One of the most important things about investing is that you must be flexible. It is extremely rare to find a company that makes for an attractive purchase forever. They do exist, as the famous Warren Buffett has come to demonstrate all too well. But many companies only have limited upside before they become a bit pricey. One such firm that I believe has achieved most of the upside that it should for now is Watsco (NYSE:WSO) (NYSE:WSO.B), an enterprise that focuses on air conditioning, heating, and refrigeration equipment. Both on an absolute basis and relative to similar firms, shares of the company look to be more or less fairly valued. On top of this, we have seen a bit of weakness lately that could cause the stock to languish if the picture persists. Given these factors, I have no problem down grading the company from the ‘buy’ I had it at previously to a ‘hold’ today.

Time for a downgrade

In February of this year, I decided to revisit my bullish thesis regarding Watsco. In that article, I talked about how well the company had done on both its top and bottom lines over the prior few months. Strong financial performance continued throughout the 2022 fiscal year and, while shares of the company weren’t exactly cheap, they did look just affordable enough to warrant optimism. This led me to keep the company rated a ‘buy’ do you reflect my view at the time that the stock should outperform the broader market for the foreseeable future. Since then, shares have risen 19.2% compared to the 8% increase seen by the S&P 500. And since first rating the stock a ‘buy’ back in December of last year, shares have seen upside of 51.2% compared to the 11.3% increase the broader market experienced.

Author – SEC EDGAR Data

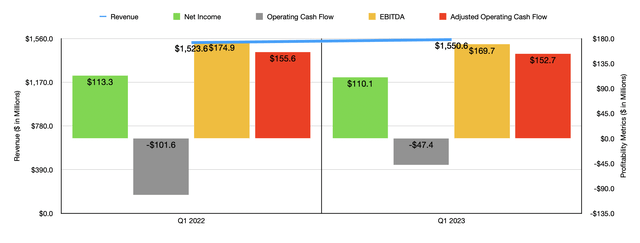

This is a fantastic amount of upside in such a short window of time. But alas, all good things must come to an end. Part of my decision to downgrade the company involves its most recent financial performance. This is financial performance that covers the first quarter of the company’s 2023 fiscal year. During that time, revenue came in at $1.55 billion. That’s 1.8% above the $1.52 billion generated one year earlier. The overwhelming majority of this upside for the company was driven by stronger comparable store sales of roughly 2%. This came about despite a 3% decline in residential products under the HVAC equipment category. At the same time, the company benefited from a 23% rise in sales of commercial HVAC equipment.

Even though revenue continued to increase, profitability metrics largely pulled back a bit. Net income, for instance, ticked down from $113.3 million to $110.1 million. Despite the rise in revenue, the company suffered from a decrease in its gross profit margin from 29.6% to 28.9%. This, according to the data provided, was largely because of pricing actions not quite keeping up with cost increases for the offerings the company provides. It is true that operating cash flow for the company improved from negative $101.6 million to negative $47.4 million. But if we adjust for changes in working capital, we would see that number decline slightly from $155.6 million to $152.7 million. Meanwhile, EBITDA for the company dropped from $174.9 million to $169.7 million.

Author – SEC EDGAR Data

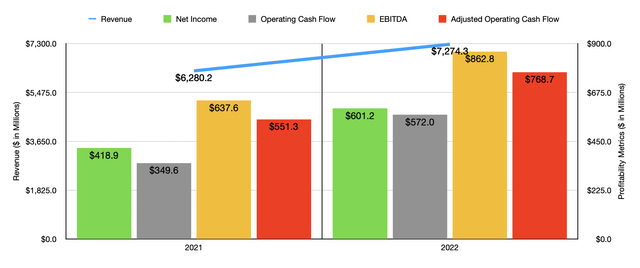

As you can see in the chart above, this performance for the first quarter of the year stands in pretty stark contrast to how the company performed in 2022 compared to 2021. Revenue, profits, and cash flows, all rose significantly during this time, driven by strong demand for the company’s offerings and price increases it was able to implement. Unfortunately, we don’t really know what to expect for the rest of the current fiscal year.

Watsco

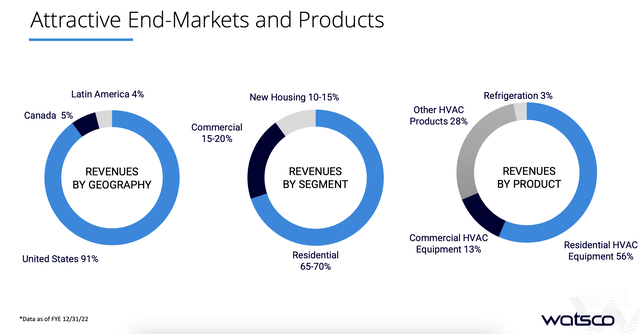

Management has not offered much at all when it comes to guidance. In fact, I would go so far as to say that management has been very opaque in how they view the industry for this year. What I do know, however, is that between 10% and 15% of the company’s revenue is related to new housing. And as I have detailed in prior articles, the residential construction space is about to feel some real pain. Another 15% to 20% of revenue is related to the commercial space. But that is a very broad term that could mean anything. To the extent that it relates to the office market, I would suspect that the company could see some pain moving forward as well.

Author – SEC EDGAR Data

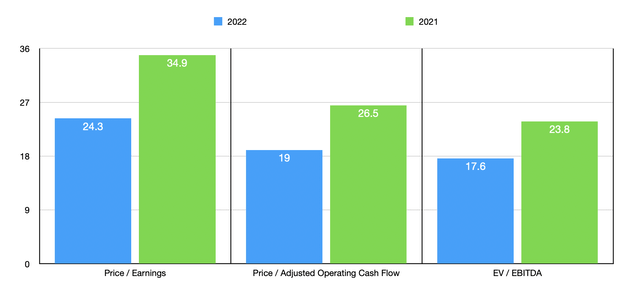

Even if we assume that financial performance will match what the company saw in 2022, shares of the company are not exactly cheap. As you can see in the chart above, the stock is trading out a price to earnings multiple of 24.3. The price to adjusted operating cash flow multiple is 19, while the EV to EBITDA multiple is 17.6. Although these numbers are lofty, they are lower than what we would get if we valued the company using data from 2021. As I do with most other companies that I analyze, I also decided to compare Watsco to five similar enterprises. Using the price to earnings approach, I found that two of the five firms ended up being cheaper than it. When it comes to the price to operating cash flow approach, three of the five were cheaper, while four were if we use the EV to EBITDA approach.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Watsco | 24.3 | 19.0 | 17.6 |

| Comfort Systems USA (FIX) | 26.8 | 15.9 | 16.6 |

| SPX Technologies (SPXC) | 124.6 | 41.5 | 34.1 |

| EMCOR Group (EME) | 19.7 | 17.2 | 11.5 |

| CSW Industrials (CSWI) | 26.3 | 20.9 | 15.9 |

| Carlisle Companies (CSL) | 15.7 | 11.7 | 10.6 |

Takeaway

The way I see it, we are starting to see a bit of weakness when it comes to Watsco and its operations. If shares of the company were cheap, I wouldn’t have a problem with some weakening. If the stock were very cheap, I would be okay with significant weakening. Even if recent bottom line issues we’re not there and even if we didn’t have top line concerns to worry over, the stock has gotten to a point where I don’t believe any significant additional upside exists. This leads me to believe that down grading the firm from a ‘buy’ to a ‘hold’ is appropriate at this time.

Read the full article here