The current bullish trend is poised to maintain its momentum and deliver significant gains in the coming 12 to 18 months, supported by both fundamental factors and historical trends. Various short-term technical signals, such as volume and momentum, suggest that the market’s upward trajectory will persist. Additionally, the probability of better-than-expected financial results is likely to act as a catalyst in boosting stock prices. Given my conviction in the bull run’s continuation, it would be prudent to invest in stocks or ETFs that have the potential to capitalize on this trend. One such option worth considering is the Fidelity® MSCI Information Technology Index ETF (NYSEARCA:FTEC).

The Bull Run Is Likely to Last

In the first half of 2023, investor confidence in equity markets was restored thanks to slowing inflation, a halt in interest rate increases, better-than-anticipated economic conditions, and higher-than-expected earnings growth. Moreover, data indicate that these underlying variables will probably become more favorable in the second half of 2023 and beyond, allowing the bull market to continue.

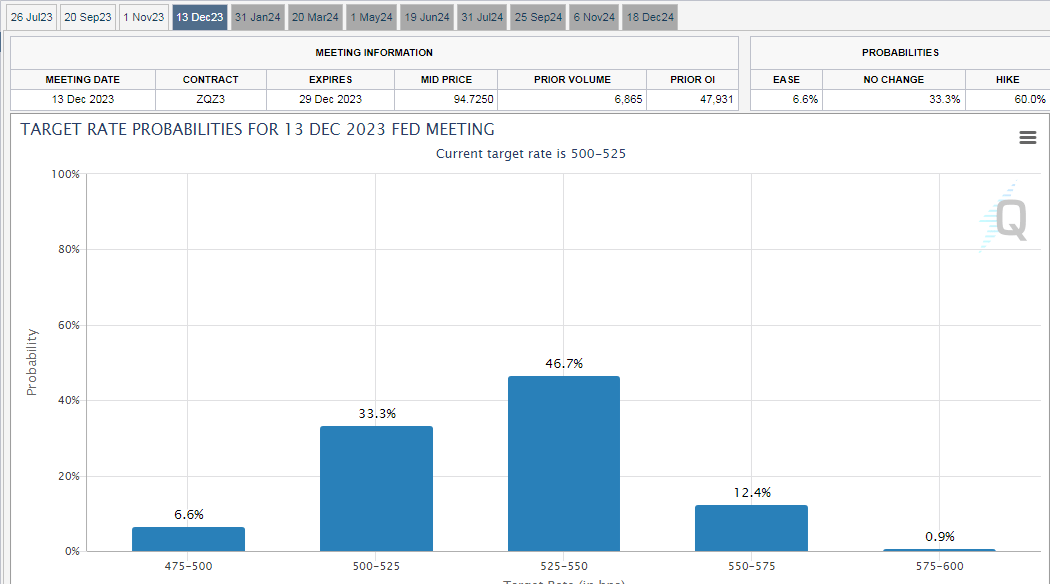

Interest Rate Expectations (CME Group)

The volatility caused by the Fed’s rate hike policy is expected to end soon. According to interest rate traders, the Fed’s rate hike policy has almost reached its peak, with only one more rate hike expected in the second half and multiple cuts the following year. Market indicators, including financial sector stress, slowing inflation, and a healthy job market, demonstrate that the Fed has been successful in cooling the economy without causing it to enter a recession. Inflation dropped to 4% in May, which is still higher than the targeted level but almost 50% lower than the last year’s high of over 8%. The Fed appears to be on track to achieve its inflation target by raising interest rates in July and keeping them there for the next six to eight months. Strong job data, on the other hand, have faded expectations for a severe recession in the second half. After reaching a record low of 3.4% last month, unemployment is now hovering around 3.7%. Employers created 339,000 new jobs in May, which is an increase from the 236,000 jobs added in March and 294,000 jobs added in April. Strong job data demonstrate that the economy is not in a recessionary mode and may even be expanding at a healthy rate.

