Hercules Capital (NYSE:HTGC) is a regulated investment company with total investments and total debt investments of $3.15 billion and $2.97 billion, respectively. The company has an effective yield of 15.1%. HTGC generally focuses its investments in venture capital-backed and institutional-backed companies in a variety of technology-related industries. About 80% of the fair value of its portfolio is composed of investments in the drug discovery and development industry, software industry, and consumer & business services industry.

Due to its strategic investments in 2022, which caused the company’s portfolio to grow to a record high, Hercules Capital’s 2023 financial performance can remain strong. The company’s 1Q 2023 results showed that despite the current financial challenges, due to high interest rates and economic uncertainty, Hercules Capital can find investment opportunities, calculate the risks effectively, and make new investments that will bring more income.

While the company’s total assets increased at a CAGR of 10.4% from $1124 million in 2012 to $3029 million in 2022, its net investment income grew at a CAGR of 14.6% in the same period, from $48 million in 2012 to $188 million in 2022. In another world, HTGC’s net investment income to its total assets increased from 4.3% in 2012 to 6.2% in 2022. In 1Q 2023, HTGC’s net investment income in 1Q 2023 was $65 million. If the company’s assets continue to grow as in the previous years (which is a reliable assumption according to its underwriting discipline), its net investment income to asset ratio may improve further by 50 bps to 6.7% by the end of 2023.

The company’s early loan repayments in 1Q 2023 were $202 million, higher than expected. In 2Q 2023, Hercules Capital estimates the early loan repayments to increase further to between $225 to $320 million. Higher early loan repayments mean that the quality of the company’s loan portfolio is high, and reflects HTGC’s ability to address and underwrite the available opportunities in the current market condition. Do not ignore the fact that within the current market condition, we have seen the failure of Silicon Valley Bank and other regional banks. While higher interest rates (which are not expected to decrease soon and even, and there might be further interest hikes) are hurting some of the companies in the capital market, as 95% of HTGC’s debt portfolio is floating with a floor, and as it has done a great job in identifying and targeting growth companies in the past years, higher interest rates can benefit HTGC’s core yield going forward. The company expects its core yield to range between 13.8% to 14.2% for the remainder of 2023. HTGC’s core yield continuously increased from 11.1% in 1Q 2022 to 14.0% in 1Q 2023

Distributions are reliable

In the first quarter of 2021, due to higher interest income, Hercules Capital’s total investment income increased to $105 million (up 62% YoY and up 5% QoQ). The company’s net investment income increased from $36 million in 1Q 2022, to $62 million in 4Q 2022, and increased further to $65 million in 1Q 2023, up 81%. As HTGC’s number of basic shares outstanding increased from 118 million in 1Q 2022 to 135 million in 1Q 2023, its net investment income increased by 60% YoY to $0.48 in 1Q 2023. The company paid a distribution per common share of $0.47 in 1Q 2023 (a $0.39 quarterly distribution plus a $0.08 supplemental distribution), compared with $0.48 in 1Q 2022 (a $0.33 quarterly distribution plus a $0.15 supplemental distribution) and $0.51 in 4Q 2022 (a $0.36 quarterly distribution plus a $0.15 supplemental distribution). It is worth noting that in 4Q 2022, HTGC’s net investment income per common share was $0.47, slightly lower than in 1Q 2023.

On 14 February 2023, HTGC declared a new supplemental cash distribution of $0.32 per share, to be distributed equally over four quarters beginning with an $0.08 per share distribution for the fourth quarter of 2022. Thus, for 2Q and 3Q 2023, we can also expect a supplemental cash distribution of $0.08 in addition to the regular quarterly cash distributions. Before this new supplemental cash distribution, HTGC’s quarterly supplemental cash distribution was $0.15 per share.

