Introduction

On April 17, I wrote an article on Peabody Energy’s (NYSE:BTU) new shareholder return program. BTU has declined roughly 20% since then as we have been dealing with further deterioration in economic indicators, which, in addition to weaker oil and gas prices, has hurt coal prices.

The drivers of BTU will be seaborne coal prices and related demand factors. So far, these factors have been bearish. However, we could be close to a bottom if we get support from rebounding economic growth and natural gas prices, which I expect to happen.

So, please be aware that the risk/reward is getting better, yet still on shaky ground.

Roughly two months later, I want to revisit Peabody Energy, as I just wrote a very bullish article on natural gas. In that article, I highlighted why I believe that structural changes in demand and supply could cause natural gas prices to start a meaningful yet volatile long-term uptrend.

This is also bullish for coal, which is the dirty and cheaper alternative to natural gas.

So, let’s dive into BTU and assess the risk/reward of this hyper-volatile energy stock.

What’s BTU?

Even though I do not have BTU exposure, I care a lot about BTU for two reasons.

- Peabody is the leading producer of metallurgical and thermal coal in the United States, which means the company tells us a lot about the state of the (global) coal industry. It’s a fantastic macro stock to monitor or to use as a proxy to trade coal without having to deal with futures.

- My second-largest investment, Union Pacific (UNP), is a key partner of BTU, shipping a big chunk of its coal. A healthy BTU company indirectly impacts my portfolio, although the impact is limited.

With that said, BTU is huge. The company has a $3.0 billion market cap. It owns interests in 17 coal mines in the United States and Australia and also engages in coal marketing, brokering, and trading activities.

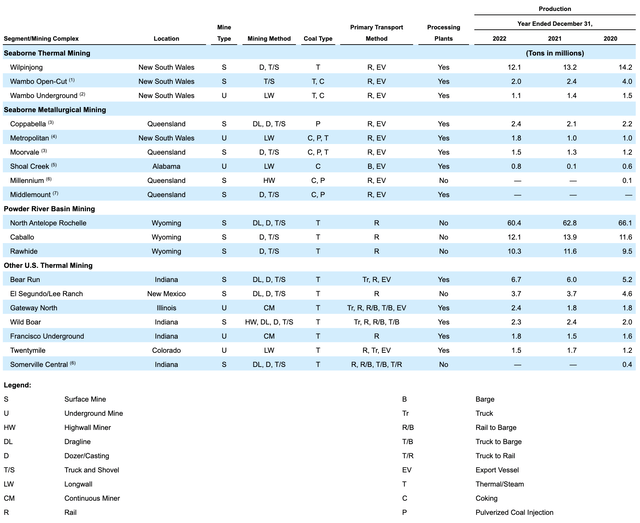

Peabody Energy

Among the company’s assets is the North Antelope Rochelle mine, located in the Powder River basin. This is the world’s largest coal mine.

This surface mine produced more than 60 million tons of coal in 2022, which is almost more than all other mines combined. This is also the mine that is exclusively serviced by railroads. In this case, Union Pacific and Buffett-owned BNSF.

Peabody Energy

With that said, BTU’s biggest problem is the long-term decline in coal usage. The company’s main coal output is thermal coal, which is heating coal.

Hence, the company’s coal supply agreements primarily involve electricity generators, industrial facilities, and steel manufacturers.

Most of the company’s sales come from long-term agreements, while a smaller portion comes from contracts with terms of less than one year or spot basis.

In 2022, long-term agreements accounted for approximately 85% of Peabody’s worldwide sales volume. The company’s top five customers contributed 28% of the total revenue in 2022.

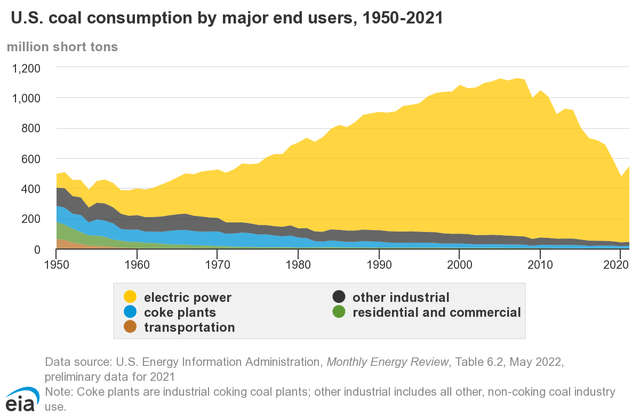

Unfortunately, for BTU, domestic coal demand is in a steep decline. In 2007, coal demand peaked when coal demand from electric power exceeded 1 billion annual short tons. Since then, coal demand for electric power has halved.