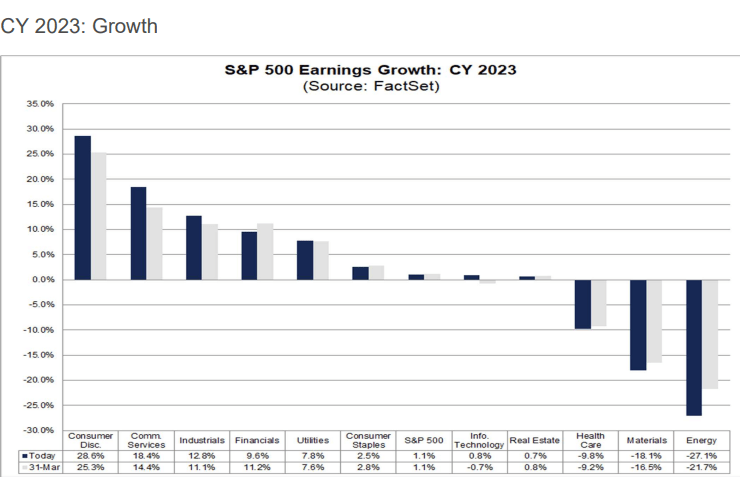

Earnings Expectations (FactSet)

Higher-than-expected earnings also reflect the economy’s underlying strength. The S&P 500 reported positive earnings in the first quarter of 2023, despite initial predictions of a mid-single-digit percentage decline. Furthermore, growth is expected to accelerate sharply in the second half, with fourth-quarter earnings expected to increase by 8% year on year. Excluding energy and materials, earnings growth prospects have improved across the board, with a significant improvement expected in the consumer cyclical, communication, and technology sectors. Earnings are anticipated to rise by a staggering 11% year over year for CY 2024.

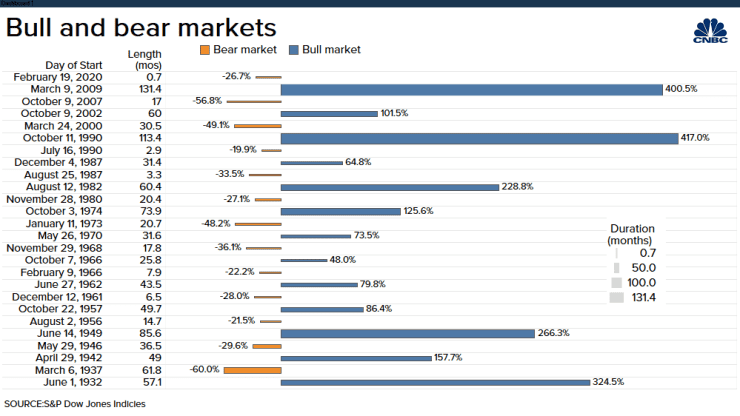

Bull and Bear Market History (CNBC)

Historical patterns are also in favor of the bull trend’s continuation. For instance, historically speaking, bull markets have longer periods of price increases and shorter periods of bear markets. Given historical trends, there is a good chance that the current bull run has only just begun and will last for years. According to Ryan Detrick, chief market strategist at Carson Group, there have been 13 occasions since 1950 when stocks have rallied 20% off their 52-week low, with 12 of those occurrences leading to higher stock prices one year later. This results in a win ratio of 92% and an average S&P 500 gain of 17.7%.

Why FTEC is a Solid ETF for the Bull Run

One of the sectors that stands to gain the most from lower inflation, improved economic conditions, and a potential Fed pivot is technology. A ~39% price surge from the tech sector in the first half of 2023 amply demonstrates this trend. Although the tech sector has been outperforming the S&P 500 returns and winning investor confidence, it is still important to choose an investment strategy that helps maximize returns and reduce risk. I believe instead of buying a single stock with a variety of risk factors, it might be a prudent move to diversify the risk by investing in ETFs, which provide both diversification and the potential for good returns. One such option is the Fidelity® MSCI Information Technology Index ETF, which has a diversified portfolio but a stronger focus on the large-cap sector, which is fueling the bull run in the NASDAQ and S&P 500.

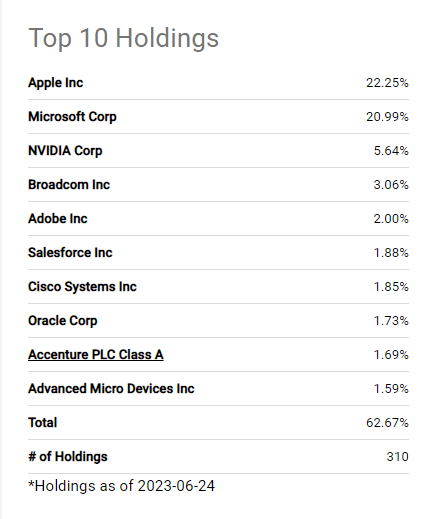

FTEC Top 10 Holdings (Seeking Alpha)

