The cross-holding and why it’s hated so much

Back in May 2021, Prosus (OTCPK:PROSY) and Naspers (OTCPK:NPSNY) announced a transaction (slides) with mind-numbing implications, which further complicated the already sufficiently intricate relationship between the two companies. Like many investors, I opposed the transaction mainly because of the added layer of complexity, calling management “a clown car in a gold mine” because it ignored much simpler ways to create value. In addition, the proposed exchange ratio was unfavorable for Naspers shareholders who basically were asked to exchange their ADRs, representing an underlying economic interest worth around $92 per ADR for 2.27443 ADRs of Prosus, representing an underlying economic interest of just about $70.

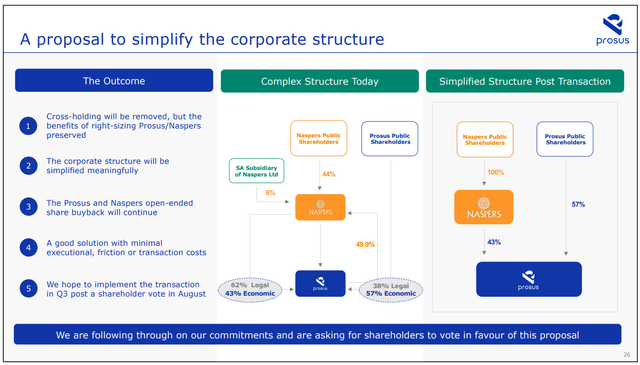

Nevertheless, the transaction was approved and Naspers now holds a smaller 43% underlying economic interest in Tencent (OTCPK:TCEHY), while Prosus holds 57%. Yet, as expected, it did not create the dangled benefits and the NAV discount to the underlying holdings remained stubbornly high both for Prosus and Naspers.

The share repurchase program and its limitations

Therefore, management finally did what I had suggested as a much more effective way to close or at least profit from the NAV discount: a massive share repurchase program, funded by the sale of Tencent shares.

Investors cheered the move, myself included. Effectively, these share repurchases are like printing money, while actually increasing exposure to Tencent on a per-share basis. – What’s not to like?

One of the key problems of the repurchase program resulted from the cross-holding structure and its foundational agreements and regulatory limitations, as specified by yesterday’s proposal:

As the Repurchase Programme at the Naspers level is being implemented through acquisitions by one of its South African subsidiaries, there is, however, a limit under the South African Companies Act, 71 of 2008, as to the amount of Naspers shares that can be acquired in this manner pursuant to the Repurchase Programme. The Proposed Transaction will remove this limitation and enable the Repurchase Programme to continue at the Naspers level. This limitation does not apply to the Repurchase Programme at the Prosus level, which continues.

As a reminder, this is how the repurchase program works: Prosus sells some of its Tencent shares and circles the proceeds into buybacks of its own stock, while Naspers sells some of its Prosus holdings and circles the proceeds into buybacks of Naspers stock. According to the cross-holding agreements, however, the exact amounts of repurchases must be coordinated precisely, so that, over time, the agreed 43/57% economic interest split remains intact.

Hence, if Naspers got blocked from continuing its part of the program, Prosus could not continue either because by doing so it would increase its economic interest in Naspers above the agreed 57%.

The removal of the cross-holding structure

By removing the cross-holding, this limitation would get removed as well. In addition, we would return to a much simpler ownership chart as soon as in Q3/2023, as shown in yesterday’s slides:

Prosus presentation

The exact steps towards this simplification are of mind-numbing complexity.

In a nutshell, both companies will first carry out dilutive capitalisation issues.

On the Prosus side, this means that Naspers’ current legal interest in Prosus will be reduced to the agreed-upon 43% economic interest level. The remainder will be held by Prosus’ free-float shareholders.

On the Naspers side, the issuance of new shares to all shareholders except Prosus will be so massive that Prosus’ legal and economic interest in Naspers will be reduced to a minimal level. These residual shareholdings will then be sold, so that Prosus won’t hold any interest in Naspers anymore.

