Strategy

Launched by State Street Global Advisors, Inc. and managed by SSGA Funds Management, Inc., SPDR S&P Semiconductor ETF (NYSEARCA:XSD) invests in stocks of companies operating the United States semiconductor industry. XSD invests in growth and value stocks of companies across diverse market capitalizations, and it seeks to track the performance of the S&P Semiconductor Select Industry Index by using a representative sampling technique. The fund was incepted in 2006 and has accumulated an AUM of $1.54 billion. XSD uses an equal weighted approach to select and weight its holdings. The index is rebalanced on a quarterly basis.

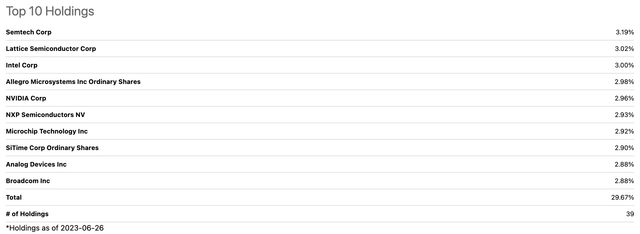

Holding Analysis

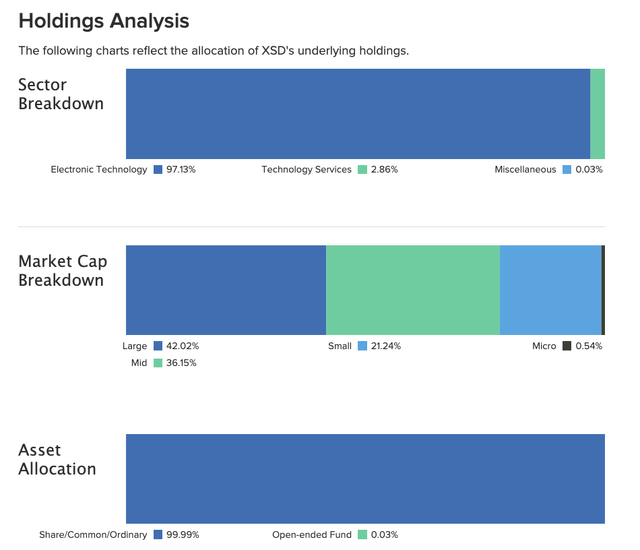

XSD invests in a total of 39 holdings, and as a result of its equal weighted approach, the fund’s holdings are equally distributed across all market capitalizations. The top 10 holdings only represent 30% of the entire portfolio, and the top 10 holdings range from 2.88% to 3.19% weightings. This can effectively reduce concentration risk especially in a highly concentrated sector like semiconductors. Moreover, the fund invests 42% of its portfolio into large-cap companies, 36% into mid-cap holdings, and 22% into small and micro-cap holdings. The fund invests almost exclusively in the United States, but it will allocate 3% each for companies in the Netherlands and the Cayman Islands.

Seeking Alpha

etfdb.com

Performance Analysis

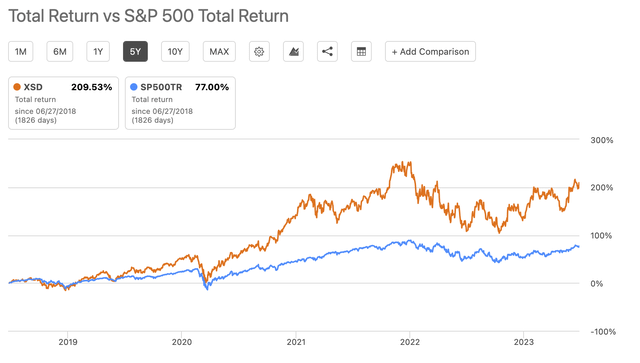

If we look at a 5 year total return comparison between XSD and the S&P 500, it is evident that the fund has historically outperformed the broader index. While both XSD and the S&P 500 reported similar returns up until 2019, the gap between began to grow in 2019 into 2020 as XSD began outperforming the broader market. After a sharp decline at the beginning of 2020 for both the S&P 500 and XSD, the fund’s rebound was significantly larger than that of the broader index. From there, the gap between the two grew significantly larger until their peak at the onset of 2022. It seems to me that XSD outperforms significantly during periods market uptrends, but performs significantly worse during bear runs, as shown by the graph below. Regardless, the fund still follows general peaks and troughs that the S&P 500 experiences, albeit at a more magnified level. XSD’s reports a total return of 210% in the past 5 years, whereas the S&P 500 is merely 77%. Moreover, XSD has a notably larger volatility than the S&P 500.

