Investment Thesis

Alteryx (NYSE:AYX) is a leading software company in self-service data preparation and wrangling. However, despite its strong position in the market, the company has faced many challenges. The stock was once seen as a high-growth name. Its valuation expanded due to its “best-in-class” fundamentals and the low interest rate environment during the pandemic. However, the stock is current trading at 76% below its recent peak. Some investors may still hold hope for a resurgence to its historical high, but we have to admit that AYX’s fundamentals have significantly deteriorated since then.

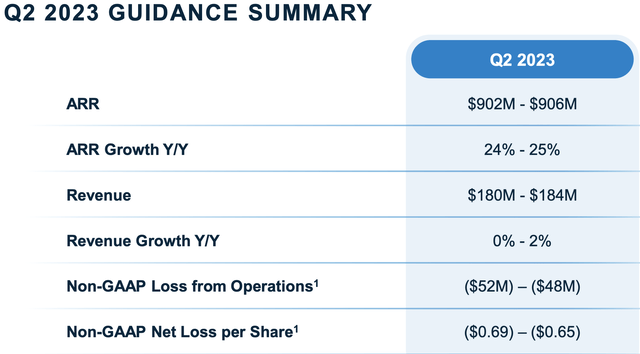

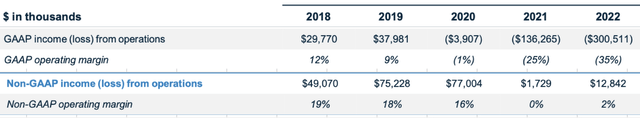

Specifically, the company has experienced a notable contraction in margins and has become unprofitable on both GAAP and non-GAAP bases in FY2021. Additionally, its FCF profile and balance sheet have worsened over the past year, indicating a low quality nature of the stock. Moreover, AYX’s high growth momentum has diminished, as the management projects a flat YoY growth in 2Q FY2023 and a 15.5% YoY growth in FY2023, a significant decrease from the 60% YoY growth achieved in FY2022.

Given the deteriorating fundamental outlook of the company, I’m giving a sell rating on AYX. The low quality nature of the stock makes it particularly vulnerable to the Fed’s “higher for longer” stance on interest rates and the potential for future economic downturns.

A High Leverage Company

1Q23 10Q

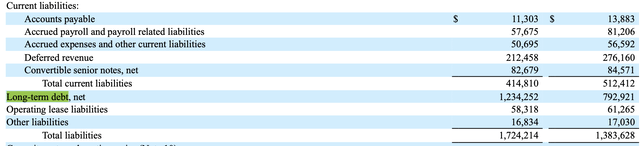

Investors often overlook the balance sheet when evaluating software companies due to their asset-light nature and low borrowing levels. However, it’s concerning that AYX carries a significant amount of long-term debt. The company’s long-term debt has reached $1.23 billion, growing 56% YoY. Furthermore, if we include the convertible senior notes of $83 million, the total debt stands at $1.31 billion.

1Q23 10Q

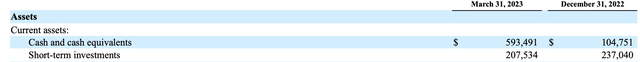

Then, we can calculate the net debt of $512 million by subtracting “cash and cash equivalents” and “short-term investments” from the total debt balance (1,313 million – 593 million – 208 million).

To assess AYX’s leverage level, we can look at its net debt / non-GAAP EBITDA TTM ratio. With AYX’s non-GAAP EBITDA TTM at $63 million, we can calculate the leverage ratio of 8.1x for the company. This ratio is significantly higher than the average for software companies, indicating a very high level of debt for AYX.

JP Morgan research has consistently indicated that the leverage ratio of less than 3x is generally considered to be healthy. Given AYX’s current ratio of 8.1x, it suggests AYX’s balance sheet is worsen. In addition, according to Corporate Finance Institute:

Generally, net debt-to-EBITDA ratios of less than 3 are considered acceptable. The lower the ratio, the higher the probability of the firm successfully paying off its debt. Ratios higher than 3 or 4 serve as “red flags” and indicate that the company may be financially distressed in the future.”

1Q23 10Q

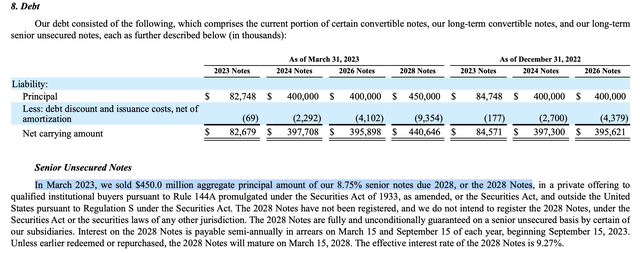

This high leverage ratio can be mostly attributed to the issuance of $450 million of 8.75% senior insured notes due in 2028. This recent issuance has contributed to the company’s elevated debt levels.