Energy Information Administration

This downtrend is expected to continue, as all major utility companies have vowed to become carbon neutral by 2050.

However, BTU isn’t dead money. Foreign demand is strong, and pricing is more important than sales volumes.

For example, let’s say annual domestic demand declines by 5% (that’s a made-up number for the sake of this example). A temporary price increase of 50% would boost revenues significantly. A price increase could offset many years of secular demand declines.

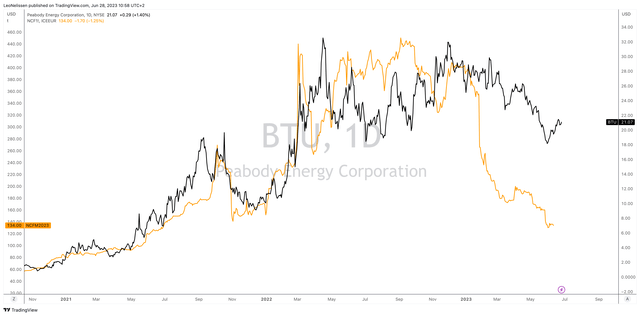

Hence, looking at the chart below, we see that BTU is mainly driven by international coal prices like Newcastle coal futures.

TradingView (BTU, ICE Newcastle Coal)

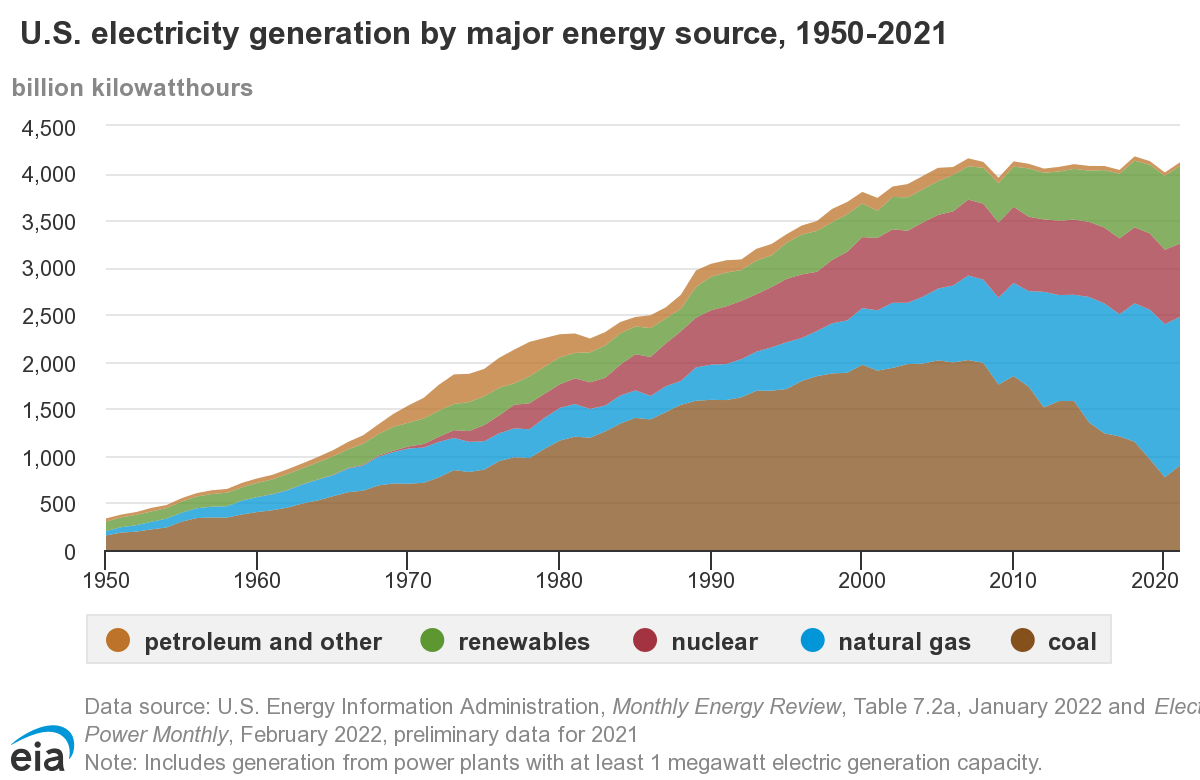

Changes in international demand are key. The same goes for changes in natural gas prices. Natural gas is currently the biggest source of electric energy in the United States. Rising natural gas prices make coal more attractive. This includes physical demand and prices.

Hence, when Russia invaded Ukraine, the energy shock caused coal usage to increase in the United States (and every region in the world).

Energy Information Administration

BTU is in a good spot to service export demand.