Finally, Naspers will consolidate its shares proportionally (practically a reverse split) to reduce the large amount of shares in issue as a result of the capitalisation issue and the cross-holding agreement will be terminated.

Importantly, the tax position of the group will remain the same following the implementation of the proposed transaction, and the costs are not expected to be significant (mainly advisory fees).

Who will benefit the most from the removal of the cross-holding structure?

Clearly, if the repurchase program was blocked, it would be very bad for both sets of shareholders. That said, I have already explained in another article why Naspers will inevitably benefit more than Prosus from the repurchases, at least as long as its NAV discount is higher than Prosus’.

This situation should continue if yesterday’s proposal is approved.

Currently, Prosus trades at a discount to its underlying holdings of 36%, while Naspers suffers (or, depending on our perspective, enjoys) a discount of 45%. Therefore, by buying back Naspers stock, the underlying value acquired corresponds to 1.81 times the price paid. In contrast, every repurchased share of Prosus adds only about 56% of the value above the price paid.

Finally, Naspers needs to sell Prosus shares to fund its own buybacks, which means that Prosus shareholders don’t get as many benefits from a shrinking float as Naspers shareholders get. While the Naspers float effectively shrinks continuously, Prosus in part only buys back what Naspers sells into the market.

The stock market has been well aware of this fact, leading to a recent outperformance of Naspers over Prosus and Tencent: One year ago, with one share of Naspers, you could buy just half a share of Tencent. Today it’s 0.81 shares. Similarly, one year ago, one share of Naspers was worth 2.1 shares of Prosus. Today it’s 2.38 shares.

Given that Naspers gets more value for each share it repurchases, these ratios should continue to develop favourably – at least as long as the NAV discount remains higher at the Naspers level.

Given that yesterday’s proposal is beneficial to both sets of shareholders, I expect it to be approved without delay, and the approval will basically free the way for the continuation of what is nothing else than money printing.

Importantly, the new structure could mean that, over time, Naspers might hold less than 43% of Prosus (while on a per-share basis, its interest in Prosus would increase). Effectively, the more Prosus stock it sells, the more Naspers stock can be repurchased, and the more money gets printed.

Similarly, Prosus also would gain greater flexibility – although we probably have already seen the highest possible repurchase rate, given that Prosus must avoid too much pressure on Tencent’s stock price.

A note on 2023 earnings

Naspers/Prosus earnings releases are usually a non-event, and yesterday’s fiscal 2023 results were no different. The companies’ most important earnings contribution comes from Tencent, and these earnings are included with a lag of an entire quarter. (This means that Tencent’s strong Q1/23 results are not included in yesterday’s report.)

Other than that, the companies reiterated their commitment to deliver positive earnings from their ex-Tencent portfolio by H1/2025 (i.e., one year from now). On the call, an analyst even suggested management might be overly cautious, as the current trend points to a much earlier breakeven of the managed portfolio. Moreover, management clarified that no selling or shutdown of additional assets will be necessary towards that goal.

This means that any acquisition of an already profitable business might accelerate breakeven – and Prosus is sitting on roughly $20B of cash (including the held-for-sale Meituan (OTCPK:MPNGY) (OTCPK:MPNGF) stake), ~$5B of which are net cash, and has already announced that it is on the hunt for M&A targets.

What makes me a bit concerned is that, apparently, Prosus is jumping on the AI bandwagon, as it has expressed the intention to add businesses with advanced generative AI applications. I doubt these are currently available for fair valuations. That said, any acquisition, good or bad, won’t really move the needle. In the end, the holding’s fate is still decided by Tencent.

On the other hand, as soon as the managed portfolio finally starts to deliver cash, the persistence of the NAV discount will become more unlikely, given that currently the market is attributing a negative value to the entire portfolio. Since the portfolio includes ~$10B worth of publicly traded stakes and ~$25B worth of unlisted stakes, roughly one-quarter of the entire NAV consists of assets beyond Tencent. If the holding finally gets some credit for its investment portfolio, the effect will be massive.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here