This article was first published to members of my service on June 23th 2023. All option calculations are hypothetical and are used to determine fair value based on the generally accepted standards.

Our constant search for “alpha” investment opportunities has led us to EPR Properties PFD C CV 5.75% (NYSE:EPR.PC), a real estate investment trust (“REIT”)-issued exchange-traded preferred stock with value-added due to its conversion clause. With the distress in the banking sector and all the hype the AI companies are enjoying, other market segments receive much less attention than usual. These are perfect conditions that create hidden gems, and it is up to the investors to dig a little deeper to be able to find them and profit from them. According to us, EPR.PC is such an undervalued investment vehicle, and we will try to defend this thesis with this short article.

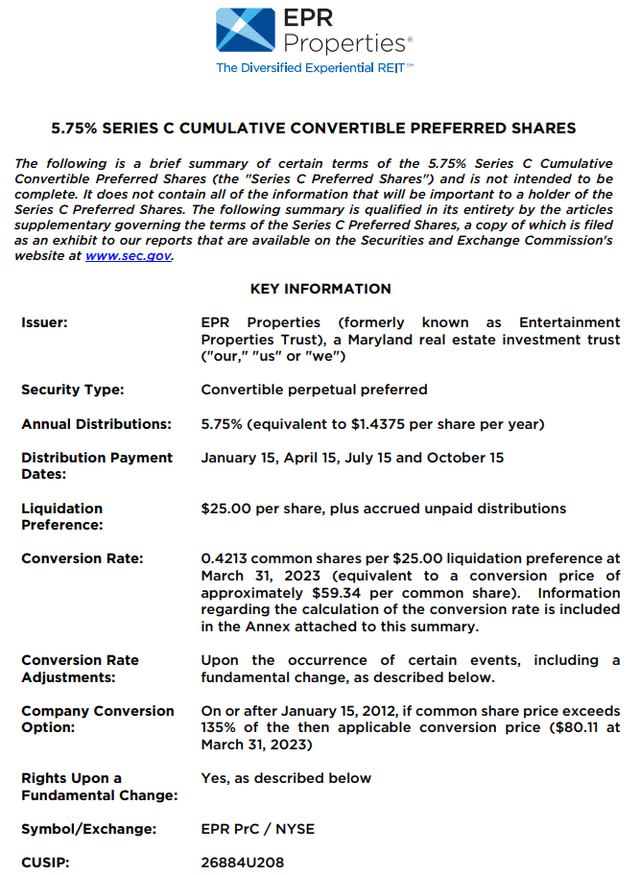

EPR-C preferred stock characteristics

EPR-C is a 5.75% fixed-rate cumulative convertible preferred stock issued by EPR Properties (NYSE:EPR) on 12/20/2006. The shares are currently convertible at any time at the holder’s option into 0.4213 common shares of EPR Properties per $25.00 liquidation preference. The current conversion rate is equivalent to a conversion price of $59.34 USD per common share.

EPR-C info (eprkc.com)

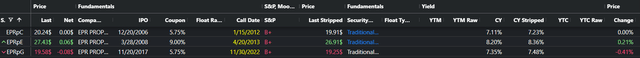

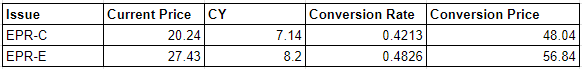

At the moment, EPR-C is trading at $20.24 USD with a CY of 7.11%.

Preferred stocks info (proprietary software)

