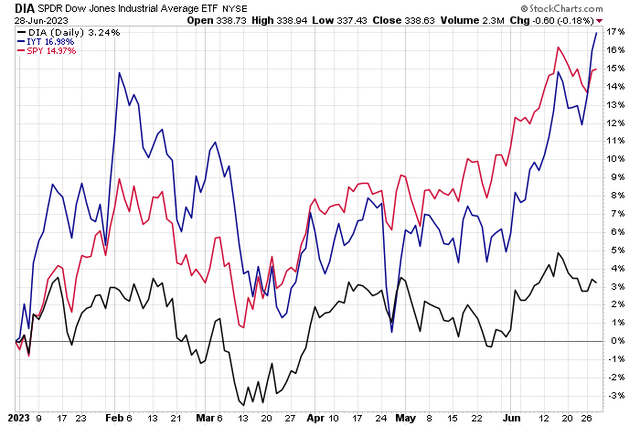

We are finally seeing signs of life in the beleaguered Dow Jones Transportation Index. For months, I have been watching this bellwether slice of the market to make a move. As megacap tech led the way over the first half, the nascent transport space failed to deliver. Today, however, the iShares Transportation Average ETF (IYT) is outpacing the S&P 500 while the Dow Jones Industrial Average continues to meander. The Dow Theory postulates that both indices must see strength to confirm a broad rally, but perhaps IYT is leading an eventual catch-up in the blue-chip DJIA.

UPS, however, has not enjoyed a recent bullish burst like IYT has. Still, with a compelling valuation and solid dividend, I have a buy rating on the freight company.

Are Transports The Bullish Tell?

Stockcharts.com

According to Bank of America Global Research, UPS provides logistics, freight (air sea ground rail) forwarding, international trade management and customs brokerage. It has roughly 481,000 employees (390,000 US), serves more than 220 countries and territories, it operates a fleet of 237 UPS aircraft, as well as a ground fleet of more than 110,000 delivery vehicles. More than 60% of volume is business-to-consumer, and it delivers more than 28 million packages per day globally.

The Georgia-based $150 billion market cap Air Freight and Logistics industry company within the Industrials sector trades at a low 14.1 trailing 12-month GAAP price-to-earnings ratio and pays a high 3.7% dividend yield, according to The Wall Street Journal.

Back in April, UPS reported disappointing Q1 results. Shares plunged despite just a modest EPS miss; UPS also failed to meet analysts’ revenue expectations. It was really the guidance outlook that Wall Street took issue with. UPS’s management team dimmed its forecast for full-year net sales with a consolidated adjusted operating margin of 12.8% – that was on the low end of its previous guidance. Still, along with a strong yield, UPS Is buying back stock, and capex plans continue to look decent. With lower freight volume trends in the quarter, an ongoing shift away from goods to services is a clear risk, along with uncertainty around the July 31 Teamster contract expiration. A soft China re-opening is another cause for near-term concern.

I assert, however, that the valuation today bakes in enough negativity, and since we are basically at the cyclical low in profitability for the firm, better headlines may emerge in the coming quarters. Of course, a key risk lies at the macro level – if we see a steeper economic slowdown in the second half, that could weigh on shares. We did get a fresh read from competitor FedEx (FDX) just last week, and more caution was voiced.

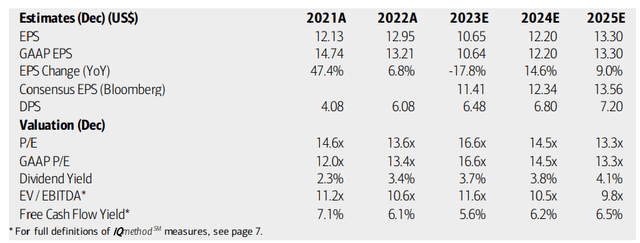

On valuation, analysts at BofA see earnings falling sharply this year, but then rising significantly in the out-year. By 2025, per-share profits are seen as rising to new highs at $13. The Bloomberg consensus forecast is about on par with what BofA projects. Given that the stock is near trough earnings, the mid-teens P/E multiples are quite attractive. Dividends, meanwhile, are expected to rise at a steady clip over the coming quarters. UPS’s EV/EBITDA ratio is about 15% cheaper than that of the broad market while its free cash flow yield should rise in the periods ahead as profitability remains sound.

UPS: Earnings, Valuation, Dividend Yield, Free Cash Flow Forecasts

BofA Global Research

UPS usually trades at a slight discount to the growth-heavy S&P 500. The cyclical stock can feature volatility depending on what macro trends are doing, but if we apply $12 of normalized forward earnings and apply a 16.5 multiple, then shares should trade near $198. Bear in mind that the firm’s longer-term multiple range is roughly 15x to 23x, so today’s P/E is compelling.

