly, when assessing the backlog, we see that production rate increases are fully supported (and then some) by the backlog. All of this bodes well as Airbus, just like Boeing, already has the production rate increases planned, and those should also amortize fixed costs over more airplanes allowing for higher profits for the European jet maker on a unit basis as well as volume driven earnings growth. As a result, I am maintaining my buy rating for the stock.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here