Well, I am freshly back from a 5-day Walt Disney World adventure. It was a magical experience for my two children as it was their first trip to the house of mouse, but far less magical for my bank account as it felt like I was at the most expensive place on earth.

The parks were not lacking for attendance, however, which is an attribute to Disney’s (NYSE:DIS) strong brand and pricing power. With the recent buy rating reiteration and per-share price target of $135 issued by Bank of America, I decided to look further into Disney and compare it to 2014, when it first hit its current share price of ~$89.

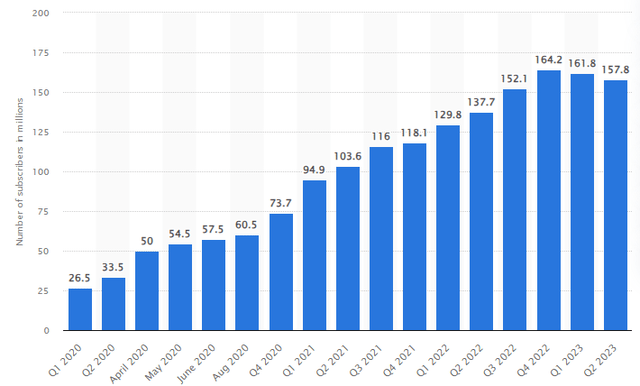

Tradingview

Purchasing Disney stock in August 2014 and holding it would result in an approximate 0% gain, excluding a few annual dividends. This stands in contrast to the S&P 500’s substantial increase of around 120% during the same period. However, Disney experienced its own significant run-up of over 100% following the pandemic flash crash, and it has received numerous buy ratings recently.

Looking at the financial position of the Walt Disney Company in 2014 compared to the present, there have been noteworthy changes. One significant change is the substantial growth in revenue. In 2014, Disney reported total revenue of approximately $48 billion, while today, the company’s annual revenue has reached around $80 billion. This growth can be attributed to successful acquisitions, strategic investments, and the launch of new ventures.

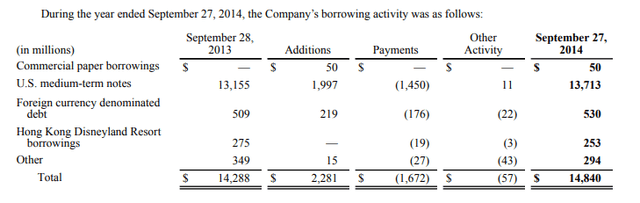

Acquiring major entertainment assets, such as 21st Century Fox in 2019, has significantly expanded Disney’s content library and strengthened its position in the global entertainment industry. Additionally, earlier acquisitions of brands like Marvel Studios, Lucasfilm, and Pixar have contributed to a diversified portfolio and increased revenue streams. However, these acquisitions have come at a cost, with the company’s borrowing activity increasing from $14.8 billion in 2014 to over $48 billion in 2022.

Disney 2014 Financials Disney 2022 Financials

In terms of interest income/(expense), net, there are notable differences between 2014 and 2022. In 2014, Disney reported a positive net interest income of $23 million. This was primarily due to lower effective interest rates, reducing the cost of borrowing, and gains on sales of investments. Additionally, income from late payments related to the settlement of an affiliate contract dispute contributed to the increase in interest and investment income. While an insignificant amount for a company generating billions of dollars, I like to highlight this small income as a testament to the company’s past efficiency.

In contrast, in 2022, Disney reported a negative interest expense, net of $(1,397) million. The interest expense remained comparable to the prior year, despite higher average interest rates, as it was offset by lower average debt balances. The increase in interest income, investment income, and other income was primarily driven by a favorable comparison of pension and postretirement benefit costs, excluding service costs. However, this increase was partially offset by investment losses compared to gains recorded in the prior year.

Apart from these financial aspects, there have been other developments impacting Disney’s position. One notable change is the decline in ESPN subscribers, which decreased from approximately 95 million in 2014 to 74 million in 2022. This decline can be attributed to various factors, including changing consumer preferences, competition from alternative streaming platforms, and cord-cutting trends.

The company’s share repurchase strategies have also shifted over time. In 2014, Disney had a publicly announced share repurchase program and purchased over 16 million shares helping to fund that strong rally, while in 2022, it no longer had such a program. Instead, the only shares purchased were on the open market to provide shares to participants in the Walt Disney Investment Plan (WDIP). This change indicates a shift in the company’s approach to share repurchases and capital allocation strategies.

In terms of earnings per share (EPS), there has been a decline from 4.31 in 2014 to 1.73 in 2022. This decrease in profitability on a per-share basis can be attributed to various factors, including the impact of the COVID-19 pandemic, temporary park closures, and disruptions in the entertainment industry. The increase in basic shares outstanding from 1,740 in 2014 to 1,822 in 2022 reflects dilution and new issuances of shares over the years.

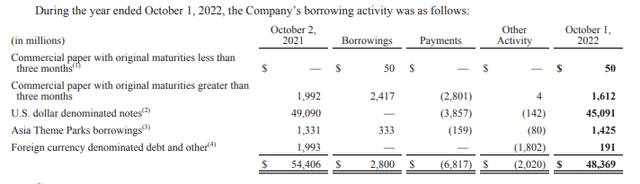

Overall, Disney’s financial position has evolved over time, with notable growth in revenue through acquisitions and strategic investments. However, challenges such as the decline in ESPN subscribers, a shift in share repurchase strategies, and a decrease in EPS highlight the company’s need to adapt to changing consumer behaviors and industry trends with the strongest entertainment trend being the rise in streaming services. In 2019, the company launched Disney+, its highly successful streaming platform. Disney+ has gained millions of subscribers worldwide and has been a major catalyst for revenue growth. The streaming service offers a vast array of Disney-owned content, including movies, TV shows, and original productions. By capitalizing on the growing demand for streaming services, Disney has been able to tap into a new revenue stream and enhance its financial standing. However, the streaming wars are far from over and Disney+ has lost subscribers the last 2 quarters.