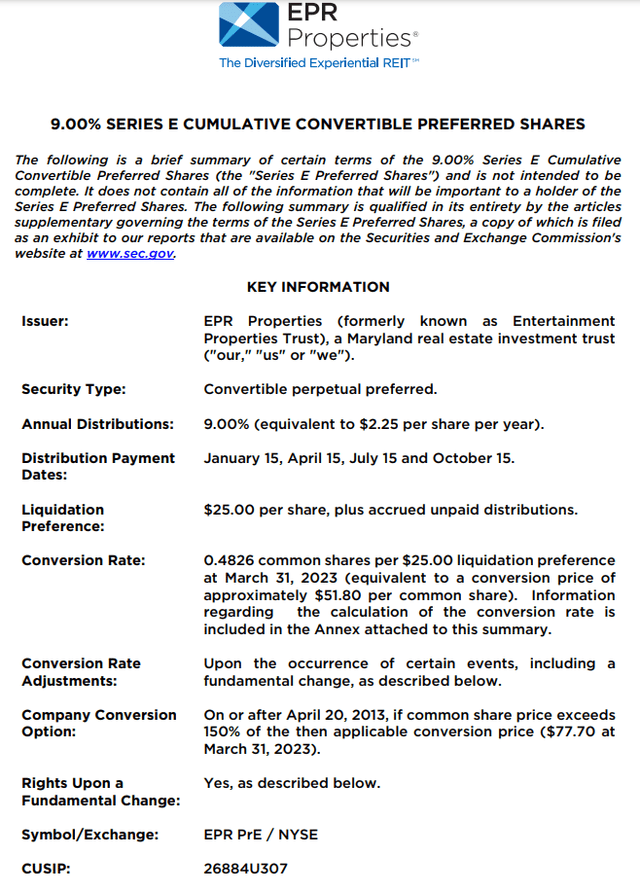

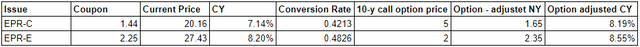

EPR-C has two exchange-traded brothers – EPR-E (EPR.PE) and EPR-G (EPR.PG). EPR-E is also convertible preferred stock, while EPR-G has no conversion clause. At the moment of writing the article, EPR-E trades at 27.43 USD with a CY of 8.20% and has a conversion rate of 0.4826. Pure CY comparison between the two convertible prefs gives an edge to EPR-E as a long pick, but the embedded conversion clause gives EPR-C additional value, and we will try to show it.

EPR-E info (eprkc.com)

EPR-C comparison to EPR-E

Convertible preferred stocks such as EPR-C and EPR-E can benefit both from being fixed-income securities and from their conversion clause. Depending on their conversion rate and the price of the common stock, these kinds of investment vehicles can trade as a fixed-income security, or with price tied for the common stock.

Both preferred stocks are convertible – they cannot be called by the issuer and can be converted by the holder into a corresponding amount of common stock. De facto, each security has an embedded no-expiration date call option with different strike prices. The price of this call option, that the holder receives, has to be included when evaluating each of the securities.

EPR-C to EPR-E comparison (proprietary spreadsheet)

At the moment, the common stock EPR is trading at around 43.60 USD, and this is pretty close to the conversion price of EPR-C. At this point, the price movement of EPR-C will be quite correlated with the upside changes in the price of EPR. The convertible security is “tied” to the common stock on the upside.

This is not the case with EPR-E. In order for EPR-E to connect the same way as EPR-C with the common stock, EPR will have to trade within 10% of the conversion price of EPR-E, or around $51 UDS. If this happens, however, EPR-C will have to appreciate at least up to $23.70 USD, as it is already tied to the common stock.

This difference in the behavior of the two brothers can be explained by the different strike prices of the embedded call options they have. Different strike prices mean different option prices.

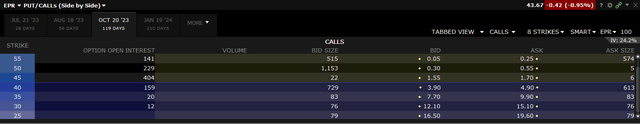

EPR call options (Interactive Brokers)

As can be seen from the screenshot above, the EPR call option with a strike price of $45 has a bid of $1.55, while the one with a strike price of $55 has a bid of $0.05. The market is giving value to the call option that EPR-C has, but not to the one of EPR-E. The BID/ASK spread for the two options is also indicative of the high interest in the 45-strike price one in comparison with the 55-strike price one.

EPR-C – EPR*0.42 (TradingView)

If we present on a chart EPR-C – EPR*0.42, one can clearly see that it is on its low. The conversion value of EPR-C is as close as ever to EPR, indicating that on the upside the convertible will move in line with the common stock. On the downside, however, it has the protection of being a preferred stock meaning it stays higher in the capital structure of the company. This is the reason why we are choosing EPR-C as the long leg in our pair trade. EPR-E is not connected in the same way with EPR on the upside, at this price of the common and EPR-G can never be, as it is lacking the conversion clause.

