Recommendation

Reynolds Consumer Products (NASDAQ:REYN) is a producer and vendor of household packaging materials. Aluminum foil, plastic wrap, oven bags, and slow cooker liners are just some of the products the company sells to aid in meal prepping, cooking, cleaning, and storing. I continue to recommend a hold rating for REYN given the valuation is still at the same level when I wrote about it previously – 19x NTM PE, which is expensive relative to its historical trading range. The same risk of multiples compression applies here, which I expect to continue, causing the stock to be range bound until valuation comes down.

Recovery mode

Higher incentive compensation and professional service fees roughly balanced out better revenue performance in the first quarter. While REYN’s management has expressed optimism that the company’s operational challenges will be resolved as it moves out of the second quarter, the spotlight is still on the Cooking & Baking segment. You may recall that REYN presented a recovery plan earlier this year to restore profitability to the Cooking & Baking segment, which had been hit by operational inefficiencies leading up to the 4Q that drove up manufacturing costs. This is obviously a very time-consuming process that necessitates new leadership, outside consultants, equipment redesign, etc. As a result, the impact has not yet been quantified. Nevertheless, it is heartening to learn that REYN has achieved its set target for 1Q23 to stabilize operations and improve operational efficiencies, which means they are on track. Therefore, I expect REYN to successfully move into the next stage of the recovery plan, which entails restoring margins. With the added benefit of cheaper metal costs in 2H, the segment will be in a better position to lap the issues beginning in the third quarter. Therefore, a significant profit inflection seems likely for the company in 2H.

The stock should remain rangebound until the market sees more concrete evidence that the company has turned the corner and that its margins have returned to their historical norms. If the recovery were to occur sooner than expected, REYN’s current valuation might not be justified. Historically, the Cooking & Baking segment has generated over $200 million in EBITDA, so extrapolating that number to the LTM would imply an increase of EBITDA of around $100 million, or around 20%. A 20% increase in net income results in an earnings multiple of 16x, which is 1x lower than the market average. Therefore, the outcome and timing of this recovery will be crucial to changes in stock price/valuation.

Forward outlook

As REYN’s business catches up to the easier comparison from last year, I anticipate a muted 2H23 price contribution to growth. Nonetheless, management has noted a more stable commodity price environment, which bodes well for a recovery in absolute gross profits as input cost headwinds begin to abate. Net-net, gross profit level should be net-positive as management intends to ramp up promotional activities, which I believe will drive topline growth. However, I am still unsure of how this will affect the EBIT line, as it will depend heavily on the performance of the Cooking & Baking division. Adj. EBITDA is expected to be between $605 and $635 million, according to guidance from management.

Valuation

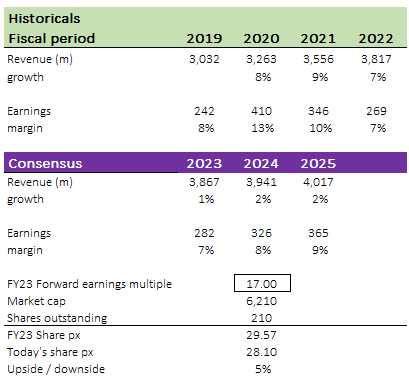

Using consensus estimates, I believe REYN is worth $29.57 in FY24, making the stock reasonably priced. I continue to have lack of visibility into REYN earnings cadence, as a result, my model still follows the same characteristics in that I expect valuation to revert to mean by the end of next year. That said, I would agree that the stock might become attractive if management mentions that they are ahead of the recovery plan, and provide a more concrete EBITDA improvement timeline (that beats consensus).

Own model

Risk

Green movement to non-plastic products

In recent years, businesses have felt more pressure than ever before to reduce their plastic production in response to growing environmental concerns. Since a large portion of REYN’s revenue comes from customers’ preference for plastics, any new legislation passed by the US government requiring people to reduce their consumption of plastic-ware could have a negative impact on REYN’s financial performance.

Commodity price volatility

Gross margin might see compression due to raw material price fluctuations because aluminum and resin make up such a large portion of REYN’s selling prices.

Summary

In conclusion, I remain uncertain about its EBIT cadence but express hope for the progress made so far. While there are operational challenges, the company has set targets to stabilize operations and improve efficiency, indicating a positive trajectory. The recovery plan, focusing on the Cooking & Baking segment, shows promise, with expectations of restored profitability and improved margins in the future. However, more concrete evidence is needed to justify the current valuation and trigger a potential stock price increase. The timing and success of the recovery will be crucial in influencing changes in valuation.

Read the full article here