Investment Thesis

Most Americans have heard of Nathan’s Famous Hot Dogs and many probably watch the Nathan’s Annual Hot Dog Eating Contest on July 4th, but few have heard of the stock. In this article, I will summarize why I think Nathan’s Famous (NASDAQ:NATH) is a well-run and asset-light consumer staple. Their improving balance sheet, steady revenue growth, and history of shareholder return are all attractive. However, I believe future growth may be slower than in the recent past, which is why I rate it a Hold.

Background & History

Nathan’s Famous was founded in 1916 as 5¢ hot dog stand in Coney Island. Since then it has grown into a business with a market cap of $316 million. While the story is a legendary one, Nathan’s Famous is still a small-cap stock that is relatively unknown. Today, Nathan’s revenue is mainly derived from 3 main sources:

- Branded Products Sales – a way for food service operators to sell Nathan’s Famous hot dogs in a variety of venues by purchasing directly from Nathan’s Famous or its distributors. This is how you can buy Nathan’s Famous at baseball games, carnivals, and other large events. No royalties are earned through this method.

- Product Licensing – allows 3rd party retailers to manufacture, distribute, market and sell Nathan’s Famous products including hot dogs, sausages, frozen crinkle-cut French fries and additional products. Nathan’s sells its product at Walmart, Kroger, Target, BJ’s, Costco, and many more. Nathan’s earns royalties on products sold.

- Restaurant Operations – Nathan’s operates 4 company-owned restaurants in New York, including their seasonal Coney Island Boardwalk location.

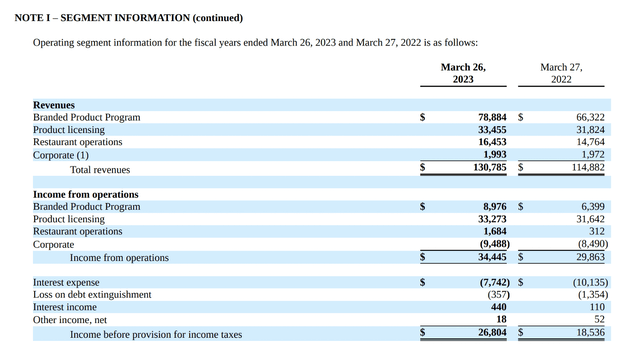

Using the fiscal 2023 results from Nathan’s 10k, revenue breakouts shows how branded products makes up 60% of revenues, product licensing makes up 25.6% of revenues, and restaurant operations makes up 12.6% of revenues.

Although their revenue is diversified, their operating income relies overwhelmingly on licensing. In fact, product licensing makes up an astounding 96.7% of operating income! This is showcased below.

Their main licensing contracts are with Smithfield Foods and Lamb Weston Holdings (LW), which manufacture Nathan’s hot dogs and crinkle-cut fries respectively and pay Nathan’s to use its well-known namesake.

Licensing revenue to operating income conversion is almost 100%, which allows Nathan’s to have superior margins compared to other food companies. In fact, Nathan’s is better understood as an asset-light royalty collector with its branded products and restaurant operations sectors as a way to expand their brand rather than make money. Their main money-making machine is licensing.

Nathan’s Famous 10K (Nathan’s Famous Fiscal 2023 10K)

Past 5 Years

I will now discuss Nathan’s recent financial history to get a good view of the company and to understand if they are growing, stagnant, or shrinking.