Seeking Alpha

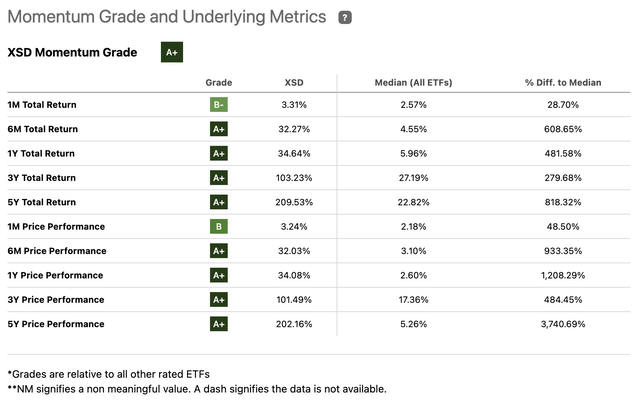

Seeking Alpha gives XSD a momentum grade of A+, and almost all of its underlying metrics also received a rating of A+, except for 1 month total return and 1m price performance. Regardless, every metric for XSD’s total return and price performance for all time frames beat the median of all ETFs. With that being said, for longer time frames, the fund typically will have a significantly larger differential to the median than for shorter time frames. XSD’s larger outperformance in the longer term suggests that the fund’s greatest strength is its long term growth potential.

Seeking Alpha

Weaknesses

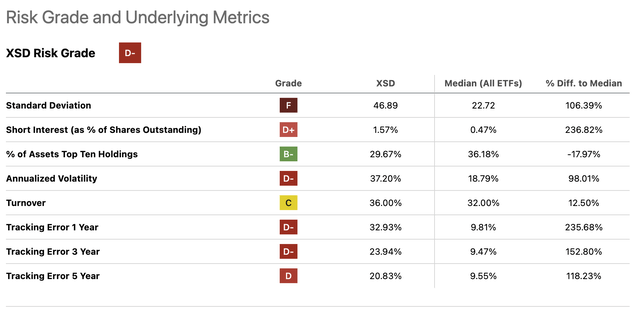

As seen in the graph comparing the total return of XSD and the S&P 500 above, it is obvious that XSD displays significantly more volatility than the broader index. There is definitely more fluctuation in its up and down swings, and this also contributes to its outperformance in bull markets and underperformance in bear markets. Seeking Alpha assigns XSD a risk grade of D-, and several of its underlying metrics hover within the D range as well. The fund’s standard deviation and annualized volatility are significantly larger, more than double, than the median of all ETFs. Its tracking error for 1, 3, and 5 years are all significantly larger than the median.

The only factor preventing the fund from having an even larger volatility is the fact that the fund employs an equal weighting strategy which results in a lower percentage of assets in the top 10 holdings than the median. This helps the fund reduce concentration risk, but that does not seem enough to significantly reduce the fund’s volatility and risk. While the fund’s larger allocation to small and mid-cap holdings may seem like it adds diversity to the fund, this unfortunately contributes to more volatility as larger chip companies tend to have more stable revenues and customer bases.

Seeking Alpha

US – India Chip Collaboration

The United States and India have an ongoing partnership in supporting the growth and development in each other’s respective semiconductor industries. In March, India and the US established a semiconductor supply chain and innovation partnership under India’s framework. The agreement will establish a secure collaboration between the two countries to uphold semiconductor supply chain resiliency and diversification. This was especially important in light of the passing of the US CHIPS and Science Act and India’s Semiconductor Mission.

Moreover, several prominent semiconductor companies have announced extensive investments in India’s chip industry. Most notably, Micron Technology (MU), one of XSD’s holdings, has confirmed its investment of up to $825 million in a new chip manufacturing facility in Gujarat India. Applied Materials (AMAT) has announced its plan to invest $400 million into a new chip engineering center in India. The company plans to pay out this investment throughout the next 4 years.

The partnership between the two countries and the investments made by these prominent semiconductor companies will create a symbiotic relationship that will largely benefit both the US and India’s semiconductor industries. Semiconductors is a highly competitive global market, with east Asian countries like China, Japan, and South Korea, dominating the global market. This partnership will strengthen the United States as a global leader in the semiconductor space.

Decline In Demand For Consumer Electronics

In addition to the recent slowdown in semiconductor supply chains worldwide, the sector is now facing a decline as there is a drop in demand for consumer electronics such as computers, smartphones, gaming devices, etc. The Future of Technology expects that consumer electronics sales will decline by 5% year over year in 2023 and 2024. This has been an ongoing trend prior to 2023, when demand for electronics slowed dramatically in a post-pandemic environment. However, I still believe that this drop in demand will have minimal impact on large-cap semiconductor companies. XSD has only experienced a downtrend in 2022, during times where the largest industries also experienced slumps. The fund has been on consistent bull run since late 2022.

Conclusion

Overall, XSD is one of my favorite semiconductor ETFs. It is one of the only funds that I have covered recently that has historically outperformed the S&P 500 and has positive momentum across the board for all time frames. The fund has demonstrated significant long term growth potential based on its impressive growth in the past 5 years, being up nearly 200%. Given my hypothesis that the fund outperforms during bull markets, right now would be an optimal time to buy in order to capitalize on this emerging bull market. As long as macroeconomic conditions improve and the S&P 500 remains on its uptrend, XSD would be a profitable investment choice. I rate XSD a Buy.

Read the full article here