It took a long time, but Onto Innovation (NYSE:ONTO) has finally managed to break out and reach new highs after being stuck below resistance for well over a year. The stock was able to accomplish this in an environment where there is growing enthusiasm for artificial intelligence or AI, which has jolted large parts of the semiconductor industry. ONTO seems to have left its struggles behind with the recent developments, although some question marks remain. Why will be covered next.

ONTO breaks out

Last I covered ONTO was in April 2023. The chart below shows how the month of May was a pivotal one for ONTO. Notice how the stock had all sorts of trouble getting past the $85-90 region for over a year. There were multiple attempts, but they all failed to break through resistance. However, this all came to an end in May when the stock finally managed to overcome resistance and break through. The dam broke and the way was clear for the stock to make a big move after being constrained for all this time.

Source: Thinkorswim app

That’s basically what happened with the stock gaining 35.2% from April 28, when the stock closed at $80.98, to May 30, when the stock got to $109.50, or $112.72 if intraday highs are included. However, the stock lost steam after that. Note how the stock has been unable to keep going in the $110-115 region despite repeated attempts. The stock has gained 59% YTD after the recent breakout, but not by much in recent weeks.

The stock has essentially traded sideways in recent weeks. The price action suggests the stock has encountered resistance in the $110-115 region. If the way higher is cut off, at least for now, the stock might seek to retrace some of the recent gains by moving lower. The stock seems to have topped out and bulls may want to consider locking part, if not all, of the recent gains, especially considering how much the stock has gained in the last two months or so.

