Investment Thesis

Constellation Brands (NYSE:STZ) is a global producer and marketer of wine, beer, and spirits with operations in the U.S., Mexico, Italy, and New Zealand with powerful, consumer-connected, high-quality brands. It’s the third-largest beer company in the U.S. and continues strengthening its leadership position as the best high-end beer supplier and the lead share gainer across the U.S. beer market.

Amidst the global inflationary pressures, the company delivered a solid performance in the fiscal year 2023 through its strategic initiatives, which center on continuing to build powerful brands that people love, introducing consumer-led innovations that address emerging trends, consistently shaping its portfolio for profitable growth, and deploying capital with discipline while balancing priorities.

Looking at its financials, the company realized losses in its net profit in the last financial year. However, the losses could originate from its growth-oriented spending on reinvestments. Given the compelling opportunities, I’m upbeat on the stock, but its current valuation shows that the company is trading at a premium, warranting a hold rating to exploit the potential upside.

Segment Analysis

The company operates two primary key business units: Beer, wine, and Spirits, contributing 79%, 18.2%, and 2.8%, respectively, in the 2023 financial year. In this section, we will understand each segment’s performance and branding position in relation to the market.

Beer segment

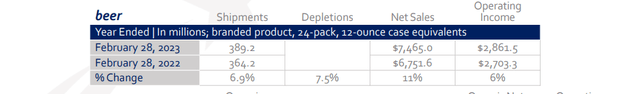

The beer business is STZ’s largest business unit. The segment contributed 77% and 79% of net sales in the 2022 and 2023 financial years, respectively. It delivered double-digit net sales growth (11%) and its 13th consecutive year of shipment volume growth. It has extended its lead as the number one high-end beer supplier in the U.S. and as the leading share gainer in IRI channels with a 12% increase in dollar sales.

Constellation Brands website

Depletions increased by nearly 27 million cases, representing 7.5%, and delivered net sales and operating income growth of 11% and 6%, respectively, above the guidance range.

Zooming into the segment anchor brands:

- Modelo Especial brand maintained its top leadership position as the top share gainer and the lead high-end beer brand in the category, increasing depletions by 9%.

- The Corona Extra brand was the third largest share gainer and the number three high-end beer brand, increasing depletions by nearly 4%.

- Pacifico brand is the fastest-growing major beer brand.

STZ’s capital investment in the last financial year, 2023, was over $800 million, which supported the ongoing expansions to grow capacity at Obregon and the continued development of the new ABA alcohol production line at Nava. Increasing production capacity in Mexican breweries allows the company to grab the opportunity to expand further its leadership position in the high-end segment of the U.S. beer market. During Fiscal 2023, brewery optimization and productivity initiatives unlocked incremental capacity from the existing footprint, increasing total capacity from approximately 39 million hectoliters to around 42 million hectoliters. Additionally, the company is setting up a new plant in Veracruz. The plant is expected to grow the company’s participation in the U.S. East Coast market. Currently, Constellation Brands exports around 400 million cases of beer every year. It expects to increase this number by 50% and reach 600 million boxes annually, propelled by the break necking expansion initiatives.

Further, it’s exciting to note that several consumer-led innovations are currently hitting the market, including Modelo Oro, which exceeded external and internal benchmarks in three test markets, and Corona nonalcoholic, which addresses the rapidly growing betterment trend. This drinking trend focuses on mindfulness and moderation. According to recent data from Horizon Media, 15% of U.S. adults 21 and over have chosen to reduce their drinking in the past two years, and 60 % are under 35. The new product will benefit from this growing market as the company continues to deploy capital to enhance its growing capacity to meet the anticipated continuing robust demand for its products in the near and long term.

The wines and spirits segment

The wine and spirit segment is a leading, higher-end wine and spirits company in the U.S. market, with a portfolio that includes higher-margin, higher-growth wine, and spirits brands. The grapes purchased from independent growers, mainly in the U.S. and New Zealand, and vineyard holdings in the U.S., New Zealand, and Italy support the wine portfolio. The wine and spirits are primarily marketed in the U.S. and sold in Canada, New Zealand, and other major world markets.

In the U.S., the company has seven of the 100 top-selling higher-end wine brands, with Meiomi and Kim Crawford achieving the fourth and eighth positions, respectively.

Constellation Brands website

The segment, over time, has transformed from a U.S. wholesale business, mainly serving the mainstream segment, to a global Omni-channel competitor with a higher-end focused portfolio. They reshaped their portfolio to the higher end, divested several residual mainstream brands, and acquired a smaller, higher-end wine brand and a ready-to-drink cocktail brand. Of note, the recent acquisition of My Favorite Neighbor portfolio is delivering substantial growth and performing above the initial expectations.

