Sleep Country Canada (TSX:ZZZ:CA) (OTCPK:SCCAF) is the biggest mattress and bedding retailer in Canada with a solid investment thesis. The company has made significant acquisitions over time to improve both their online presence and their margins by focusing on improving accessory sales. This has led to solid investment returns over time, but the stock has proven to be very volatile. As a large discretionary purchase, mattress sales are seen as extremely cyclical with the stock often falling far in front of any recessionary fears.

As it stands today ZZZ sales and margins are both holding well, but the market is telling us they will soon fall as pressure on consumers continues to rise. That said the reasonable valuation of $27 and 9.5x trailing P/E has me at a neutral level on the shares, with under $20 being the ideal buy area for a longer term shareholder.

Sleep country has a stranglehold on the Canadian mattress and bedding space, but that can possibly be described as a potential weakness in appreciation from here. The company will have trouble growing further in a market as fractured as mattresses, and will not be expanding south of the border as the market is much more competitive than Canada. This makes future revenue and earnings growth difficult to come by, as gains are mostly made via acquisition or productivity gains.

Same store sales for Q1 were -6.2%, showing some weakness already even has the Canadian economy has continued to grow nicely. Overall retail sales in Canada were slightly down in Q1, showing ZZZ underperforming as consumers pull back on the larger goods purchases and focus their funds on services instead. Revenue was only down 0.3% to $206.5 million in Q1, partially as they benefitted from the recent bedding acquisition of Silk and Snow.

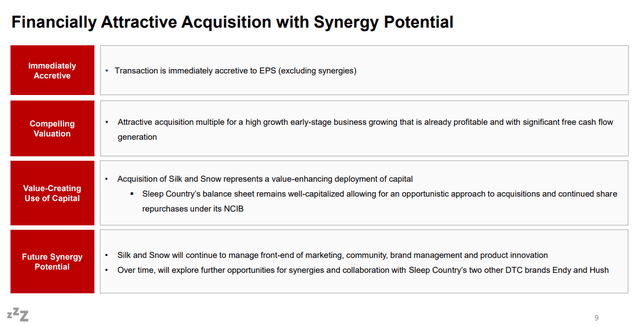

Silk and Snow (ZZZ presentation)

Combined with the Endy (Canada’s biggest bed in a box company) acquisition, Hush blankets and buying Casper’s Canadian assets, ZZZ continues to solidify its stranglehold in the space. These smart additions of different accessories and options has helped push those operating margins from 14-15% up to the 17 to 18% range over the past 3 years. They help innovation at Sleep Country, increase synergies and the brands assist each other to increase profitability. They target companies that are already free cash flow positive, so risk is small for ZZZ as they have all been earnings accretive during year 1.

In the short term, however, ZZZ earnings are coming down, with a 38.5% drop of earnings in Q1 to $11.3 million. Revenue estimates for 2023 and 2024 appear too high for Sleep Country, with 4.5 and 4.7% expected revenue growth over the next two years. I see risk to these numbers with 1-2 more interest rate hikes expected in Canada to over 5%. This will put further pressure on consumers with a mortgage, and it’s likely ZZZ will not be able to meet these growth estimates. A positive of the story is a low debt load means continued profitability in a downturn as ZZZ only has $138.6 million in long term debt. Longer term the company will continue to leverage its cash flow to purchase smaller companies in the space and improve its online presence.

The company seems reluctant to add many showrooms in Canada now at 290 stores as they have solid coverage of the population. This means longer term a higher portion of revenue will be its collection of online native brands like Endy or Silk and Snow. The company will also continue to grow its dividend, as it increased it most recently to $0.237 per quarter – or a solid 3.5%.

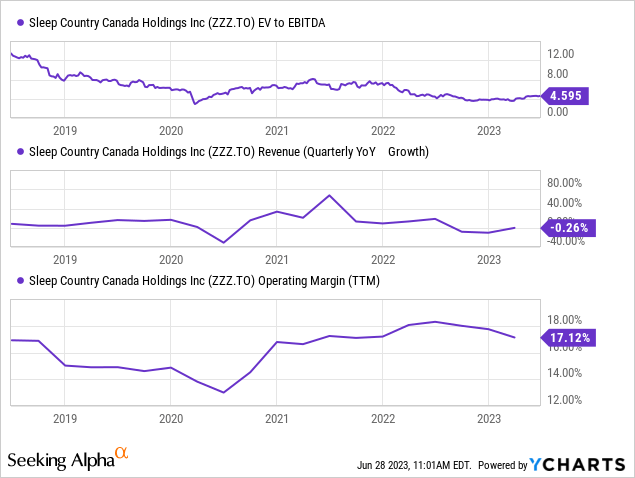

As you can see, the above valuation is very reasonable compared to its most important metrics. Revenue growth has slowed to zero in recent quarters against hard comparisons but margins are still very solid with 24% EBITDA margin in the most recent quarter. This has the company trading at 4.6x EV to EBITDA, which is not far above its trough multiple in 2020. However, sales of big ticket items should continue to fall with discounting putting pressure on the high operating margins in 2023 and 2024.

At this point risks seem skewed to the downside based on a weakening consumer and a market not willing to give the stock a multiple at its average of 6-7x EV to EBITDA. This would be a 33-40% gain in the shares from where they are now at $26.95. The shares have rebounded with the market in the past 9 months, with a good bounce off the November 2022 low of $19.66. However, this name is likely to retest those levels if more weakness comes through in the economy, being in such a highly sensitive sector. It is that which is keeping me on the sidelines now, as money continues to flow into sectors like staples and industrials in Canada where earnings are more stable.

Conclusion – Hold rated

While the valuation of Sleep Country is appealing at these low levels, it is because the market is discounting a recession in late 2023 or 2024. Higher for longer interest rates mean big purchases like mattresses will be pushed out later and sales will suffer as a result. The company should continue to do well in growing its bedding and pillow categories, but that will not make up for reduced mattresses in the short term. Those looking for a value priced stock at the moment would be better served to look at the staples or infrastructure related sectors for areas where spending will hold up better in a likely recessionary scenario. Those who wait are getting paid a solid 3.5% dividend but you can get better capital appreciation in other sectors at this point in the economic cycle. As a result I would put this company in the hold category – one that would be a buy below $20 but has significant headwinds to share price appreciation for the coming 12 months.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here