Why the ONTO rally may be on shaky ground

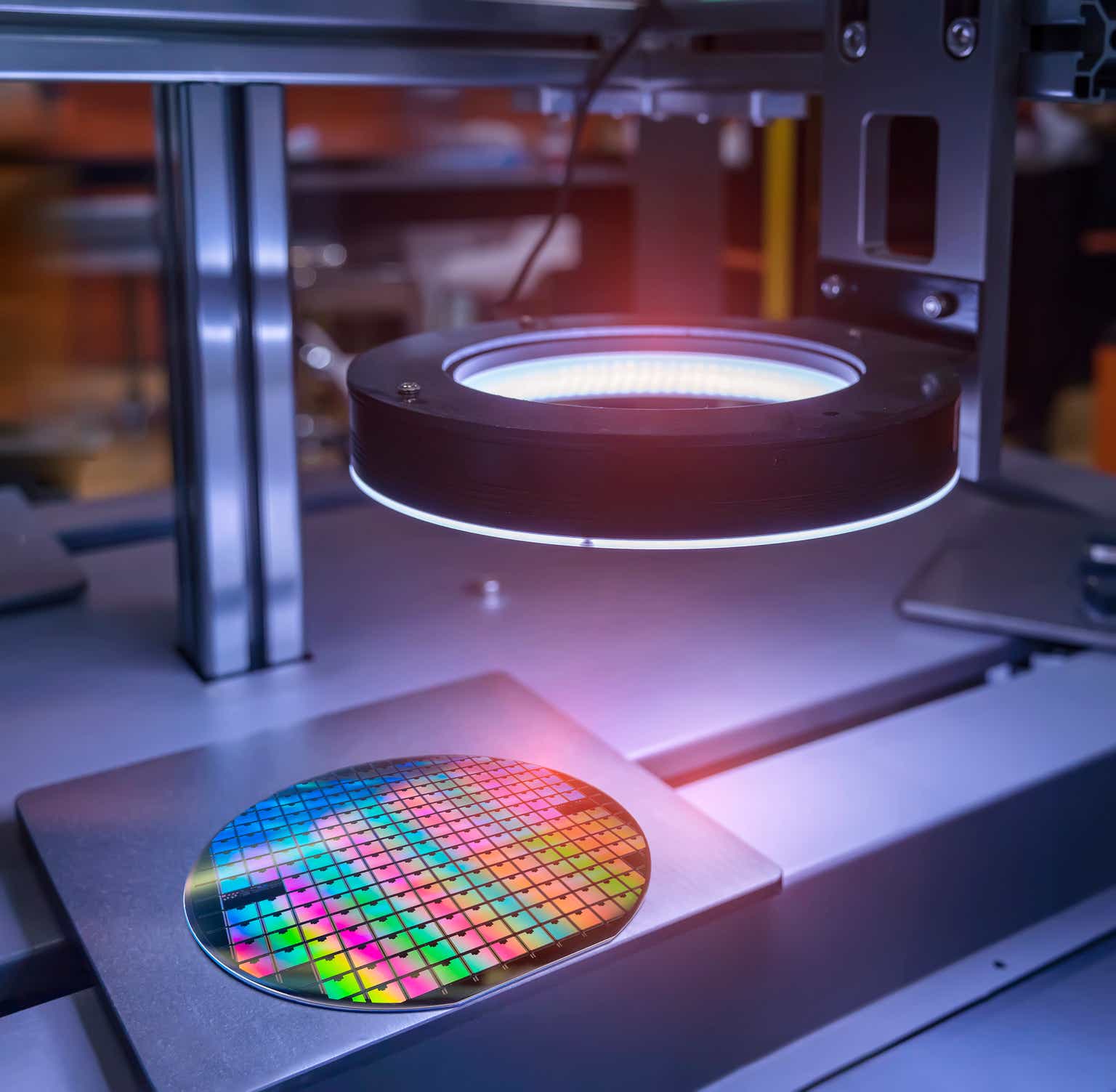

It’s worth mentioning that ONTO was not alone in having a great month in May. The sector as a whole rose thanks to a powerful tailwind sweeping through the industry. There were a number of companies, but none more than Nvidia (NVDA), which credited its much stronger than expected quarterly results and guidance to rising uptake of AI solutions. Increased demand for server GPUs from NVDA is expected to raise demand for leading-edge process nodes, which in turn should increase the need for yield control, something that works in favor of ONTO as a supplier of metrology tools, at least on paper.

However, while AI may eventually prove to be a boon for ONTO down the road, it’s important to note that ONTO is not seeing much, if any, benefits right now. On the contrary, ONTO is in the midst of a slump. A look at the most recent report shows as much. Q1 revenue declined by 21.4% QoQ and 17.5% YoY to $199.2M. GAAP EPS fell by 44.9% YoY to $0.59 and non-GAAP EPS fell by 29.8% YoY to $0.92. The table below shows the numbers for Q1 FY2023.

|

(Unit: $1000, except for EPS) |

|||||

|

(GAAP) |

Q1 FY2023 |

Q4 FY2022 |

Q1 FY2022 |

QoQ |

YoY |

|

Revenue |

199,165 |

253,270 |

241,350 |

(21.36%) |

(17.48%) |

|

Gross margin |

53% |

54% |

54% |

(100bps) |

(100bps) |

|

Operating income |

29,305 |

61,212 |

58,744 |

(52.13%) |

(50.11%) |

|

Net income |

29,068 |

66,214 |

53,330 |

(56.10%) |

(45.49%) |

|

EPS |

0.59 |

1.34 |

1.07 |

(55.97%) |

(44.86%) |

|

(Non-GAAP) |

|||||

|

Revenue |

199,165 |

253,270 |

241,350 |

(21.36%) |

(17.48%) |

|

Gross margin |

54% |

54% |

54% |

– |

– |

|

Operating income |

48,895 |

76,082 |

74,264 |

(35.73%) |

(34.16%) |

|

Net income |

45,047 |

77,544 |

65,628 |

(41.91%) |

(31.36%) |

|

EPS |

0.92 |

1.57 |

1.31 |

(41.40%) |

(29.77%) |

Source: ONTO Form 8-K

Guidance was not much better either. Guidance calls for Q2 FY2023 revenue of $203M, plus or minus 4%, a decline of 20.8% YoY at the midpoint. The forecast calls for GAAP EPS of $0.47-0.61, a decline of 47.6% YoY at the midpoint, and non-GAAP EPS of $0.75-0.90, a decline of 35.6% YoY at the midpoint.

|

Q2 FY2023 (guidance) |

Q2 FY2022 |

YoY (midpoint) |

|

|

Revenue |

$203M, +/- 4% |

$256.3M |

(20.80%) |

|

GAAP EPS |

$0.47-0.61 |

$1.03 |

(47.57%) |

|

Non-GAAP EPS |

$0.75-0.90 |

$1.28 |

(35.55%) |

ONTO also gave a preview of Q3. Q3 non-GAAP EPS is expected to be better than Q1’s $0.92. From the Q1 earnings call:

“Looking ahead to the third quarter, we expect to be back to 54% gross margin levels due to the improving contribution from our JetStep Systems. We expect OpEx to be in the range of $55 million to $56 million as we move past the annual one-time compensation elements in Q2 and see the full benefit of our cost reduction activities together. Together this will result in exceeding first quarter earnings levels.”

A transcript of the Q1 FY2023 earnings call can be found here.

Still, while the outlook for the rest of FY2023 sees a better second half than the first half, nothing major is expected. ONTO expects incremental improvement with the industry still dealing with a number of headwinds, including soft demand, particularly in the memory segment.

“we expect only a slight uptick from the first quarter reflecting the continued weakness in memory and weaker advanced logic spending projected in the second quarter. Offsetting that weakness is strong demand from specialty customers and power, packaging and EUV wafer manufacturing.

