Main Thesis/Background

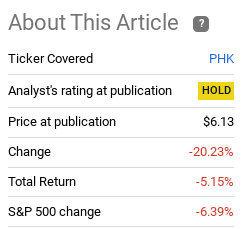

The purpose of this article is to evaluate the PIMCO High Income Fund (NYSE:PHK) as an investment option at its current market price. This is a CEF that I have often suggested readers avoid, and over time that has generally been the right call. As such, I review it less frequently than other CEFs that I actually own (or recommend) since the value proposition rarely changes. Still, it has been over a year and a half since I last covered PHK specifically – so I thought it was time to take another look at this high yielder. In retrospect, my passiveness towards this fund has been vindicated so far:

Fund Performance (Seeking Alpha)

Regardless, PHK still comes up on the radar because it offers a high distribution yield and has a premium that – while high – is lower than many of its peers from PIMCO. But after reviewing it today I still come to the same conclusion. PHK does have some attractive attributes, but I am reluctant to take on the risk posed by other metrics. With the economic cycle teetering on slower growth, now doesn’t seem to time to get too risk-on. This leads me to continue to place a “hold” rating on this security.

Valuation Since 2021 – Unchanged

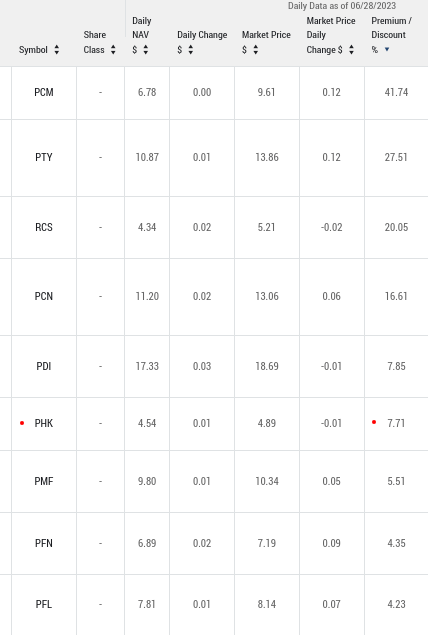

One interesting place to use as a starting point is the fund’s premium. As I mentioned above, it may not seem too crazy with compared to some of the PIMCO peers. But this alone doesn’t make me like PHK – it simply makes me dislike those other alternatives!

PIMCO’s Premiums (PIMCO)

In this regard a 7% (really closer to 8%) premium is a bit of a mixed bag. What basically counts is two factors. One, what other funds are you considering – the ones that are more or less expensive than PHK (whether from PIMCO or not)? And two, how important premiums are to you. This makes this analysis a bit subjective and quite frankly is dependent on the audience. I personally see a premium in the 7-8% range as a bit frothy. Others will surely disagree and that is fine.

Expanding on this discussion is an important point to note. Back in November 2021 and my last article on PHK, this premium metric has not budged! It sat at 8% at that time and still does today. We can’t necessarily draw any definitive conclusion from this but it does speak for itself a bit. Since the last time PHK sat at this range, the total return has been modestly lower. So there wasn’t a whole lot of value there. Today, I still see a similar story playing out given the macro-backdrop and the consistent valuation. This helps support the neutral rating I am giving it.

High Yield Has Been Doing Well – Justified?

I will now shift to a discussion on PHK’s largest sector by weighting. This is the high yield credit market and has consistently dominated this fund’s portfolio over time. Today, it represents almost one-third of total fund assets which is in-line with where it stood in my last article:

PHK’s Sector Breakdown (PIMCO)

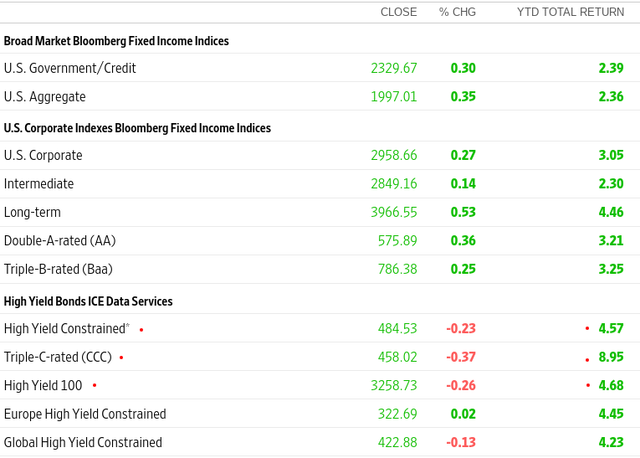

Clearly this fund is impacted by both high yield credit and mortgage debt in a big way. Fortunately, the riskier corners of the debt market have been easily outpacing their peers in terms of total return year-to-date in 2023. This isn’t relevant to the mortgage piece, but it does show how the high yield securities within PHK are helping the fund’s overall performance recently:

