The most advertised recession in history

Despite initial fears of recession and banking crises, the global economy has demonstrated impressive resilience so far. The quarter was marked by the resolution of the debt ceiling issue, which had hung like a sword of Damocles over the financial markets and caused uncertainty. There was no concrete evidence of an imminent recession in the US, and unemployment rates remained historically low, indicating a strong labour market and bolstering consumer confidence. First quarter earnings exceeded expectations, instilling confidence in the markets. Both the US and global economies posted steady growth in the quarter, with the S&P 500 gaining 6.6% as risky assets built positive momentum.

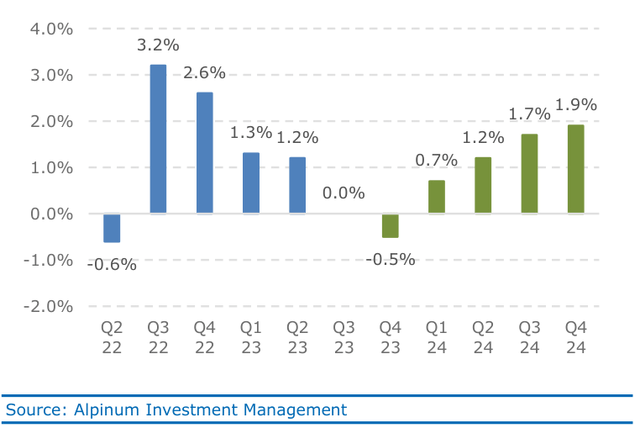

Chart 1: Expected US quarterly real GDP growth (annualized)

The slower pace of central bank rate hikes signalled to markets that the peak of terminal rates and the end of the tightening cycle were near, as inflationary pressures remained subdued over the quarter. Falling energy prices provided relief from cost pressures for businesses and consumers, contributing to an overall disinflationary environment. Although markets had been predicting a US recession for several months, the macroeconomic picture did not provide conclusive evidence to support these concerns. Instead, the global economy showed resilience, low unemployment, disinflationary pressures, and positive momentum in risky assets.

United States

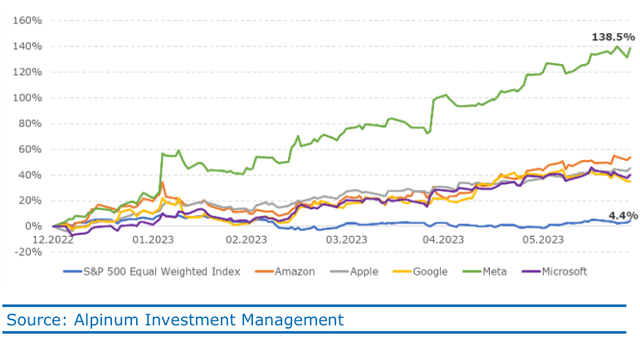

The second quarter was dominated by the highly publicized impasse between Democrats and Republicans over the debt ceiling. However, despite the political drama, equity markets proved resilient, with the S&P 500 recording a solid 6.6% increase in the second quarter. Growth investors, particularly those focused on US mega-cap tech stocks, have had a strong performance thus far in 2023. The Nasdaq index surged by an impressive 36.6% YTD, marking the sharpest outperformance of the tech sector in the past two decades, excluding the post-Covid lockdown period driven by stimulus measures. However, the S&P 500’s year-to-date rally has been concentrated among a few mega-cap stocks. At the same time, the VIX Index has fallen sharply to trade below 14, a level not seen since the pandemic-induced period.

Chart 2: Large tech-focused stocks led the rally in S&P 500

Market sentiment was also supported by US economic data. Following encouraging growth in real GDP in Q1 2023, stronger-than-expected auto sales, housing starts, and employment figures suggest that real GDP growth should continue in the next few quarters. Disinflationary pressures persisted during the quarter, with the inflation rate cooling in May to its lowest annual level in around two years, standing at 4.0%. Although overall inflationary pressures remained subdued, core inflation, which excludes food and energy prices, recorded a significant month-on-month increase of 0.4%. On a year-on-year basis, core inflation remained elevated at 5.3%. At the last FOMC meeting, on June 14, 2023, the Federal Reserve hit the “hawkish” pause button keeping interest rates unchanged at 5.00-5.25%, having raised them ten consecutive times at previous meetings. The median projection for the year-end now points to a Fed funds target of 5.4% implying additional rate hikes in the second half of the year.

Europe

The Eurozone economy exhibited a modest improvement in economic conditions during the first quarter 2023, despite falling short of consensus expectations for GDP growth. However, the release highlighted the resilience of the bloc in avoiding a recession, primarily attributed to factors such as the easing energy crisis, unseasonably warm weather conditions, the reopening of China’s economy, and the implementation of fiscal stimulus measures. Contrarily, the German economy experienced a technical recession in the first quarter of the year, as households tightened their spending habits. Following a contraction of 0.5% in the final quarter of 2022, the GDP for Q1 2023 was revised downward from zero to -0.3%. Germany, as Europe’s largest economy, has faced significant challenges, particularly in the aftermath of the Russia-Ukraine conflict.