Peabody has secured transportation infrastructure in Australia through rail and port contracts. It has access to several coal export terminals, including Dalrymple Bay Coal Terminal, Abbot Point Coal Terminal, Port Kembla, and Newcastle (the futures are named after this city).

The Shoal Creek Mine utilizes barge and port contracts, primarily operating through the McDuffie Terminal in Mobile, Alabama.

With all of that said, how is BTU doing? After all, the current decline in natural gas and oil prices has done a number on its stock price.

BTU is still 36% below its 52-week high despite rising 21% from its 52-week lows.

How’s BTU Doing?

On April 27, BTU held its first-quarter earnings call.

During the call, the company made the case that global thermal coal prices stabilized in March and showed improvement due to supply disruptions in Colombia and South Africa and strong demand from India, China, and ASEAN countries.

China lifted its unofficial ban on Australian coal imports, which provided additional demand for Australian thermal coal. The import rates for Australian coal reached over 4 million tons per month. Domestic coal production and renewable generation have been strong. Seaborne thermal coal demand remains robust globally while supply constraints persist.

So far, new headlines continue to support these comments.

Bloomberg

According to Bloomberg:

India will continue to build more coal-fired power capacity to feed its booming energy demand even as it expands renewable generation.

The nation, one of the world’s top carbon emitters, has about 27 gigawatts of coal-based power plants under construction and another 24 gigawatts capacity is in pre-construction stages, according to Power Minister Raj Kumar Singh.

[…] Consumption of coal has been surging as a rebound in the economy has pushed up electricity demand. Grueling heat waves further boosted power consumption as homes and businesses cranked up cooling appliances. The country also aims to generate 500 gigawatts by 2030 from solar, wind and other renewable sources.

However, lower liquefied natural gas prices and high coal inventory levels in Europe pose short-term pricing challenges. This is still a key issue and one of the reasons why I believe in a favorable risk/reward for coal prices in light of the upcoming winter and supply situation – as a lot of bad news has been priced in.

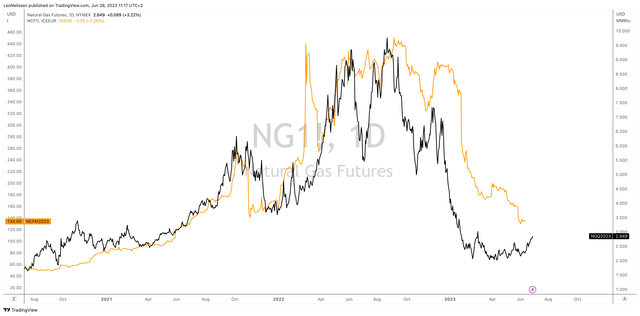

This is what the comparison between Henry Hub natural gas and Newcastle coal (orange) looks like:

TradingView (NYMEX Henry Hub, ICE Newcastle Coal)

Furthermore, with regard to my macro-weakness comments, the company commented that the quarter experienced volatility in the seaborne metallurgical coal market due to global macroeconomic turbulence, improving demand, and supply disruptions caused by weather conditions in Australia.

In the United States, natural gas prices weakened due to near-record gas production levels. US natural gas prompt prices were around $2.25 per MMBtu. They are currently roughly $0.40 higher, which is favorable for BTU.

The EIA forecasted Henry Hub natural gas spot prices to rise above $3 per MMBtu in the second half of 2023, driven by higher LNG exports. However, near-term demand for US thermal coal is expected to be muted due to low gas prices and stronger renewable generation.

Peabody also commented that the potential for increased coal demand arises in the second half of 2023 as summer weather could lead to stronger total load demand and increased pressure on gas prices from LNG exports. So far, these expectations are materializing.

With all of this in mind, 1Q23 wasn’t half bad.

Peabody reported a strong financial performance in the first quarter, with net income attributable to common stockholders of $269 million or $1.68 per diluted share. Adjusted EBITDA stood at $391 million, representing a nearly 20% increase compared to the previous year.

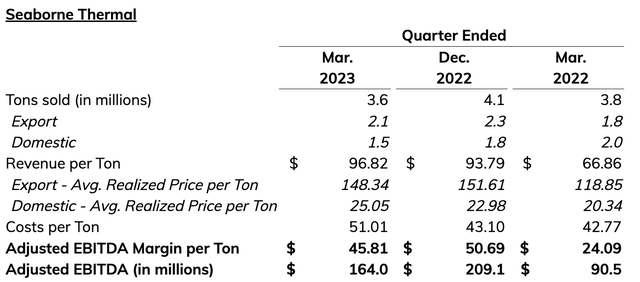

Looking at the Seaborne Thermal segment, the company sold less coal but benefited from a more favorable shift from domestic to export sales, allowing it to capture better prices. This resulted in a significant improvement in EBITDA.