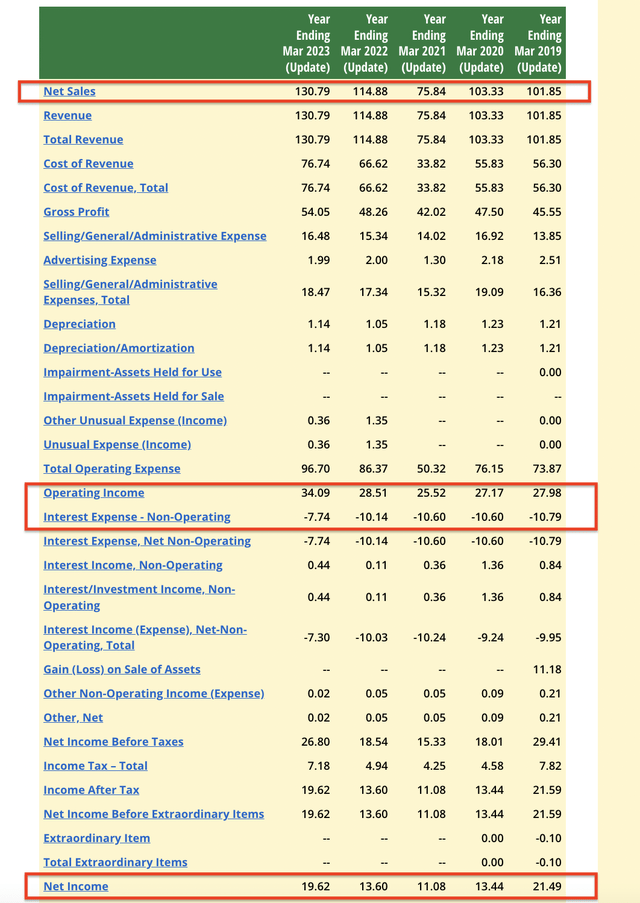

Nathan’s has an easy and clean income statement to understand. From 2019 – 2023 revenue increased at a CAGR of 5.13%; Operating income increased at a CAGR of 3.96%, and net income increased at CAGR of 10.32% if one were to exclude the $11 million in asset sales that inflated net income in fiscal 2019.

It might seem odd that operating income grew slower than revenue, but net income grew substantially faster than both revenue and operating income. This is primarily due to the decrease in interest expense due to debt paydown over the past year, which helped Nathan’s save ~$3 million. This $3 million drops down to net income and benefits common stock shareholders, although a good chunk of the savings is eaten up by higher income tax as less debt also means less tax-deductible interest. Nathan’s debt now primarily consists of $79.5 million of 2025 notes with a 6.625% coupon.

Because Nathan’s is a mature business with almost 0 in capex (just 3% of operating cash flow is used for capex), most of the operating cash flow & interest expense savings are being returned to shareholders or used to pay down debt.

In fact, Nathan’s has a rich history of shareholder return. Not only has its dividend increased by a CAGR of 12.2% between 2018 – 2023, it also paid an enormous 25$ special dividend in 2015 (as a result of a junk bond offering, which it subsequently refinanced) and a 5$ special dividend in 2017. I expect this method of shareholder return to continue. And as Nathan’s pays down more debt, it may incrementally raise its dividend. Nathan’s also has a small share buyback program, but it is not so material to the share price. Although it is worth mentioning that prior to 2015, Nathan’s buyback program was much more active and shares outstanding fell 30% between 2008 – 2014.

Nathan’s Famous Past 5 Years Fundamentals (Nathan’s Famous Website)

Impact of COVID-19

Because the branded products segment is made up of revenue from sporting events and other large gatherings, its revenue took a hit in fiscal 2021, which contributed to the sharp revenue decline seen in that year. Ever since, that segment has been recovering and this year marked a very strong milestone in that segment. From Nathan’s 10K:

The impact of COVID-19 on our Branded Product Program eased significantly in fiscal 2023 as compared to fiscal 2022. As the level of comfort of consumers gathering in social settings increased and travel increased, our Branded Product Program customers, including professional sports arenas, amusement parks, shopping malls, and movies theaters experienced stronger traffic and attendance contributing to higher sales. The total volume of hot dogs sold in the Branded Product Program increased by approximately 15% over fiscal 2022, rebounding and exceeding pre-pandemic levels. Our Branded Product Program contributed $78,884,000 in revenue in fiscal 2023, representing a 19% increase over fiscal 2022.

