Editor’s note: Seeking Alpha is proud to welcome Mandela Amoussou as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

Thesis

Liquid staking, an advanced form of crypto staking, presents a compelling opportunity for crypto investors. With its ability to provide liquidity, flexibility, and potential for growth, liquid staking has become a significant trend in the decentralized finance (DeFi) space. As Ethereum (ETH-USD) leads the way in liquid staking and the emerging LSDfi market segment gains momentum, investors stand to benefit from participating in this evolving ecosystem, while keeping an eye on regulatory developments to mitigate potential risks.

Overview

Crypto staking is a core feature of proof-of-stake (PoS) cryptocurrency networks; it is needed to secure and validate transactions on a PoS network. PoS crypto networks have become popular over the years as several concerns about the carbon footprint created by energy-intensive proof-of-work (PoW) blockchain networks, like Bitcoin (BTC-USD), have been raised.

In a PoW network, miners who make use of resource-intensive computing power to validate transactions and secure the network are rewarded with a crypto coin. In a PoS network, users, known as validator nodes, secure the network and validate transactions by locking up some of the native crypto assets of the blockchain—a process known as staking.

Crypto staking has gained popularity among crypto investors—especially investors with a buy-and-hold portfolio strategy—and has become a way for crypto investors to earn regular passive income. The total value locked (TVL) of staked crypto assets has become one of the important metrics in measuring the state of the crypto market and the value of assets.

TVL in crypto staking jumped from around $400 million in 2020 to ~$2 billion in 2022. With the introduction of liquid staking (which this article is focused on), TVL continues to grow on major blockchains. In Q1 2023, TVL on Ethereum increased by 33.6%, while Arbitrum (ARB-USD) had a whopping TVL increase of 83.4%.

The Evolution of Crypto Staking

The crypto space is fast-paced and ever-evolving. Like other crypto trends, crypto staking has indeed evolved significantly over the years; various staking mechanisms such as DeFi staking and liquid staking have been introduced, each with distinct concepts that offer different approaches to staking crypto assets.

PoS Staking

PoS staking is sometimes referred to as traditional staking. It is the earliest form of crypto staking. PoS staking refers to the process of participating in the consensus of a PoS blockchain network by locking up a certain amount of cryptocurrency to support network operations. By staking or “locking up” coins, participants contribute to the network’s security and transaction validation process, earning rewards in return. Traditional staking typically involves locking up funds for a predetermined period, during which the staked assets are illiquid and cannot be freely used or traded.

Depending on the specific PoS blockchain, staking participants may not have the ability to unstake and withdraw assets at any time, while some PoS blockchains have lock-up periods or require a notice period for the unstaking of assets.

DeFi Staking

DeFi staking refers to staking activities carried out within DeFi ecosystems. It involves locking up crypto assets in smart contracts within DeFi protocols. DeFi staking offers additional benefits like liquidity, yield farming, and participation in governance. Unlike PoS staking, which is considered rigid and illiquid, DeFi staking provides greater flexibility. Users can typically stake and unstake their assets at any time, allowing for liquidity and immediate access to funds.

Liquid Staking

Liquid staking is the latest trend in crypto staking. It is an advanced form of PoS staking that eliminates the rigidness and illiquidity that comes with traditional staking. Liquid staking provides a tokenized representation of a staked crypto asset. When a crypto asset is staked, a “receipt” that represents the underlying asset’s value is issued. This “receipt,” which is in the form of a financial instrument known as a liquid staking derivative (LSD), can be traded or used across DeFi protocols without needing to first unstake the underlying asset. LSD provides on-the-go liquidity for staked crypto assets.

Another perk of liquid staking is the low barrier to entry it gives users. Running a solo PoS node could be expensive for the average user, costing thousands of dollars in most cases. With liquid staking, users can participate in the staking process with just a few dollars. For example, running a solo Ethereum node requires staking 32 ETH, but with liquid staking, a user can stake a fraction of ETH.

Liquid Staking on Ethereum

Ethereum began its transition from PoW to PoS consensus in December 2021, when it launched the Beacon Chain and allowed the staking of ETH. The move to PoS was completed on April 12 in a blockchain upgrade called the Shanghai or Shapella upgrade. Liquid staking has gained massive momentum following the Shanghai upgrade on the Ethereum blockchain.

The idea of users staking their ETH and at the same time getting a derivative token that is usable on DeFi platforms, for purposes like lending and yield farming, was far-reaching. Several analysts have called liquid staking “the biggest crypto trend of 2023,” and the fastest-growing DeFi category in terms of total value locked. The TVL on some liquid staking protocols has surpassed the TVL on decentralized exchanges (DEXs). Though the Ethereum network has a giant share of total LSD volume, the liquid staking trend has spread to other blockchain networks.