Collectively, we believe our specialty and advanced packaging markets reached the bottom in the first quarter with solid growth into the second quarter and incrementally stronger second half. Although we believe advanced nodes will bottom in the second quarter, the rate of recovery remains uncertain. So even while revenue projections reflect broader market challenges we’re very pleased with the progress we’re making expanding into new accounts and new markets.”

Consensus estimates expect non-GAAP EPS of $0.84 on revenue of $203M in Q2, which is expected to lead to non-GAAP EPS of $3.69 on revenue of $813.3M for all of FY2023. In comparison, ONTO earned $3.86 on revenue of $788.9M in FY2021 and $5.52 on revenue of $1,005.2M in FY2022.

Multiples are expanding

The stock has been able to rally even though earnings have dipped due to an industry downturn. In fact, the stock price has surpassed the old high set in January 2022, even though ONTO and the semiconductor industry as a whole are nowhere in as good a shape as back then. The stock has essentially priced in a major upturn, even though there is not much, if any, evidence one is indeed on the way.

Multiples have expanded with the expectation of an upturn due to the rise in the stock and the drop in earnings. However, multiples are now higher than the average for the last five years and the sector as whole. For instance, ONTO trades at 28.6 times forward non-GAAP earnings with a trailing P/E of 20.6.

In comparison, the 5-year averages are 20.3x and 23x respectively. The median in the sector are 22.1x and 18.0x respectively. Valuations are still not excessive, but they are elevated, which suggests now is not the best of times to be a buyer of ONTO as far as valuations are concerned. The table below shows some of the multiples ONTO trades at.

|

ONTO |

|

|

Market cap |

$5.16B |

|

Enterprise value |

$4.60B |

|

Revenue (“ttm”) |

$963.0M |

|

EBITDA |

$272.2M |

|

Trailing non-GAAP P/E |

20.60 |

|

Forward non-GAAP P/E |

28.56 |

|

Trailing GAAP P/E |

26.26 |

|

Forward GAAP P/E |

40.79 |

|

PEG GAAP |

1.57 |

|

P/S |

5.39 |

|

P/B |

3.17 |

|

EV/sales |

4.78 |

|

Trailing EV/EBITDA |

16.89 |

|

Forward EV/EBITDA |

21.96 |

Source: SeekingAlpha

Semis like ONTO have thus rallied in anticipation of the end of the current industry downturn and the beginning of a strong upturn led by rising semiconductor demand with AI in the driver seat. However, the risk here is that there is too much exuberance due to AI and the market may be overestimating how much AI can move the needle for companies like ONTO.

Investor takeaways

While it is tempting to ride the AI-induced rally higher for as long as possible, I would not be a buyer of ONTO, as stated in a previous article. The stock seems to be topping out and it might be getting ready to surrender some of the recent gains. The stock has certainly come a long way in the last two months and a pullback after an almost vertical move higher is probably warranted.

While AI is very likely to provide a boost in the coming years for ONTO and the industry as a whole, there may also be too much exuberance in the market due to AI. Keep in mind that AI has been around for years. So too the machine learning/deep learning and large language models that form the basis for AI applications like ChatGPT from OpenAI, which have hogged the headlines recently.

Many people come into contact with AI in their daily life, although they are often not aware of it. Popular social media apps like TikTok, for instance, have been using AI for years to achieve the effects seen in their filters and other popular applications that have take off. This is not to dismiss AI or what it can bring to the table, but some moderation may be sorely needed. If AI was all that matters, then the current downturn in semiconductors would never have happened in the first place.

It’s worth asking whether semis like ONTO have gotten ahead of themselves in the last few months. While the market believes a boom is close, if not already here, based on the recent price action, ONTO is actually in the midst of a downturn. There is no real evidence the current slump in semiconductor demand is near its end, let alone a boom. While things may change, the current outlook from ONTO does not anticipate a strong upturn.

This is not just the case for ONTO, Most semis are in the same boat. Many semis have actually downgraded their FY2023 outlook due to weaker-than-expected demand. This is why industry forecasts have actually been lowered recently. For instance, WSTS is now forecasting a 10.3% YoY decline in the semiconductor market in 2023, a bigger decline than the 4.4% expected earlier in the year.

There seems to be an increasing divergence between perception and reality. The market seems to be moving based on hope more than anything. Hope that the good times are back, thanks in no small part to AI, even though there is little to no evidence this is true. Just because NVDA is benefiting from AI does not necessarily mean other stocks like ONTO will experience a similar benefit, if any.

Bottom line, the stock has broken out, but resistance may be blocking further advances. While the recent rally is impressive, the rally may not be supported by a solid foundation. Its sustainability may therefore be in doubt. To be a buyer of ONTO at this time means AI must live up to the hype. Because if it doesn’t, a reckoning is in the air.

Read the full article here