All values are in CAD unless noted otherwise.

Allied Properties Real Estate Investment Trust (OTC:APYRF) (TSX:AP.UN:CA) owns and operates office buildings across major Canadian cities. Rather than being run of the mill office structures, these properties are unique as they are recycled from light industrial structures located in downtowns. They are classified as Class I workspaces and in the REIT’s own words are characterised by “high ceilings, abundant natural light, exposed structural frames, interior brick and hardwood floors”.

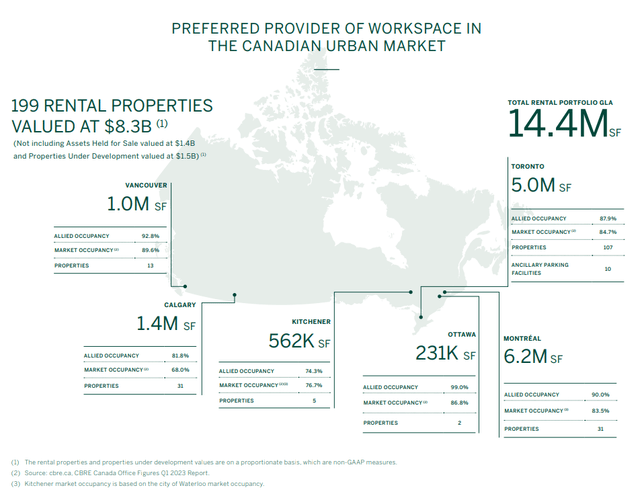

2023 Investor Presentation

Office REITs have struggled in the years since the pandemic and Allied is no different. Its uniqueness though, does add a shine to its portfolio. It appears to be doing better than its vanilla counterparts, in terms of occupancy, in almost all of its locations.

2023 Investor Presentation

Of the 14.4 million square feet in gross leasable area or GLA, 11.2 million is located in Toronto and Montreal. In both those markets, Allied’s occupancy was higher by 3.2% and 6.5% respectively. While the Calgary portion of the portfolio is smaller, it has a 81.8% occupancy versus the overall 68.0% for the market. The REIT is holding its own vis a vis the market average, however, its overall year over year occupancy declined slightly from 88.8% as at March 31, 2022 to 88.2% as at March 31, 2023. This was due to a non-renewal in Kitchener, and transition of an under development property in Calgary to the rental portfolio. As per the Q1-2023 financial report, Allied is in discussion with potential tenants for both. On the Q1 earnings call, management noted that they expect the occupancy levels to end higher, more specifically, in the low 90s by the end of the year.

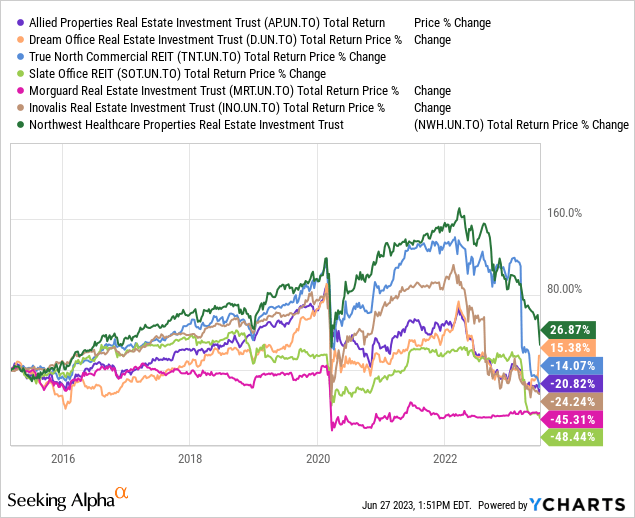

In terms of returns to its investors, it has left them wanting in the last decade. That said, some of its counterparts like Slate Office REIT (SOT.UN:CA) and Morguard REIT (MRT.UN:CA) fared far worse. The best performer was NorthWest Healthcare REIT (NWH.UN:CA), but that is a unique case as they have medical office properties.

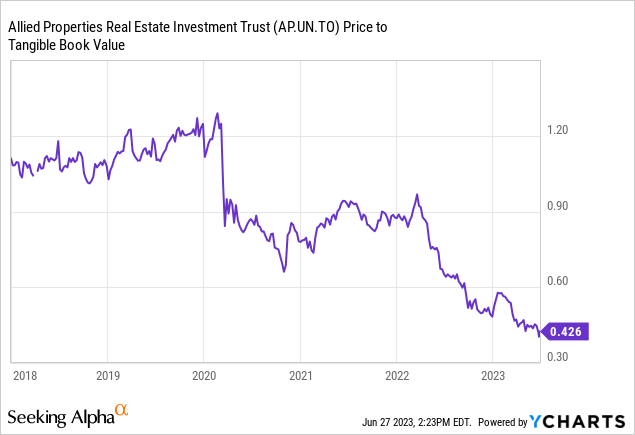

Investors flocking to buy this REIT at a premium pre-pandemic have also moved on after seeing the writing on their home office wall. The market now wants to buy Allied assets at 43 cents on the dollar.