YTD Returns (Various Sectors) (Wall Street Journal)

What this might suggest is that junk debt is the place to be. Yields are high on a historical basis, returns are alpha-generating, and momentum could lead to more gains in the second half of the year. This is a very valid scenario.

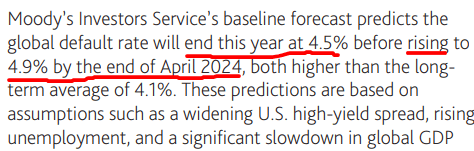

But there are concerns too. One is that these gains may signal it is time to take some profit. This is especially true if the economy is weakening at home and abroad. If tougher times are ahead, locking in profit where we found “alpha” in the first half of the year could be justifiable. And this is precisely what some analysts are predicting. According to a report from Moody’s, the U.S. trailing 12-month speculative-grade default rate rose to 3.1% in May, up from 1.4% a year ago. Worse, analysts are expecting this trend to continue next year:

Moody’s Forecasts (June 2023) (Moody’s)

This is where the challenge comes in. High yield is performing well – that’s the good news. But should it be? That’s a highly charged debate. Of course, analysts are often wrong and a marked uptick in defaults may not occur. That will result in lost opportunity if investors are too passive at this juncture. But I’m okay with that potential. I don’t see a lot of merit to buying in to a sector that has already had a nice run-up when there is a weakening backdrop and this fund – PHK – makes it expensive for one to have access to it. I don’t see any need to rush in here, again supporting a “hold” decision.

Mortgage Debt Also Has Mixed Outlook

The mortgage aspect of PHK’s portfolio is another area that has a bit of a push-pull dynamic. Mortgage bonds are generally seem as more stable for investors because some (agency) are backed by government agencies and most others are at least backed by the value of the underlying property. So they tend to be a more conservative play and one that can stabilize a broad-based CEF such as PHK.

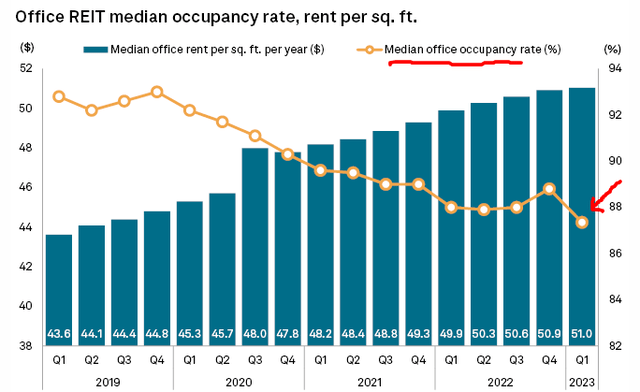

However, the mortgage market is a bit tricky right now. More so than usual. In the commercial space, we are seeing some holders walk away from their properties due to declining demand for office space and higher vacancy rates:

Commercial (Office) Occupancy Rates (US) (S&P Global)

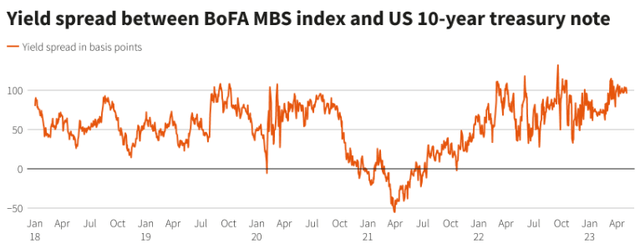

This is putting some pressure on existing mortgage holdings. Compounding this is that mortgage yields have been rising consistently through 2023 on the backdrop of Fed rate hikes. This makes pre-existing MBS less attractive by comparison if investors can pickup similar securities on the open market today that offer higher yields. The net result has been a general move away from MBS on the open market – causing a spike in spreads for the sector:

Current Spreads (MBS vs. Treasury) (Bloomberg)

There are two ways of looking at this as with most things in life. One way is the bull case – investors have been moving out of this sector and it is offering historically strong spreads. That is a valid argument. The flip side is that this is a weakening sector that investors are moving away from. That is a trend that could continue, setting up the sector for more losses.

