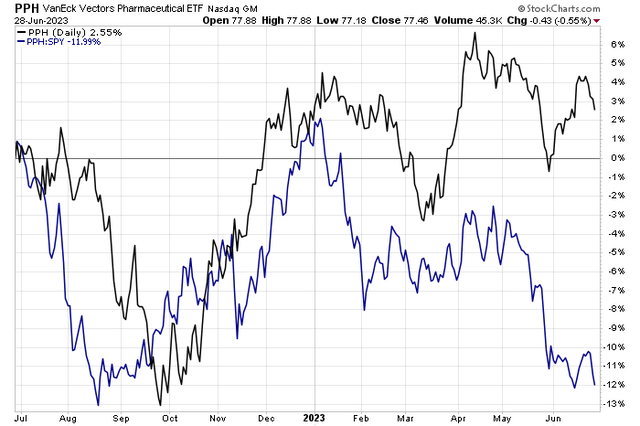

Pharma stocks performed well compared to the S&P 500 (SP500) during the final few months of 2022. Relative returns of the sometimes-defensive niche of the stock market have suffered this year, however. The VanEck Pharmaceutical ETF (PPH) is down about 14 percentage points on the SPX YTD.

One of these healthcare equities is likewise stuck in a sideways trend, but I see upside potential in Sanofi (NASDAQ:SNY) given a low current valuation and a building pipeline of drugs, headlined by Dupixent.

Unloved Pharma Stocks in 2023

Stockcharts.com

According to Bank of America Global Research, Sanofi is a global pharmaceutical company headquartered in Paris, France. It has 4 divisions: Specialty Pharmaceuticals (with a focus on atop allergic disorders, oncology, and, through the acquisition of Genzyme, rare diseases), Vaccines, General medicines, and Consumer Health. Sanofi is present in most geographies worldwide deriving its sales from U.S., Europe, and RoW/emerging markets in roughly equal portions.

The Paris-based $135 billion market cap Pharmaceuticals industry company within the Health Care sector trades at a low 15.0 trailing 12-month GAAP price-to-earnings ratio and pays a high 3.5% dividend yield, according to The Wall Street Journal. Implied volatility is low at 19%.

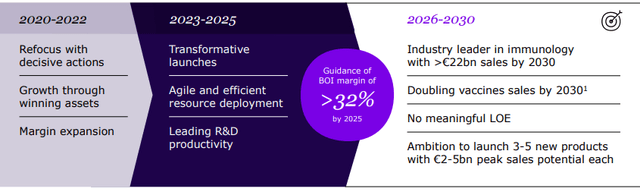

With a new management team in place and a solid pipeline, helping to drive potential future bullish catalysts, Sanofi appears to be in a good spot for future growth. We will hear more details at its Vaccines Day today (June 29).

June 29: SNY Vaccines Day

Sanofi

Earlier this month, SNY said they were “all in” on artificial intelligence and data science to accelerate breakthroughs for patients. Its Plai app is expected to deliver real-time, reactive data interactions and gives an unprecedented 360° view across all the company’s activities. Shares rallied during the middle of the month after a bearish price trend in the preceding weeks.

The stock topped out in April when SNY reported a bottom-line beat, but strong short-run profits were partially driven by some one-offs and divestments. Key to watch with SNY is, of course, its blockbuster Dupixent drug – its sales grew a whopping 43.5% YoY to 2.32 billion euro. Dupixent is seen as the primary potential EPS upside for the company while adverse currency moves and litigation concerns are downside risks to consider.

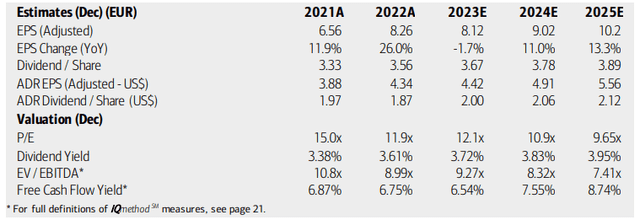

On valuation, analysts at BofA see earnings falling fractionally this year before EPS is seen as rising at a solid low-double-digit rate in the out year through 2025. Earnings attributable to the ADR shares are expected to rise in 2023 with robust growth over the coming quarters, too. Dividends, meanwhile, are forecast to rise at a steady pace.

With low-teens earnings multiples during this per-share profit soft patch, anticipated future advancements are attractive. What’s more, SNY trades at a low EV/EBITDA ratio of around 9 compared to the S&P 500’s average near 14. Lastly, I like the firm’s strong free cash flow (“FCF”) track record. The FCF multiples should dip to the mid-teens should the stock price hold in the low $50s. Sanofi is a cash cow with strong profitability trends, too.