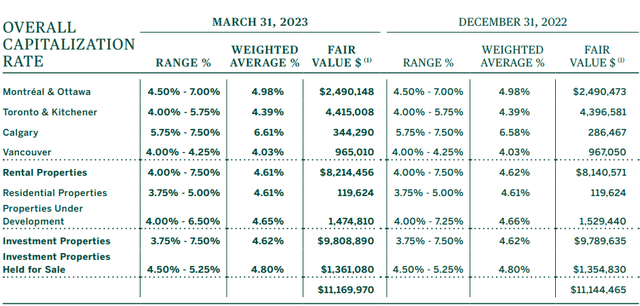

Perhaps it’s the disbelief at the capitalization rates used by Allied to calculate their NAV, which has been more or less unchanged since the end of last year.

Q1-2023 Financial Report

In comparison, the market is awarding it a capitalization rate closer to 8.3%, post the pending sale of their Urban Data Centre located in Toronto.

Urban Data Centre Sale

In our prior piece, with recession at our door step, the 9.6X debt to EBITDA had us calling for deleveraging.

Allied cannot afford going into 2024 with debt to EBITDA approaching 10X. A recession will likely create serious stresses on the extended balance sheet. The time to deleverage is now and that same process can demonstrate to the markets the validity of its NAV. The market clearly has doubts.

The current implied cap rate is closer to 7% vs the 5% that Allied uses in its NAV calculation. A few dispositions can help set the record straight and allow for some more breathing room in the next 2 years. The company is making a general effort in this area, though we think it needs to have more urgency.

Source: Allied: Deleveraging Needs To Be A Priority In 2023

The market continues to punish this REIT.

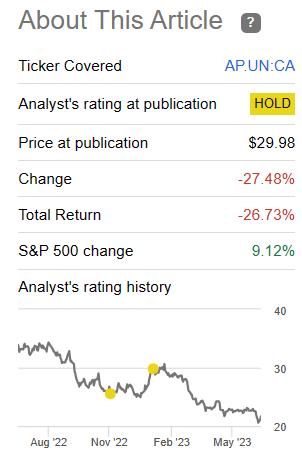

Seeking Alpha

But the REIT has taken a huge step in the right direction by selling its data centre portfolio located in the Toronto downtown. The sale was at $1.35 billion, a cool $118 million above the fair value and is expected to close before the end of Q3 of this year. The majority of the proceeds are going to be used to deleverage with the balance to fund upgrades and developments already in the pipeline for this year and the next.

Allied’s principal motivation in selling the UDC portfolio is two-fold. First, Allied wants to reaffirm its mission and pursue it over the next few years with low-cost capital. Second, it wants to supercharge its balance sheet and reduce its dependence on the capital markets going forward.

Allied expects to use most of the sale proceeds to retire debt and the balance to fund current development activity. Allied may elect to use a portion of the sale proceeds to buy back units under its NCIB. It does not expect to use any of the proceeds to fund acquisitions, nor does it expect to engage in material acquisition activity in 2023.

Source: Q1-2023 Press Release

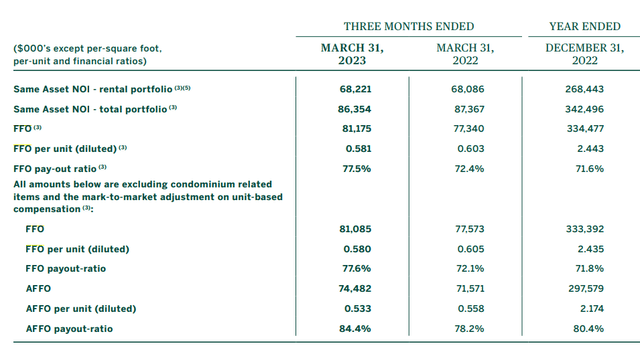

Q1-2023

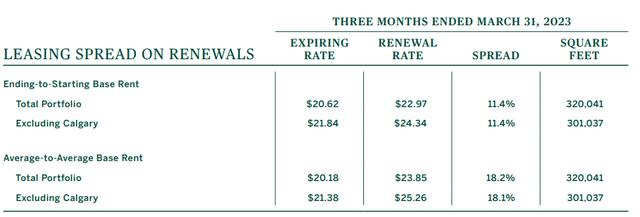

Besides a higher average in place rent per occupied square foot by 1% year over year, Allied also saw a 11.4% growth in rents for renewals.

