The CBOE Volatility Index has been in a downtrend after spiking at the onset of the pandemic; a trend that has accelerated since at least October of last year. The index is now trading at levels not seen since late 2019/early 2020. The index as calculated and published by the CBOE is currently at about 13.50. For context, its lowest level over the last 30+ plus years was November 3, 2017, when it reached 9.14.

The mean value for the VIX since January 1990 is 19.65 with a standard deviation of about 7.94. This tells us a couple of things: 1) The current level of the VIX is below average, but within 1 standard deviation of the mean, and 2) the volatility index itself is volatile.

Despite its low level and identifiable potential risks to the financial markets, using the VIX to hedge against the unknown is not an efficient way to hedge. The first issue is with gaining exposure to the index itself. Rather than own VIX futures, most investors will purchase a fund that tracks the index. One of, if not the most popular, is the iPath Series B S&P 500 VIX Short-Term Futures ETN (BATS:VXX).

VXX’s objective is to provide exposure to the movement of VIX futures that are meant to measure the return volatility of the S&P 500. The VIX index is constructed using prices of S&P 500 puts and calls across strike prices and expirations with average weighted exposure targeting a constant 30 days. I will discuss more details regarding the index construction, and specifically how rising interest rates impact the index value below.

Potential Market-Moving Risks

There are countless known and unknown risks that have the potential to move markets. Despite that, volatility has been low and falling. Based on this reality, it appears that the stock market may be either more resilient or has grown complacent.

The following is only a small sample of what is currently known and could be of sufficient magnitude to move markets.

The latest news out of Russia is troubling and could lead to greater problems

The ongoing war in Ukraine has the potential to become a greater global issue. While an escalation and use of nuclear weapons would be catastrophic, there are many other outcomes that could also cause severe disruptions. Not only are Ukraine and Russia significant producers and exporters of wheat, corn, and fertilizer, but Russia is also a major producer of nickel and cobalt, two major elements used for renewable energy and EVs. The war in the region is disruptive to this production and its exportation. Any escalation could cause these supply lines to be severed as well as causing wider destabilization in the region. The recent alleged attempted coup by private mercenary Wagner Private Military Company in Russia fizzled fast but highlighted that risks can arise quickly with the potential to exacerbate an already tense situation.

China’s plans for taking over Taiwan

The desire of the Chinese government to “unify” Taiwan with mainland China, by force if necessary, has caused greater tension between the two countries and between China and the rest of the world. Taiwan has been independently governed since 1949 and its current president has made it clear that it does not want to be “unified” with China. The U.S. has indicated that it will back Taiwan’s independence and provide military support if/when necessary. Although there are more questions than answers, this situation has the potential to escalate quickly. Like with Russia, China is also a major producer of key commodities used in renewable energy generation and EVs, including vanadium, graphite, molybdenum, aluminum, lithium, and a smaller, but important share of copper.

U.S. monetary policy

The rapid tightening of U.S. monetary policy has strained certain areas of the economy and has the potential to create further issues in the future. The aggressive rate hikes over the 16+ months caused several bank failures in March of this year and have contributed to rising housing costs. The ripple effects of higher rates and higher vacancies are expected to be felt in other areas of real estate, namely office. Many owners of office properties, who are already facing shrinking cash flow, will be forced to refinance debts at higher interest rates supported by lower cash flow due to higher vacancy rates. For some companies in that space, the result will likely be forced and/or fire sales of assets or possible bankruptcy.

But what we don’t know is how the broad economy and financial markets will ultimately respond to a shrinking money supply as measured by M2. The money supply in the U.S. has not shrunk since the 1930s so there isn’t a lot of data to work with. The consequences could be severe, and investors would be wise to prepare their portfolios for a range of possible outcomes.

Unknown risks

The last item that should be included in any list of known risks is the possibility of unknown risks, sometime referred to as unknown unknowns. These are the risks that are lurking in the shadows, potentially developing into black swans, market-moving events that are currently unknown and largely unpredictable.

The purpose of mentioning these few examples is not to create fear, but to highlight the fact that there are many known sources of risk and market volatility that just haven’t mattered yet. This highlights the importance of portfolio positioning and hedging where needed. However, it also shows that hedging must be done efficiently as the timing of risks is unpredictable. That unpredictability of timing disqualifies VXX as a good hedge as its value is eroded over time as explained below.

Recent Performance

As mentioned at the outset of this article, performance has been negative for an extended period. This is driven by relative quiet in financial markets as well as some mechanical factors that erode value over time. This is also a good place to emphasize that even if you disagree with my perspective on VXX, it should not be purchased as a long-term investment (ever.) It is meant to be held for short periods (if at all) to be used as a hedge against potentially higher volatility in stocks.