Couple the modest undervaluation with a strong yield, and I assert UPS is a buy here even with a potential economic slowdown in the second half. If $13-plus of EPS verifies in 2025, and the stock returns near the middle of its historical multiple range, then we could be talking about a $275 stock by late 2024.

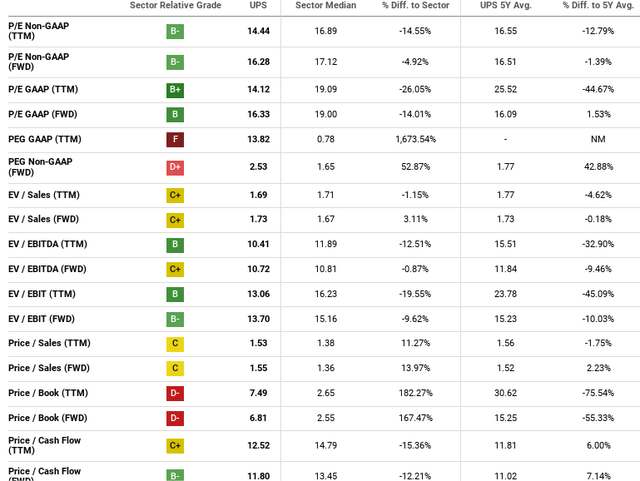

UPS: Favorable Valuation Metrics Considering the Cycle-Low in EPS

Seeking Alpha

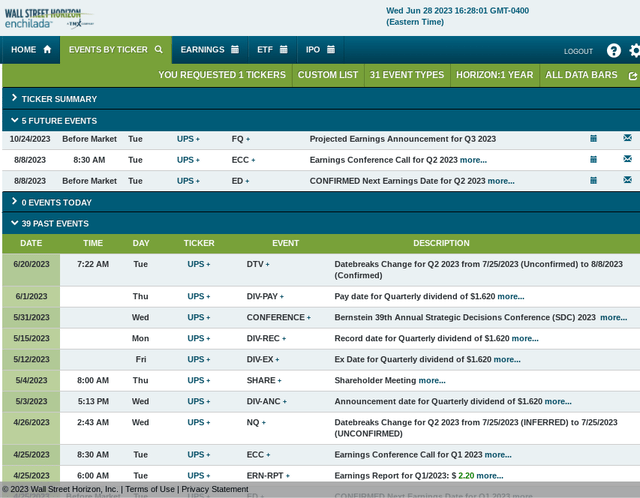

Looking ahead, corporate event data provided by Wall Street Horizon show a confirmed Q2 2023 earnings date of Tuesday, August 8 BMO with a conference call taking place immediately after the numbers hit the tape. You can listen live here. No other volatility catalysts are seen in the next several months.

Corporate Event Risk Calendar

Wall Street Horizon

The Technical Take

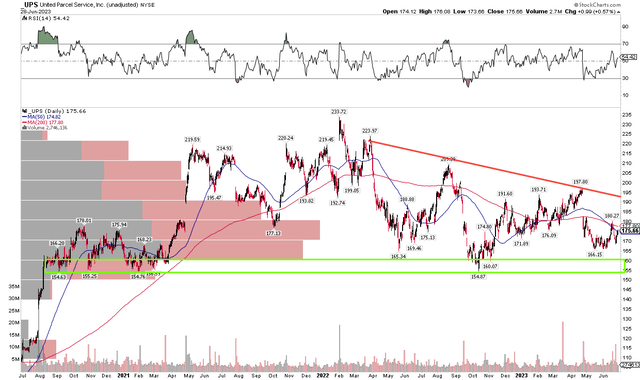

UPS shareholders have been waiting for a bullish trend to arrive, but no delivery is expected overnight. Puns aside, notice in the chart below that there’s key support in the $155 to $160 range while there is a downtrend resistance line that comes into play near $195, slightly under my fundamental value estimate.

The $197 high from earlier this quarter featured a major gap-down that ensued in the following sessions. That means we have some confluence of possible selling pressure about 10% above the current price. With a falling long-term 200-day moving average, the bears are arguably in control, but I see more of a battle going on with the bulls defending a key support range. Lastly, there’s a high amount of volume by price right where UPS trades now, so it could be tough for a trend to develop either way.

Overall, the chart is a hold, but long with a stop under $150 appears like a fine risk/reward play.

UPS: Holding Critical Support Near $155

Stockcharts.com

The Bottom Line

Despite macro headwinds that could emerge in the second half, I see UPS being near trough earnings, warranting a decent P/E multiple. With a neutral chart and solid yield, UPS stock is good enough for a buy rating today.

Read the full article here