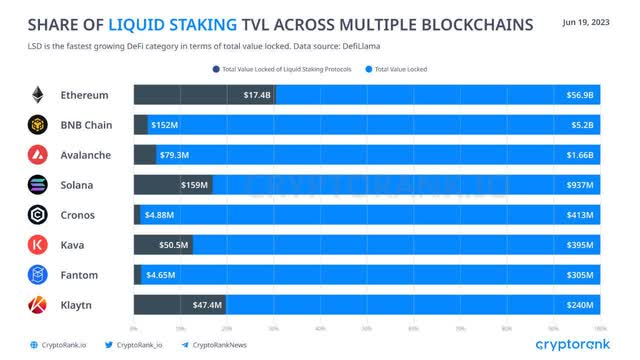

Liquid Staking TVL Across Multiple Blockchains (twitter.com/CryptoRank_io)

Recent data reveal that of the ~$57 billion TVL recorded on the Ethereum network, ~$17 billion are locked in liquid staking—an impressive 30% of Ethereum’s TVL. Other blockchains like Avalanche (AVAX-USD), Solana (SOL-USD), and Kava (KAVA-USD) have seen some uptick in liquid staking activities; however, Ethereum remains the blockchain with the highest liquid staking TVL. Ethereum takes the lead in liquid staking, with Lido Finance (LDO-USD) having a giant market share of staked ETH deposits. On the BNB chain, Ankr Network (ANKR-USD) is the largest liquid staking provider.

LSDfi: The Intersection of Liquid Staking and DeFi

A recent report published by Binance Research, on June 16, 2023, highlights the state of LSDs and the steady increase of the liquid staking market. The report explores newer DeFi protocols built on LSD and older DeFi protocols that have recently integrated LSD. These protocols have created a fusion of DeFi and liquid staking and have created a new market segment fondly called LSDfi.

LSDfi protocols have experienced a rapid increase in total value locked ((“TVL”)) over the past few months, benefiting from the adoption of liquid staking. As the narrative gained steam, cumulative TVL in top LSDfi protocols crossed the US$400M mark and has more than doubled since a month ago.

Source: Binance Research

LSDfi is the newest crypto-staking narrative; it is growing rapidly and has the potential to catch up with the TVL of LSDs. The current TVL in LSDFi protocols is just ~3% of the total addressable LSD market, creating much headroom for growth. According to the Binance Research report, the TVL in LSDfi protocols across all chains is ~$400 million. This figure in comparison with the liquid staking TVL on Ethereum alone (~$17 billion) shows that the LSDFi segment is fairly nascent and the untapped volume is huge.

Potential Gains and Risks

As mentioned earlier, liquid staking is now available in virtually every major PoS blockchain. But for the scope of this article, I would stick to LSDs on the Ethereum blockchain, the top liquid staking protocols on Ethereum, and how Ethereum has been the main beneficiary of the LSD narrative growth.

Just when Ethereum was losing significant NFT and DeFi market share to competing smart-contract blockchains after the 2021 crypto bull run, the transition to PoS and the introduction of liquid staking has given Ethereum the needed comeback to dominate the DeFi and NFT space. A recent report shows that Ethereum’s market cap dominance is on the rise. I believe that as the LSDfi narrative gains more momentum, Ethereum could easily maintain this dominance in the coming months or even years.

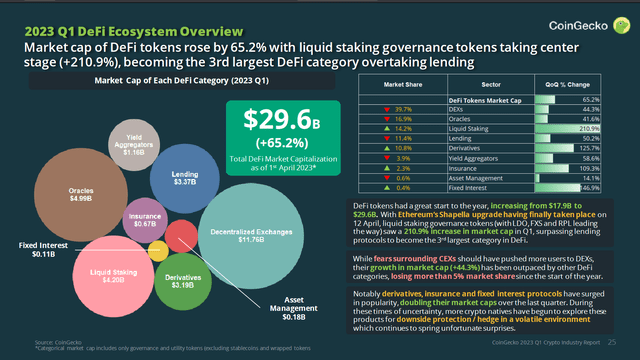

2023 Q1 DeFi Ecosystem Overview (CoinGecko)

Liquid staking protocols on the Ethereum network and their governance tokens have also done well in Q1 2023. Lido Finance takes the lead as the protocol with the most staked ETH deposits. The governance tokens of these ETH-based staking protocols have seen impressive returns post-Shapella. Lido Finance’s governance token LDO and RocketPool’s token (RPL-USD) led the crypto market gains in mid-May, defying the downward price trend of the broader crypto market in that period. Data from the CoinGecko Crypto Industry Report for Q1 2023 reveal that liquid staking governance tokens had an impressive 210.9% quarter-on-quarter change in Q1, with LDO and RPL taking the lead.

With the recent SEC clampdown on centralized exchanges’ staking-as-a-service offerings, the volume of staking on decentralized protocols like Lido and Rocket Pool will most likely see a steady increase over time. Though the SEC hasn’t issued any set-in-stone rules related to crypto staking, no on-chain permissionless staking protocols have been sanctioned by the SEC yet. The lack of regulatory clarity, however, still poses some threat to the booming crypto-staking sector. This same sentiment was shared by Jacob Blish, head of business development at Lido Finance, earlier this year.

Final Thoughts

In conclusion, crypto staking has emerged as a significant force in the cryptocurrency industry, offering investors a way to take part in consensus, earn passive income, and participate in the evolving world of DeFi. The introduction of liquid staking has revolutionized the crypto staking landscape, providing better liquidity and flexibility to staked assets. As the liquid staking market continues to grow, particularly within the emerging LSDfi segment, there is immense potential for further expansion and adoption. Regulatory clarity, however, remains crucial to ensure the sustained growth and stability of the crypto-staking sector. With Ethereum’s dominance reaffirmed through liquid staking, we can expect continued advancements and opportunities in the liquid staking space and the solidification of Ethereum’s position at the forefront of the crypto industry.

Read the full article here