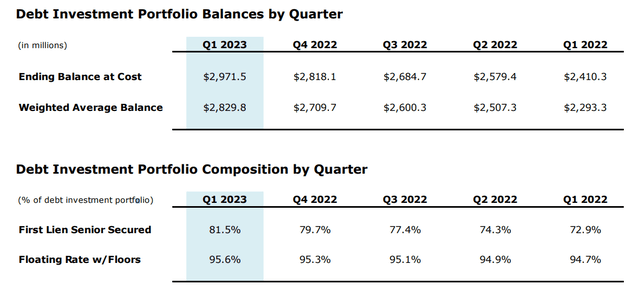

HTGC’s total investment income and net investment income reached a record high in 1Q 2023. Also, its total gross fundings reached a record high of $476 million (with net Hercules fundings of $355 million). Due to unscheduled early principal repayments or early loan repayments of $202 million (up 54.6% QoQ), HTGC’s total investment portfolio balance on a cost basis increased from $3006 million on 31 December 2022 to $3151 million on 31 March 2023. Figure 1 shows that HTGC’s debt investment portfolio balance at cost increased continuously in the past five quarters. Also, it shows that the share of first-lien senior secured debt investments increased from 72.9% in 1Q 2022 to 81.5% in 1Q 2023, implying lower credit risk.

In the second quarter, we will carefully navigate the tremendous market opportunity created by the recent banking crisis, utilizing the same guideposts that delivered our outstanding financial and credit performance in 2022 – maintaining strong liquidity, staying disciplined on credit and new underwritings and further expanding our platform capabilities,” the CEO explained.

The company’s financial position is consistent with a quarterly distribution of $0.39 per share in 2Q, 3Q, and 4Q 2023. It is too soon to talk about HTGC’s supplemental distribution in 4Q 2023 and beyond. However, as the company is benefitting from the market condition, at least, I don’t expect a distribution cut to happen in the following quarters. With a quarterly distribution of $0.39 per share and a supplemental distribution of $0.08 each quarter, HTGC has a dividend yield of 13%, which makes it a buy for me.

Figure 1 – HTGC’s debt investment portfolio balance

1Q 2023 results

Credit risk position

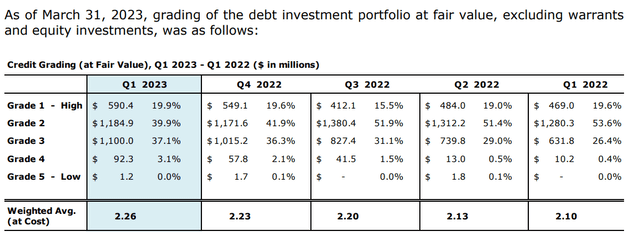

According to the grading of the HTGC’s debt investment portfolio at fair value As of 31 March 2023, the company has $590 million of debt investment with grade 1 (high quality), representing 19.9% of its total debt investment, $1185 million of debt investment with grade 2, representing 39.9% of the total, $110 million with grade 3, representing 37.1% of the total, $92 million with grade 4, representing 3.1% of the total, and $1.2 million with grade 5 (low quality), representing lower than 0.1% of total debt investment. Overall, it seems that HTGC’s debt investment portfolio is in a good position. However, compared with the first quarter of 2022, the weighted average grade of HTGC’s debt investment portfolio (at cost), has been impaired. In 1Q 2022, grade 2, 3, and 4 debt investments accounted for 53.6%, 26.4%, and 0.4% of the company’s debt investment portfolio, respectively. However, as the portfolio companies faced financial challenges driven by high interest rates, HTGC downgrade some of them as they were not meeting HTGC’s financing criteria or were underperforming relative to their respective business plan. It is worth noting that according to HTGC’s grading model, grade 2 means that the borrower is performing as expected. Grade 3 means that the borrower may be performing below expectations, and the loan’s risk has increased materially since origination. It also means that the borrower is approaching a low liquidity point and an expected capital raise is not imminent when an expected milestone has failed. Grade 4 means the borrower is performing materially below expectations, and the loan may experience some partial loss.

For me, the changes in the shares of grade 3 and grade 4 debt investment in HTGC’s total debt investment portfolio are so important. Interest rates increased significantly in the past year, and due to the high inflation rates, and tight capital market, the economic condition was not favorable for the companies that are at the first stages of their development. Thus, it is not surprising that some loans were downgraded from grade 2 to grade 3. The significant increase of the grade 3 loans ($1100 million in 1Q 2023 compared to $632 million in 1Q 2022), is not still frightening, as in the second half of 2023, the economic condition might become more favorable. However, the $82 million increase in grade for loans from 1Q 2022 to 1Q 2023, is not something that can be ignored. The interest rates are still high and there might be further rate hikes that make the situation harder for companies whose loans are categorized as grade 4. Thus, HTGC may experience some loan losses or some loss of interest. Nonetheless, 96.9% of HTGC’s debt investment portfolio is in an acceptable position, and overall, the company is not facing a significant credit risk.