The fact is there isn’t a strong buy/sell case in either direction. It is up to one’s individual outlook, their current holdings, and need for income. But in this type of environment I would be cautious at overpaying. To buy a CEF at a premium to NAV to own this exposure seems unwise with some headwinds here. If PHK had a cheaper buy-in price, I think getting exposure to MBS through it would make sense. But that isn’t the case today, again supporting a cautious view.

Income Metrics Are Concerning

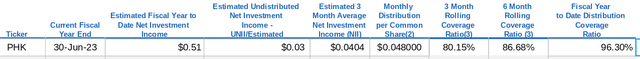

The next attribute I will look at is income production. As a high yield CEF, this is certainly of primary concern for buyers of the fund. With a distribution yield in the 12% range, this is sure to attract some attention. And the good news is there really isn’t a major cause for alarm on its sustainability. The income stream has been steady for a while and the fund has an income cushion in the bank (albeit a small one). This is balanced out a bit by coverage ratios that fall short of the 100% mark:

Income Metrics (PIMCO)

As with the other aspects of PHK I touched on in this review – income is a mixed bag. The current yield is high, the income cushion is settling, and the coverage ratios are not “terrible”. Is this is positive enough story to buy this particular fund? Again this is subjective. In my mind, it isn’t. A CEF at a premium should have a much more comforting income backdrop so me to be a buyer. But I am not an alarmist here either – which is why I am rating it “hold”, and not a more bearish sentiment.

The Leverage Use Is Lower Than Others In The PIMCO Suite

My last focus area is on the fund’s use of leverage. As my followers know, this has been an area where I am very hesitant to add right now. Leveraged CEFs in particular have been punished over the past year. The continued inversion of the yield curve makes borrowing at short-term rates to deploy those proceeds for longer-term securities a relatively unattractive proposition. This has limited the benefits of leverage and is a fundamental reason why many PIMCO CEFs have struggled of late – and may continue to in the second half of the year.

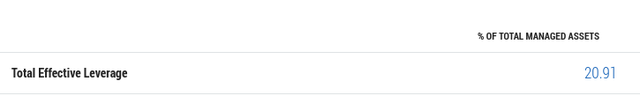

The good news with respect to PHK is that the fund’s use of leverage is not as dramatic as some. While a 20% effective leverage rate is not really “low”, it isn’t alarmingly risky either:

PHK’s Leverage (PIMCO)

When it comes to PIMCO CEFs, I would prefer the ones with a more manageable amount of leverage at the moment. So this would include PHK in relative terms. I don’t like most of the PIMCO CEFs at this juncture so don’t read in to this as a buy call – I am not contradicting my hold rating.

For perspective, other CEFs within PIMCO are quite spread in terms of their leverage. So we can use some of these options as a benchmark when determining if PHK’s leverage is high or not:

| Fund | Effective Leverage |

| Income Strategy Fund (PFL) | 27% |

| Corporate & Income Opportunity Fund (PTY) | 32% |

| Corporate & Income Strategy Fund (PCN) | 21% |

| Dynamic Income Fund (PDI) | 40% |

Source: PIMCO

My hope is this provides a baseline for comparison with PHK. Whether or not any individual fund or leverage amount is right for you is subjective. I would not fault anyone for wanting more or less leverage – that is entirely up to an individual’s risk tolerance. But it should show that in terms of leverage risk, PHK is near the bottom of the scale. That would be a supporting signal for a less risk tolerant investor to perhaps choose this one would another.

Bottom Line

PHK continues to struggle and I see that trend continuing in the second half of the year. There are some positive attributes, such as momentum in the high yield credit sector, a high distribution yield, and reasonable income metrics. But the premium price and use of leverage continue to suggest the risk-reward balance for this fund is difficult for a more value-oriented investor. I believe not enough has changed to warrant an upgrade on this CEF and have decided to reiterate my “hold” position on the fund at this time.

Read the full article here