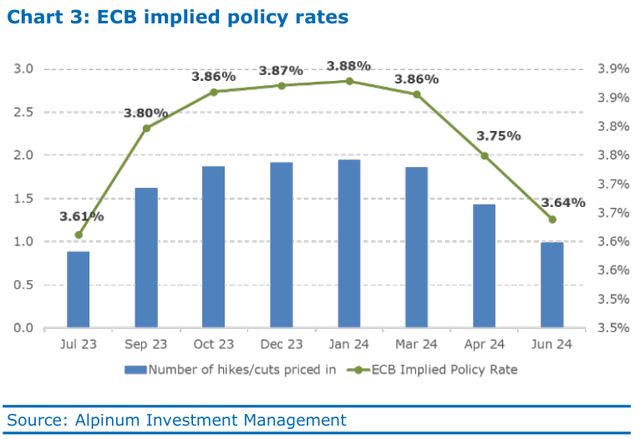

Chart 3: ECB implied policy rates

The current economic situation is characterized by elevated inflation and high interest rates throughout the region. In response to this environment, the European Central Bank (ECB) decided to raise rates by an additional 25 basis points at its meeting on June 15. This brings the ECB’s total rate increase since July 2022 to 400 basis points, reflecting its determination to counter inflationary pressures. President Christine Lagarde has repeatedly expressed concern about excessively high inflation over an extended period. In May, headline inflation in the eurozone declined 0.9% to 6.1% year-on-year. Furthermore, core inflation, which excludes energy and food prices more prone to fluctuations, declined by 0.3% to 5.3% year-on-year. Although European equities are considered comparatively inexpensive, the rally observed on the European stock markets lasted until around mid-February. Since then, however, equities have entered a sideways phase, with no clear trend.

China and emerging markets (EM)

After a strong first quarter, Chinese macro data’s latest release revealed a slowdown in activity. Imports dropped by 4.5%, and industrial production grew only 3.5% year-on-year. However, it is important to note that these figures were measured against last year’s depressed data during the Shanghai lockdown. The decline in the property market also accelerated, with property investments falling 7.2% year-on-year in May compared to a 6.2% drop in April. Other indicators such as trade data and May PMIs confirm the lack of a significant Chinese economic recovery. Chinese equities have underperformed global counterparts, and falling industrial metal prices reflect disappointing momentum. The underperformance of Chinese equities by around 8% relative to the MSCI Asia ex-Japan Index in Q2 further highlights this trend. With a CPI close to zero, the People’s Bank of China (PBOC) announced a reduction in key interest rates in June. The seven-day reverse repo rate was lowered by 10 basis points to 1.9% from 2.0%, while the rate for one-year medium-term lending facility (MLF) loans was also decreased by 10 basis points, going from 2.75% to 2.65%.

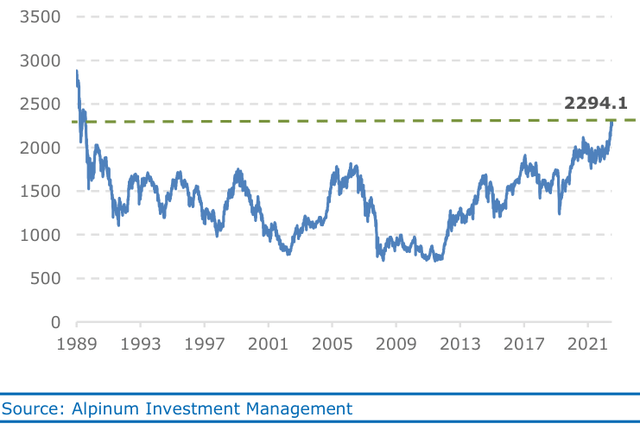

Chart 4: Topix reached highest level since 1990

Japan’s Q1 real GDP saw a year-on-year increase of 1.3%, propelled by robust private consumption and non-residential investment. Moreover, May’s CPI demonstrated further acceleration, with the Bank of Japan’s key inflation measure rising by 4.3% year-on-year, marking the largest surge since 1981. This encouraging data has bolstered optimism that Japan is breaking free from its previous deflationary stagnation. The major Japanese equity index, TOPIX, outperformed other large developed equity markets in the first half of the year, returning 21.1%. It also reached its highest level since 1990.

Investment conclusions

Despite the economic cycle turning negative, the presence of a resilient consumer base and supportive government policies so far has prevented a near-term recession, reducing the likelihood of a severe downturn. While inflation has reached its peak, it will remain a concern heading into 2024, necessitating the continuation of higher interest rates to address wage inflation. Companies, on average, are expected to fare well as they have adapted to the challenging environment by implementing cost-cutting measures. With the prospect of positive nominal growth, most companies are anticipated to perform satisfactorily, particularly those with pricing power. Overall, a sustained wave of corporate defaults is expected to be avoided. Finally, the global monetary policy tightening phase is nearing its peak.

