Stocks were mixed Thursday after first-quarter gross domestic product was revised higher and weekly jobless claims declined more than expected, signaling a resilient U.S. economy.

These stocks were making moves Thursday:

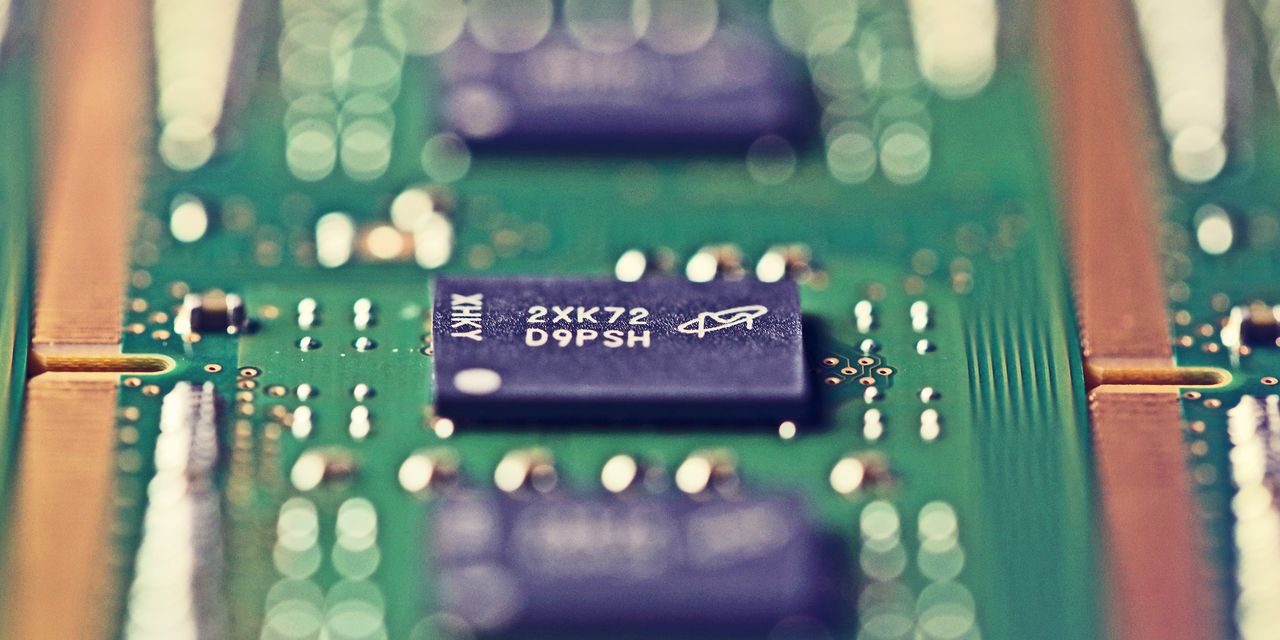

Micron Technology

(ticker: MU) reported a fiscal third-quarter loss that was narrower than expected by analysts. The memory-chip maker issued a fourth-quarter revenue forecast of about $3.9 billion, plus or minus $200 million, and said it anticipates an adjusted loss of $1.19 a share, plus or minus 7 cents. “We believe that the memory industry has passed its trough in revenue, and we expect margins to improve as industry supply-demand balance is gradually restored,” said

Micron

CEO Sanjay Mehrotra in a statement.

Analysts at Piper Sandler upgraded Micron shares to Neutral from Underweight and raised their price target to $70 from $45. However, the stock was falling 4.2% to $64.27. Earlier this week, The Wall Street Journal, citing people familiar with the matter, reported that the Biden administration is considering more restrictions on selling artificial intelligence chips to customers in China.

JPMorgan Chase

(JPM) rose 2.5%,

Bank of America

(BAC) gained 2.5%, and

Wells Fargo

(WFC) was up 3.2% after the Federal Reserve’s annual stress test showed that the U.S. banking system remains strong. All 23 banks that participated in the test this year were able to stay above their minimum capital requirements despite facing a theoretical loss of $541 billion in the test’s hypothetical recession.

FREYR Battery

(FREY) jumped 19% after the battery cell production company was upgraded to Overweight from Equal Weight at

Morgan Stanley.

Overstock.com

(OSTK) jumped 18% after completing the acquisition of the

Bed Bath & Beyond

brand and certain intellectual-property assets of the bankrupt retailer for $21.5 million.

BlackBerry

(BB) reported first-quarter adjusted earnings of 6 cents a share, beating analysts’ calls for a loss of 6 cents. Revenue in the quarter rose to $373 million from $168 million a year earlier and topped expectations of $161.1 million. Shares of the security-software developer jumped 12%.

Virgin Galactic

(SPCE) was falling 3.1% ahead of the space-tourism pioneer’s first commercial space flight. The flight, dubbed Galactic 01, can be watched via live stream at 11 a.m. Eastern time.

Unity Software

(U) was down 2.7% even after JMP Securities initiated coverage of the game-development company with a Market Perform rating.

McCormick

(MKC) lost 2.4% after the spice maker posted second-quarter sales that landed a bit below expectations. It also raised its full-year profit forecast to a range of $2.60 to $2.65 per share, up from a prior range of $2.56 to $2.61. Analysts are expecting $2.65 per share.

Snowflake

(SNOW) lost 1.7% to $180.70 even after the software company, which enables customers to remotely store and analyze large quantities of data in the cloud, received a price target raise to $203 from $165 at

Barclays.

Earnings reports are expected Thursday from sports apparel and equipment giant

Nike

(NKE).

Write to Joe Woelfel at [email protected]

Read the full article here