Its portfolio is well-diversified, with approximately 320 stock holdings in the technology sector. However, its top 20 holdings, which are either mega or large cap and are the primary drivers of the current bull run, account for roughly 75% of its portfolio weightage. The top 10 tech stocks make up 62% of its total portfolio. Apart from Accenture (ACN) and Cisco Systems (CSCO), the rest of its top stock holdings have generated massive gains in 2023. For example, its top two stock holdings, Apple (AAPL) and Microsoft (MSFT), which account for more than 40% of portfolio weightage, have generated 48% and 38% year-to-date share price gains, respectively. Similarly, chipmakers NVIDIA (NVDA) and Broadcom (AVGO) experienced price increases of more than 180% and 50%, respectively. Share prices of software companies like Adobe (ADBE), Salesforce (CRM), and Oracle (ORCL) have all increased by more than 40% in 2023.

In addition to the fundamental factors mentioned above, some key industries in the tech sector are benefiting from a variety of factors. For instance, businesses that focus more on artificial intelligence (AI) or those that sell goods and services that support the development of cutting-edge technology have seen an increase in investor confidence. Share prices for semiconductor manufacturers and software developers in particular skyrocketed. This is because high-end Nvidia chips are used to power ChatGPT and other AI products. Other chipmakers, such as Qualcomm (QCOM) and Advanced Micro Devices (AMD), have also benefited from the AI boom. The CEO of Advanced Micro Devices, Lisa Su, said in an earnings call that “We are very excited about our opportunity in AI – this is our number one strategic priority.”

Microsoft has also been making significant investments in the technology to take the lead. It poured billions of dollars into OpenAI, the ChatGPT developer. Salesforce recently unveiled Einstein GPT, the world’s first generative language artificial intelligence platform. Einstein GPT will be integrated into all of the company’s products, including Tableau, MuleSoft, and Slack. Markets and Markets predicts that between 2022 and 2027, the global AI market will expand at a compound annual rate of 36.2 percent, reaching a market value of more than US$407 billion. Additionally, it is possible that Wall Street’s enthusiasm for AI will help in sustaining the bull market even if the economy does not perform as expected.

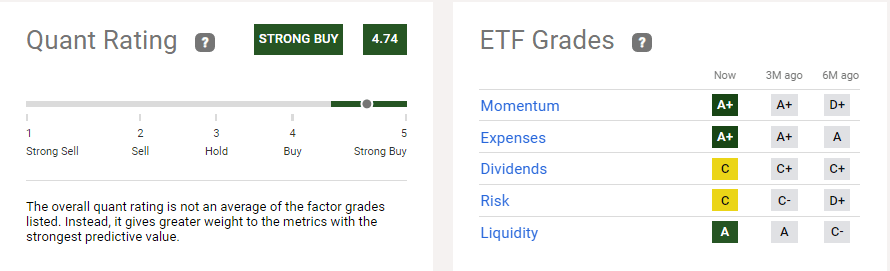

Quant Rating

Quant Rating (Seeking Alpha)

With a quant score of 4.74, the FTEC Fidelity® MSCI Information Technology Index ETF received strong buy recommendations. The momentum factor received an A+ grade due to strong share price gains over the last six months. Technically, stocks or ETFs with strong momentum are thought to continue the trend. Moving averages and other indicators also support the uptrend. For instance, currently, the S&P 500 is trading significantly above the 125-day and 200-day moving averages, indicating upward momentum. It also received an A plus for its 0.10% expense ratio, which is significantly lower than the average expense ratio for all ETFs. Expenses play a key role when it comes to total returns, particularly when it comes to long-term investing. Furthermore, a high liquidity score indicates greater investor interest and confidence in future fundamentals. Its dividends received low ratings. Dividends are irrelevant when trying to outperform the market through price increases.

Risk Factors to Consider

When investing in the FTEC, there are a number of risk factors to take into account. For example, higher-than-expected rate hikes in the second half could cause volatility in technology stocks and stymie the bullish trend. Furthermore, a severe recession is another risk factor that could derail the bull run. This is due to the fact that technology stocks generally outperform in times of expansion while remaining volatile in times of contraction.

In Conclusion

The Fidelity® MSCI Information Technology Index ETF appears to be one of the best ETFs to take advantage of the bull market. Its portfolio focus on mega and large-cap tech stocks increases its potential to perform well in bullish market conditions. Furthermore, its portfolio contains a long list of stocks that are benefiting from the AI hype. A low expense ratio and high beta also make FTEC a solid ETF to hold in bullish market conditions.

Read the full article here