Nathan’s not only benefitted from a 15% increase in volume, but a 4% increase in price while cost inflation was just 1.4% helped boost margins for that segment. Because most events are now back in person, I do not think Nathan’s can sustain such a trajectory and would anticipate future year sales in this segment to rise just slightly or stay flat as COVID-19 restrictions are all but gone.

Restaurant operations grew revenue grew 12% and also benefitted from more in-person dining post-COVID-19. Apart from branded products and restaurant operations, licensing revenues from hot dogs, which makes up 90% of their licensing income and most of the operating income as discussed earlier, grew just 4% due to a 7% price increase offset by a 3% volume decrease.

And as most COVID-19 recovery tailwinds subside, I expect revenue and operating income growth to converge on the growth in the product licensing sector as that is what makes up the majority of Nathan’s operating income.

Valuation

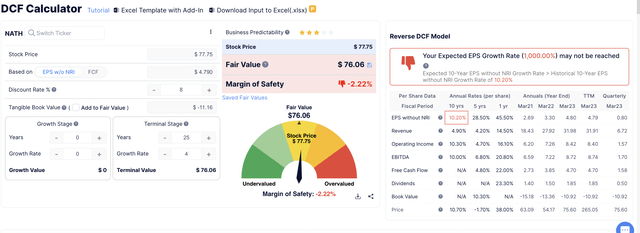

Nathan’s DCF (Gurufocus DCF Calculator)

To value Nathan’s Famous, I used a DCF using EPS, which is a good proxy for their free cash flow, due to the almost negligible capex. If Nathan’s is able to grow earnings in line with its growth in licensing income, or about 4% over the next 25 years (Nathan’s has existed for over 100 years at this point) and retains its competitive position as an American staple and go-to hot dog brand, then it is most likely around fairly priced at the current price.

There is one major upside scenario, which I did not account for, which is that the current licensing contract with Smithfield Foods, from which the majority of Nathan’s operating income is derived from, was inked in 2014 for an 18-year-term. It expires in 2032, which would allow Nathan’s to negotiate a better licensing deal, and perhaps, a substantial price increase leading to a big one-time, but sticky increase in operating income. However, the details of a future licensing deal is uncertain and I did not account for it.

There are some more minor upside scenarios in which Nathan’s opens more restaurants or increases its emphasis on growing its franchise operations, which could help increase net income. However, there are also several downside risks including a decline in hot dog consumption due to health-conscious behaviors, which I discuss further below in my risks section.

Peer Comparison

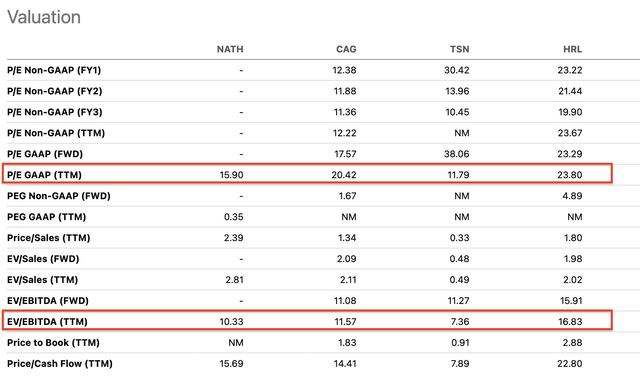

Compared to peers like Hormel Foods (HRL), Conagra Brands (CAG), and Tyson Foods (TSN), on a P/E and EV/EBITDA basis Nathan’s is cheaper than most except Tyson foods.