Sanofi: Earnings, Valuation, Free Cash Flow Forecasts

BofA Global Research

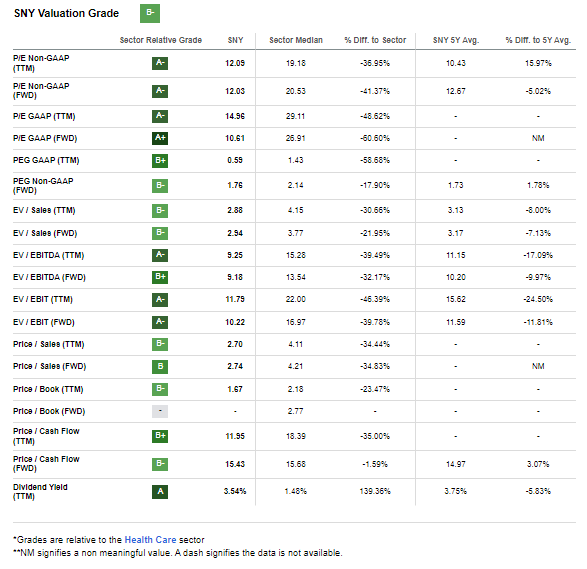

If we assume a normalized EPS growth rate of 10% and use the current 12.0 forward operating earnings multiple, then we are talking about a PEG of just 1.2 – that is at a 30% discount to its 5-year average. Now, that bullish assertion must be tempered with the realization that SNY’s forward non-GAAP P/E is right near its long-term average. Thus, I conclude that a fair value is about 15% above the current price, so a $62 valuation is fair, making it a buy.

SNY: Favorable Valuation Metrics Across the Board

Seeking Alpha

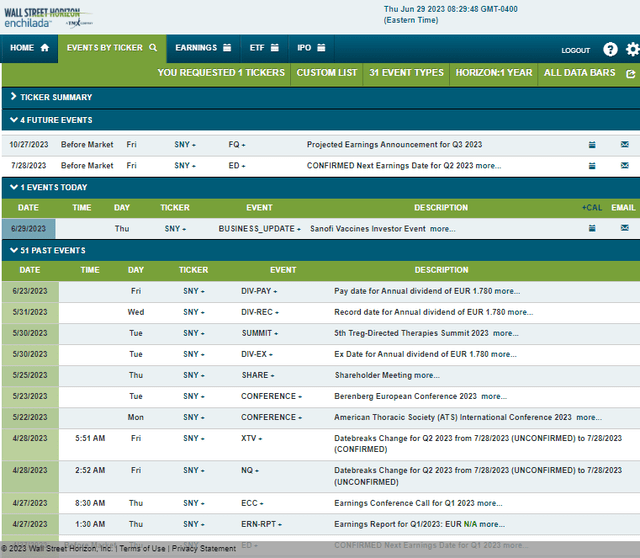

Looking ahead, corporate event data provided by Wall Street Horizon show a confirmed Q2 2023 earnings date of Friday, July 28 BMO. Today, though, the firm hosts its Vaccines Investor Event from 9 a.m. to 12 p.m. ET, so be on the lookout for potential volatility, though the slide deck is already posted, so big undisclosed information may be unlikely.

Corporate Event Risk Calendar

Wall Street Horizon

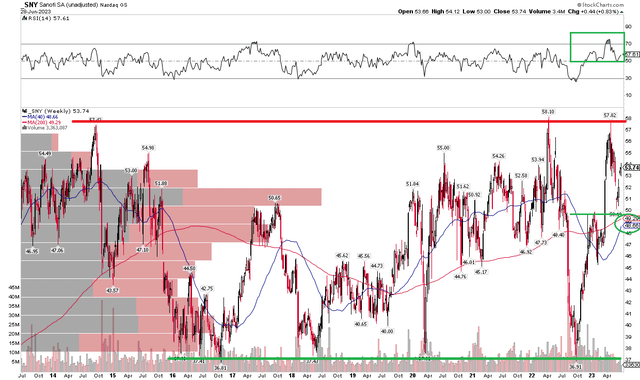

The Technical Take

With a solid pipeline and favorable valuation backdrop, the setup on the chart is less sanguine. Notice in the chart below that shares are simply rangebound for the last decade. There’s ongoing resistance in the mid to high $50s, while long-term support is seen in the mid-$30s.

Nearer term, I see support emerging near $50 – and that is where the rising 200-week moving average and 40-week moving average (equivalent to the 200-day moving average) come into play. Moreover, the RSI momentum gauge at the top of the chart has marched into bullish territory, ranging from 50 to 80. Also, I spot ample volume by price in the $47 to $52 range, which should offer a cushion on any downside moves as 2023 progresses.

Ultimately, we need to see price action prove itself. A bullish breakout above $58 would help trigger what could be a significant upside run. For now, it is a hold technically until we see that breakout.

SNY: Long-Term Trading Range, Low $50s Support Emerging

Stockcharts.com

The Bottom Line

Putting it all together, I have a buy rating on Sanofi stock. I assert the valuation case and SNY’s pipeline with a dabble into AI are solid-enough positive features to offset the neutral chart.

Read the full article here