Looking ahead, AYX faces near-term macro headwinds that could impact its revenue growth. In response to these challenges, the management has already revised down its revenue guidance for FY2023. Additionally, the market has already priced in the Fed’s hawkish tone, especially considering the recent robust economic data. This high interest rate environment is likely to add further pressure on AYX’s financial health. In the event of a severe economic downturn, the company’s high leverage could potentially affect its credit ratings as well.

Not A High Growth Company Anymore

1Q23 Presentation

Regarding its revenue growth, AYX failed to beat its revenue estimates for 1Q FY2023, and the company’s 2Q FY2023 revenue guidance is significantly below the market consensus. AYX anticipates a flat YoY revenue growth due to a longer sales cycle and lower contract duration. The management blamed the delayed deals to the following quarter. While AYX achieved an impressive 60% YoY growth in FY2022, the management only expects a 15.5% YoY growth in the current fiscal year.

If we take a look at the company’s past earnings presentations, we notice that the total customer count dropped from 8.4k in 4Q FY2022 to 8.3k in 1Q FY2023, marking the first decline in the company’s history. I think it’s possible that AYX may be focusing on larger customers with higher ARR. However, if there is a persistent downtrend in customer count, it may indicate a deterioration in customer engagement. Therefore, we can argue that AYX should be valued at a lower multiple compared to other software companies that are consistently achieving over 20% revenue growth.

Margin Compression

1Q23 Presentation

Furthermore, we have also observed a significant decline in AYX’s operational efficiency, as shown from the table. The Non-GAAP operating margin has experienced a massive contraction, dropping from 19% in FY2018, to only 2% in FY2022. However, I admit that there is an improvement in 1Q FY2023, with the company’s Non-GAAP operating margin reaching -9%, from -19% in 1Q FY2022. This improvement provides some reassurance as it reflects the company’s current emphasis on “head count optimization”. During the 1Q FY2023 earnings call, the management addressed:

we announced today that we are executing a plan to reduce full-time employee headcount by approximately 11%.”

While the improvement in the non-GAAP operating margin for FY2023 is a positive sign, we should understand that this improvement may have a consequential impact on AYX’s top-line growth. As a result, this move can potentially bring mixed result to the company’s fundamentals.

Disappointing FCF Profile

1Q23 Presentation

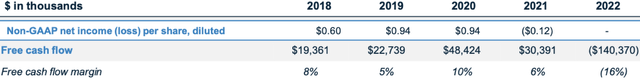

Now let’s turn our attention to AYX’s FCF generation. By looking at the table, we notice that the company’s FCF margin has also been deteriorating. The margin dropped from 10% in FY2020 to -16% in FY2022, indicating a negative trend in FCF growth.

Additionally, AYX experienced an non-GAAP EPS of -$0.12 in FY2021, which disrupted its positive earnings trend. However, it’s encouraging to see the company achieved earnings breakeven in FY2022. The management also raised the FY2023 non-GAAP EPS guidance to be in a range of $0.65 to $0.75, compared to the previous outlook of $0.36 to $0.46. Despite these positive developments, it’s prudent for investors to be cautious. I think we need to observe several consecutive positive earnings results before concluding that AYX can consistently sustain and grow its earnings in the future.

Valuation

Zachs

Unsurprisingly, the stock is currently trading at a low valuation of 3.3x P/S TTM, which is likely 78% below its 5-year average of 15x. However, investors should not be overly excited about this cheap valuation because it could be a classic example of a value trap. This is due to the significant deteriorations in AYX’s revenue growth.

Considering the risk factors such as AYX’s high leverage ratio, margin contraction, low profitability, and weak FCF generation, I believe that the stock should be trading at a lower multiple compared to its peers. Until we see consistent improvements in the company’s fundamentals, I don’t think we will see a significant expansion in its valuation multiple, especially in the current high interest rate environment.

Conclusion

In sum, AYX faces many headwinds with deteriorating fundamentals, including margins contraction, worsening FCF, and high leverage ratio. The company’s revenue growth has significantly decelerated, evident from declining customer count and muted revenue guidance. While there have been some improvements in non-GAAP operating margin and earnings due to the cost optimization, sustaining a consistent expansion remains uncertain. I admit that AYX currently trades at a discounted valuation, but it could be a value trap considering its weakened fundamentals. Given these factors, a lower valuation relative to industry peers seems justified. Particularly, 8.1x net debt/non-GAAP EBITDA TTM is a red flag to me. It’s reasonable to stay away from a high leverage company in the late stage of the economic cycle. Therefore, I consider a sell rating on AYX.

Read the full article here