Figure 2 – HTGC’s credit grading

1Q 2023 results

Comparison with the peers

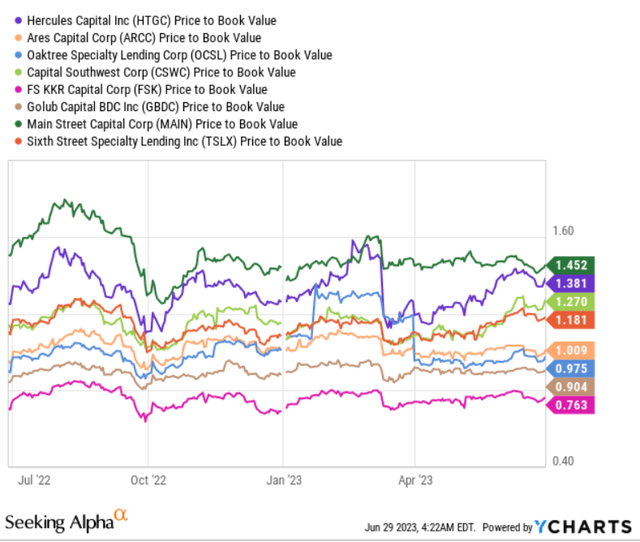

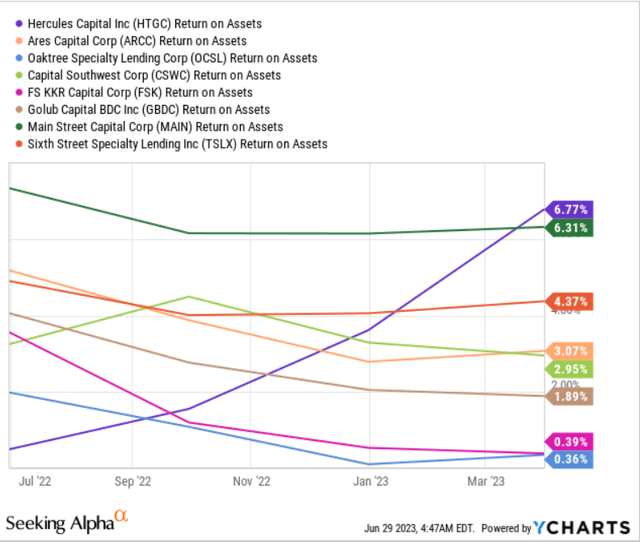

According to Figure 3, Hercules Capital’s P/B ratio is on average, higher than its peers. One might argue that HTGC’s higher-than-average P/B ratio could mean that the stock is overvalued. It could be an acceptable argument if it was a new thing. But, be mindful that Hercules capital has consistently maintained a premium to NAV, which creates a strong capital raising position to support its investment growth. In 2019, HTGC’s price to NAV was 1.33x and decreased to 1.19x in 1Q 2023. Meantime, its peer group price to NAV decreased from 1.00x in 2019 to 0.83x in 1Q 2023. My understanding is that as the market sees HTGC as a growing company, has accepted its higher-than-average P/B and P/NAV. Figure 4 is consistent with this understanding. We can see that HTGC’s return on assets increased significantly in the past year. A year ago, HTGC’s return on assets was lower than its peers. However, as of 31 March 2023, HTGC had a return on assets of 6.77%, higher Ares Capital (ARCC), Oaktree Specialty (OCSL), Capital Southwest (CSWC), FS KKR Capital (FSK), Golub Capital (GBDC), Main Street Capital (MAIN) and Sixth Street Specialty Lending (TSLX). HTGC’s return on assets’ significant growth in the past year reflects why the company’s higher-than-average P/B and P/NAV may not be a sign of being overpriced.

Figure 3 – HTGC’s P/B vs. peers

Ycharts

Figure 4 – HTGC’s return on assets vs. peers

Ycharts

End note

Hercules Capital has shown that it can benefit from the high interest rates. The company’s underwriters are continuously identifying and targeting growth tech-based companies, and HTGC’s net investment income can reach higher record levels by the end of the year. With a dividend yield of 13%, HTGC is a buy.

Read the full article here