Statista

There are a lot of headwinds against Disney today with fierce streaming competition and political challenges. The only positive development I have found in the last 9 years is the strong revenue growth, which appears to be at the expense of share dilution, increased debt burden, and reduced operational efficiency. There is strong hope that Robert Iger returning can right the ship and return Disney to its past efficiencies where even its less significant charges (i.e. interest going from a minor income to an expense) were in the positive. Still, the technicals do support a bullish thesis and I do believe in Disney’s brand and staying power. The best time to invest is always when there is blood in the streets so for my Disney investment; I am going with a LEAPS (Long-Term Equity Anticipation Securities) and using it to sell what is known as a Poor Man’s Covered Call.

The bullish technicals I mentioned previously can be shown below as there is a positive divergence on the RSI and price action has started a small bounce off an area of support.

Tradingview

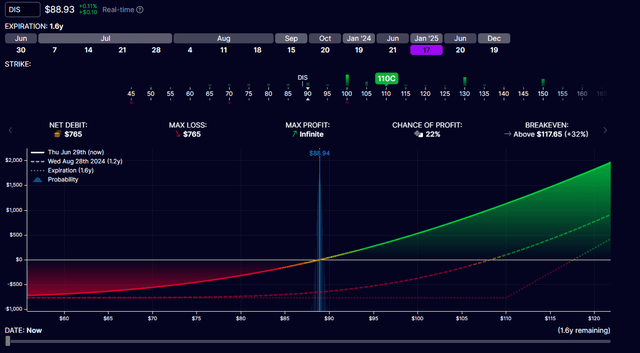

I have highlighted in the upper box Bank of America’s price target of $135 and it seems like a reasonable area as price as gravitated towards that zone in the past. A $110 strike is a past resistance area that will need to be overcome, but the expiration date on this option isn’t until January 2025.

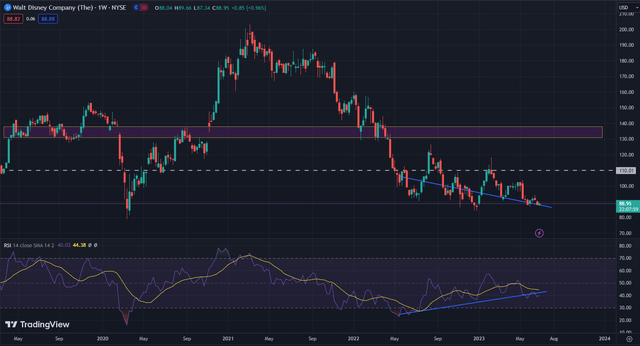

Optionstrat

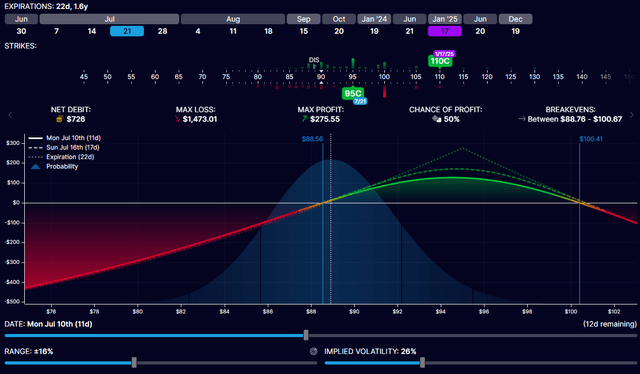

The $110 strike call for January 2025 is currently a $765 debit. Since Disney does have some challenges, I want to offset this cost by selling near dated calls. This is the portion that is known as the Poor Man’s Covered Call since traditionally, you would need to own 100 shares of the underlying to safely sell a call which can be quite capital intensive. But with the long dated option serving as coverage, you can sell short dated calls for weekly or monthly income, albeit only if they expire out of the money. I am not worried about slightly entering the money on the short option though; since that would mean a decent run-up and the entire position can be closed for a gain. A $95 July expiration would provide about 5% income on the initial $765 debit but there are also weekly options available for those who want to be more aggressive. The Poor Man’s Covered Call gives you protection against a consolidation period and can help offset losses if the share price declines further. My goal will be to recoup part of my initial investment while share prices still show weakness and then let it ride for the rest of 2024.

Trade Idea

Buy to Open $110 strike call January 2025 expiration

Sell to Open – Variable Call Strikes on a weekly or monthly basis

Optionstrat

Disney’s financial position has evolved with substantial revenue growth from successful acquisitions, although challenges like declining ESPN subscribers and decreased earnings per share persist. Despite these challenges, there is belief in Disney’s brand and staying power, supported by bullish technicals and a $135 price target from Bank of America. To mitigate risks, a Long-Term Equity Anticipation Securities (LEAPS) strategy, specifically a Poor Man’s Covered Call, can offset costs and provide potential income. Overall, Disney’s strong brand and strategic investments position it well for the future.

Read the full article here