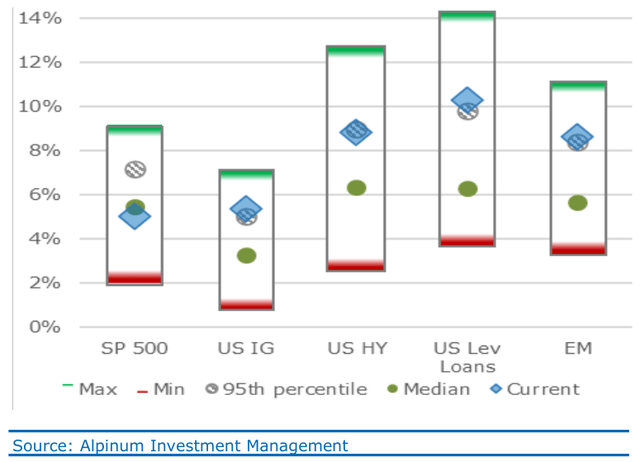

Chart 5: Yields on credit continue to outperform equities

Bonds: Monetary policy is in tightening mode worldwide, led by the pace of the Fed. Currently, markets are assuming a terminal policy rate close to 5.4%. We continue to favour European loans, IG, non-cyclical US and Scandinavian short-term HY bonds as well as structured credit.

Equities: Equity multiples remain challenged by rising interest rates and vulnerable/shrinking profit margins. Within equities, we continue to favour non-US markets, maintaining a mixed approach.

Our cautious stance with a neutral positioning has been the right action during these extremely uncertain times. However, we believe it is now time to increase risk. As a first step we want to slightly upgrade equities from its minimal underweight position and keep the overweight in “credit exposure”.

Scenario Overview 6 Months

|

Base case 65% |

Investment conclusions |

|

|

|

Base case 65% |

Investment conclusions |

|

|

| Bear case 15% | Investment conclusions |

|

|

| Tail risks | |

|

|

Asset Class Assessment

|

Equities |

Comment |

|

|

| Credit/Fixed Income | Comment |

|

longer, but peak level is in sight”.

~4%, whereas the US Fed is pausing and peak rate is in sight @ around 5.5%.

|

| Alternatives | Comment |

|

|

| Real Assets | Comment |

|

|

Disclaimer

This is an advertising document. This document does not constitute an offer to anyone, or a solicitation by anyone, to make any investments in securities. Such an offer will only be made by means of a personal, confidential memorandum. This document is for the intended recipient only and may not be transmitted or distributed to third parties.

Past performance is not a guide to future performance and may not be repeated. You should remember that the value of investments can go down as well as up and is not guaranteed. The actual performance realized by any given investor depends on, amongst other things, the currency fluctuations, the investment strategy invested into and the classes of interests subscribed for the period during which such interests are held. Emerging markets refer to the markets in countries that possess one or more characteristics such as certain degrees of political instability, relative unpredictability in financial markets and economic growth patterns, a financial market that is still at the development stage, or a weak economy. Respective investments may carry enhanced risks and should only be considered by sophisticated investors.

Nothing contained in this document constitutes financial, legal, tax, investment or other advice, nor should any investment or any other decisions be made solely based on this document. Although all information and opinions expressed in this document were obtained from sources believed to be reliable and in good faith, no representation or warranty, express or implied, is made as to its accuracy or completeness and no liability is accepted for any direct or indirect damages resulting from or arising out of the use of this information. All information, as well as any prices indicated, is subject to change without notice. Any information on asset classes, asset allocations and investment instruments is only indicative. Before entering into any transaction, investors should consider the suitability of the transaction to their own individual circumstances and objectives. We strongly suggest that you consult your independent advisors in relation to any legal, tax, accounting and regulatory issues before making any investments.

This publication may contain information obtained from third parties, including but not limited to rating agencies such as Standard & Poor’s, Moody’s and Fitch. Reproduction and distribution of third- party content in any form is prohibited except with the prior written permission of the related third party. Alpinum Investment Management AG and the third-party providers do not guarantee the accuracy, completeness, timeliness or availability of any information, including ratings, and will not be responsible for any errors or omissions (negligent or otherwise), or for the results obtained from the use of such content. Third-party data are owned by the applicable third parties and are provided for your internal use only. Such data may not be reproduced or re-disseminated and may not be used to create any financial instruments or products, or any indices. Such data are provided without any warranties of any kind.

If you have any enquiries concerning the document please contact your Alpinum Investment Management AG contact for further information. The document is not directed to any person in any jurisdiction risdiction which is prohibited by law to access such information. All information is subject to copyright with all rights reserved. Any communication with Alpinum Investment Management AG may be recorded.

Alpinum Investment Management AG is incorporated in Switzerland and is FINMA licensed and regulated.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here