Peer Comparison Valuation (Seeking Alpha )

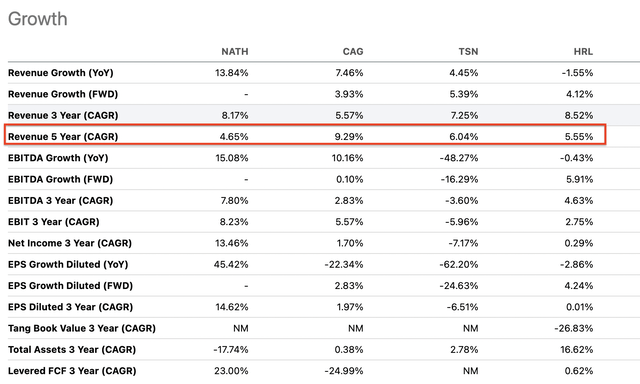

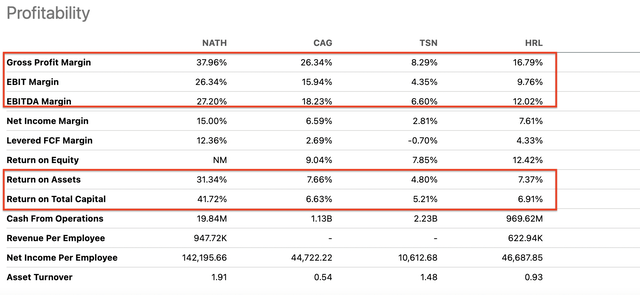

In terms of growth, on a 5-yr basis Nathan’s growth is slower than most of its peers at only a 4.65% revenue CAGR, but its stronger margin profile and strong return on assets and return on capital, which are 31.34% and 41.72% respectively, show that Nathan’s is well-managed. It is also exceptionally asset-light owing to its royalty-like licensing revenue that makes up a majority of Nathan’s income.

Peer Comparison Growth (Seeking Alpha) Peer Comparison Profitability (Seeking Alpha)

A Note on Insider Ownership

Before I go on to the risks, I wanted to note one important fact, which is that the chairman of Nathan’s Famous and largest shareholder, who wields about 23.9% of shares outstanding is Howard Lorber. He is also the CEO of Vector Group (VGR), which is a holding company that used to own Douglas Elliman (DOUG) and still owns a tobacco company. He is a successful investor and CEO and his large ownership may be one of the reasons for Nathan’s large debt-financed dividend in 2015.

Risks

There are several risks to my thesis. One of the main risks is a secular shift to eating healthier, which may result in a decline in total hot dogs consumed and hurt all segments of Nathan’s business. Although this is a real risk, recent history has shown that Nathan’s products may be more resilient than feared. During COVID-19, or fiscal 2021, Nathan’s was able to grow licensing income by 24.9% and despite tough comparisons, it followed up the following year of fiscal 2022 with a 1.5% increase in licensing income. In its most recent year of fiscal 2023, Nathan’s managed a 5% increase in licensing income. Some of their other products including crinkle-cut fries are growing faster than hot dogs, which has helped bolster their licensing income.

Continued inflation, especially in meat products, may limit Nathan’s ability to offset cost inflation with price increases. In fact in the most recent year, their licensing revenue from hot dogs showed how a 7% increase in price was offset by a 3% decrease in volume, which shows how Nathan’s struggles to increase pricing.

A resurgence of COVID-19 would hurt Nathan’s branded products and restaurant operations segment. Because Nathan’s products are sold at ballparks, stadiums, and other large events, they are more exposed to deleterious effects of COVID-19 restrictions compared to other consumer staples.

Finally, a decline in Nathan’s brand or a tarnished brand image may lead to a decrease in revenue and operating income. Nathan’s derives most of its income from licensing its brand name and if there is backlash against Nathan’s similar to what Anheuser-Busch (BUD) is dealing with, then Nathan’s could take a serious hit to its income and stock price.

Conclusion

Nathan’s Famous is a well-managed asset-light consumer staple with a true American story behind it. The brand has been around for over 100 years and while the company has an improving balance sheet and high level of shareholder return, its future revenue growth may be slow. At its current price, I believe the stock is fully valued.

Read the full article here