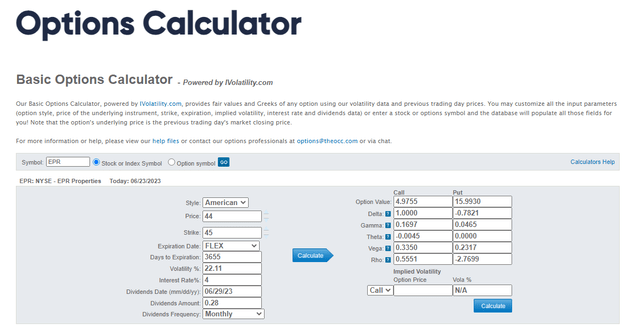

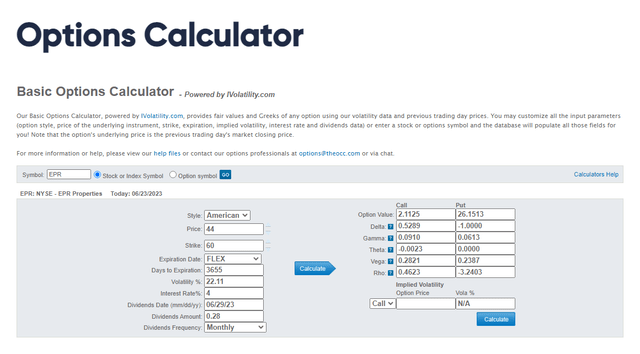

EPR-C and EPR-E have embedded call options, and their value should be included in each of the preferred stock’s evaluation. For each of these convertible securities, we can sell a call option in the common stock EPR with a strike price as close to the corresponding conversion price as possible. By doing so, we have value-added by further boosting the yields of each investment vehicle. In the options calculator we are using, we calculate the price for a 10-year call option in an effort to simulate the no-expiration embedded call option in each convertible preferred stock.

EPR 10-year call option with a strike price of 45 (optionseducation.org) EPR 10-year call option with a strike price of 60 (optionseducation.org)

These options values, multiplied by the conversion values, are then divided by 10 and added to the corresponding nominal yield in an effort to determine the adjusted current yields.

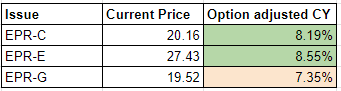

Adjusted CY comparison (proprietary spreadsheet)

The call option adjusted CY spread for EPR-C and EPR-E is rather narrower than the vanilla CY spread, and this is the expected result. As stated above, the embedded call option of EPR-C has more value than the EPR-E one.

EPR-G

EPR-G is a 5.75% fixed-rate cumulative redeemable preferred stock issued by EPR Properties on 11/20/2017. It has no conversion clause, unlike its two exchange-traded brothers. At the moment of writing this article, it trades at $19.58 USD with a CY of 7.35%.

EPR-G info (eprkc.com)

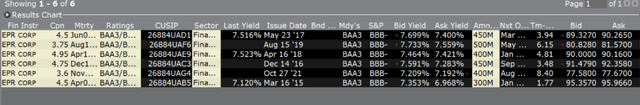

The bonds

EPR bonds (Interactive Brokers)

In the screenshot above, we are showing the debt issues of EPR that trade on the bond market. All the debt issues are rated Baa3 by Moody’s and BBB- by S&P. By comparison, the exchange-traded preferred stocks are rated Ba1 by Moody’s and B+ by S&P. The different debt issues have yields in the range of 7.2% to 7.7%. These yields are the main reason for us to believe that the EPR-G preferred stock is very overvalued. The preferred stock stays lower in the capital structure of the company compared to the bond issues and we find no sound financial reason for it to be priced at an equal yield with them. A difference of four notches in the credit rating is not a joke.

The trade

In our opinion, there are a couple of options for the sophisticated investor to take a position in the EPR products, should he/she decides it is worth it:

1. If the investor is liking the idea of taking a long position in the common stock, our analysis suggests that a corresponding size in EPR-C is a better choice. The conversion value of EPR-C is as close as ever to the price of EPR, and on the upside, they will move “tied” together. On the downside, EPR-C has better protection from EPR for being a preferred stock.

2. Take EPR-C or EPR-E as the long leg and EPR-G as the short leg in a pair trade between the exchange-traded products of one issuer. Simultaneously with that sell the corresponding amount of call options in the common stock EPR, so that the convertible preferred stock is equalized to the non-convertible one. As an example – for every 2 call options of EPR with a strike price of 45 we sell, we need to have a 9000 US dollar value in the common stock. EPR-C is trading with a conversion rate of 0.42, so for every EPR-C share we convert should EPR reaches 45, we receive an 18.9 USD value in the common stock. That means we need 476 shares of EPR-C in order to obtain the 9000 USD value in the common stock and to cover 2 call options of EPR with a strike price of 45. That way we can exploit the difference between the convertible and non-convertible preferred stock of a single issuer to our advantage while not taking an unnecessary credit risk. The embedded call options in EPR-C and EPR-E are boosting the long leg’s yield and making this pair trade a rather decent opportunity.

Something additional the investor can do, to eliminate credit risk, is to use part of the profit from selling call options and to buy deep out of the money put options of EPR. This is only food for thought, and the calculations will not be included in this article. DOOM put options are not very liquid and pricing them accurately can be a challenging task.

Option-adjusted CY comparison (proprietary spreadsheet)

3. Take a position in the bonds of the company. With yields in the range of 7.2% to 7.7% for investment-grade debt issues, they offer a decent investment opportunity, as they stay higher than the preferred stocks in the capital structure of EPR.

Summary

The conversion clauses of EPR-E and EPR-C make them absolutely mispriced and are the clever way to be bullish on EPR Properties as long as you agree with the model used to determine their relative value.

Read the full article here