Q1-2023 Financial Report

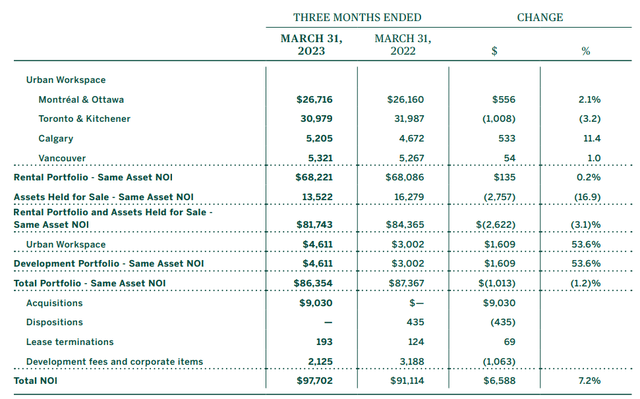

Aided by this and an increase in variable parking revenue, the same asset rental portfolio managed to come out slightly ahead on a year over year basis.

Q1-2023 Financial Report

That it was not a higher increase was due to the negative offsets from non-renewals in the quarter, resulting in a lower occupancy which was discussed earlier in the piece. Some of the development pipeline coming online and a full quarter of operations from the properties acquired early last year from Choice Properties Real Estate Investment Trust (OTC:PPRQF), propelled the net operating income or NOI higher by 7.2% on a comparative basis.

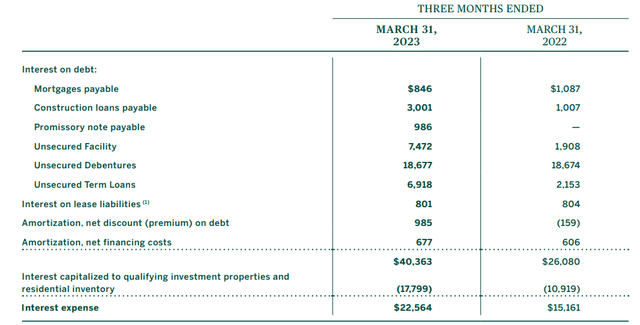

The weighted average interest rate increased to 3.56%. That along with higher loan balances resulted in close to a 50% higher hit to the bottom line from this line item.

Q1-2023 Financial Report

That offset the 7.2% higher NOI and then some, resulting in around a 4% decline in the year over year funds from operations or FFO.

Q1-2023 Financial report

Allied hiked its monthly dividend from 14.58 cents to 15 cents starting 2023 and at the current price ($21.60) yields around 8%. Management is confident about ending this year with growth in both FFO and Adjusted FFO, along with a yearly increase in dividends.

Our outlook for 2023 remains unchanged at low to mid-single-digit growth in each of FFO and AFFO per unit and same asset NOI. We also expect to continue increasing our distribution at our historical rate of 2% to 3% per year. Our team and our operating platform has never been stronger.

Source: Q1-2023 Earnings Call Transcript

We think that is highly optimistic in today’s climate.

Verdict

We had stressed on the debt a few times and it appears that Allied got the message. You can see it in their communication on the most worrisome metrics.

Pending completion of the sale, Allied expects its total indebtedness ratio to drop to 32.7 per cent, its net debt as a multiple of annualized adjusted EBITDA to be 8.0x and its interest-coverage ratio to be approximately 3.0x. Allied also expects its net debt as a multiple of EBITDA will decline steadily over the next three years as elements of its large-scale development activities are completed and the assets begin providing revenue.

Source: RENX

8.0X is what we would call a “good start”. Considering conditions for office space, we would aim for at least 7.0X and perhaps a 6.0X if Allied can manage it. If they do get there, you can expect that AFFO would be quite a bit lower, but it will definitely improve the risk-reward profile. As things stand, Allied appears at an attractive discount to NAV and might be a play for those bullish on the office sector. For our part we reject the idea that we need to be chasing this with such negative trends in place. We also remain highly skeptical of the published NAV and think the market has got this more or less correct in terms of fair value of the office buildings. Allied gets a 6 on our potential pain scale rating.

Author’s Pain Scale

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here