Year-To-Date Total Return (Seeking Alpha)

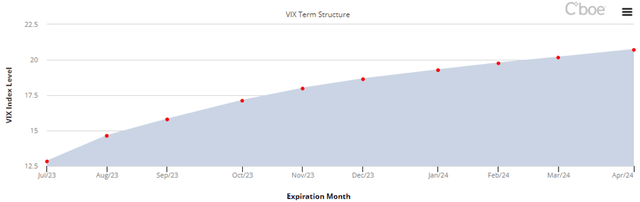

Trading in futures contracts can erode value over time. VIX futures are traded similarly to those in commodities, currencies, etc. If the term structure of those futures contracts is in contango, in other words priced higher for longer expiration dates and therefore upward sloping, then the index experiences what is referred to as negative roll yield. A negative roll yield occurs when the front month futures contract must be traded and replaced with a longer dated contract. Because the curve is in contango, that longer dated contract costs more, resulting in losses to the index. This creates an additional headwind for holders of VXX and similarly structured funds that generally results in declining share prices to the point that the issuer is forced to conduct reverse stock splits. For VXX, it has completed two reverse stock splits since April of 2021. In March of 2023 and April of 2021, VXX reverse split 1:4 each time. That means that 4 shares became 1 twice in two years.

VIX Term Structure (CBOE)

Impact of Interest Rates

Option prices are directly impacted by interest rates. Without diving too deep into the details of the mechanics explaining the effect, rising rates create a headwind for put prices and tailwind for call prices. This dynamic has the potential to suppress the index’s estimate of market volatility as the index is derived from aggregating the weighted prices of puts and calls. Looking at the generalized formula for the index calculation from CBOE also shows that a higher interest rate will result in a lower VIX value, all things equal (see page 5 in the linked PDF.

Risks

In addition to the challenges with VXX mentioned above, the following is a more direct summary description.

1. Tracking error – This will always be an issue given the construction of the ETN and the underlying index it tracks. In VXX’s case, there was a situation last year during which an administrative error at Barclays resulted in the company being unable to sell additional shares until receiving SEC approval to do so. In the meantime, the existing shares lost value and the tracking error relative to the underlying index widened. Although there is a lawsuit pending, that issue should not impact existing shares or shareholders in VXX.

2. Negative roll yield – When buying any futures contract or constructing an index based on those future contracts, if the term structure is in contango, then there will be a negative roll yield. The consequence of this is an erosion of value over time. This is another reason why VXX and similar securities are intended for short-term trading and are not suitable for a long-term investment.

3. Wrong timing – given the erosion of value in the absence of a sharp uptick in market volatility, the timing of trades in VXX is important. However, due to the unpredictability of market-moving events, correct timing is near impossible and being early or holding VXX long-term is costly.

4. Low volatility persists – low volatility can persist for longer than expected, making a position in VXX in costly. Volatility can continue to decline and even break below the November 2017 low, resulting in capital losses for VXX shareholders.

5. ETNs are subject to credit risk – ETNs are technically debt instruments backed by the issuer and therefore carry credit risk, in this case Barclays Bank PLC. This is a low probability risk, but one that investors should be aware of prior to purchasing a position in VXX or any other ETN.

Why Would Anyone Buy VXX?

If VXX could be structured to avoid erosion of value from the negative roll yield and other issues, there would be (at least the potential) some hedging benefits.

1. Relatively cheap today – As measured by the CBOE Volatility index, the expected return volatility for the S&P 500 is well below its long-term average and quickly approaching multi-year lows despite numerous known potential causes of market disruption.

2. VXX does not expire – Unlike put options that have an expiration date, VXX is perpetual. That said, given the structure and mechanics of the fund, value will evaporate over time without a jump higher in volatility in the short run.

3. Not a binary outcome – Even if a trade in VXX is directionally incorrect or the timing off, the value of the position will not go to $0.

4. Hedge strategic allocations – Theoretically, allows investors to remain invested for the long-term while hedging against short-term risks. However, there are better ways to accomplish this objective without using VXX.

Portfolio Strategy

Do not buy VXX.

I rate VXX as a ‘STRONG SELL’.

However, . . .

. . . if you do feel inclined to buy VXX, then please limit the position size to no larger than a couple percent of your equity allocation. If you decide to buy this fund, then you will also have to choose an entry point and target price to exit. Despite the risks to financial markets highlighted above, VXX has been steadily declining for more than 3 years. What could make it change direction? And more importantly, when?

If you do purchase VXX, and the trade works, then the position needs to be trimmed back to its initial size or sold completely. Like many hedging strategies, once the trade “works” investors need to be disciplined enough to take the gains off the table and redeploy elsewhere in the portfolio.

Final Thoughts

This is the first article I have written for Seeking Alpha in which I have a ‘Strong Sell’ recommendation. VXX and similar securities appear to provide a useful function on the surface but fall short due to their structure and execution. Simply put, the risks to owning VXX outweigh any potential benefits. In many ways, it is surprising that securities like this are allowed to be sold to the general investing public. I suspect that the influence of large financial institutions that issue this type of security plays a major role in their legality. Despite over promising and under delivering, they serve as a nice revenue source for the issuers.

While my typical caveats (“As always, this suggestion should be considered within the broader context of strategic asset allocations as well as personal needs and constraints. Any overweight or underweight positions need to be considered carefully to understand the impact on long-term total returns.”) remain valid, hopefully they will not be needed in this case.

Thank you for reading. I look forward to seeing your feedback and comments below.

Read the full article here