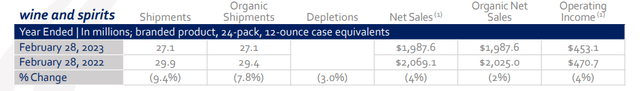

Focusing on its performance in fiscal 2023, while net sales declined just under 4%, a large part of that was due to the recent divestiture of primarily mainstream brands. And despite the strong performance of the higher-end brands on an organic basis, net sales declined by 2%, mainly driven by lower demand for the mainstream brands.

The fine wine and craft spirits brands also delivered solid shipment growth, driven primarily by The Prisoner Wine Company brands and High West and by strong performance in Direct-to-consumer [DTC] channels and international markets.

Financial performance

Zooming in on the financial front, the company has registered solid performance. The company’s net sales increased by 7%, largely due to an increase in Beer net sales driven primarily by shipment volume growth and a favorable impact from the pricing.

A net loss of $ 71 million is attributable to higher operational and logistics costs within both the Beer and Wine and Spirits segments and the increase in Beer investments. The growth-oriented spending pressured the profit margins.

While the earnings and EPS growth rates were near -43% each, the future growth is estimated to be 30% and nearly 27%, respectively. My assertion is based on the tremendous growth prospects that the company presents through strong brands, product innovation in line with customer preference and industry trends, and capacity expansion.

The company’s commitment to pay dividends to shareholders has remained solid over the last seven years. Dividends are paid from earnings, so an increase in earnings translates to high dividends. The steady growth in dividend payments is a green shoot for investors while at the same time raising concern about how sustainable dividend payments are for STZ since the company is making losses.

How strong is the balance sheet?

Constellation has current liabilities of $2.9 billion and long-term liabilities of $15.9 billion. Offsetting this, it has $133.5 million in cash and nearly $1 billion in receivables due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by nearly $17 billion. However, the short-term assets can adequately cover short-term liabilities, given its 1.1x current ratio.

The average operating expenses in the last three quarters stood at $466. Given the current cash position of $133.5 million, the company’s cash position is in distress to cover operating expenses in the next quarter. Further, its debt is $12.96 billion, and its equity is $8.73 billion. The debt-to-equity ratio of 142% is significantly high. The high financial leverage could pose a significant financial risk on the company’s profile given the global inflationary environment despite its market cap of 44.4 billion.

On the other hand, the 7.3X interest coverage ratio suggests that the company can take care of the interest expenses. STZ’s high capital expenditure of nearly $1 billion translated to a levered FCF YOY decline of 21%.

Valuation

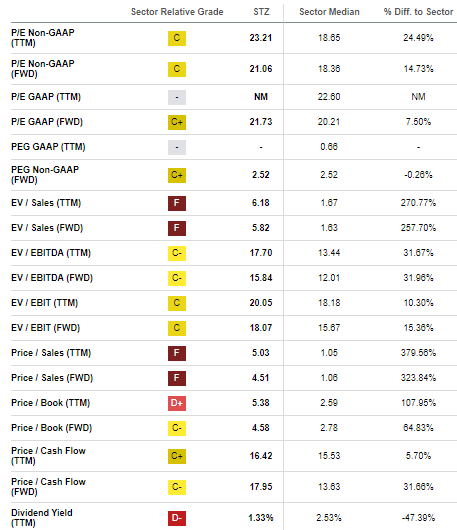

Based on the relative valuation metrics, STZ appears to be trading at a premium, with nearly all its valuation metrics above the industry median.

Seeking Alpha

Looking at this valuation, the most essential question would be what opportunity is here. For potential investors, at this valuation, it isn’t the best time to cash in. But for the existing investors, there lies an opportunity here for them. Guided by the company’s growth levers, particularly the beer segment and the company’s momentum, I believe the stock still has some upside potential. The company has a three-month momentum of 12.53 which is higher than the S&P500 momentum of 10.08. This leaves me optimistic that the stock has some upside potential.

Guided by this background, I think the opportunity here is for current investors to hold their current positions for the stock to exploit its current momentum and peak perhaps at about $255 per share, where they can cash out profits and wait for a cheaper entry point to cash in again.

Conclusion

Despite the industry’s and consumers’ inflationary pressures, the company demonstrated the strength of an adaptable business with higher-end brands and product innovations. The fundamental growth drivers for these brands, including awareness, distribution, and demographic upside opportunities, remain as strong as ever.

Investors should not worry since the company is heavily investing in expanding its production capacity, pumping more cash into new plants, and developing more competitive and innovative products that the customers have embraced. The current massive growth expenditure has pressured overall STZ’s profitability outlook. However, despite the promising future, the company’s valuation is not a good entry point for potential investors, but existing investors can hold their positions to exploit the current momentum.

Read the full article here