Peabody Energy

Furthermore, in light of what I wrote in my prior article, the company fulfilled its commitments to amend the surety agreement and eliminate the bank letter of credit facility, strengthening its balance sheet.

Because of this, the company announced a new shareholder return program. The board authorized a $1 billion share buyback program and implemented a regular quarterly cash dividend of $0.075 per share, resulting in a current yield of 1.4%.

The first-quarter performance will lead to $170.2 million being returned to shareholders, including nearly $160 million for share buybacks.

Essentially, the company is planning to return at least 65% of its annual available free cash flow to its shareholders.

So, what’s next?

Outlook & Valuation

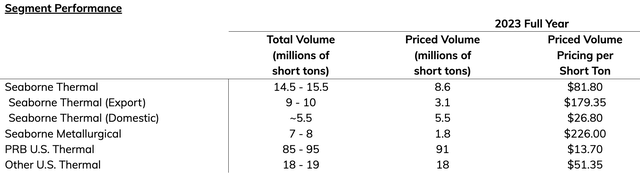

For the second quarter, improvements are expected in the Seaborne segment’s performance, while the US thermal segments are anticipated to deliver consistent and reliable results.

Seaborne Thermal export volumes are projected to be 500,000 tons higher due to the completion of a longwall move at Wambo Underground and sustained production levels at Wilpinjong. Seaborne Metallurgical volumes are expected to increase by 400,000 tons as CMJV shipments recover from the impacts of heavy rains in Queensland.

Peabody Energy

Costs are expected to decline to $135 to $145 per ton in the Seaborne Metallurgical segment.

While the company did not adjust its full-year outlook, it no longer expects significant net cash interest for the year and expects the revised balance sheet measures to generate a conservative US treasury-like yield.

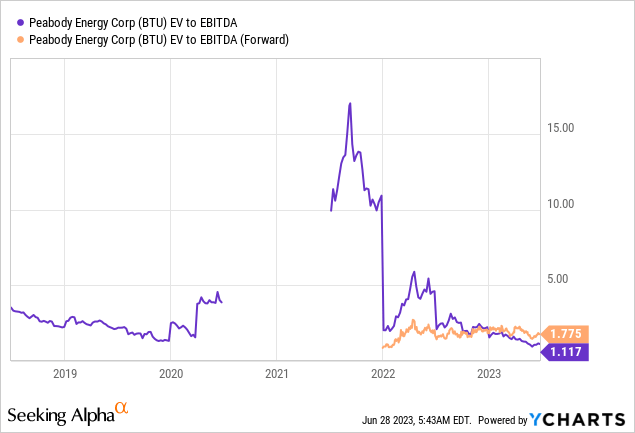

With that said, BTU is trading at 1.1x LTB EBITDA and 1.8x NTM EBITDA. Both of these numbers are cheap.

However, the problem with putting a valuation on companies like BTU is volatility and dependence on coal prices. It is much easier to value a company with steady sales growth and less dependence on the price of its product. For example, the price of an iPhone doesn’t suddenly jump from $500 to $900, followed by a decline to $300. Imagine what this kind of pricing volatility would do to a stock like Apple (AAPL).

BTU is currently trading at 21. The consensus price target is $28.

I believe that BTU will remain in a volatile trading range between $16 and $30 until economic growth bottoms.

It is highly likely that in a situation of bottoming economic growth, we could see a rotation from growth to value triggered by an improving supply/demand balance in oil and gas that favors higher prices. This is highly favorable for coal, which could push BTU to $50 and beyond.

So, traders and investors looking to buy BTU might benefit from buying gradually, as I wouldn’t exclude the possibility of another correction.

That said, I do not recommend coal stocks to anyone. Coal is highly volatile. I prefer gas and oil companies. Only trade/invest in coal if you are aware of the risks and able to manage portfolio risks.

Takeaway

Peabody Energy’s stock has faced a significant decline due to deteriorating economic indicators and weak coal prices. However, there are potential signs of a bottoming-out phase, dependent on rebounding economic growth and natural gas prices.

The company’s future is influenced by international coal futures and changes in natural gas prices, making it a volatile stock.

While domestic coal demand continues to decline, foreign demand remains strong, which emphasizes the importance of pricing over sales volumes.

BTU’s recent financial performance has shown strength, with a comprehensive shareholder return program implemented.

Traders and investors considering BTU should be aware of its volatility and the risks associated with coal stocks. Alternative investments in gas and oil companies may be more favorable, given their relative stability.

Read the full article here